Employment Contract of Consultant with Nonprofit Corporation

Description

How to fill out Employment Contract Of Consultant With Nonprofit Corporation?

Aren't you tired of choosing from countless templates each time you need to create a Employment Contract of Consultant with Nonprofit Corporation? US Legal Forms eliminates the lost time numerous Americans spend searching the internet for perfect tax and legal forms. Our skilled team of lawyers is constantly changing the state-specific Forms catalogue, to ensure that it always has the right files for your scenarion.

If you’re a US Legal Forms subscriber, just log in to your account and click the Download button. After that, the form may be found in the My Forms tab.

Visitors who don't have a subscription need to complete easy steps before having the ability to download their Employment Contract of Consultant with Nonprofit Corporation:

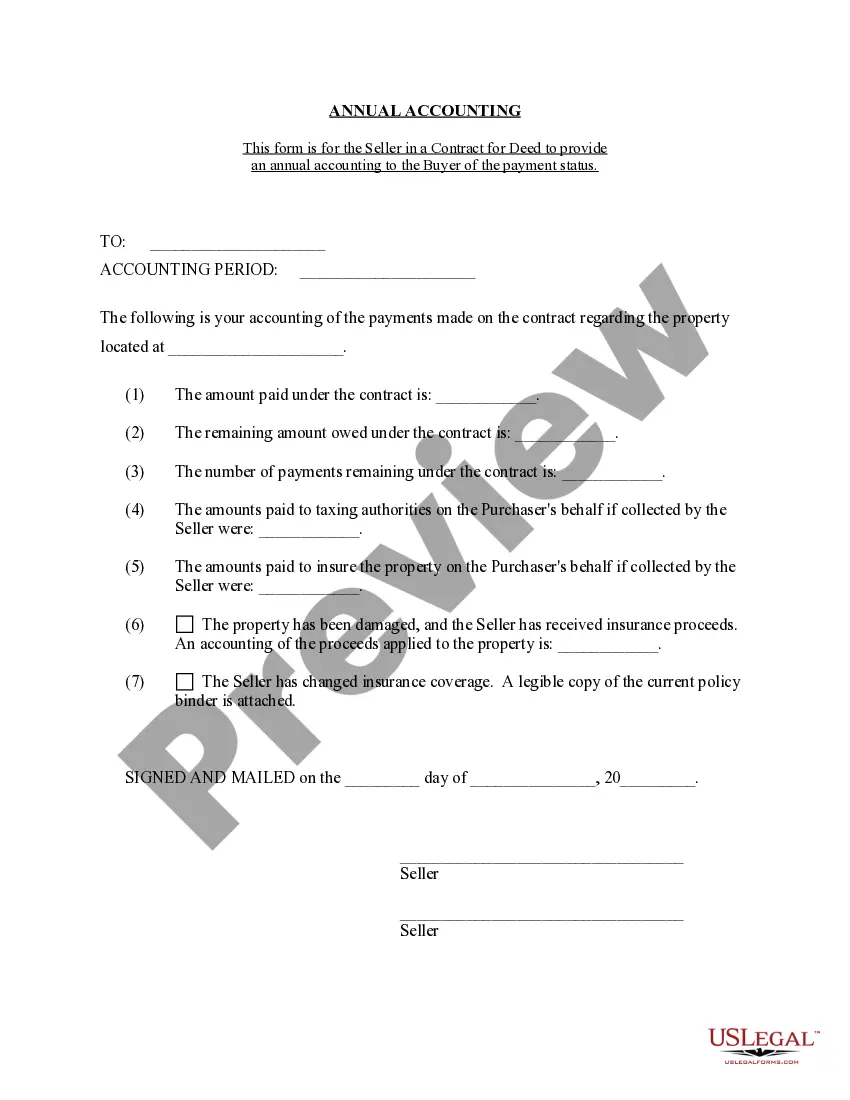

- Use the Preview function and look at the form description (if available) to make certain that it is the best document for what you’re trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the correct sample for the state and situation.

- Make use of the Search field on top of the web page if you need to look for another document.

- Click Buy Now and choose a convenient pricing plan.

- Create an account and pay for the service utilizing a credit card or a PayPal.

- Download your document in a needed format to finish, create a hard copy, and sign the document.

When you’ve followed the step-by-step guidelines above, you'll always have the ability to log in and download whatever document you require for whatever state you want it in. With US Legal Forms, completing Employment Contract of Consultant with Nonprofit Corporation templates or other official documents is not hard. Begin now, and don't forget to look at your samples with accredited attorneys!

Form popularity

FAQ

Non-profit founders earn money for running the organizations they founded. They often put in long work hours and make far less money than executives at for-profit organizations.The bottom line is that non-profit founders and employees are paid from the gross revenues of the organization.

Usually, an officer of the corporation and others authorized to sign contracts can legally sign documents on behalf of the corporation. For a contract to legally bind a corporation, the board of directors must provide authorization.

Legally, to bind a company to a contract, it must be signed by a person who has the authority to do so. This would normally be a director of the company, its solicitor, or a manager.

Yes. Both state law (which governs the nonprofit incorporation) and the IRS (which regulates the tax-exempt status1feff ) allow a nonprofit to pay reasonable salaries to officers, employees, or agents for services rendered to further the nonprofit corporation's tax-exempt purposes2feff .

Nonprofit organizations often hire consultants to help with fundraising, board orientation and development, strategic planning, executive search, facility planning, membership promotion, marketing, public relations, and event planning. The best way to find a consultant is to ask around.

The President or CEO is typically authorized to sign contracts on behalf of the organization up to a specified dollar amount. If the Board does not appoint one or more officers and delegate authority to them, then every corporate action would require a Board vote.

An average range for nonprofit consultants is $75 - $175/hour. (Consultants who work mostly with corporations or very large nonprofits may have rates as much as $250/hour or higher.)

An average range for nonprofit consultants is $75 - $175/hour. (Consultants who work mostly with corporations or very large nonprofits may have rates as much as $250/hour or higher.)

Individuals serving as board members can sign contracts outside of a meeting if they are granted the authority to do so. Authorization is addressed in the corporation's bylaws or in a resolution by the board of directors.