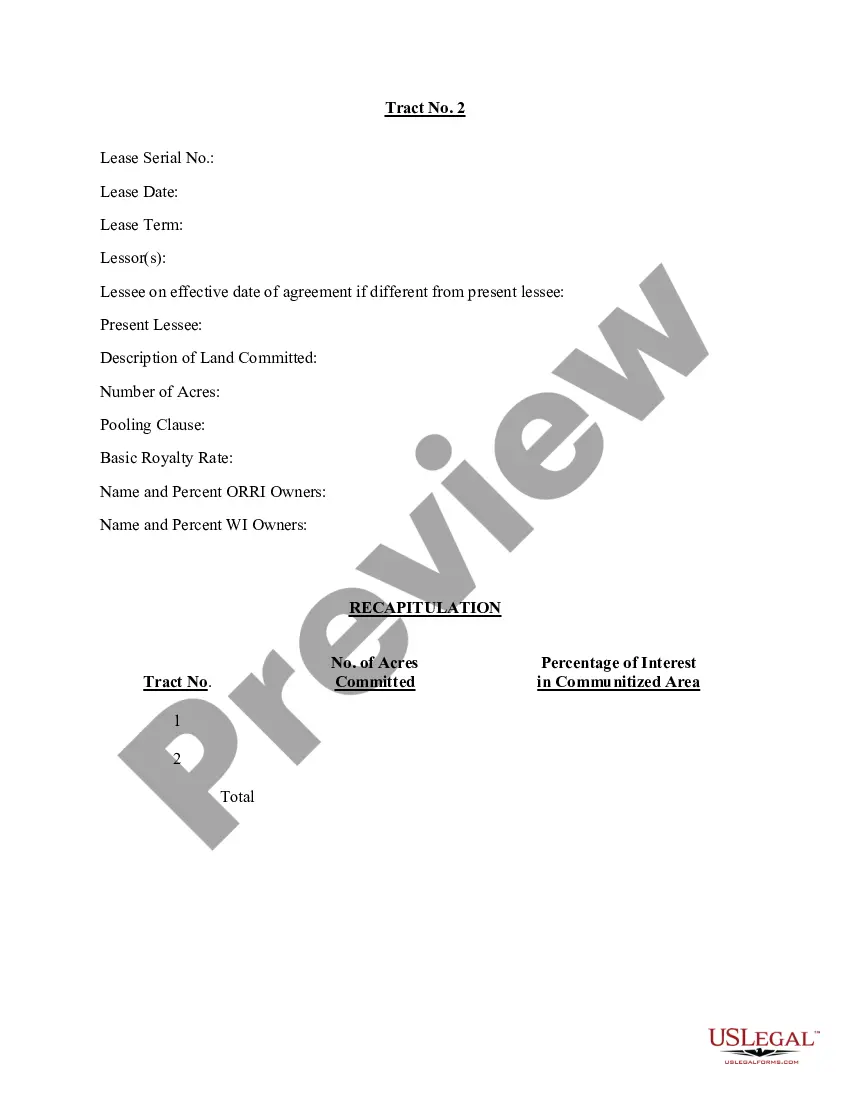

This form is pursuant to The Act of February 25, 1920, as amended and supplemented, authorizes communitization or drilling agreements communitizing or pooling all or a portion of a Federal oil and gas lease, with other lands, whether or not owned by the United States, when separate tracts under the Federal lease cannot be independently developed and operated in conformity with an established well-spacing program for the field or area.

Texas Communitization Agreement

Description

How to fill out Communitization Agreement?

US Legal Forms - one of several largest libraries of authorized kinds in the United States - delivers a variety of authorized record templates it is possible to acquire or print. While using internet site, you can find thousands of kinds for company and specific uses, categorized by types, suggests, or key phrases.You can find the most up-to-date variations of kinds just like the Texas Communitization Agreement in seconds.

If you already have a membership, log in and acquire Texas Communitization Agreement from the US Legal Forms catalogue. The Acquire switch will appear on every type you view. You gain access to all earlier delivered electronically kinds inside the My Forms tab of your accounts.

If you wish to use US Legal Forms initially, allow me to share easy recommendations to obtain started:

- Make sure you have selected the correct type for the area/state. Select the Preview switch to examine the form`s content. Read the type information to actually have chosen the right type.

- If the type does not suit your demands, use the Search area on top of the display screen to get the the one that does.

- In case you are pleased with the shape, verify your selection by simply clicking the Purchase now switch. Then, pick the rates program you like and offer your qualifications to sign up to have an accounts.

- Process the purchase. Utilize your credit card or PayPal accounts to finish the purchase.

- Pick the format and acquire the shape on your own system.

- Make modifications. Fill out, revise and print and sign the delivered electronically Texas Communitization Agreement.

Each and every format you added to your money lacks an expiry particular date and is also the one you have for a long time. So, if you would like acquire or print one more backup, just proceed to the My Forms portion and click on around the type you want.

Gain access to the Texas Communitization Agreement with US Legal Forms, by far the most comprehensive catalogue of authorized record templates. Use thousands of specialist and status-specific templates that fulfill your company or specific requires and demands.

Form popularity

FAQ

Communitization allows for the development of a separate lease or a portion thereof that cannot be independently developed and operated in conformity with an established well-spacing or well development program.

Mineral rights ownership can be established in the following ways: Deed. A deed is used in transferring the ownership of mineral rights from one party to the other. Lease. ... Severance. ... Adverse Possession. ... Surface Use Agreement. ... Royalties. ... Mineral Estate. ... Texas Railroad Commission.

A clause in an oil & gas lease that provides that if the leased land is later owned by separate parties, such as in a sale of part of the property, the lessee can continue to operate, develop, and treat the lease as a whole and pay royalties to each owner based on its percentage of ownership of the entire area.

The general rule of thumb for the value of mineral rights in Texas is 2x to 3x the lease bonus you received. For example, if you got $500/acre when you leased your property, you might expect to sell for somewhere between $1,000 to $1,500/acre if you were to sell mineral rights in Texas.

A Pugh Clause is enforced to ensure that a lessee can be prevented from declaring all lands under an oil and gas lease as being held by production. This remains true even when production only takes place on a fraction of the property.

Royalty Payment Clauses A royalty is agreed upon as a percentage of the lease, minus what was reasonably used in the lessee's production costs. This is stipulated in a Royalty Clause. The royalty is paid by the lessee to the owner of the mineral rights, the lessor in the lease.

Under communitization agreements (also called drilling agreements), operators who cannot independently develop separate tracts due to well-spacing or well development programs may cooperatively develop such tracts.

A clause in oil & gas leases that generally: States that if the lease covers separate tracts, no pooling or unitization of royalty interest as between the separate tracts is intended or implied.