Texas Partial Release of Mortgage / Deed of Trust Lien on Leasehold Interest in Part of Lands Subject to Mortgage / Deed of Trust

Description

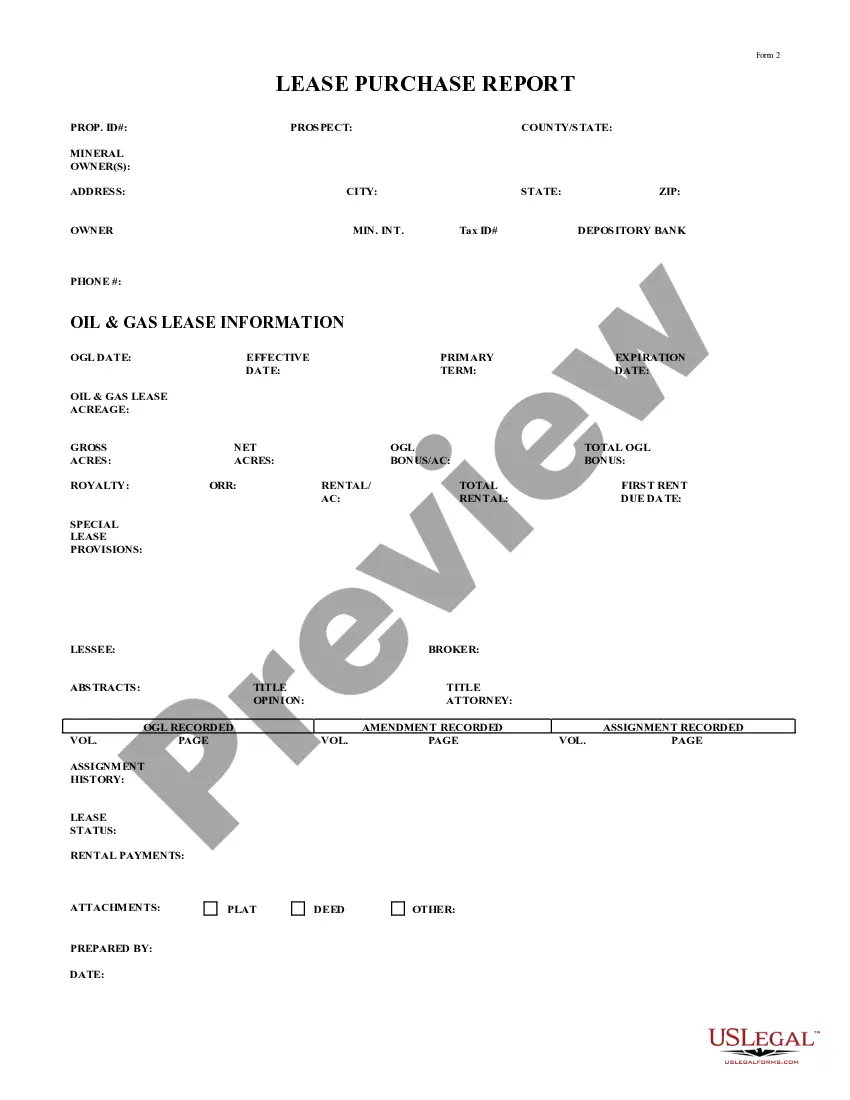

How to fill out Partial Release Of Mortgage / Deed Of Trust Lien On Leasehold Interest In Part Of Lands Subject To Mortgage / Deed Of Trust?

You may commit hours online trying to find the legal document web template that suits the state and federal requirements you need. US Legal Forms gives a large number of legal kinds that happen to be reviewed by experts. You can actually acquire or produce the Texas Partial Release of Mortgage / Deed of Trust Lien on Leasehold Interest in Part of Lands Subject to Mortgage / Deed of Trust from the service.

If you already have a US Legal Forms accounts, you are able to log in and then click the Acquire button. Afterward, you are able to full, change, produce, or sign the Texas Partial Release of Mortgage / Deed of Trust Lien on Leasehold Interest in Part of Lands Subject to Mortgage / Deed of Trust. Every legal document web template you get is your own property for a long time. To have yet another copy associated with a acquired form, go to the My Forms tab and then click the related button.

If you use the US Legal Forms web site the first time, adhere to the straightforward guidelines under:

- First, make certain you have chosen the best document web template for your region/town that you pick. Browse the form outline to make sure you have chosen the appropriate form. If readily available, take advantage of the Review button to check from the document web template too.

- If you would like find yet another model from the form, take advantage of the Lookup field to find the web template that meets your needs and requirements.

- Once you have discovered the web template you need, simply click Buy now to move forward.

- Select the pricing plan you need, enter your accreditations, and register for a merchant account on US Legal Forms.

- Total the deal. You may use your charge card or PayPal accounts to cover the legal form.

- Select the format from the document and acquire it for your product.

- Make modifications for your document if necessary. You may full, change and sign and produce Texas Partial Release of Mortgage / Deed of Trust Lien on Leasehold Interest in Part of Lands Subject to Mortgage / Deed of Trust.

Acquire and produce a large number of document templates making use of the US Legal Forms site, which provides the greatest variety of legal kinds. Use specialist and state-specific templates to tackle your small business or person requires.

Form popularity

FAQ

Deed of Trust The trustee (someone other than the buyer and the lender) gets the deed and technically owns the property while the loan exists. The trustee cannot sell the property unless the borrower defaults on the loan. The trustee transfers the property to the buyer when the borrower repays the loan.

A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release.

Instead of an agreement directly between a lender and a borrower, a trust deed places the title of a property in the hands of a third party, or trustee. Only after the borrower has satisfied the terms of their debt to the lender will the property be fully transferred to the borrower.

A Deed of Trust can also provide for Partial Releases if the Borrower pays the loan amount down and wants some of the property released from the lien. Note: Once the loan is paid as agreed, the Lender must file a Release of Lien to remove the lien from the property.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

Through a deed of release of mortgage, also called a release of deed of trust, the lender agrees to remove the deed of trust, which is the document containing all of the mortgage's terms and conditions that is filed at the beginning of the mortgage process.

To show that a lien has officially been removed on a property, you have to file a document called a ?lien release? in the real property records of the county where the property is located. A release of lien simply means removing the lien claim from a specific property.

Lenders in Texas customarily use a release of lien when the loan secured by a deed of trust has been paid in full or otherwise satisfied. The release of lien is recorded in the county where the real property collateral is located.