Texas Partial Release of Lien on Assigned Overriding Royalty Interest

Description

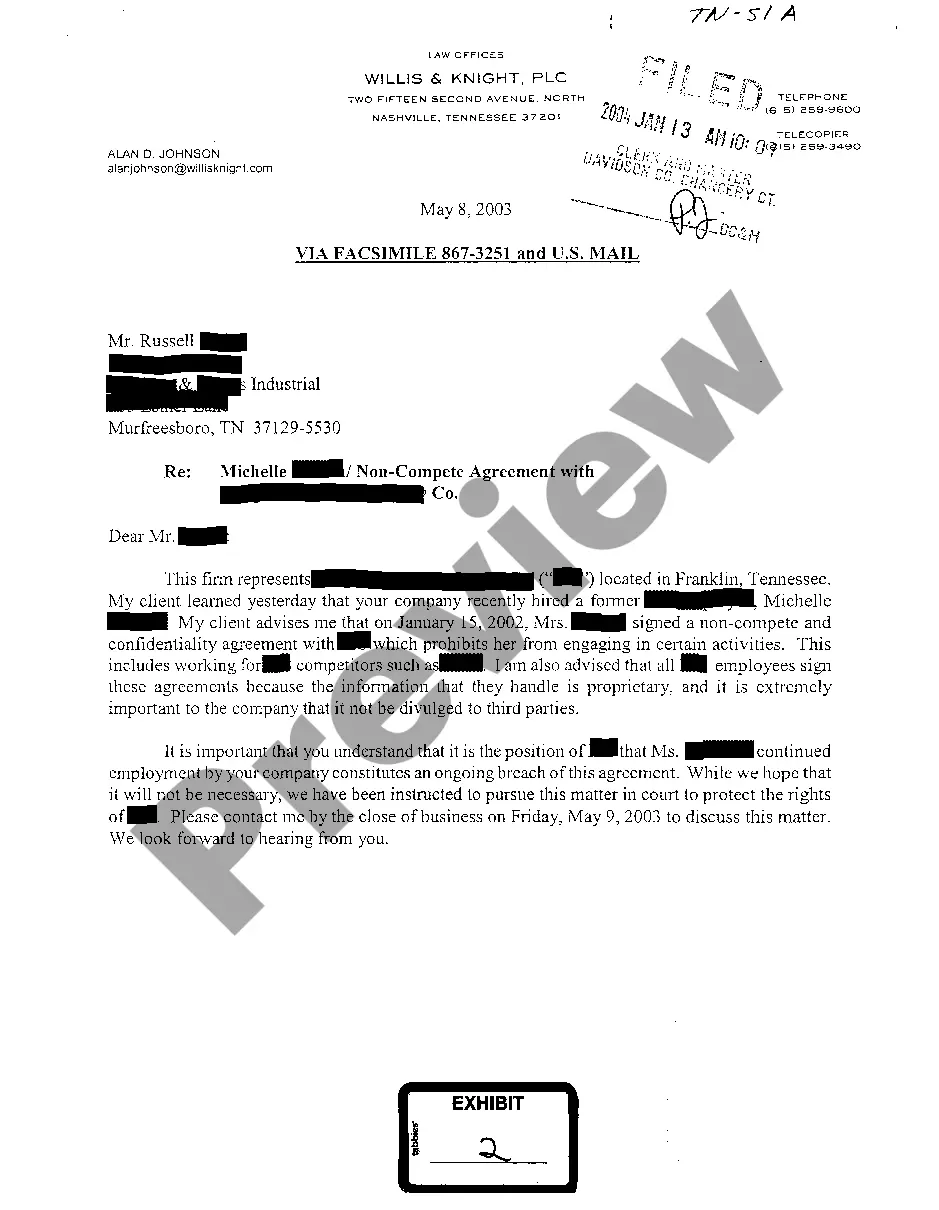

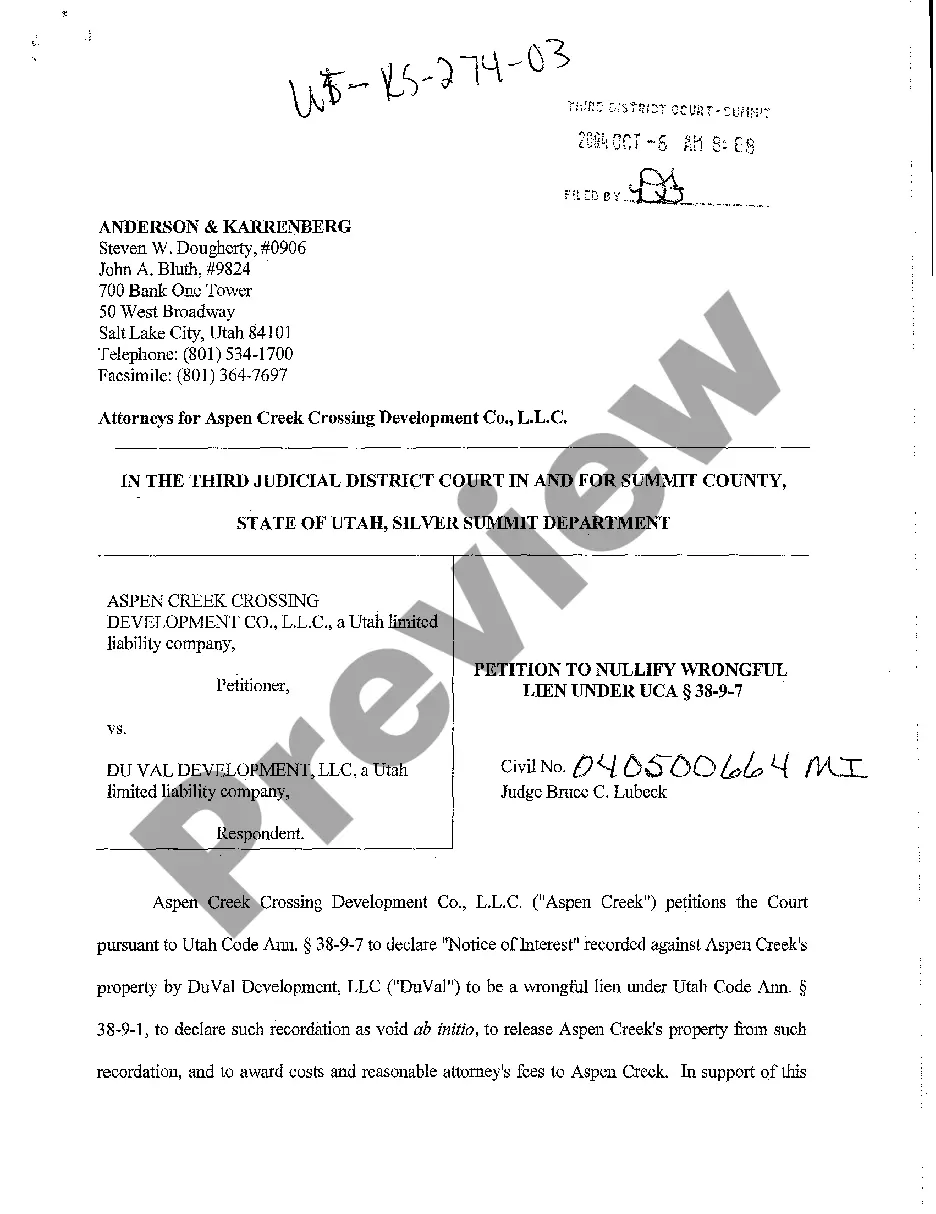

How to fill out Partial Release Of Lien On Assigned Overriding Royalty Interest?

If you wish to comprehensive, obtain, or print lawful record themes, use US Legal Forms, the largest assortment of lawful types, that can be found on the Internet. Use the site`s simple and easy handy lookup to get the papers you will need. A variety of themes for organization and person purposes are sorted by types and claims, or keywords and phrases. Use US Legal Forms to get the Texas Partial Release of Lien on Assigned Overriding Royalty Interest in just a few click throughs.

If you are already a US Legal Forms consumer, log in to the profile and click the Down load button to have the Texas Partial Release of Lien on Assigned Overriding Royalty Interest. You may also entry types you previously delivered electronically from the My Forms tab of your own profile.

Should you use US Legal Forms for the first time, refer to the instructions under:

- Step 1. Make sure you have chosen the form for your right area/country.

- Step 2. Take advantage of the Preview choice to look over the form`s content material. Don`t neglect to read the explanation.

- Step 3. If you are unsatisfied together with the type, make use of the Look for field towards the top of the screen to locate other variations of the lawful type format.

- Step 4. Once you have discovered the form you will need, click on the Buy now button. Pick the prices plan you like and include your accreditations to register to have an profile.

- Step 5. Procedure the transaction. You can use your bank card or PayPal profile to finish the transaction.

- Step 6. Pick the structure of the lawful type and obtain it on your system.

- Step 7. Total, change and print or sign the Texas Partial Release of Lien on Assigned Overriding Royalty Interest.

Each and every lawful record format you buy is your own permanently. You have acces to every type you delivered electronically with your acccount. Go through the My Forms portion and pick a type to print or obtain once again.

Remain competitive and obtain, and print the Texas Partial Release of Lien on Assigned Overriding Royalty Interest with US Legal Forms. There are many specialist and express-specific types you may use for the organization or person demands.

Form popularity

FAQ

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

What Determines the Value of an Overriding Royalty Interest? Mineral interest location. One in a shale basin with high production is worth more. Producing oil and gas wells. Wells currently producing are valued more. ... Production reserves and levels. ... Prices.

Lenders in Texas customarily use a release of lien when the loan secured by a deed of trust has been paid in full or otherwise satisfied. The release of lien is recorded in the county where the real property collateral is located.

The document is usually called a Release of Lien, Lien Release, or a Deed of Reconveyance. It can be prepared by the owner or the Lien Claimant, but it must be signed by the Lien Claimant in front of a notary public and filed in the property records in the county where the property is located.

Overriding Royalty Interest Example The mineral estate can be severed from the surface, beginning two separate chains of title. The mineral owner has the right to explore and develop the minerals, but the vast majority do not have the finances or knowledge to drill and operate a well.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

An overriding royalty agreement is a contract that gives an entity the right to receive revenue from certain productions or sales. The specific type of occurence that royalties are required to be paid on is included in the overriding royalty agreement.