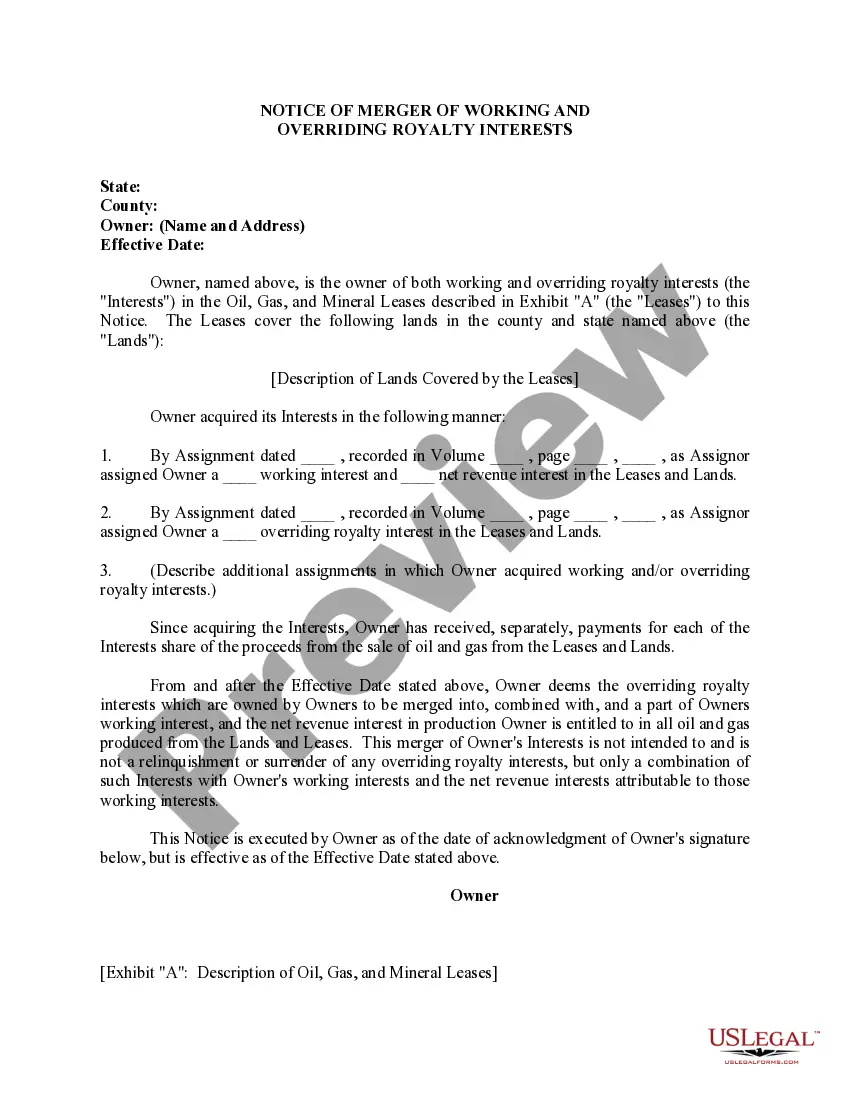

This form is used by the Owner to provide notice that the overriding royalty interests which are owned by Owners are to be merged into, combined with, and a part of Owners working interest, and the net revenue interest in production Owner is entitled to in all oil and gas produced from the Lands and Leases.

Texas Notice of Merger of Working and Overriding Royalty Interests

Description

How to fill out Notice Of Merger Of Working And Overriding Royalty Interests?

US Legal Forms - one of several greatest libraries of lawful varieties in the States - offers an array of lawful file themes it is possible to download or print. Using the website, you will get 1000s of varieties for company and personal purposes, categorized by classes, claims, or keywords.You will find the most recent models of varieties like the Texas Notice of Merger of Working and Overriding Royalty Interests within minutes.

If you currently have a membership, log in and download Texas Notice of Merger of Working and Overriding Royalty Interests from your US Legal Forms local library. The Down load button can look on every single type you view. You have accessibility to all formerly delivered electronically varieties in the My Forms tab of the account.

In order to use US Legal Forms the very first time, allow me to share basic instructions to help you started off:

- Make sure you have selected the right type for your town/county. Go through the Preview button to check the form`s information. Look at the type explanation to ensure that you have selected the correct type.

- When the type does not match your demands, make use of the Research field towards the top of the screen to find the the one that does.

- Should you be content with the form, validate your decision by clicking on the Acquire now button. Then, opt for the costs prepare you want and offer your qualifications to sign up to have an account.

- Approach the transaction. Use your charge card or PayPal account to finish the transaction.

- Select the format and download the form on the gadget.

- Make modifications. Load, change and print and sign the delivered electronically Texas Notice of Merger of Working and Overriding Royalty Interests.

Every template you included with your account does not have an expiry particular date and it is yours eternally. So, if you would like download or print an additional duplicate, just visit the My Forms segment and then click about the type you require.

Get access to the Texas Notice of Merger of Working and Overriding Royalty Interests with US Legal Forms, one of the most considerable local library of lawful file themes. Use 1000s of skilled and status-distinct themes that fulfill your business or personal demands and demands.

Form popularity

FAQ

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well. Overriding Royalty Interest (ORRI) (US) - Westlaw Westlaw ? PracticalLaw Westlaw ? PracticalLaw

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. What is Overriding Royalty Interest and How to Value it? Pheasant Energy ? overriding-royalt... Pheasant Energy ? overriding-royalt...

Whether mineral rights transfer with the property depends on the estate type. If it's a severed estate, surface rights and mineral rights are separate and do not transfer together. However, if it's a unified estate, the land and the mineral rights can be conveyed with the property.

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons. Overriding Royalty Interest (ORRI) - Sell Your Oil and Gas Royalties bluemesaminerals.com ? overriding-royalty-intere... bluemesaminerals.com ? overriding-royalty-intere...

Title to a mineral or royalty interest can be transferred via conveyance (deed) or death of the owner. In every case, it is most important that we receive immediate notification that the interest has been transferred so that the new account can be established. Texas Royalty/Mineral Owners/Commonly Used Forms texasroyalty.com ? commonly-used-forms texasroyalty.com ? commonly-used-forms

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

How to transfer mineral rights in Texas? Review The Current Title. Review the current title before transferring the mineral rights. Negotiate And Execute A Transfer Agreement. An agreement should be outlined in the terms of transfer. ... Record The Transfer. ... Pay Any Fees.

Licensing royalties, like any other asset, can be transferred into a trust. This is a common practice among individuals with intellectual property rights who earn substantial income from licensing royalties. This blog post will guide you through the process of transferring licensing royalties into a trust.