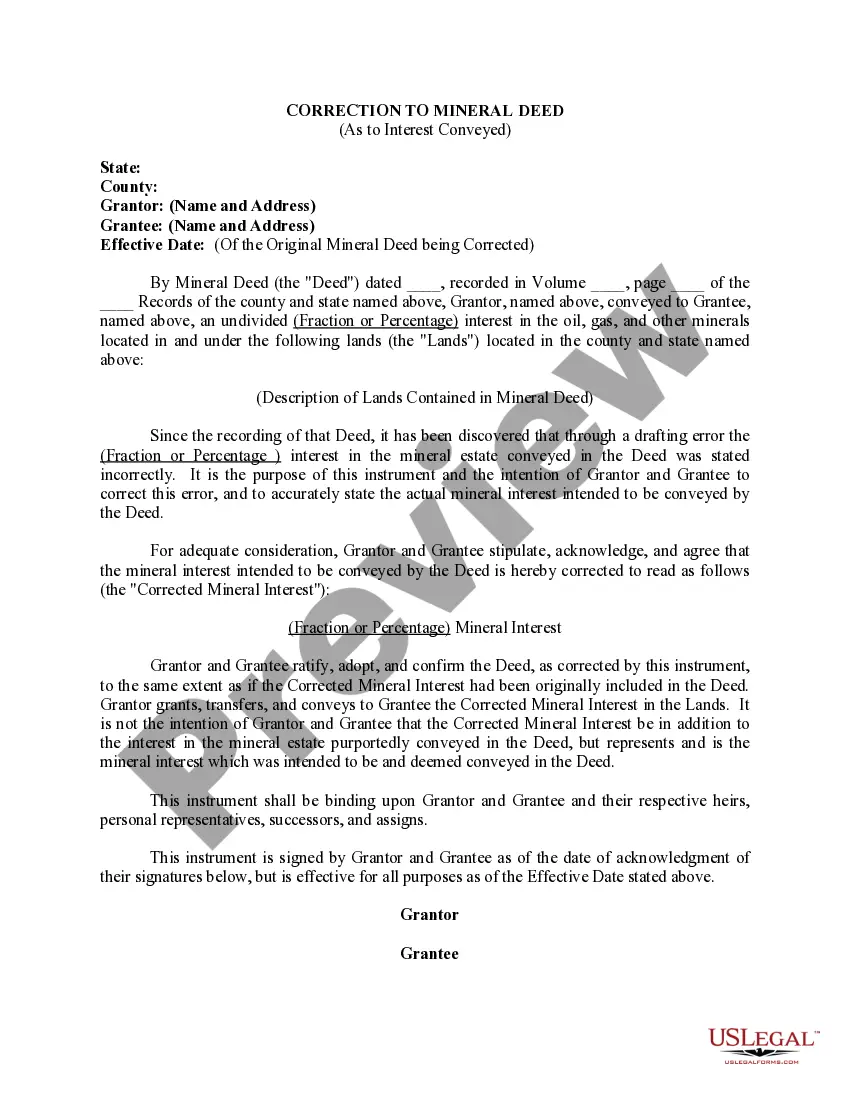

This form is used to when it has been discovered that through a drafting error the (Fraction or Percentage ) interest in the mineral estate conveyed in a Deed was stated incorrectly. It is the purpose of this instrument and the intention of Grantor and Grantee to correct this error, and to accurately state the actual mineral interest intended to be conveyed by the Deed.

Texas Correction to Mineral Deed As to Interest Conveyed

Description

How to fill out Correction To Mineral Deed As To Interest Conveyed?

It is possible to spend several hours on-line attempting to find the authorized document format that suits the federal and state needs you require. US Legal Forms supplies 1000s of authorized forms that are examined by experts. It is simple to acquire or produce the Texas Correction to Mineral Deed As to Interest Conveyed from the services.

If you currently have a US Legal Forms bank account, it is possible to log in and then click the Acquire switch. Afterward, it is possible to complete, edit, produce, or signal the Texas Correction to Mineral Deed As to Interest Conveyed. Every single authorized document format you purchase is your own forever. To get another duplicate of any acquired form, check out the My Forms tab and then click the corresponding switch.

If you are using the US Legal Forms web site initially, keep to the basic guidelines listed below:

- First, ensure that you have chosen the best document format for the region/town of your choice. Look at the form explanation to ensure you have selected the correct form. If accessible, take advantage of the Preview switch to check with the document format as well.

- If you would like discover another edition of your form, take advantage of the Research industry to get the format that fits your needs and needs.

- After you have found the format you need, click on Buy now to continue.

- Select the pricing program you need, enter your qualifications, and register for an account on US Legal Forms.

- Complete the transaction. You can utilize your bank card or PayPal bank account to purchase the authorized form.

- Select the structure of your document and acquire it to the device.

- Make modifications to the document if necessary. It is possible to complete, edit and signal and produce Texas Correction to Mineral Deed As to Interest Conveyed.

Acquire and produce 1000s of document themes utilizing the US Legal Forms site, which provides the biggest collection of authorized forms. Use specialist and express-particular themes to take on your business or individual demands.

Form popularity

FAQ

In Texas, Oklahoma, Colorado and Montana, mineral owners can own the mineral rights indefinitely and there is no way for them to passively revert to the surface owner. If a surface owner wants to own the mineral rights under their land, they must find and contact the mineral owners and offer to purchase them.

?Either the landowner sells the minerals and retains the surface, or more commonly, the landowner sells the surface and retains the minerals. If the seller fails to reserve the minerals when selling the surface, the buyer automatically receives any mineral interest the grantor owned at the time of conveyance.?

Mineral rights in Texas are the rights to mineral deposits that exist under the surface of a parcel of property. This right normally belongs to the owner of the surface estate; however, in Texas those rights can be transferred through sale or lease to a second party.

Not owning the mineral rights to a parcel of land doesn't mean your property is worthless. If someone else owns the mineral rights and they sell those rights to an individual or corporation, you can still make a profit as the surface rights owner. You have the rights of ingress and egress.

A One and the Same Affidavit or an Identity Affidavit may be used in Texas when the current owner has changed his or her name or when there was an error in the spelling of the current owner's name in his or her deed.

You will need to sign the mineral deed form in front of a notary to confirm its authenticity, have it notarized, and have it recorded. The recorder of the deed can send a copy back to us, and you will keep a copy. And you are done!

Generally, all parties who signed the prior deed must sign the correction deed in the presence of a notary, who will acknowledge its execution. Then record it in the country court records system to make it valid.

The following are methods for establishing mineral rights ownership: Deed. A deed is used to transfer mineral rights ownership from one party to another. Lease. ... Severance. ... Adverse Possession. ... Surface Use Agreement. ... Royalties. ... Mineral Estate. ... Texas Railroad Commission.