This document is a standstill agreement for a firm that considering merger with another firm. It assures that the status quo remains while the partners pursue various alternatives.

Texas Standstill Agreements

Description

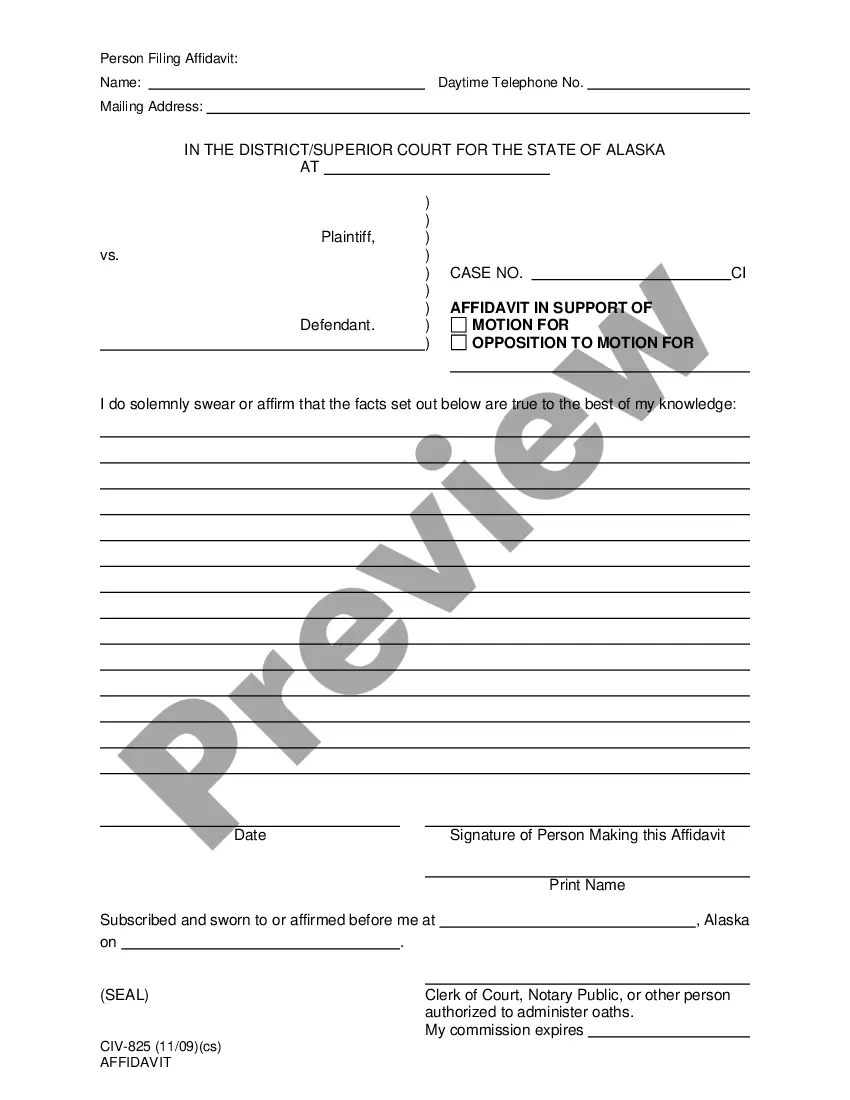

How to fill out Standstill Agreements?

Have you been within a place where you need papers for either organization or personal functions just about every time? There are tons of legal papers layouts accessible on the Internet, but finding types you can depend on is not straightforward. US Legal Forms delivers thousands of type layouts, just like the Texas Standstill Agreements, that happen to be published to meet federal and state demands.

Should you be presently knowledgeable about US Legal Forms website and get an account, merely log in. After that, it is possible to down load the Texas Standstill Agreements template.

Should you not offer an profile and would like to begin using US Legal Forms, follow these steps:

- Get the type you require and ensure it is for that right metropolis/area.

- Take advantage of the Preview option to examine the form.

- Read the description to actually have chosen the proper type.

- In the event the type is not what you`re looking for, utilize the Search field to discover the type that suits you and demands.

- When you obtain the right type, click Purchase now.

- Opt for the prices plan you need, fill in the required information and facts to make your money, and pay money for the transaction with your PayPal or Visa or Mastercard.

- Choose a practical data file formatting and down load your version.

Find all the papers layouts you may have bought in the My Forms menus. You may get a additional version of Texas Standstill Agreements any time, if needed. Just click on the necessary type to down load or print out the papers template.

Use US Legal Forms, the most considerable assortment of legal varieties, to save time as well as prevent mistakes. The support delivers expertly created legal papers layouts that you can use for a range of functions. Produce an account on US Legal Forms and start making your lifestyle easier.

Form popularity

FAQ

An investor makes a purchase of shares in a company which brings their holdings to 45%. Concerned about the potential for a controlling share takeover by the investor, the company enters negotiations over a standstill, which prevents further purchasing beyond this point.

A standstill agreement is a contract that contains provisions that govern how a bidder of a company can purchase, dispose of, or vote stock of the target company. A standstill agreement can effectively stall or stop the process of a hostile takeover if the parties cannot negotiate a friendly deal.

A standstill agreement is a contract that contains provisions that govern how a bidder of a company can purchase, dispose of, or vote stock of the target company. A standstill agreement can effectively stall or stop the process of a hostile takeover if the parties cannot negotiate a friendly deal.

A standstill agreement prevents a party from issuing proceedings during the currency of that agreement. As such a standstill agreement is a voluntary contractual arrangement between the parties to pause limitation for an agreed length of time (typically 3-6 months).

It has advantages and can ease the pressure associated with limitation deadlines. It allows parties time to consider the merits of the claim and/or the defence; and gives some breathing space to explore a resolution without needing to spend otherwise unnecessary time and costs heading down the route of litigation.

In a ?standstill clause? the parties to a trade agreement commit to keeping the market at least as open in the future as it was as at the time of conclusion of the agreement.

The standstill agreement prevents these potential buyers from publicly announcing a bid for the target, without first acquiring the consent of the target (the public company exploring a sale). In this sense, the standstill agreement is seen to help the target company control the bidding process.

An agreement in which a hostile bidder agrees to limit its holdings in a target company. A standstill agreement stops the takeover bid from progressing for a period of time.