Texas Self-Employed Seasonal Picker Services Contract

Description

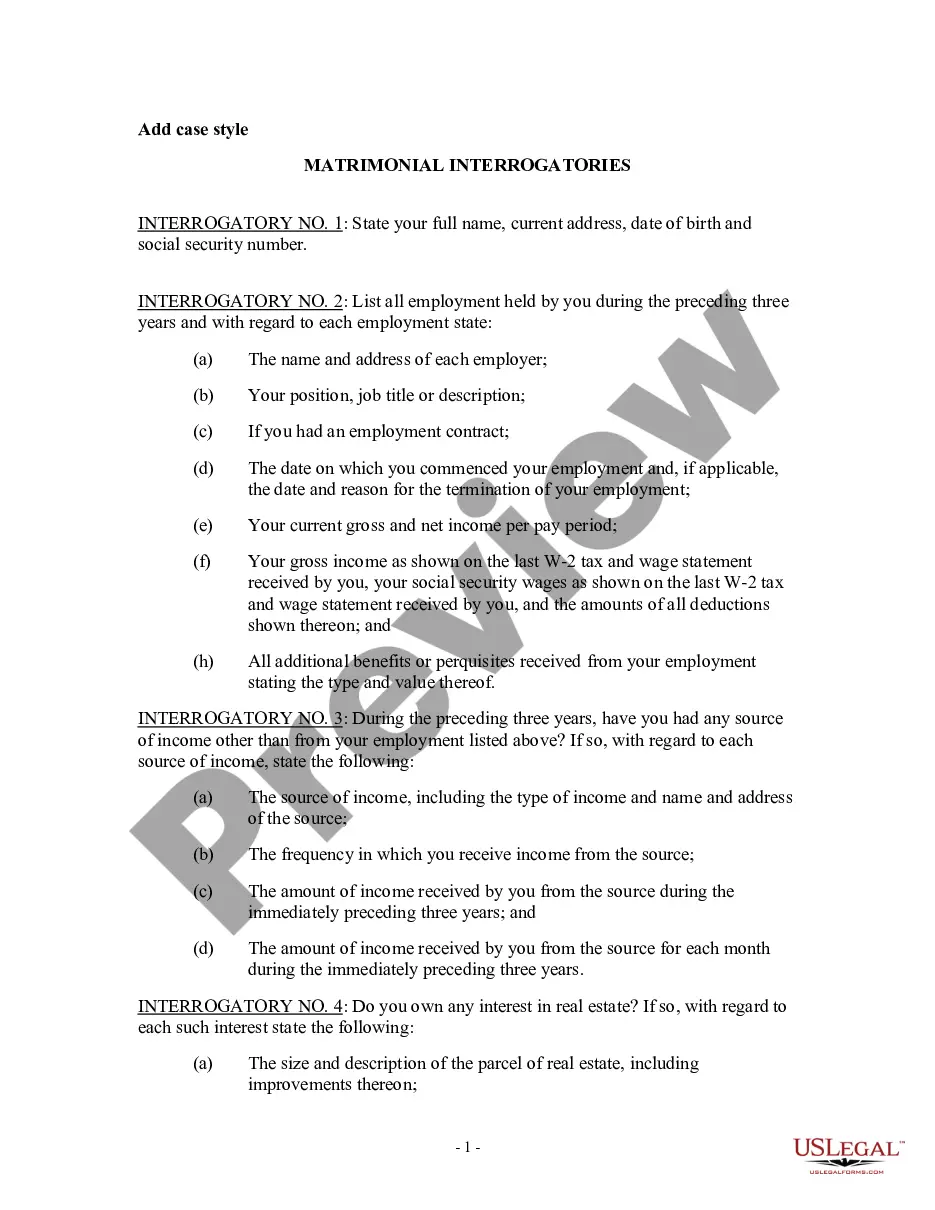

How to fill out Self-Employed Seasonal Picker Services Contract?

If you wish to accumulate, acquire, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the website's simple and user-friendly search to locate the documents you need. Many templates for business and personal purposes are organized by categories and titles, or keywords.

Use US Legal Forms to find the Texas Self-Employed Seasonal Picker Services Contract in just a few clicks.

Every legal document template you purchase is yours permanently. You can access every form you downloaded in your account. Click on the My documents section and select a form to print or download again.

Compete and acquire, and print the Texas Self-Employed Seasonal Picker Services Contract with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and then click the Obtain button to access the Texas Self-Employed Seasonal Picker Services Contract.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for the correct state.

- Step 2. Utilize the Preview option to review the form's details. Remember to read the summary.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Choose the payment plan you prefer and enter your credentials to register for an account.

- Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Texas Self-Employed Seasonal Picker Services Contract.

Form popularity

FAQ

Filing taxes as an independent contractor in Texas involves several steps, especially when working under a Texas Self-Employed Seasonal Picker Services Contract. First, gather all necessary documents, including your 1099 forms and any business expenses. You will report your income on Schedule C of your tax return. Additionally, consider making estimated tax payments throughout the year to avoid penalties. Using platforms like US Legal Forms can simplify the process by providing templates and guidance specific to your needs.

In Texas, independent contractors must earn at least $600 during a calendar year from a single client to receive a Form 1099. This form is crucial for reporting income from your Texas Self-Employed Seasonal Picker Services Contract. If your earnings exceed this threshold, it’s essential to keep accurate records for tax purposes. Always consult with a tax professional to ensure compliance with IRS regulations.

When writing a self-employment contract, start by defining the services you will provide and the payment structure. Be sure to include the terms of engagement, deadlines, and any expectations for both parties. Platforms like US Legal Forms offer templates for a Texas Self-Employed Seasonal Picker Services Contract, simplifying the drafting process and ensuring legal compliance.

To write a simple employment contract, clearly state the job title, duties, salary, and the duration of employment. Additionally, include clauses about confidentiality and termination to protect both parties. Using a Texas Self-Employed Seasonal Picker Services Contract template can help streamline this process and ensure all important details are covered.

Typically, a temporary or seasonal employee is offered a fixed-term contract or an employment agreement that specifies the duration of their employment. This type of contract outlines job responsibilities, payment details, and the expected timeframe for the work. A Texas Self-Employed Seasonal Picker Services Contract can effectively address these points for self-employed individuals.

Writing a self-employed contract involves detailing the scope of work, payment terms, and the responsibilities of both parties. Make sure to include a termination clause and any relevant provisions that protect both parties' interests. For ease, consider using a Texas Self-Employed Seasonal Picker Services Contract template available on US Legal Forms.

To write a contract for a 1099 employee, start by outlining the specific services they will provide, the payment terms, and the duration of the work. Include a clause that clarifies their independent contractor status, ensuring they are not treated as an employee. A Texas Self-Employed Seasonal Picker Services Contract can serve as a great reference for this type of agreement.

Yes, you can write your own legally binding contract, including a Texas Self-Employed Seasonal Picker Services Contract. However, it is essential to ensure that the contract includes all necessary elements, such as clear terms, mutual agreement, and signatures. Utilizing templates from platforms like US Legal Forms can simplify this process and provide a solid foundation.

Technically, you can receive 1099 payments without a formal contract, but this is not recommended. Without a Texas Self-Employed Seasonal Picker Services Contract, you may lack legal protection and clarity about your job responsibilities. A contract serves as a documented agreement between you and the payer, ensuring you both understand the terms. Thus, it is wise to have a contract to safeguard your interests.

Yes, a contract is advisable even if you are self-employed. A Texas Self-Employed Seasonal Picker Services Contract formalizes your agreement with clients, detailing the scope of work, payment terms, and deadlines. This clarity can enhance your professional relationships and provide legal protection. Consider using a platform like uslegalforms to create a tailored contract that fits your needs.