Texas Self-Employed Seamstress Services Contract

Description

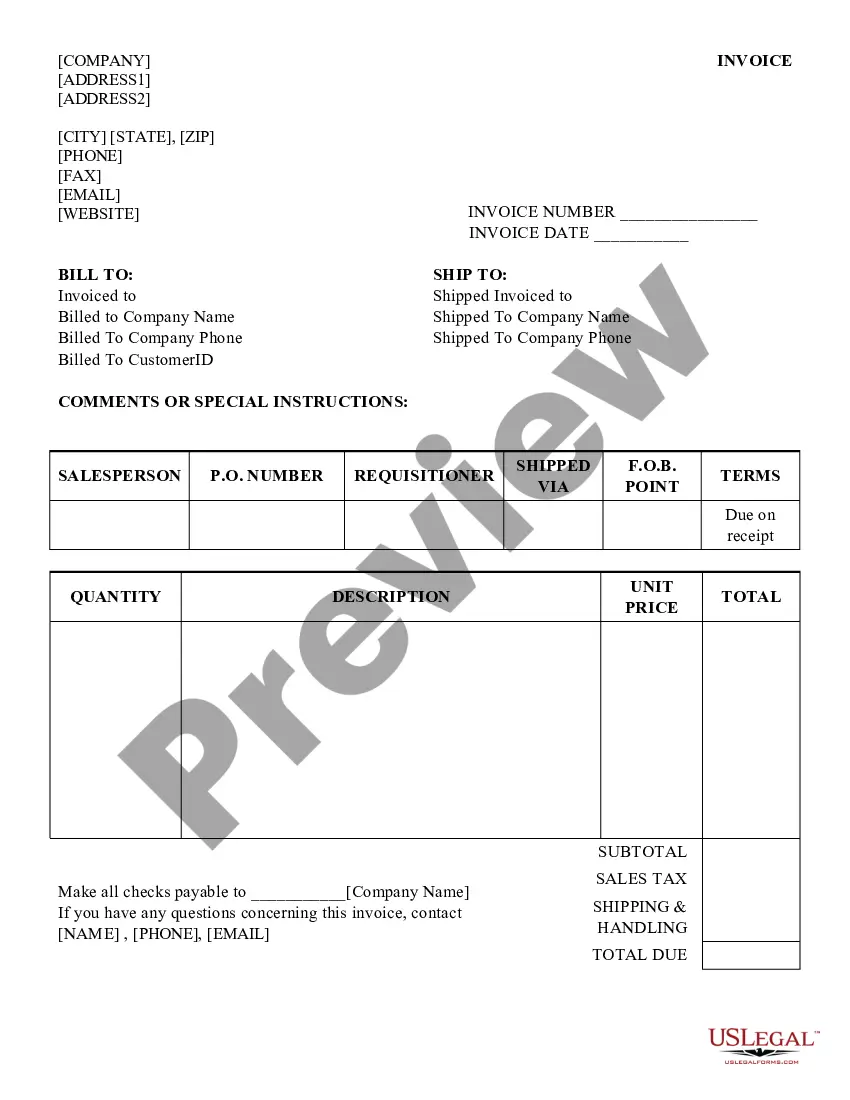

How to fill out Self-Employed Seamstress Services Contract?

You can allocate time on the internet trying to find the legal document template that meets the state and federal specifications you require. US Legal Forms offers thousands of legal forms that are vetted by experts.

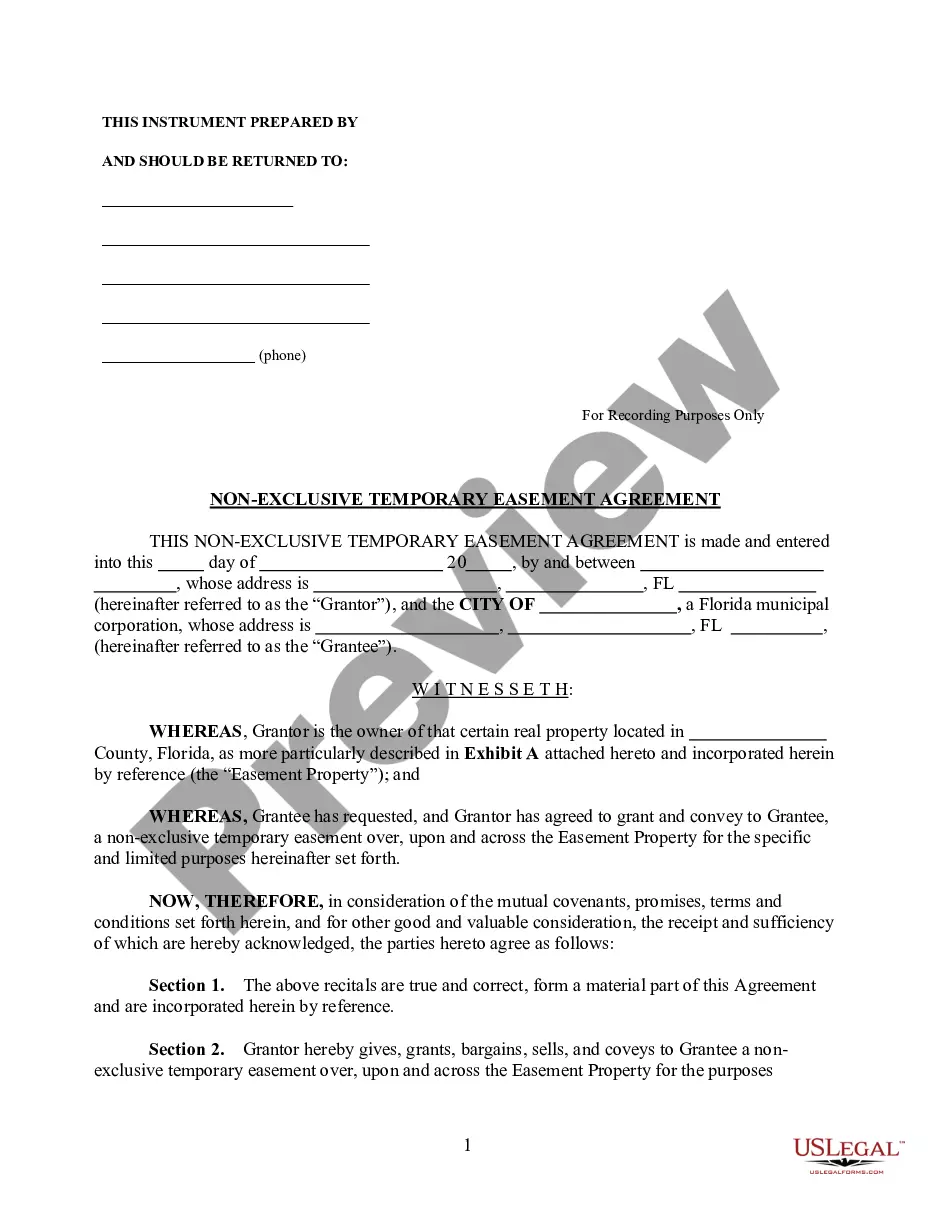

You can download or print the Texas Self-Employed Seamstress Services Contract from the service. If you already have a US Legal Forms account, you may Log In and click the Download button. After that, you may complete, modify, print, or sign the Texas Self-Employed Seamstress Services Contract.

Every legal document template you acquire is yours indefinitely. To obtain another copy of a purchased form, visit the My documents section and click the respective button.

Choose the format of the document and download it to your device. Make modifications to your document if necessary. You can complete, modify, sign, and print the Texas Self-Employed Seamstress Services Contract. Download and print thousands of document templates using the US Legal Forms website, which provides the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/area of your choice. Review the form description to ensure you have chosen the appropriate document.

- If available, use the Review button to preview the document template as well.

- To find another version of the form, use the Search box to locate the template that suits your needs and requirements.

- Once you have identified the template you want, click Get now to continue.

- Select the pricing plan you prefer, enter your details, and create your account on US Legal Forms.

- Complete the transaction. You can utilize your credit card or PayPal account to purchase the legal form.

Form popularity

FAQ

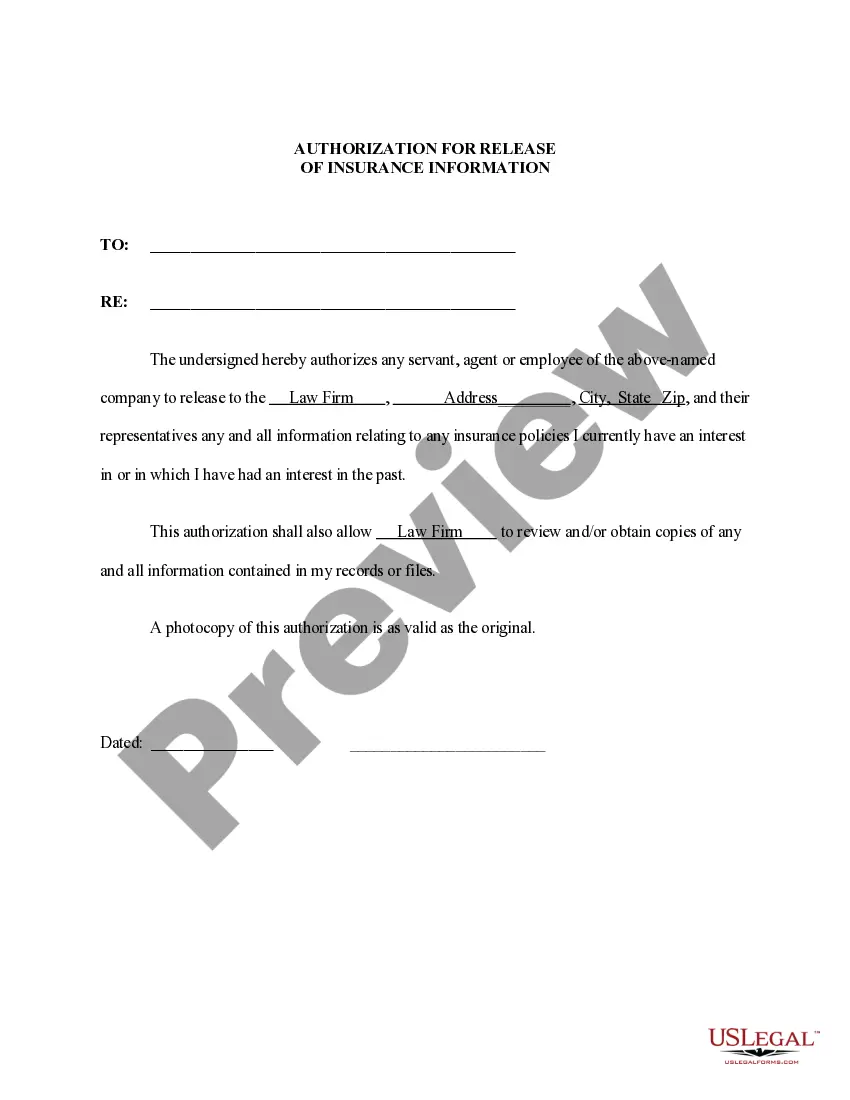

Being employed without a contract can lead to confusion and potential legal issues. Without a Texas Self-Employed Seamstress Services Contract, you may find it challenging to enforce payment or clarify project expectations. In such cases, you might have limited recourse if disputes arise, underscoring the importance of having a written agreement.

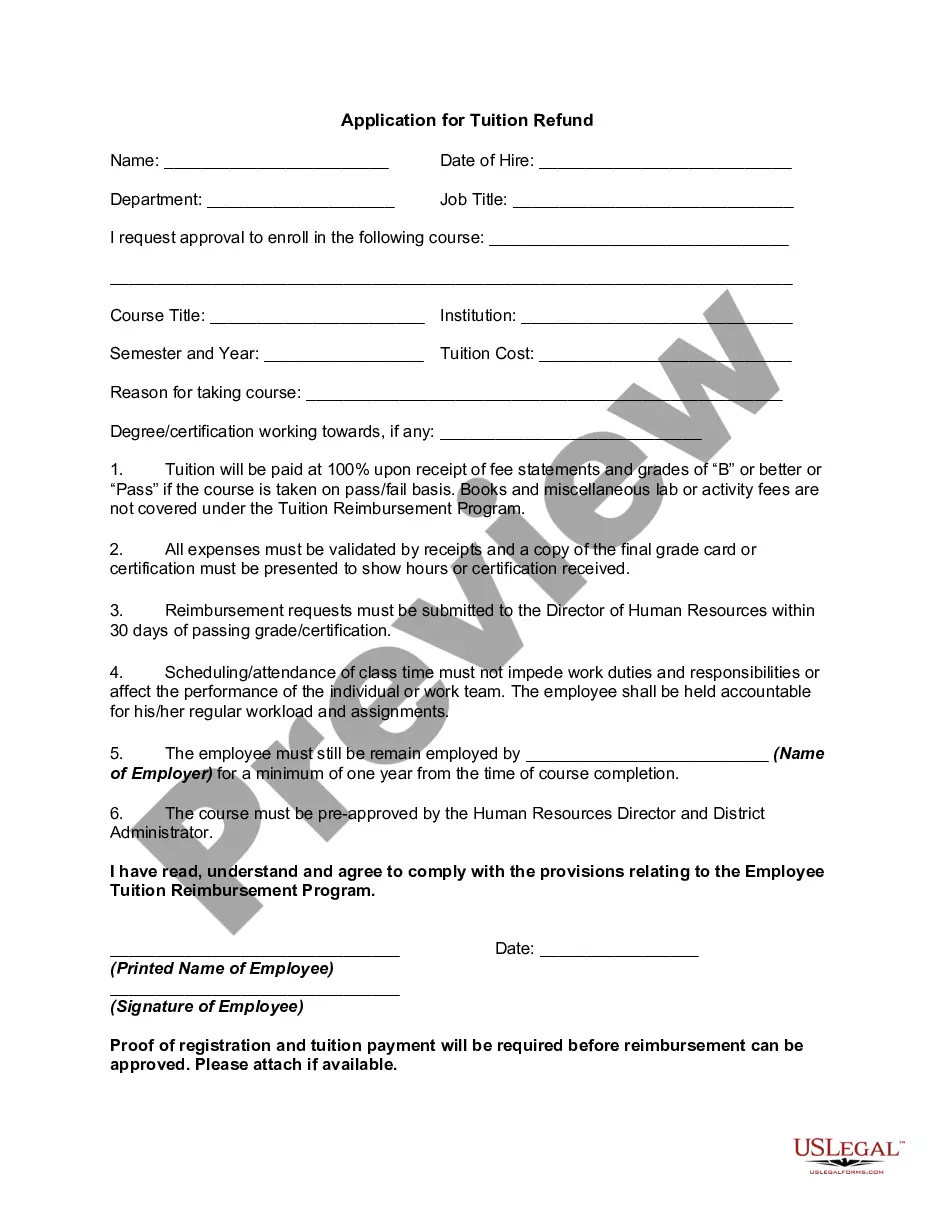

While not legally required, having a contract is highly recommended for self-employed individuals. A Texas Self-Employed Seamstress Services Contract provides clarity in your agreements, ensuring both you and your client understand the terms of your work. This can prevent disputes and foster a positive working relationship.

Self-employed individuals must meet several legal requirements, such as registering their business if necessary, paying taxes, and obtaining any required licenses. Having a Texas Self-Employed Seamstress Services Contract is also beneficial as it formalizes your business agreements and clarifies tax obligations. It helps you maintain professionalism in your dealings with clients.

In most cases, you do not need a specific license to be an independent contractor in Texas. However, certain professions may require additional certifications or permits. It's essential to check local regulations and ensure compliance, and a Texas Self-Employed Seamstress Services Contract can help clarify your business structure.

You can freelance without a contract, but it increases your risk of disputes. Without a Texas Self-Employed Seamstress Services Contract, you may face challenges regarding payment and project specifics. To ensure a smooth working relationship, it is wise to have a contract in place to define terms and protect your interests.

Yes, it is legal to work without a signed contract, but it is not advisable. Working without a Texas Self-Employed Seamstress Services Contract can lead to misunderstandings regarding payment, scope of work, and deadlines. A contract protects both you and your client by clearly outlining expectations and responsibilities.

To file taxes as an independent contractor in Texas, you need to report your income using IRS Form 1040, along with Schedule C for business income. Maintain detailed records of your finances, especially for expenses related to your Texas Self-Employed Seamstress Services Contract. Consulting a qualified tax advisor can provide you with guidance tailored to your situation.

Yes, a self-employed person can enter into contracts to formalize their business relationships. For example, a Texas Self-Employed Seamstress Services Contract outlines the terms of service, payment, and responsibilities for both parties. Having a contract in place helps protect your rights and clarifies expectations.

Contract employees may be self-employed, depending on the terms of their contract. In the case of a Texas Self-Employed Seamstress Services Contract, you operate independently, which typically classifies you as self-employed. However, it is essential to review the specifics of your contract to understand your employment status.

Yes, if you are working under a contract, you are likely self-employed. A Texas Self-Employed Seamstress Services Contract defines your role as an independent service provider. This status gives you autonomy over your work and financial decisions, distinguishing you from traditional employees.