Georgia Term Royalty Deed

Description

How to fill out Term Royalty Deed?

US Legal Forms - one of many greatest libraries of authorized kinds in the States - delivers a wide array of authorized papers templates it is possible to download or print out. While using website, you may get thousands of kinds for company and personal uses, categorized by groups, claims, or keywords.You will discover the most recent types of kinds like the Georgia Term Royalty Deed in seconds.

If you already possess a subscription, log in and download Georgia Term Royalty Deed from the US Legal Forms local library. The Down load key will show up on each type you perspective. You gain access to all in the past downloaded kinds from the My Forms tab of your respective account.

If you want to use US Legal Forms the first time, here are simple instructions to get you started:

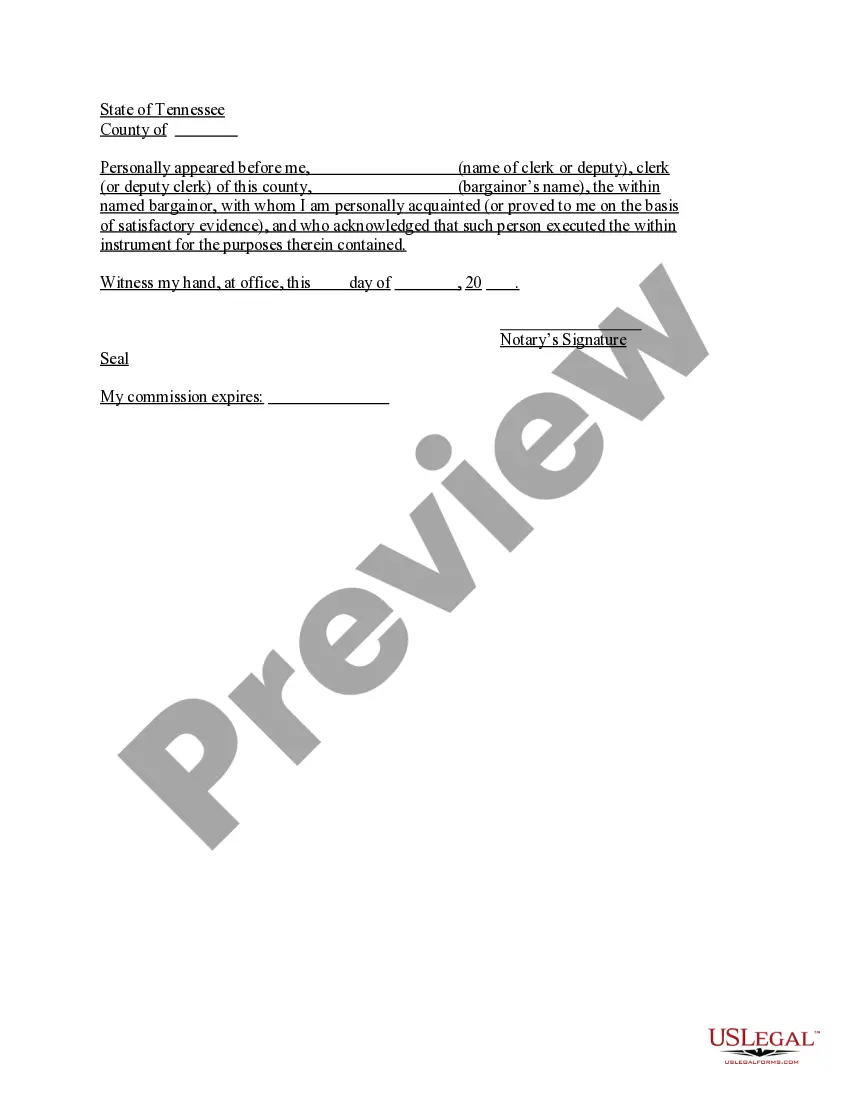

- Be sure you have selected the right type to your city/state. Select the Preview key to check the form`s information. Look at the type explanation to actually have selected the proper type.

- In case the type doesn`t suit your demands, use the Look for industry towards the top of the display screen to discover the one who does.

- Should you be content with the form, validate your selection by clicking the Get now key. Then, select the prices strategy you want and provide your credentials to register for an account.

- Process the financial transaction. Use your charge card or PayPal account to complete the financial transaction.

- Select the format and download the form on your device.

- Make changes. Load, edit and print out and indicator the downloaded Georgia Term Royalty Deed.

Each format you put into your account does not have an expiration time and is also yours forever. So, if you wish to download or print out another version, just proceed to the My Forms portion and click on on the type you want.

Get access to the Georgia Term Royalty Deed with US Legal Forms, the most considerable local library of authorized papers templates. Use thousands of specialist and condition-distinct templates that fulfill your small business or personal needs and demands.

Form popularity

FAQ

When the mineral interest owner becomes inactive or simply abandons the parcel of land and stops exploring or exploiting oil and gas and other resources ? as well as the oil and gas wells ? present beneath the land for an extended period, the rights may become abandoned. As a result, the mineral rights expire.

What is the difference between working interest and royalty interest? Working interests are oil and gas investments that give owners the right to exploit the resources on a property. Royalty interests are the rights belonging to the landowner who leased out the property to the working interest owner.

Mineral rights deeds are not the same as royalty deeds. Royalty deeds do not allow for surface access, or for the initiation of the extraction and sale of minerals. A royalty owner will only benefit economically if the mineral owner decides to produce and sell the minerals.

A royalty interest is a property interest that entitles the owner to receive a share of the production revenue. An individual or company that owns a royalty interest does not have to pay for any of the operational costs required to produce the resource, but they still own a portion of the revenue produced.

A royalty deed gives its holder the right to receive a percentage of the profits from the sale of the minerals, if and when they are actually produced. This kind of legal document does not convey all of the mineral rights to the holder, only the right to receive royalties.

An administrator's deed is a legal document that transfers the property of an intestate individual, who is a person who passes away without a will.

A mineral deed form is a legal document, regarding the ownership of the minerals below the surface of the earth. It is important to understand that surface rights and mineral rights, on the same piece of land, can be owned by different parties.