Texas Disability Services Contract - Self-Employed

Description

How to fill out Disability Services Contract - Self-Employed?

Are you presently in a circumstance where you require documentation for some organization or individual utilizes nearly every working day.

There are numerous legal document templates accessible online, but finding ones you can trust is not easy.

US Legal Forms offers thousands of document templates, including the Texas Disability Services Contract - Self-Employed, which are designed to comply with state and federal regulations.

Utilize US Legal Forms, the most extensive collection of legal documents, to save time and prevent errors.

The service provides properly crafted legal document templates that you can use for a variety of purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you are currently familiar with the US Legal Forms website and have your account, simply Log In.

- After that, you can download the Texas Disability Services Contract - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the document you need and ensure it is for your specific city/county.

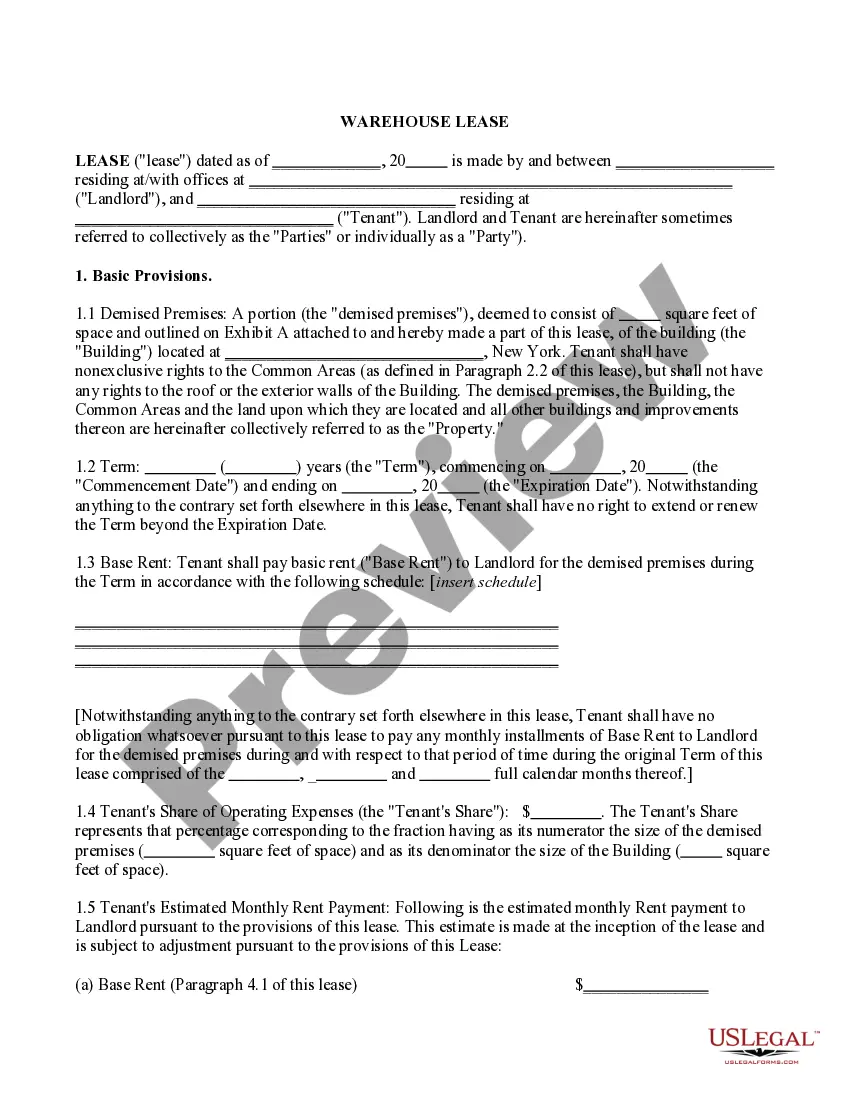

- Use the Preview button to examine the form.

- Read the description to confirm that you have selected the correct document.

- If the form is not what you’re seeking, use the Search field to find the document that meets your requirements.

- Once you acquire the right document, click on Get now.

- Choose the pricing plan you want, fill in the necessary information to create your account, and pay for your order using your PayPal or Visa or Mastercard.

- Select a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of Texas Disability Services Contract - Self-Employed at any time, if necessary. Just click on the desired document to download or print the template.

Form popularity

FAQ

Yes, vocational rehabilitation can support you in starting a business through training, resources, and sometimes funding. They focus on helping individuals with disabilities become self-sufficient. The Texas Disability Services Contract - Self-Employed can guide you in accessing vocational rehabilitation services tailored to your needs.

employment assistance program helps individuals start or grow their own businesses while receiving benefits. These programs provide resources, training, and sometimes financial assistance. Engaging with the Texas Disability Services Contract SelfEmployed can connect you with these valuable resources.

To get disability while self-employed, you need to demonstrate how your condition impacts your ability to run your business. Collect medical records, work history, and other relevant documentation. The Texas Disability Services Contract - Self-Employed can assist you in presenting your case clearly and persuasively.

The Department of Assistive and Rehabilitative Services (DARS) was replaced by the Texas Workforce Commission's Vocational Rehabilitation Services. This change aims to enhance support for individuals with disabilities, including those who are self-employed. The Texas Disability Services Contract - Self-Employed can help you access these new services effectively.

Yes, you can claim a disability allowance even if you are self-employed. It is essential to provide detailed documentation of your condition and how it affects your ability to work. The Texas Disability Services Contract - Self-Employed offers guidance on navigating this process to ensure you meet all requirements.

The easiest disabilities to get approved for typically include conditions like depression, anxiety, or certain physical disabilities. However, your specific situation will play a significant role in the approval process. The Texas Disability Services Contract - Self-Employed can help you understand the eligibility criteria and streamline your application.

Self-employed individuals can indeed qualify for disability benefits. The key is to demonstrate how your disability affects your ability to work and earn an income. Under the Texas Disability Services Contract - Self-Employed, you will need to provide evidence of your condition and its impact on your business activities. USLegalForms can assist you in understanding the requirements and submitting your claim effectively.

Yes, you can file for disability even if you are self-employed. The Texas Disability Services Contract - Self-Employed allows you to apply for benefits based on your income and work history. Ensure you have documentation that supports your claim, including records of your earnings and medical information. Using a platform like USLegalForms can simplify the application process and help you gather the necessary documents.

An example of a self-employment statement could include a document that outlines your business activities, average monthly income, and any relevant expenses. This statement should be clear and concise, providing a snapshot of your financial situation. The Texas Disability Services Contract - Self-Employed can guide you in creating a professional self-employment statement tailored to your needs.

Filling out form 1049 involves providing information about your business activities, income, and expenses. Be sure to include your business name, address, and a detailed account of your earnings. Utilizing the Texas Disability Services Contract - Self-Employed can simplify the process and ensure you provide all necessary details for your statement.