Texas Carpentry Services Contract - Self-Employed Independent Contractor

Description

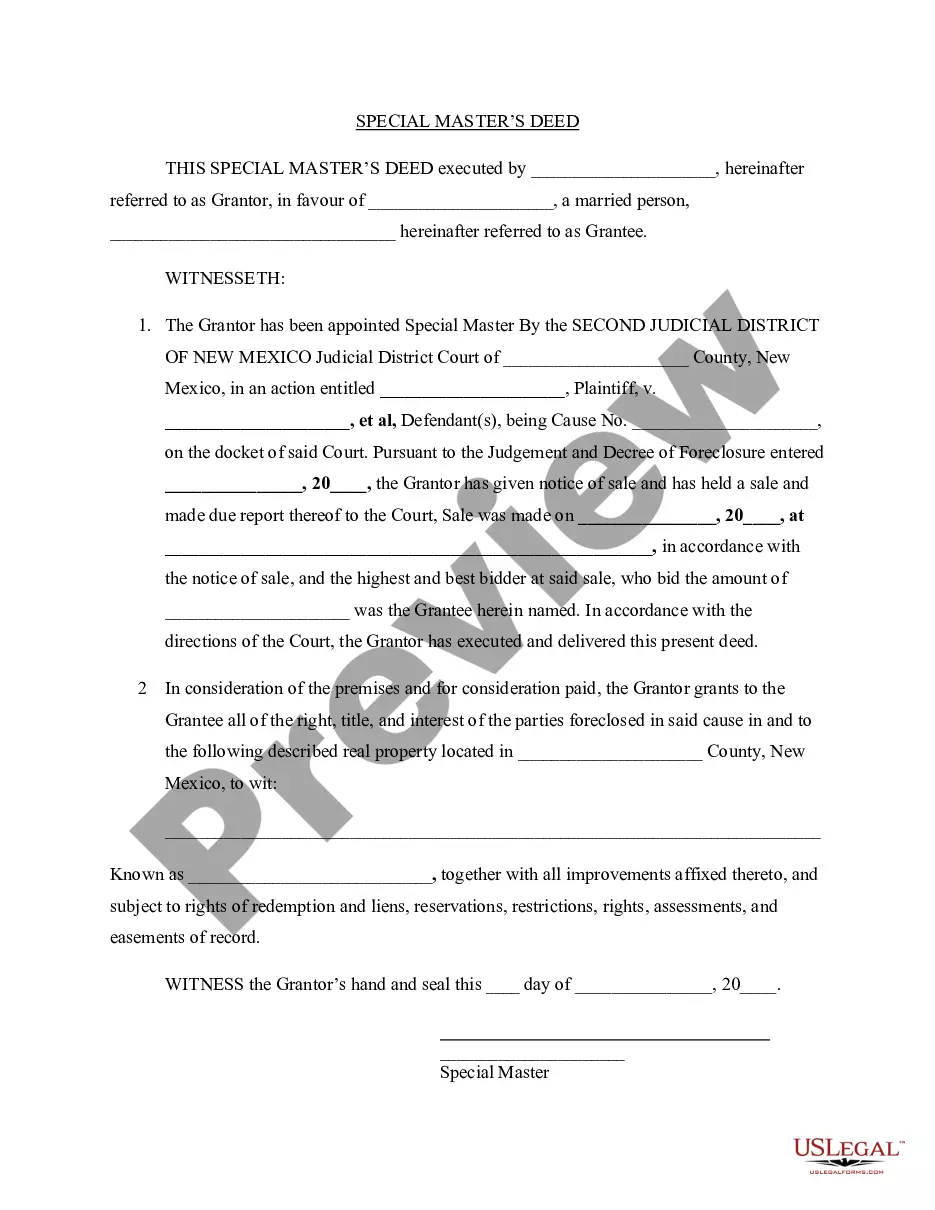

How to fill out Carpentry Services Contract - Self-Employed Independent Contractor?

Finding the appropriate legal document format can be a challenge.

Of course, there are numerous templates available online, but how can you locate the legal form you require.

Utilize the US Legal Forms website. The platform offers a plethora of templates, including the Texas Carpentry Services Agreement - Self-Employed Independent Contractor, which you can utilize for both business and personal purposes.

If the form does not meet your requirements, utilize the Search field to find the appropriate form.

- All of the forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log Into your account and click the Download button to obtain the Texas Carpentry Services Agreement - Self-Employed Independent Contractor.

- Use your account to view the legal forms you have purchased previously.

- Visit the My documents tab in your account and access an additional copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps that you can follow.

- First, ensure you have selected the correct form for your region/state. You can preview the form using the Preview option and read the form description to confirm that it is suitable for you.

Form popularity

FAQ

Creating an independent contractor contract involves outlining the scope of work, payment terms, and other important details. To ensure clarity and protect your rights, consider using a Texas Carpentry Services Contract - Self-Employed Independent Contractor template available on uslegalforms. This resource provides a solid framework, saving you time and ensuring all essential elements are included.

Filing your own taxes as an independent contractor involves collecting your income documents, completing the necessary tax forms, and submitting them to the IRS. A Texas Carpentry Services Contract - Self-Employed Independent Contractor helps you track your income and expenses, which is essential for accurate tax reporting. Make sure to double-check your calculations to avoid any issues with the IRS.

Yes, you can file your 1099 taxes yourself as a self-employed independent contractor. However, it's important to understand the forms you need and how to report your income accurately. Using a Texas Carpentry Services Contract - Self-Employed Independent Contractor can help you organize your income and expenses, making it easier to file your taxes without professional assistance.

Writing an independent contractor agreement involves several steps to protect both parties involved. Start by defining the scope of work and duration of the contract. Include terms for payment, liability, and confidentiality. A Texas Carpentry Services Contract - Self-Employed Independent Contractor template can simplify this task, providing clear guidelines to follow so you can focus on your carpentry business.

An independent contractor typically fills out several important documents. This includes the independent contractor agreement, tax forms like the W-9, and any necessary permits or licenses specific to their trade. Utilizing a Texas Carpentry Services Contract - Self-Employed Independent Contractor can help ensure you have the correct paperwork ready, making your work as smooth as possible.

To fill out an independent contractor form, gather essential information related to your business and the services provided. Include personal details like your name, address, and social security number. Lay out the services you will perform and any associated costs. A Texas Carpentry Services Contract - Self-Employed Independent Contractor form can guide you through each section and ensure nothing is overlooked.

Filling out an independent contractor agreement is straightforward when you understand the key components. Start by entering basic information such as names, contact details, and the scope of work. Specify payment terms and deadlines to ensure clarity. Using a Texas Carpentry Services Contract - Self-Employed Independent Contractor template can help streamline this process and ensure you include all necessary elements.

To gain authorization as an independent contractor in the US, familiarize yourself with both federal and state tax regulations. Registering with the IRS for an Employer Identification Number (EIN) can be a great first step. Additionally, a Texas Carpentry Services Contract - Self-Employed Independent Contractor will detail your service agreement. Consider consulting legal resources or platforms like uslegalforms to ensure you're following the proper procedures for authorization.

While a general business license is not required for every independent contractor in Texas, some fields may require specific licenses. Holding a Texas Carpentry Services Contract - Self-Employed Independent Contractor can provide clarity on your operating procedures. Research your particular area of work to determine if you need any special licensing. Be proactive in seeking out these details to avoid compliance issues.

To prove you are an independent contractor, maintain documentation such as contracts, invoices, and payment records. A Texas Carpentry Services Contract - Self-Employed Independent Contractor can serve as a key piece of evidence of your status. Keep track of your work freedom, business expenses, and the nature of your client relationships. This documentation will be useful if you encounter any disputes.