Texas Notice Regarding Introduction of Restricted Share-Based Remuneration Plan

Description

How to fill out Notice Regarding Introduction Of Restricted Share-Based Remuneration Plan?

Have you been in the situation in which you need to have papers for both organization or specific reasons virtually every time? There are tons of legal document web templates available on the Internet, but locating ones you can rely isn`t effortless. US Legal Forms gives thousands of form web templates, like the Texas Notice Regarding Introduction of Restricted Share-Based Remuneration Plan, that happen to be written to satisfy federal and state needs.

If you are previously informed about US Legal Forms site and also have a merchant account, simply log in. After that, it is possible to acquire the Texas Notice Regarding Introduction of Restricted Share-Based Remuneration Plan design.

If you do not have an profile and would like to start using US Legal Forms, follow these steps:

- Get the form you want and ensure it is for that right metropolis/county.

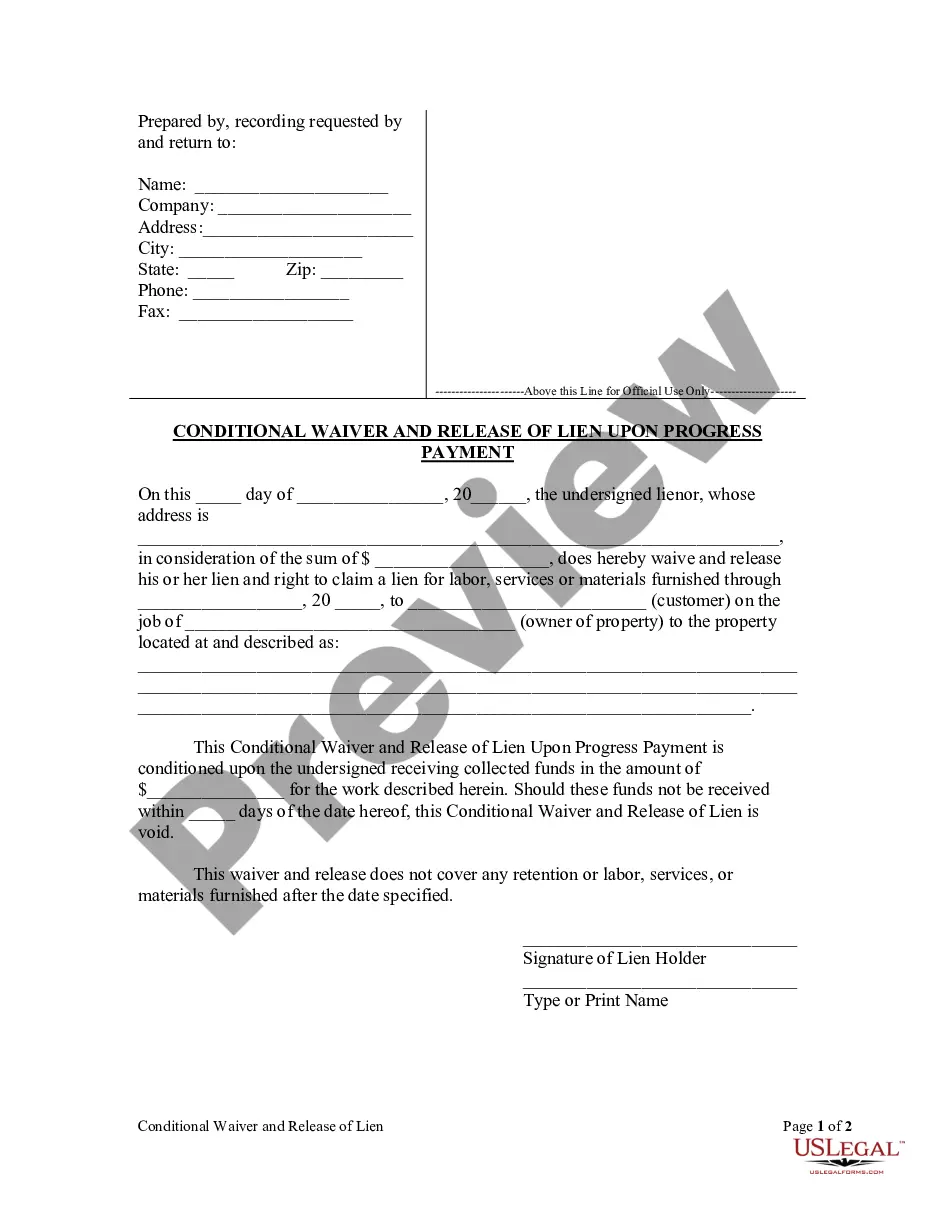

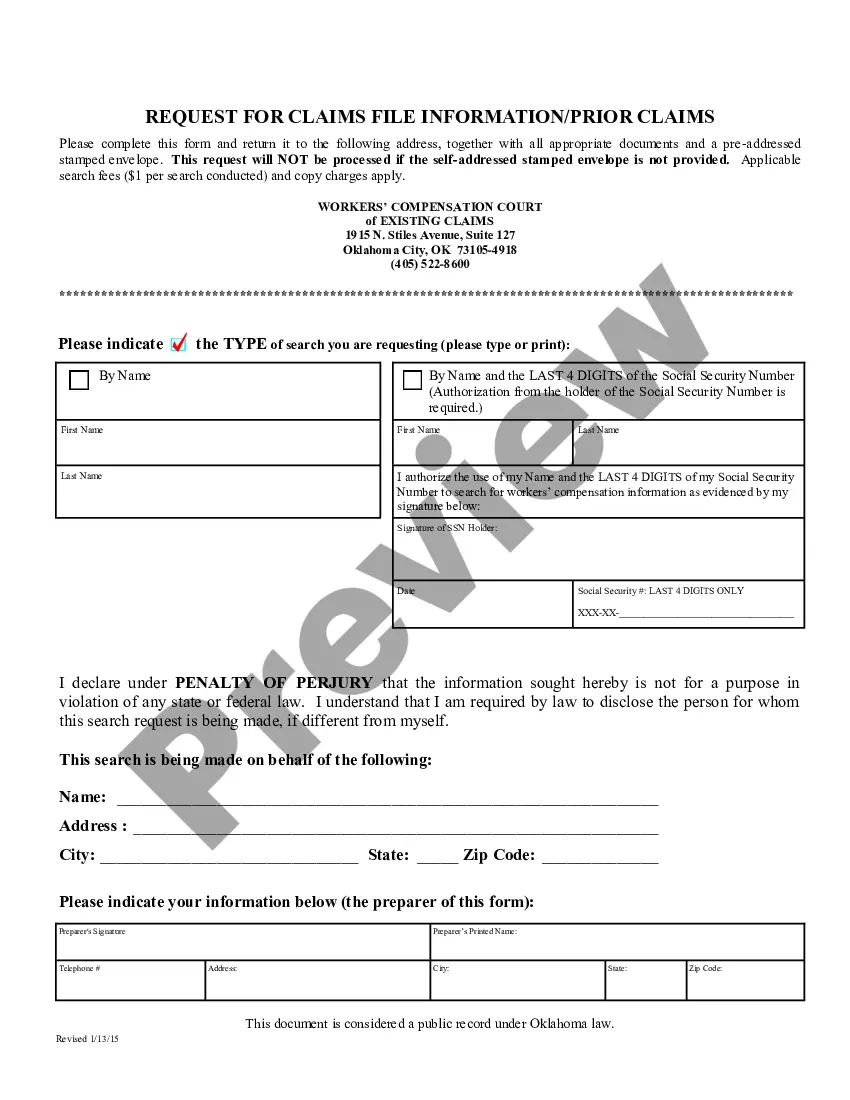

- Take advantage of the Preview button to review the shape.

- Look at the description to ensure that you have selected the right form.

- If the form isn`t what you`re seeking, take advantage of the Look for industry to obtain the form that meets your needs and needs.

- Once you find the right form, just click Acquire now.

- Choose the rates program you desire, submit the required information to generate your money, and pay money for your order with your PayPal or charge card.

- Choose a handy document file format and acquire your duplicate.

Get all the document web templates you possess bought in the My Forms menus. You may get a additional duplicate of Texas Notice Regarding Introduction of Restricted Share-Based Remuneration Plan at any time, if possible. Just select the needed form to acquire or produce the document design.

Use US Legal Forms, probably the most considerable selection of legal varieties, to conserve time as well as avoid faults. The services gives expertly produced legal document web templates that can be used for a selection of reasons. Create a merchant account on US Legal Forms and begin making your lifestyle a little easier.