Texas Term Sheet - Series A Preferred Stock Financing of a Company

Description

The Term Sheet is not a commitment to invest, and is conditioned on the completion of the conditions to closing set forth.

How to fill out Term Sheet - Series A Preferred Stock Financing Of A Company?

Are you currently inside a situation in which you need documents for possibly enterprise or individual functions almost every day? There are tons of legitimate papers layouts available on the net, but locating ones you can rely is not straightforward. US Legal Forms delivers a huge number of develop layouts, such as the Texas Term Sheet - Series A Preferred Stock Financing of a Company, that are composed to fulfill federal and state needs.

When you are already knowledgeable about US Legal Forms site and get a merchant account, just log in. Following that, you are able to download the Texas Term Sheet - Series A Preferred Stock Financing of a Company format.

Should you not provide an account and want to begin using US Legal Forms, follow these steps:

- Get the develop you want and make sure it is for the appropriate city/state.

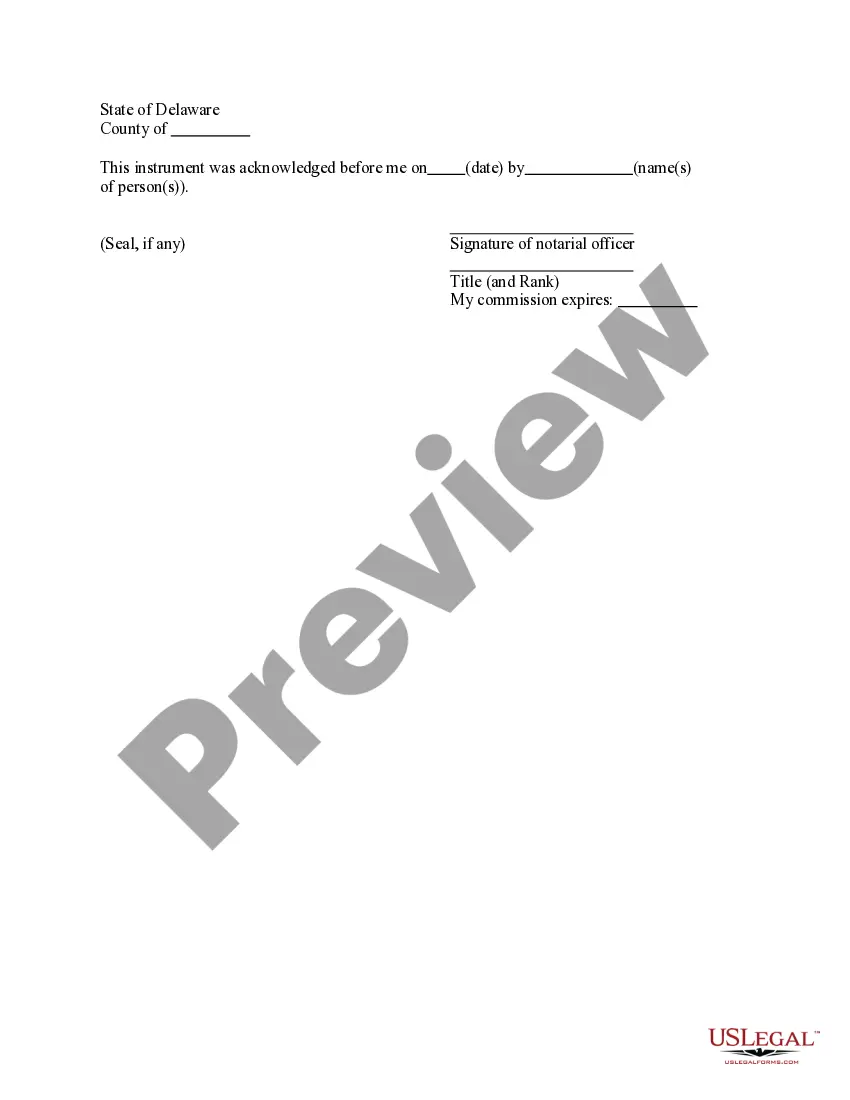

- Use the Preview button to review the form.

- Read the explanation to ensure that you have chosen the appropriate develop.

- If the develop is not what you`re searching for, make use of the Research area to obtain the develop that fits your needs and needs.

- Once you find the appropriate develop, simply click Buy now.

- Choose the costs prepare you want, fill out the required information and facts to make your bank account, and pay for the transaction utilizing your PayPal or Visa or Mastercard.

- Decide on a handy data file file format and download your backup.

Find every one of the papers layouts you may have purchased in the My Forms food selection. You can get a extra backup of Texas Term Sheet - Series A Preferred Stock Financing of a Company any time, if needed. Just click the essential develop to download or printing the papers format.

Use US Legal Forms, by far the most extensive variety of legitimate forms, to save time as well as prevent faults. The support delivers appropriately created legitimate papers layouts which can be used for an array of functions. Create a merchant account on US Legal Forms and initiate generating your way of life easier.

Form popularity

FAQ

In finance, a class A share refers to a share classification of common or preferred stock that typically has enhanced benefits with respect to dividends, asset sales, or voting rights compared to Class B or Class C shares.

Term sheets for venture capital financings include detailed provisions describing the terms of the preferred stock being issued to investors. Some terms are more important than others. The following brief description of certain material terms divides them into two categories: economic terms and control rights.

In Series B investors provide capital to a company in exchange for the latter's preferred shares. The majority of the deals include anti-dilution provisions like in the series A. This means that a company usually sells preferred shares that do not provide its holders with voting rights.

The first round of stock offered during the seed or early stage round by a portfolio company to the venture investor or fund. This stock is convertible into common stock in certain cases such as an IPO or the sale of the company.

Key Takeaways The company valuation, investment amount, percentage stake, voting rights, liquidation preference, anti-dilutive provisions, and investor commitment are some items that should be spelled out in the term sheet.

But no matter who the investor is, a term sheet will always contain six key components, including: A valuation. An estimate of what a company is worth as an investment opportunity. ... Securities being issued. ... Board rights. ... Investor protections. ... Dealing with shares. ... Miscellaneous provisions.

They calculate the cost of preferred stock by dividing the annual preferred dividend by the market price per share. Once they have determined that rate, they can compare it to other financing options. The cost of preferred stock is also used to calculate the Weighted Average Cost of Capital.

Redeemable preferred stock is a type of preferred stock that includes a provision allowing the issuer to buy it back at a specific price and retire it. Also known as callable preferred stock, redeemable preferred stock can be advantageous for issuers because it gives them more financial flexibility.

Outstanding Series A Preferred Shares means the aggregate number of shares of Company Series A Preferred Stock issued and outstanding immediately prior to the Effective Time.

Preamble: It states the major points in a typical term sheet such as the non-binding statement of intent and that it cannot be construed as an offer but an expression of interest. Party Details: States the parties involved, generally the investor, the startup and the founders.