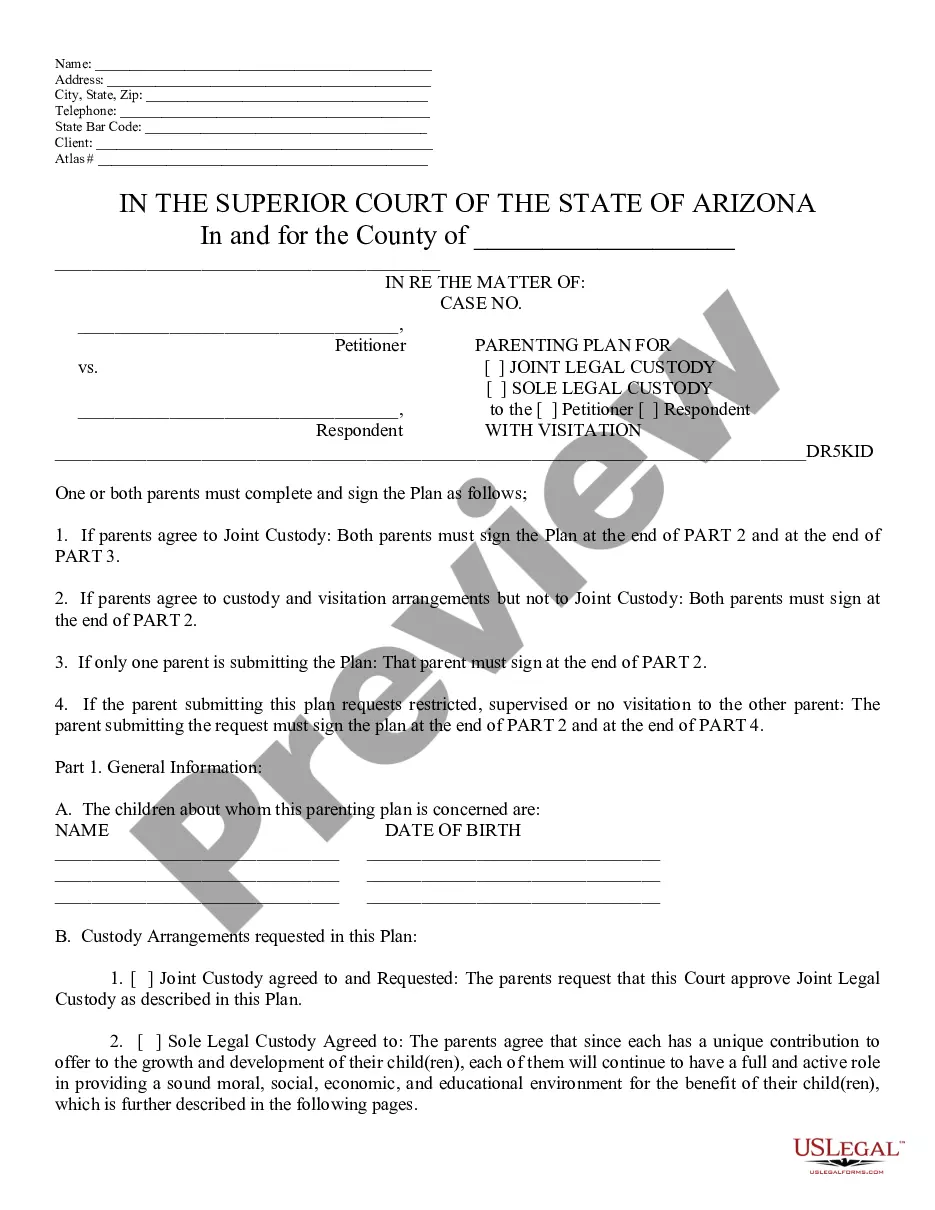

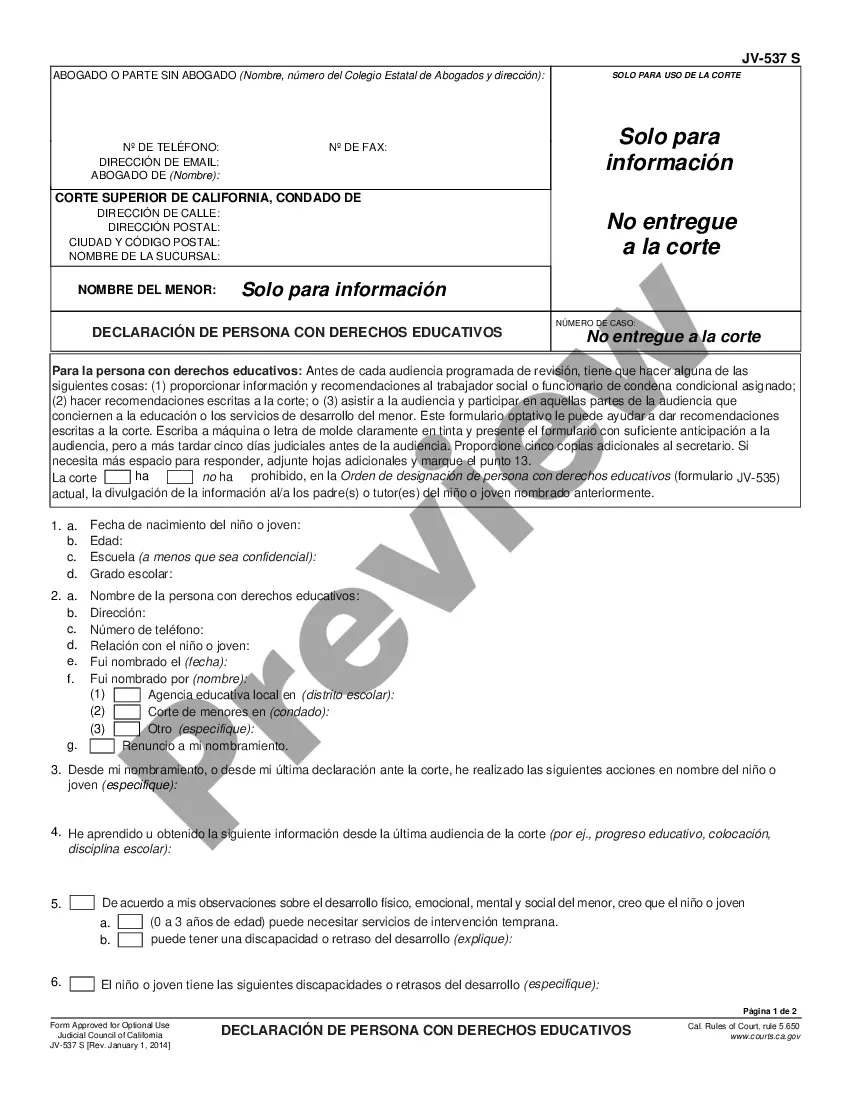

Texas Subsequent Transfer Agreement between MLCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. regarding consummation for purchase and sale of mortgage loans

Description

How to fill out Subsequent Transfer Agreement Between MLCC Mortgage Investors, Inc. And Bankers Trust Of CA, N.A. Regarding Consummation For Purchase And Sale Of Mortgage Loans?

Discovering the right authorized file format might be a struggle. Of course, there are plenty of web templates available online, but how do you discover the authorized kind you require? Make use of the US Legal Forms site. The service delivers thousands of web templates, including the Texas Subsequent Transfer Agreement between MLCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. regarding consummation for purchase and sale of mortgage loans, which can be used for organization and private needs. Every one of the varieties are checked out by professionals and fulfill federal and state specifications.

In case you are already listed, log in to your accounts and click the Download key to get the Texas Subsequent Transfer Agreement between MLCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. regarding consummation for purchase and sale of mortgage loans. Use your accounts to appear through the authorized varieties you have purchased in the past. Proceed to the My Forms tab of your respective accounts and get an additional duplicate in the file you require.

In case you are a fresh customer of US Legal Forms, listed here are basic directions for you to follow:

- Very first, make certain you have chosen the proper kind to your city/area. It is possible to look through the shape making use of the Review key and read the shape outline to make sure it is the right one for you.

- In case the kind will not fulfill your preferences, make use of the Seach industry to obtain the appropriate kind.

- Once you are sure that the shape is acceptable, select the Buy now key to get the kind.

- Opt for the costs strategy you want and enter in the essential information. Build your accounts and purchase your order making use of your PayPal accounts or charge card.

- Choose the document format and download the authorized file format to your system.

- Total, revise and print and signal the acquired Texas Subsequent Transfer Agreement between MLCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. regarding consummation for purchase and sale of mortgage loans.

US Legal Forms is definitely the biggest catalogue of authorized varieties for which you can find a variety of file web templates. Make use of the service to download appropriately-created papers that follow status specifications.