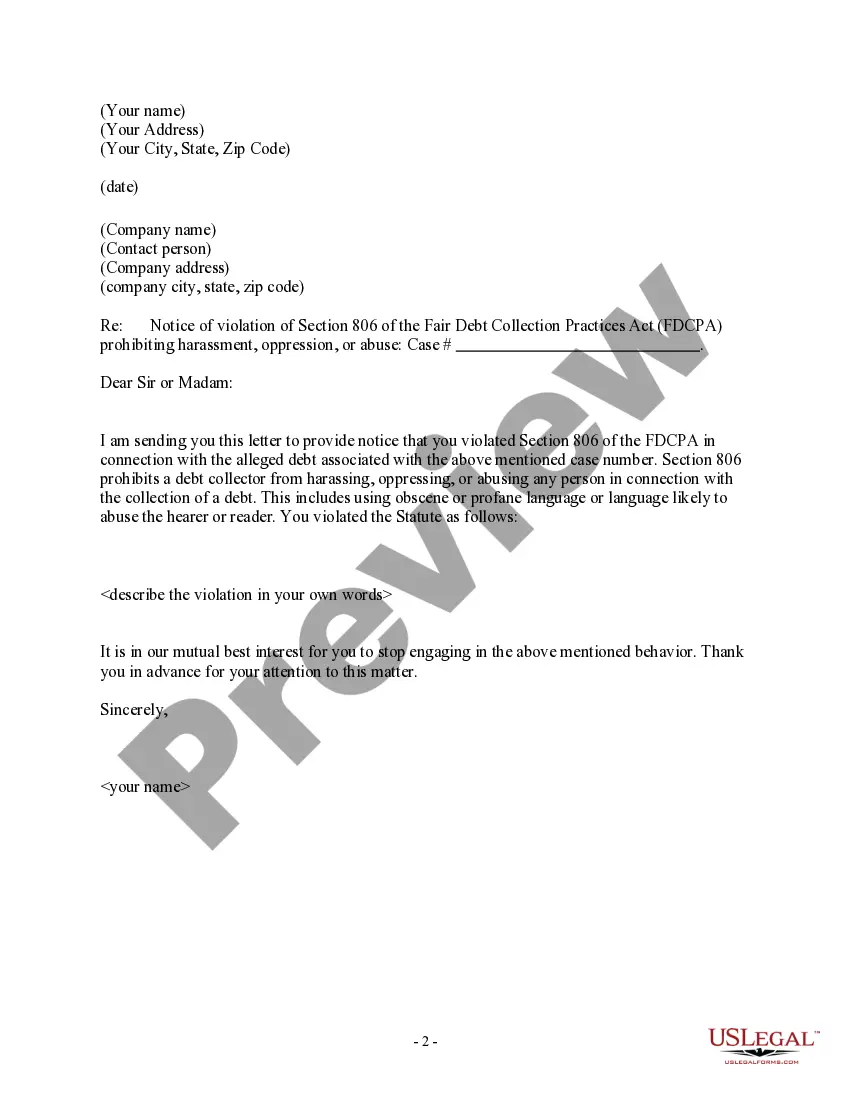

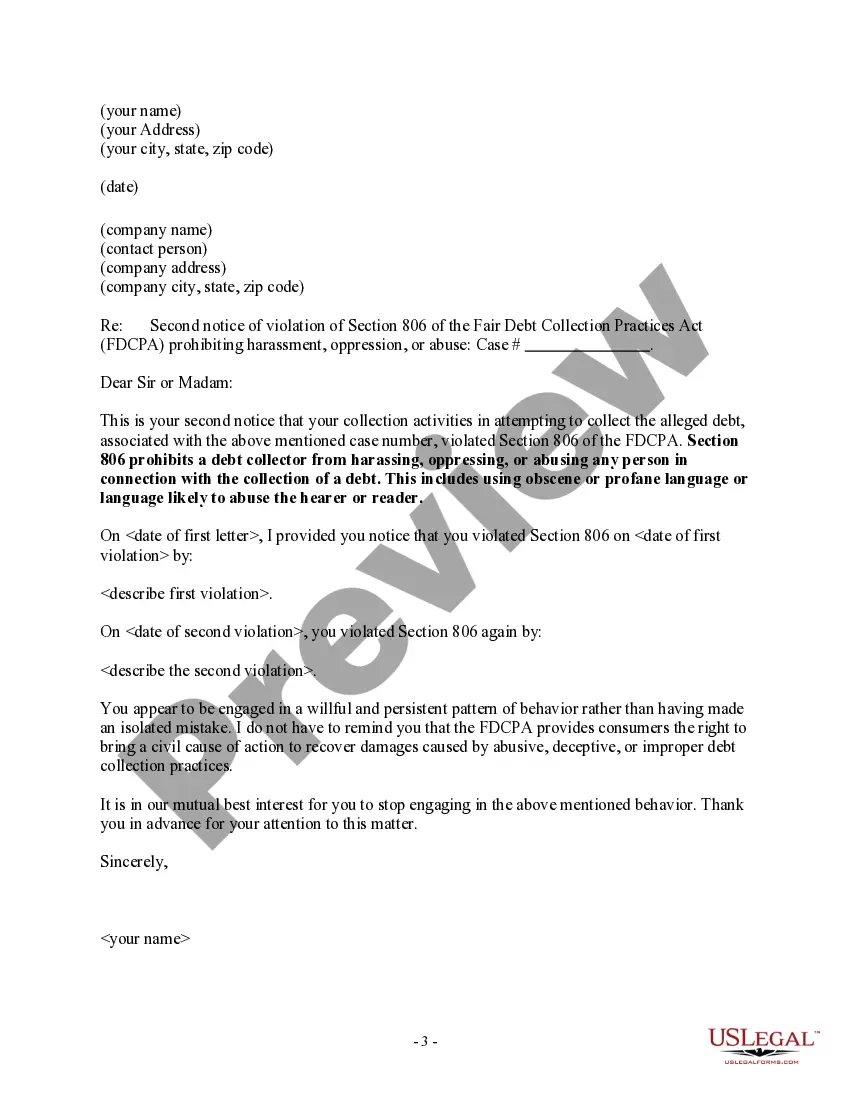

A debt collector may not use obscene or profane language or language likely to abuse the hearer or reader. This includes abusive language includes religious slurs, profanity, obscenity, calling the consumer a liar or a deadbeat, and the use of racial or sexual epithets.

Texas Notice to Debt Collector - Use of Abusive Language

Description

How to fill out Notice To Debt Collector - Use Of Abusive Language?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal document templates that you can download or create.

By utilizing the website, you can access thousands of documents for business and personal reasons, categorized by types, states, or keywords.

You can obtain the most recent versions of documents such as the Texas Notice to Debt Collector - Use of Abusive Language in just seconds.

If the document does not meet your needs, use the Search field at the top of the page to find the one that does.

Once you are satisfied with the document, confirm your selection by pressing the Purchase now button. Then, select your preferred pricing plan and provide your information to create an account. Process the transaction. Use your credit card or PayPal account to complete the purchase. Choose the format and download the document onto your device. Make edits. Fill out, modify, print, and sign the downloaded Texas Notice to Debt Collector - Use of Abusive Language. Each document you add to your account has no expiration date and is yours forever. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the document you desire. Gain access to the Texas Notice to Debt Collector - Use of Abusive Language through US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that suit your business or personal needs and requirements.

- If you hold a subscription, Log In to access the Texas Notice to Debt Collector - Use of Abusive Language from the US Legal Forms library.

- The Download button will be available for every document you view.

- You can access all previously downloaded documents in the My documents section of your account.

- To start using US Legal Forms for the first time, here are simple instructions to help you get underway.

- Make sure you have selected the correct form for your city/county. Click the Review button to examine the document's content.

- Check the form description to ensure that you have chosen the appropriate document.

Form popularity

FAQ

The effective 11-word phrase to halt debt collectors is: 'Please cease all communication with me regarding this debt.' This statement can protect you from relentless contact and demonstrate your assertiveness. Knowing this phrase is integral for those seeking clarity on the Texas Notice to Debt Collector - Use of Abusive Language.

The 11-word credit phrase loophole refers to the specific wording that can disrupt a debt collector's approach. It typically signals your intent to dispute the debt and protects your rights under the Fair Debt Collection Practices Act. Leveraging this phrase can empower you when addressing the Texas Notice to Debt Collector - Use of Abusive Language.

In the book 'Credit Secrets,' the 11-word phrase that garners attention is: 'This communication is from a debt collector, and it is important.' This phrase is crucial for debt collectors to disclose their identity. Being aware of this can provide you leverage during discussions with collectors. It gives insight into the Texas Notice to Debt Collector - Use of Abusive Language.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

Debt Collectors Can't Call You Repeatedly to Harass You This means that while the FDCPA doesn't place a specific limit on the number of calls debt collectors can make, it prohibits them from calling you multiple times just to harass you. (15 U.S. Code §? 1692d).

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

3 Things You Should NEVER Say To A Debt CollectorAdditional Phone Numbers (other than what they already have)Email Addresses.Mailing Address (unless you intend on coming to a payment agreement)Employer or Past Employers.Family Information (ex.Bank Account Information.Credit Card Number.Social Security Number.06-Apr-2022

Don't be surprised if debt collectors slide into your DMs. A new rule allows debt collectors to contact you on social media, text or email not just by phone. The rule, which was approved last year by the Consumer Financial Protection Bureau's former president Kathleen L. Kraninger, took effect Tuesday, Nov.

Fortunately, there are legal actions you can take to stop this harassment:Write a Letter Requesting To Cease Communications.Document All Contact and Harassment.File a Complaint With the FTC.File a Complaint With Your State's Agency.Consider Suing the Debt Collection Agency for Harassment.

No harassment The Fair Debt Collection Practices Act (FDCPA) says debt collectors can't harass, oppress, or abuse you or anyone else they contact. Some examples of harassment are: Repetitious phone calls that are intended to annoy, abuse, or harass you or any person answering the phone. Obscene or profane language.