Texas Personal Property - Schedule B - Form 6B - Post 2005

Description

How to fill out Personal Property - Schedule B - Form 6B - Post 2005?

Are you presently in a place where you need to have files for both business or specific functions just about every working day? There are plenty of legitimate file layouts available on the net, but discovering kinds you can rely isn`t simple. US Legal Forms provides a huge number of form layouts, much like the Texas Personal Property - Schedule B - Form 6B - Post 2005, which can be written to fulfill state and federal needs.

When you are previously knowledgeable about US Legal Forms internet site and possess a free account, just log in. After that, you can acquire the Texas Personal Property - Schedule B - Form 6B - Post 2005 design.

Should you not provide an bank account and want to begin using US Legal Forms, abide by these steps:

- Discover the form you will need and make sure it is to the appropriate metropolis/county.

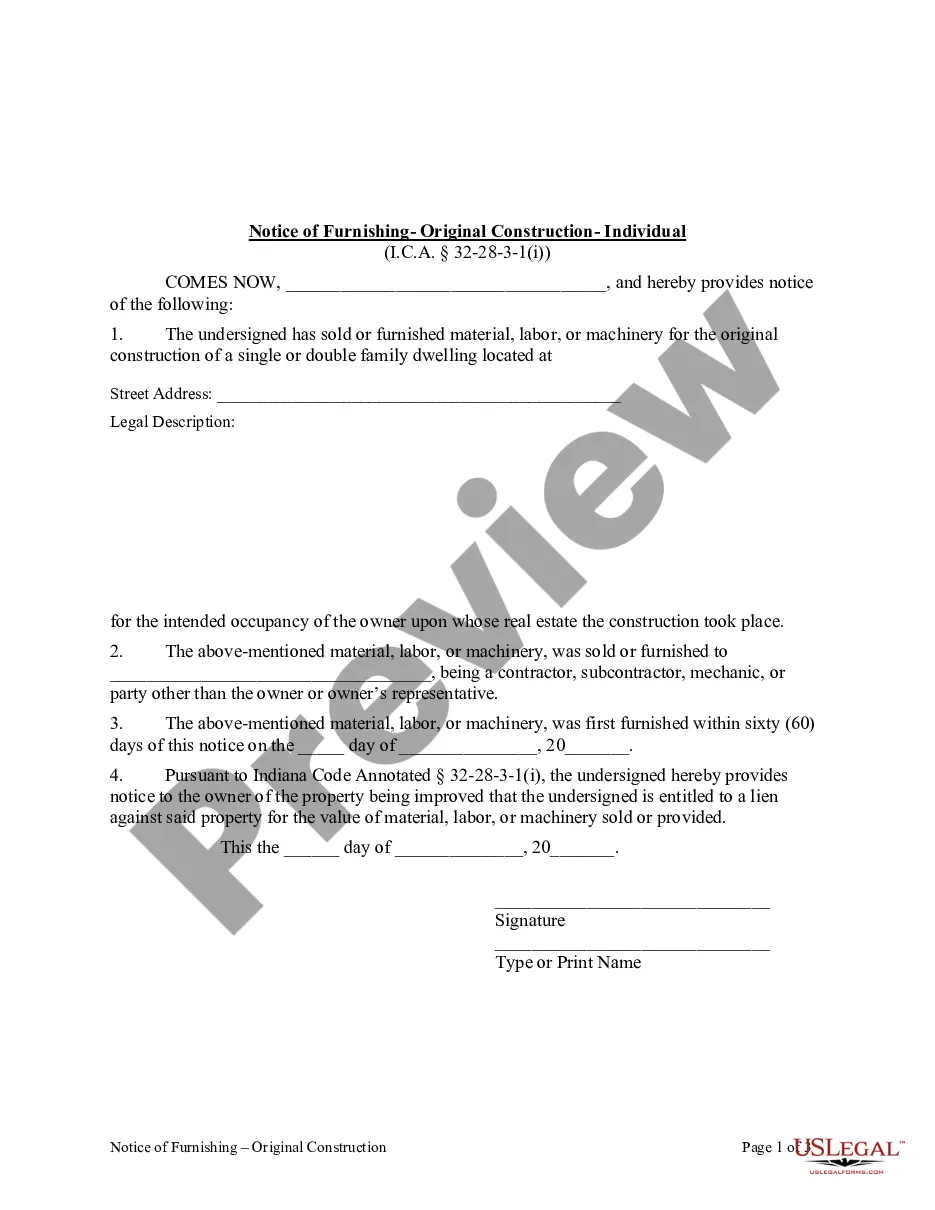

- Take advantage of the Preview key to check the form.

- Look at the outline to actually have selected the right form.

- In the event the form isn`t what you are seeking, make use of the Lookup field to obtain the form that meets your requirements and needs.

- When you obtain the appropriate form, simply click Buy now.

- Pick the costs strategy you desire, complete the required details to make your money, and buy your order using your PayPal or bank card.

- Decide on a handy document format and acquire your version.

Get all of the file layouts you possess purchased in the My Forms menus. You may get a extra version of Texas Personal Property - Schedule B - Form 6B - Post 2005 at any time, if needed. Just click the essential form to acquire or printing the file design.

Use US Legal Forms, probably the most substantial selection of legitimate forms, to save lots of time as well as prevent errors. The support provides expertly manufactured legitimate file layouts that you can use for a range of functions. Produce a free account on US Legal Forms and start generating your daily life easier.

Form popularity

FAQ

Rendition Requirements A person or business who owns tangible personal property with an aggregate value of $20,000 or more is required to file a rendition statement. The rendition is to be filed with the county appraisal district where the property is located.

Business owners are required by State law to render personal property that is used in a business or used to produce income. This property includes furniture and fixtures, equipment, machinery, computers, inventory held for sale or rental, raw materials, finished goods, and work in process.

Texas' property tax applies to all real estate (land and improvements). Texas's property tax also applies to tangible personal property (furniture, machinery, supplies, inventories, etc.) used in the ?production of income,? i.e. business-owned property. Personal property owned by individuals is specifically exempted.

If you own tangible personal property that is used to produce income, you must file a rendition with the (NAME OF COUNTY) County Appraisal District by April 15. A rendition is a report that lists all the taxable property you owned or controlled on Jan. 1 of this year.

"Personal property" in Texas refers to items that a person owns. These things can be tangible?like a vehicle or household furniture?or intangible, like intellectual property. Personal property is not attached to real property and can be moved.

A rendition is a form that provides the appraisal district with the description, location, cost and acquisition dates for business personal property that you own. The appraisal district uses the information to help estimate the market value of your property for taxation purposes.

A rendition is a form (report) that provides information about property that you own. The information you provide in your rendition is confidential by law. For Hidalgo County Appraisal District, most businesses will need to file the general rendition, Form 50-144.