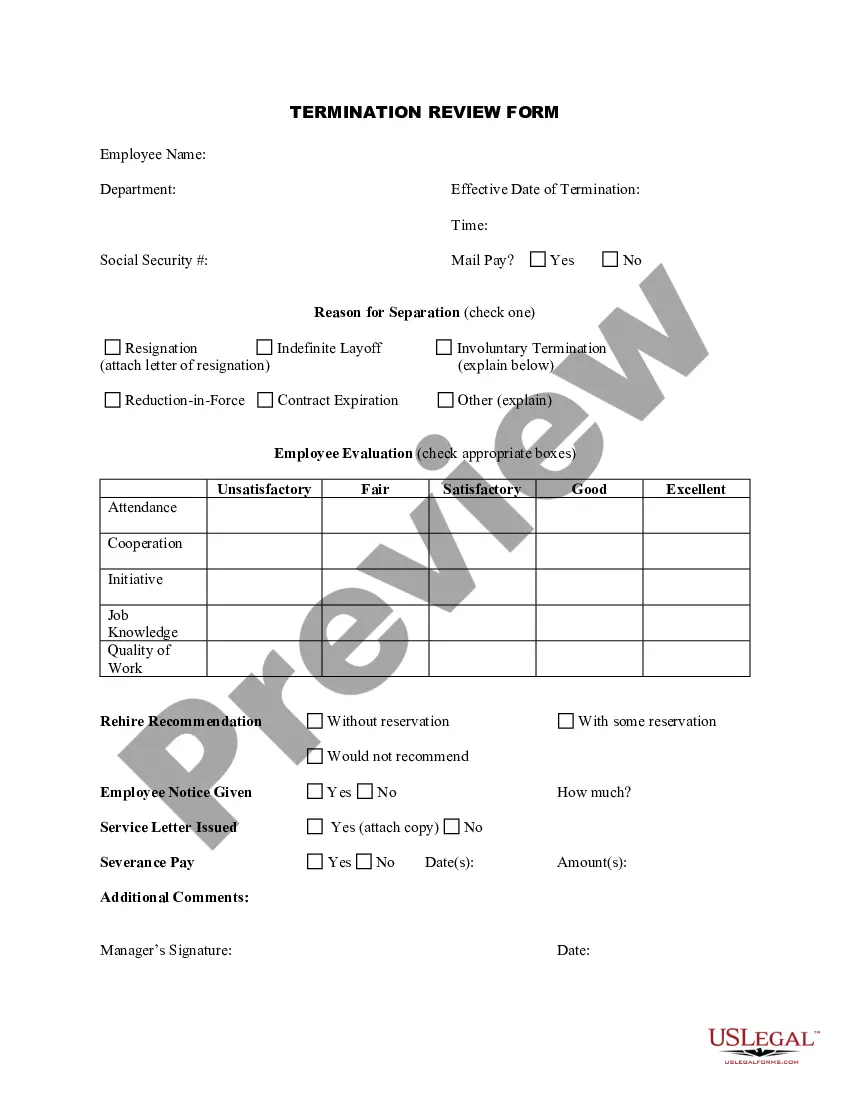

Texas Termination Review Form

Description

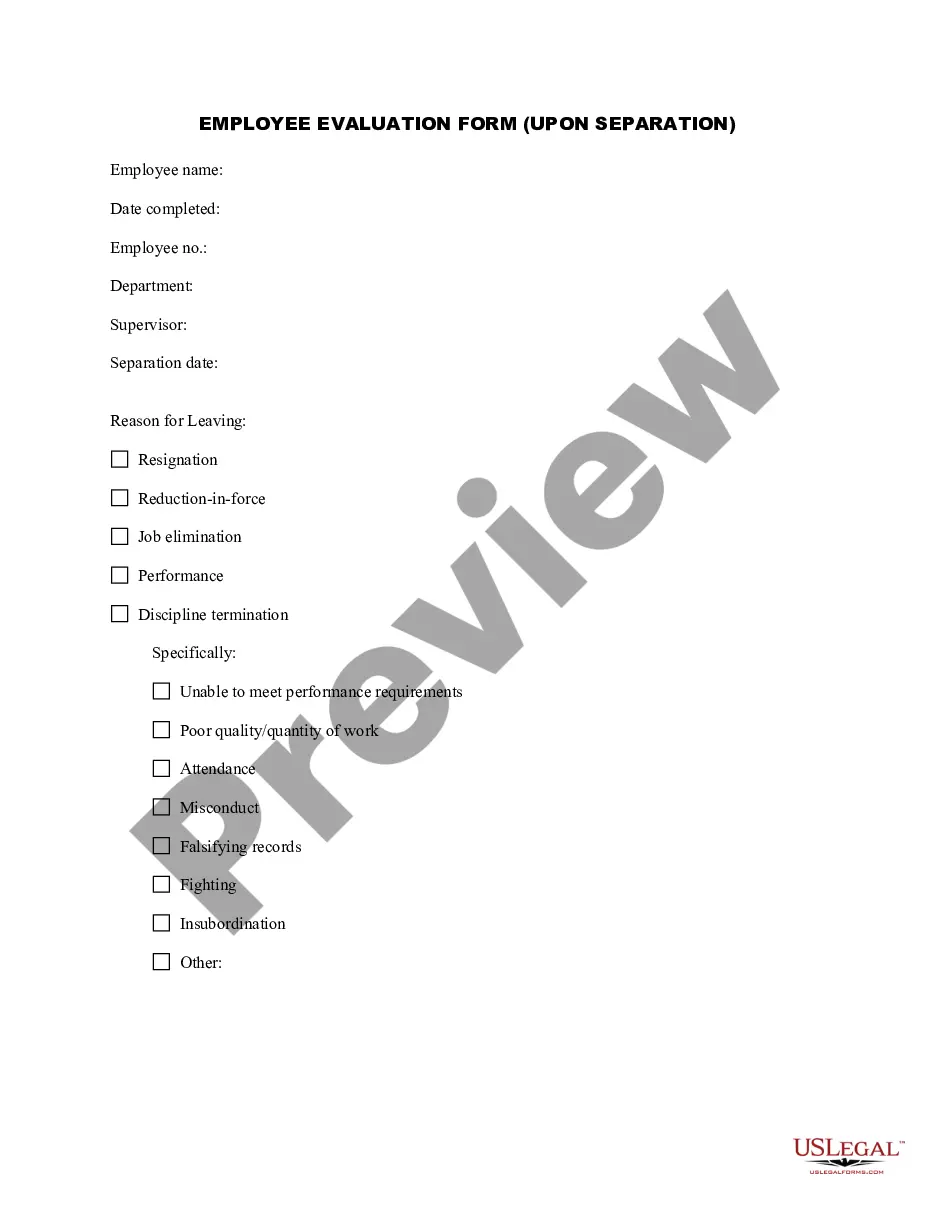

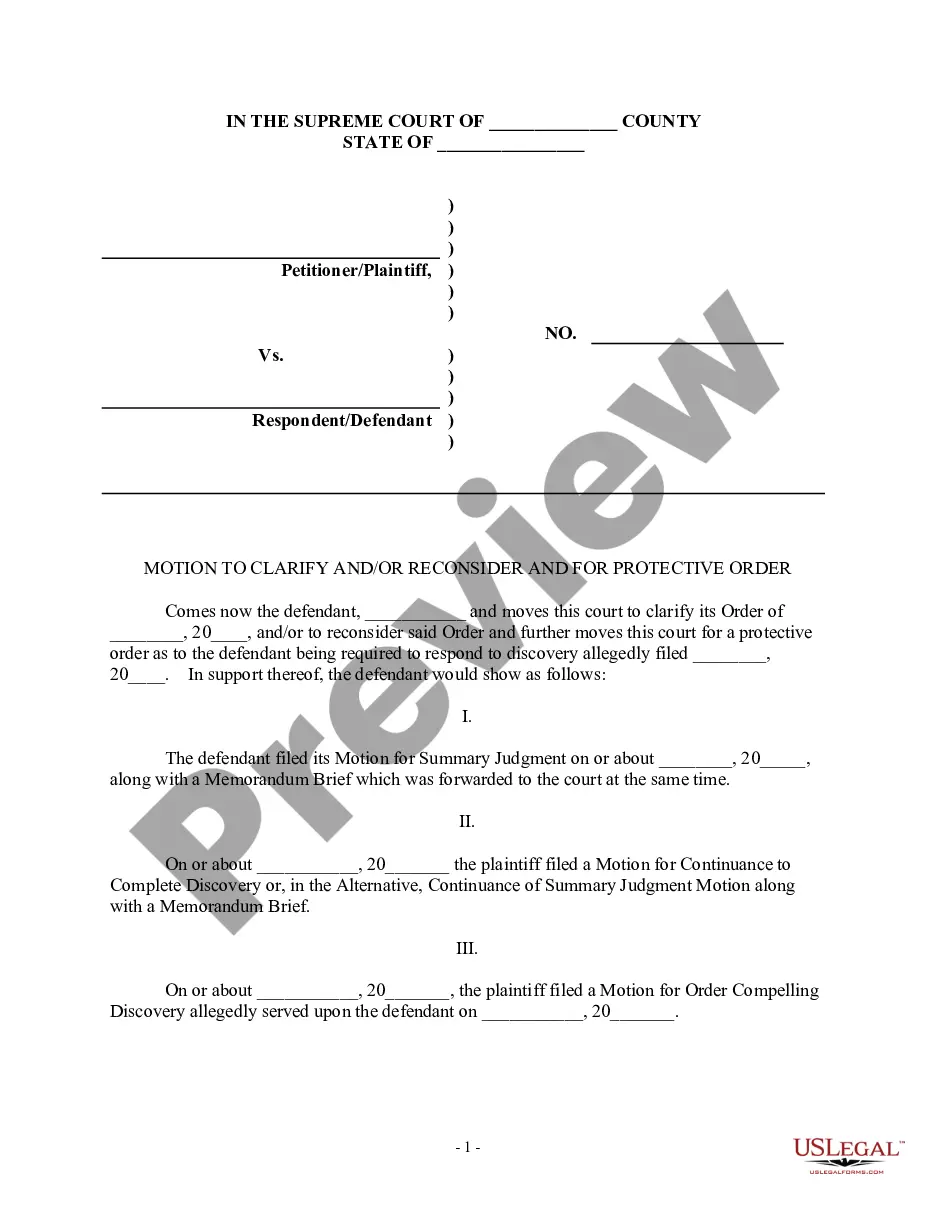

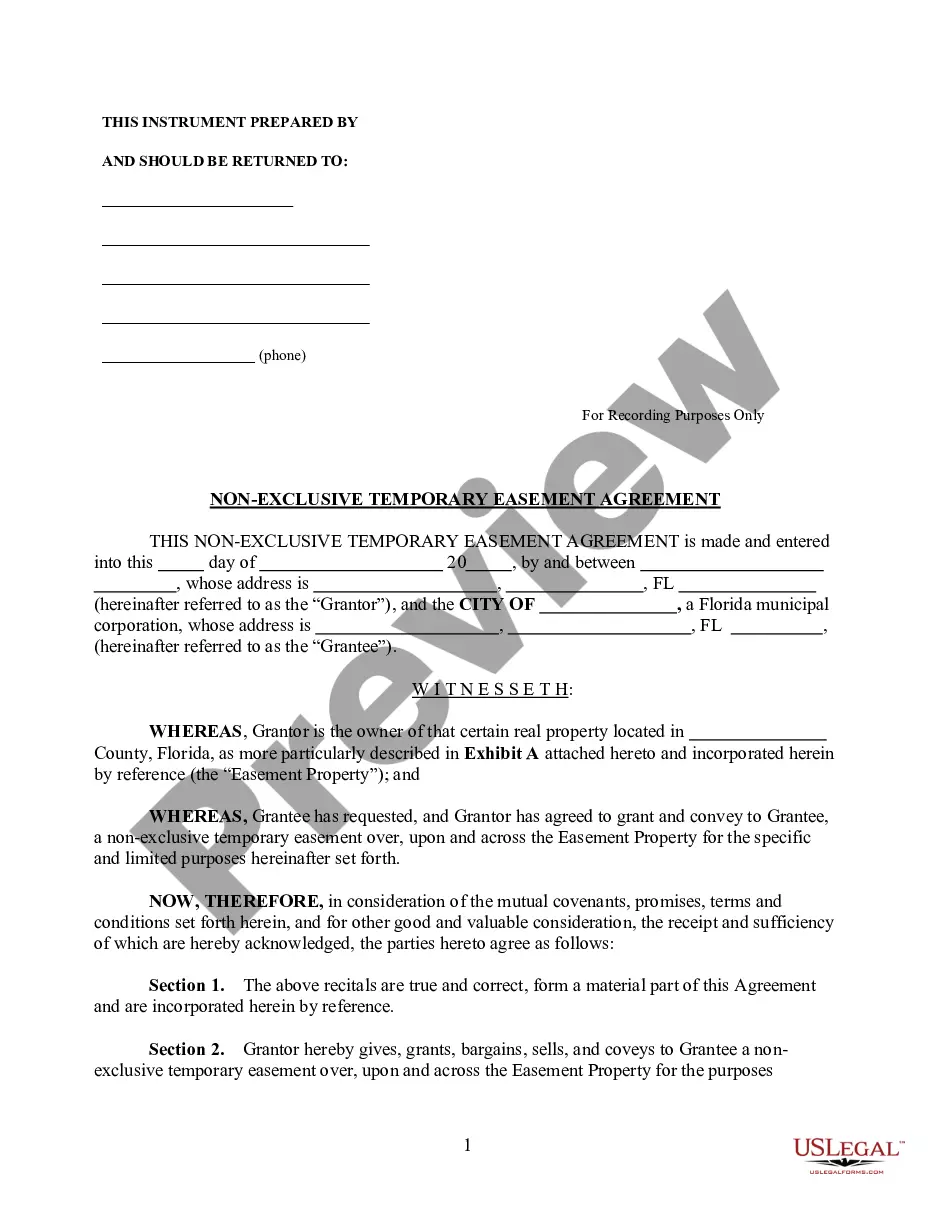

How to fill out Termination Review Form?

US Legal Forms - one of the largest collections of authentic documents in the United States - offers a vast selection of legal templates that you can download or create.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent forms, such as the Texas Termination Review Form, in just moments.

If you have an account, Log In and retrieve the Texas Termination Review Form from your US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms under the My documents section of your account.

Select the format and download the form onto your device.

Make adjustments. Fill out, modify, print, and sign the downloaded Texas Termination Review Form.

Each form you added to your account has no expiration date and is yours permanently. Therefore, to download or print another copy, just go to the My documents section and click on the form you need.

- Ensure you have selected the correct form for your city/state. Click the Review button to examine the form's details.

- Review the form summary to confirm that you have chosen the right document.

- If the form does not meet your requirements, use the Search field at the top of the page to find the one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, choose your preferred payment plan and provide your details to register for an account.

- Complete the purchase. Use your credit card or PayPal account to finalize the transaction.

Form popularity

FAQ

Just keep in mind these five key steps when dissolving a partnership:Review your partnership agreement.Discuss with other partners.File dissolution papers.Notify others.Settle and close out all accounts.04-Nov-2013

Dissolving a Business PartnershipPlan ahead during your initial start-up process.Remove all sentiment and emotion from the situation.Be honest in delivering the news.Follow your initial buyout plan or negotiate a new one.Propose that your co-owner buys you out.

The entity must:Take the necessary internal steps to wind up its affairs.Submit two signed copies of the certificate of termination.Unless the entity is a nonprofit corporation, attach a Certificate of Account Status for Dissolution/Termination issued by the Texas Comptroller.Pay the appropriate filing fee.

Forfeited Existence - An inactive status indicating that the corporation or limited liability company failed to file its franchise tax return or to pay the tax due thereunder. Status is changed by secretary of state when certification of the delinquency is received from the comptroller of public accounts.

A general partner must lodge a Dissolution of LP online via Bizfile+. No fee is payable for filing this transaction....An LP may be dissolved under various circumstances, for example:Discontinuation of Partnership.Death or Bankruptcy of one or more partners.By Order of Court.Any Other Reason.09-Apr-2021

Depending on the state, you can terminate a domestic partnership.An alternative to terminating a domestic partnership is simply sending the secretary of state a Notice of Termination. The dissolution of a domestic partnership can only be resolved by divorce or annulment in some jurisdictions.

Your attorney can walk you through the process and make sure you comply with all legal requirements.Read Your Partnership Agreement.Formally Dissolve Your Partnership.Dividing Assets and Liabilities.Notify Customers, Creditors, and Suppliers.29-Jun-2020

A corporation qualified to do business in California can be forfeited if: (1) the corporation fails to file its annual statement; (2) the corporation fails to maintain a registered agent (or the agent resigns) in the State of California; (3) the corporation fails to pay its annual California franchise tax; (4) the

Franchise Tax Involuntarily Ended. The entity's registration or certificate was ended as a result of a tax forfeiture or an administrative forfeiture by Texas Secretary of State. State of Formation. The state in which the entity is organized.

To dissolve your Texas LLC, you must file a Certificate of Termination with the Secretary of State. There is a $40 filing fee. The form can be filed online. If you'd like to save yourself some time, you can hire us to dissolve your LLC for you.