Texas Personnel Status Change Worksheet

Description

How to fill out Personnel Status Change Worksheet?

It is feasible to devote hours online searching for the legal document template that satisfies the federal and state requirements you need.

US Legal Forms offers a multitude of legal forms that are assessed by professionals.

You can easily download or print the Texas Personnel Status Change Worksheet from our service.

If available, utilize the Preview button to review the document template as well.

- If you have a US Legal Forms account, you can sign in and click the Obtain button.

- Then, you can fill out, modify, print, or sign the Texas Personnel Status Change Worksheet.

- Each legal document template you purchase is yours to keep indefinitely.

- To obtain another copy of any purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, ensure that you have selected the correct document template for the state/region of your choice.

- Review the form description to verify that you have chosen the right form.

Form popularity

FAQ

Payment Voucher - (Form C-3V) allows employers who have an approved hardship waiver on file, or their representatives to submit their personal check payments to the Texas Workforce Commission.

A status change allows you to change from one medical insurance plan to another if the coverage category is changing. For example, current coverage category is "employee only". Due to the status change the coverage category is now "employee + family".

Among the most common system changes affecting work status are reduced clinic volume and revenue, and surge-induced demand to care for COVID-19 patients.

Forms C-3 and C-4 are prepared to report total, taxable and individual wages paid by the employer in each calendar quarter.

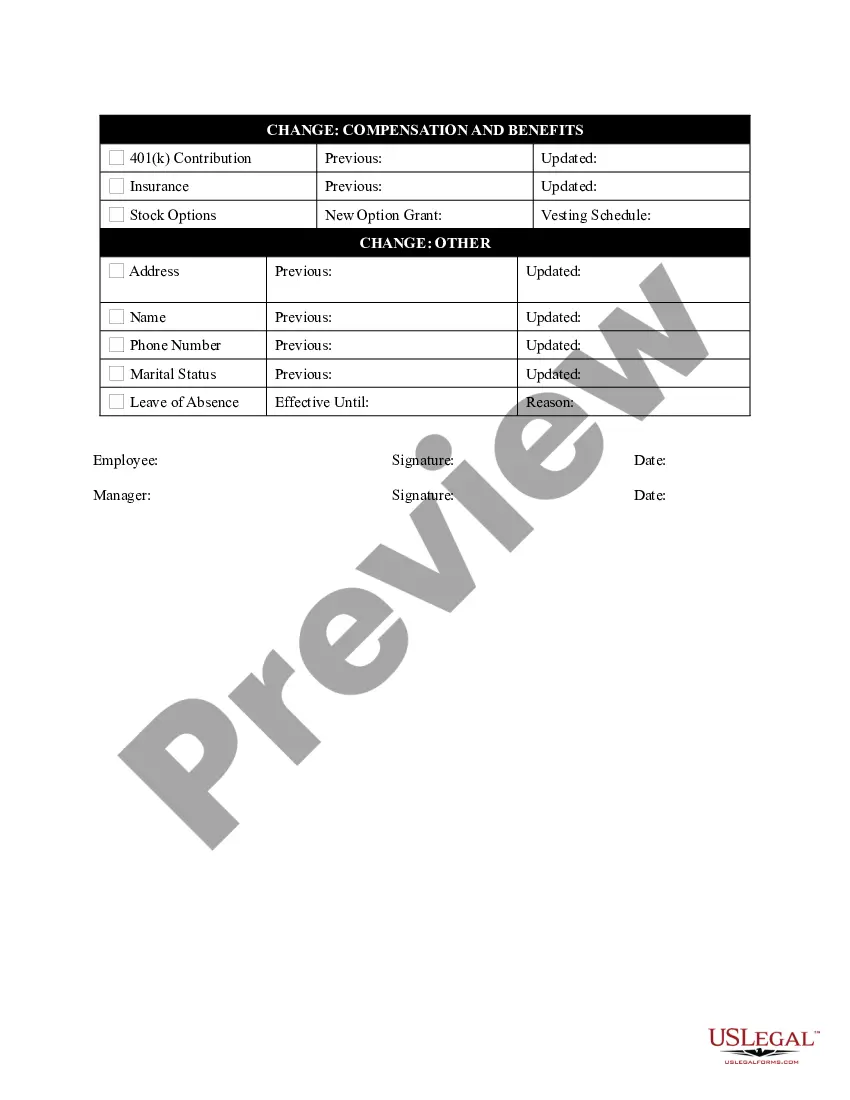

The purpose of the Employee Change of Status Form is to collect historical documentation and communication information. All Employee Change of Status Forms must include the employee's name, department if applicable, job title, effective date, date it was prepared and signed, and the change of status.

A change of status occurs when an employee will change from full-time to part-time, part-time to full-time, or will otherwise have a change is the number of hours regularly worked per week. Change in Appointment Months.

There are three types of employment status:Worker. The 'worker' is the most casual among the three types of employment status.Employee. A person that falls under the employee employment status is one who works under a contract of employment.Self-employed.

For state unemployment tax purposes, only the first $9,000 paid to an employee by an employer during a calendar year constitutes "taxable wages." Quarterly wage reports and taxes must be filed and paid by the last day of the month following the end of the calendar quarter.

Wage reports, also known as quarterly contribution or wage detail reports, are the reports you file on a quarterly basis with each state, district and territory in which you pay employees in order to stay compliant with paying state unemployment insurance (SUTA).

Forms C-3 and C-4 are prepared to report total, taxable and individual wages paid by the employer in each calendar quarter.