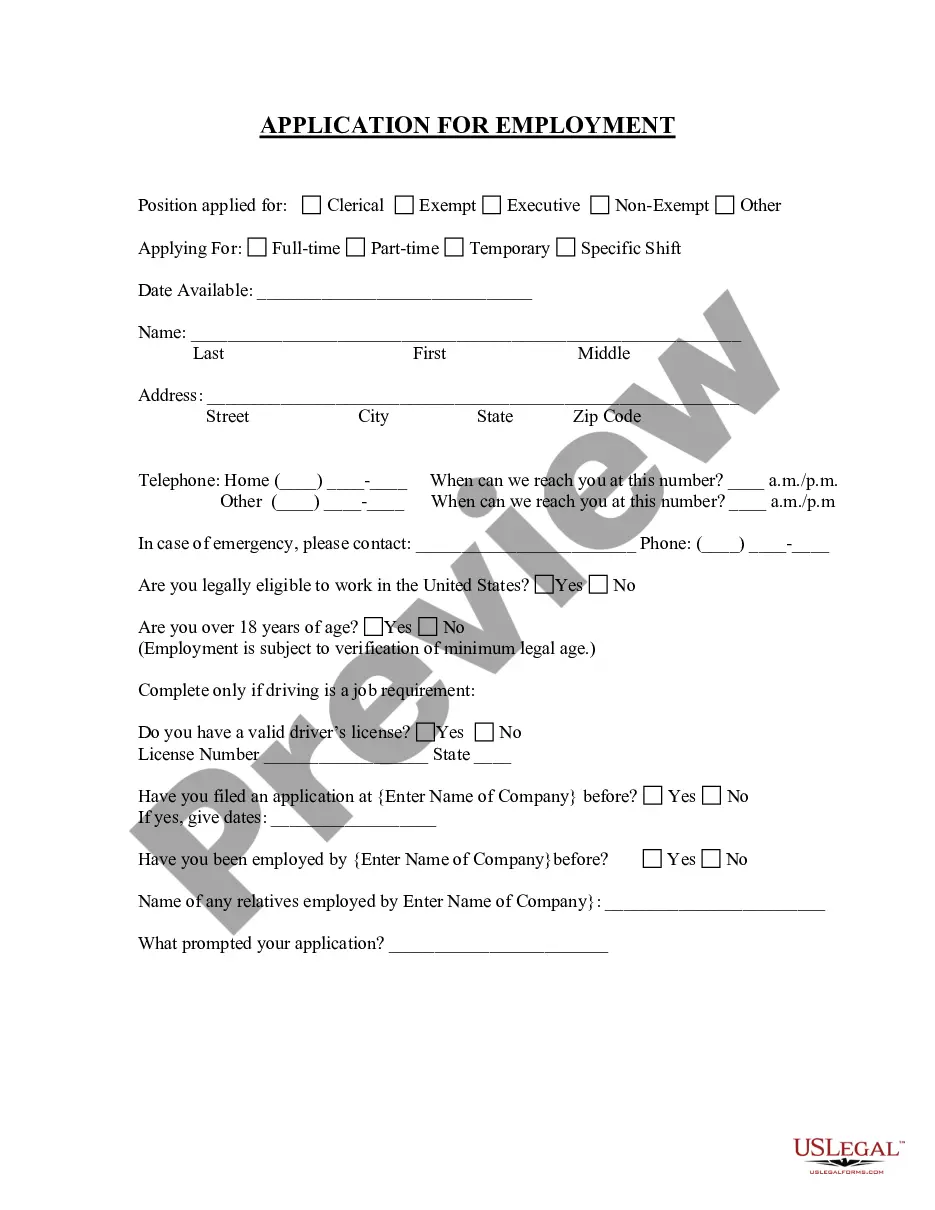

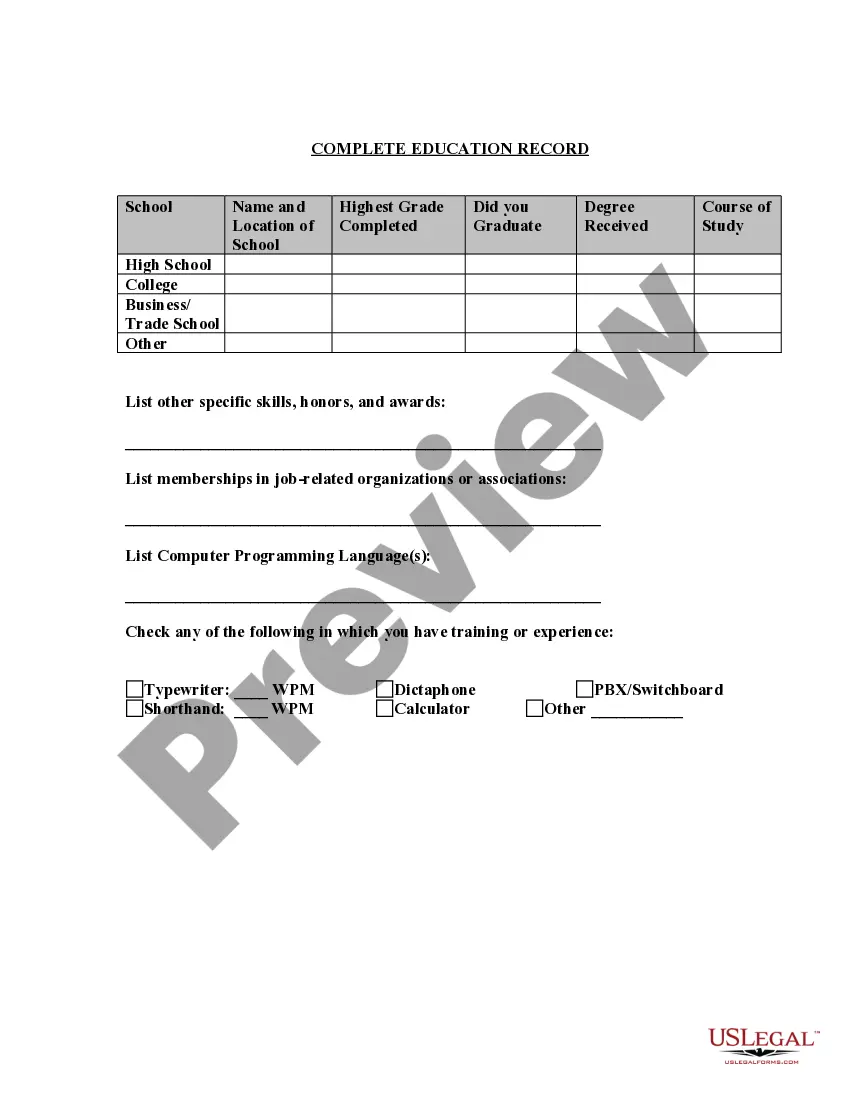

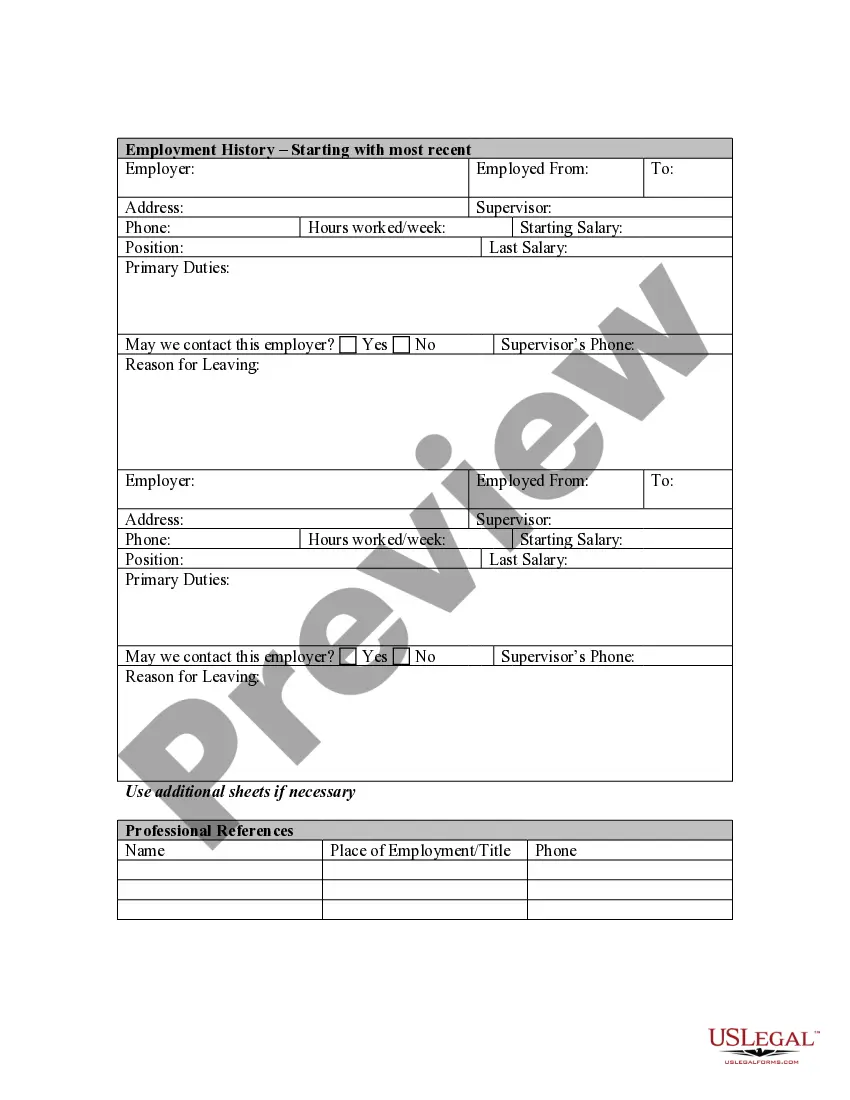

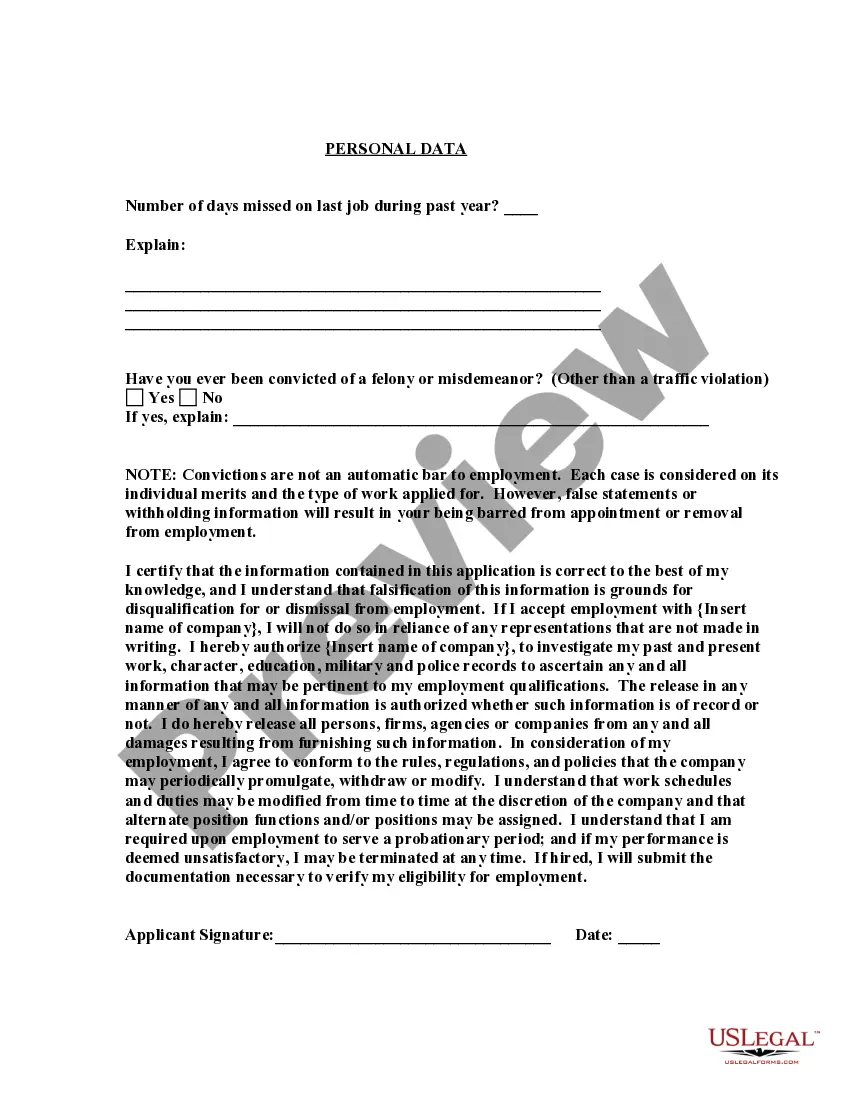

Texas Application for Work or Employment - Clerical, Exempt, Executive, or Nonexempt Position

Description

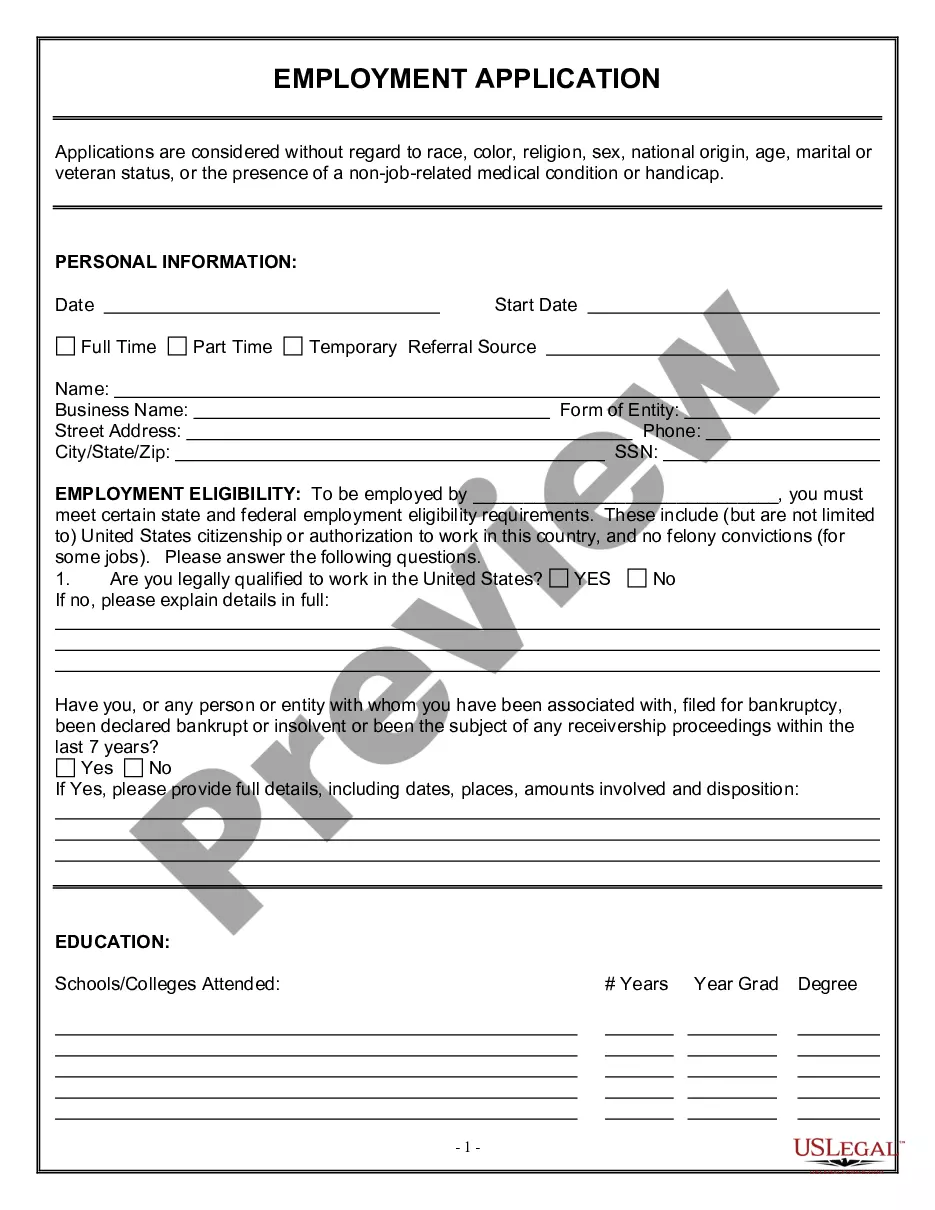

How to fill out Application For Work Or Employment - Clerical, Exempt, Executive, Or Nonexempt Position?

Selecting the appropriate legal document template can be a challenge.

Indeed, there are numerous templates accessible on the web, but how can you find the legal form you need.

Utilize the US Legal Forms website.

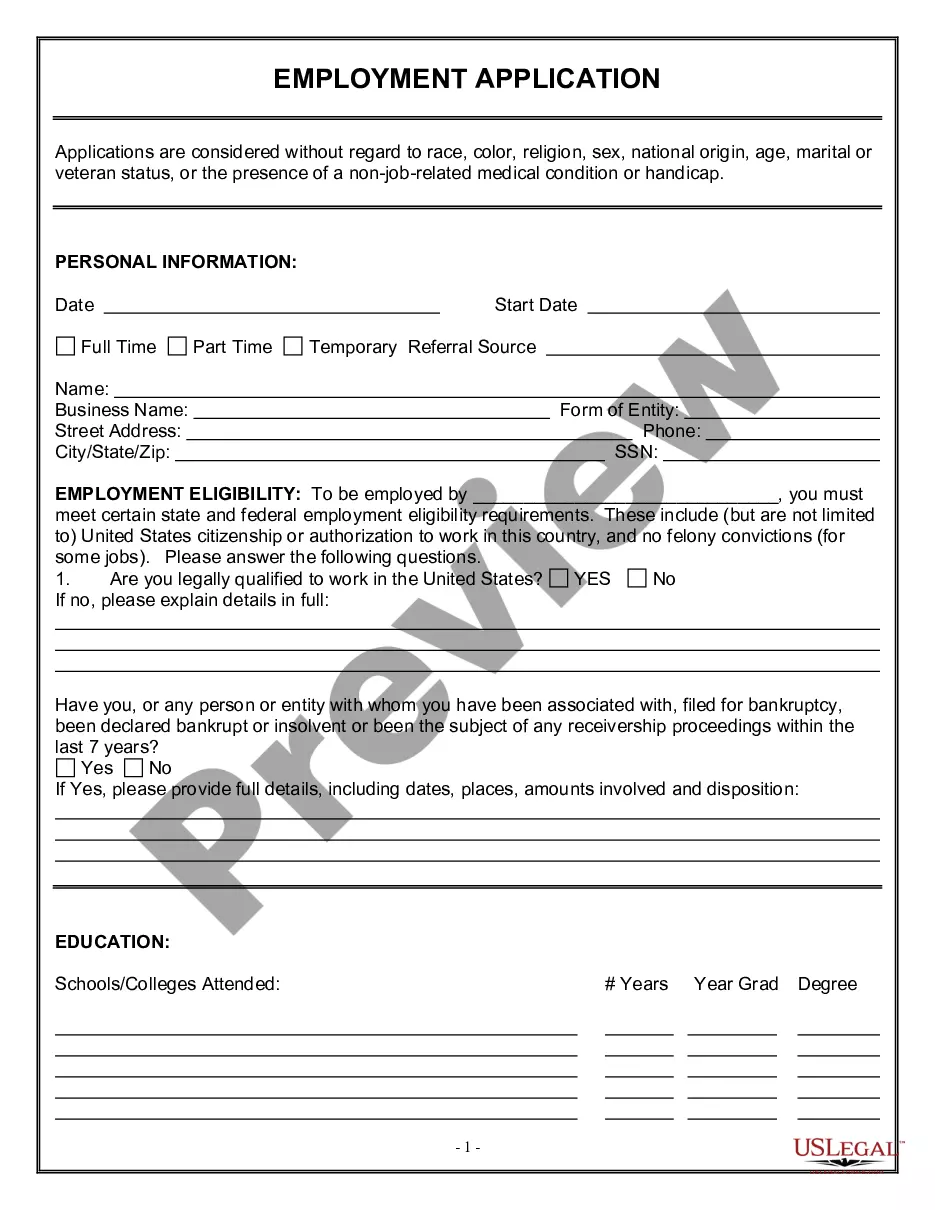

If you are a new user of US Legal Forms, here are simple steps for you to follow: First, ensure you have selected the correct form for your jurisdiction/county. You can preview the form using the Review button and read the form description to confirm it is suitable for you. If the form does not fulfill your requirements, use the Search field to find the appropriate form. Once you are certain the form is acceptable, click on the Order now button to acquire the form. Choose your desired pricing plan and enter the required information. Create your account and pay for your order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the received Texas Application for Employment - Clerical, Exempt, Executive, or Nonexempt Position. US Legal Forms is the largest library of legal forms where you can locate a variety of document templates. Take advantage of the service to acquire professionally created documents that meet state requirements.

- The service provides a vast selection of templates, including the Texas Application for Employment - Clerical, Exempt, Executive, or Nonexempt Position, that you can utilize for professional and personal purposes.

- All the forms are reviewed by experts and adhere to federal and state regulations.

- If you are already registered, sign in to your account and then click on the Download button to receive the Texas Application for Employment - Clerical, Exempt, Executive, or Nonexempt Position.

- Use your account to browse the legal forms you have previously purchased.

- Visit the My documents section of your account to obtain another copy of the document you need.

Form popularity

FAQ

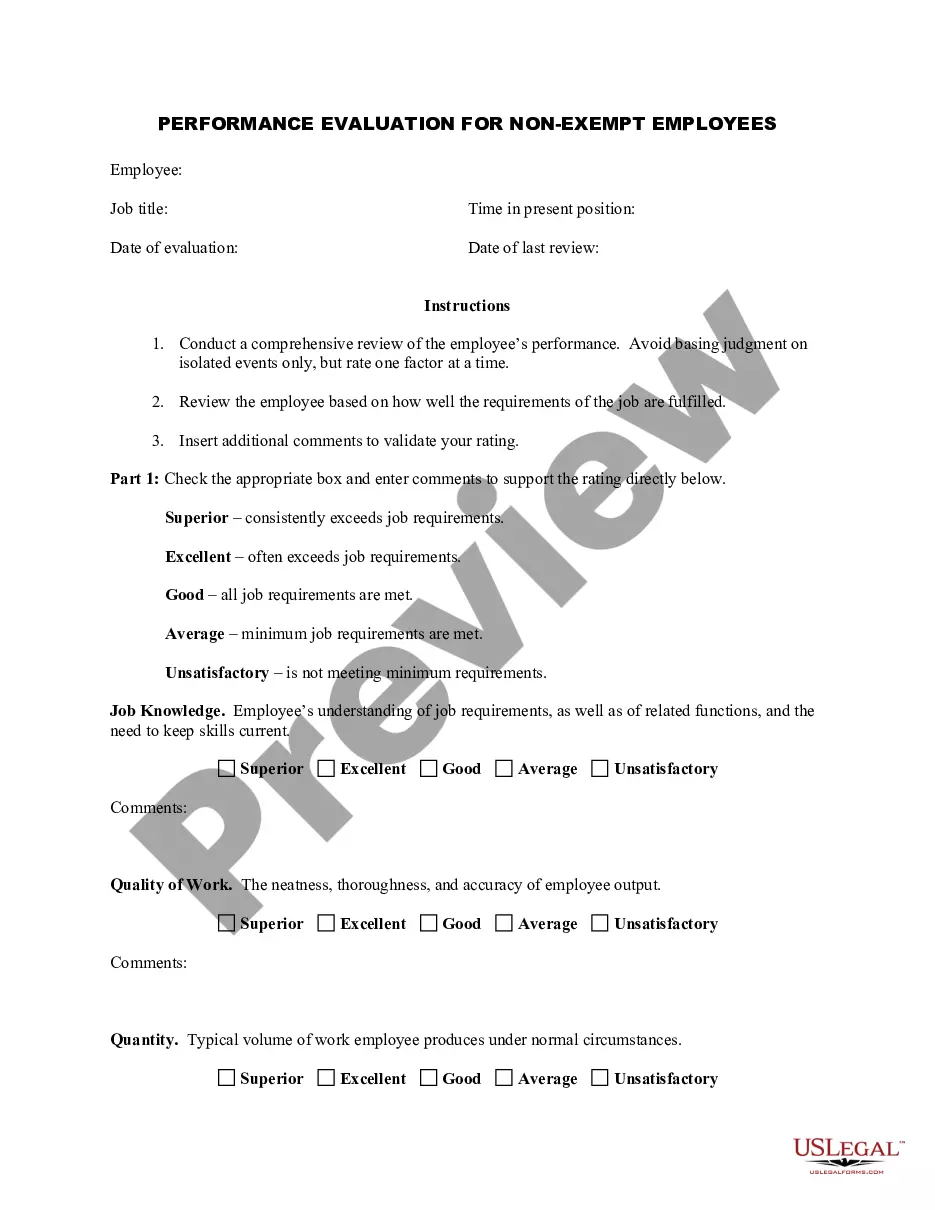

The Texas Application for Work or Employment - Clerical, Exempt, Executive, or Nonexempt Position offers a comprehensive overview of the employment classification and requirements in Texas. It provides clear guidelines on job duties, salary thresholds, and employee rights, ensuring individuals have the information needed to navigate their employment status effectively. Additionally, this application serves as a valuable tool for employers to classify their staff correctly. Using uslegalforms promotes better comprehension of employment classifications while streamlining the application process.

Exempt employees are typically salaried employees, seasonal workers, and those who earn more than a certain amount each year. Also, some jobs are considered "exempt" by definition, including the following: Railroads and certain airline employees. Taxi drivers.

Nonexempt: An individual who is not exempt from the overtime provisions of the FLSA and is therefore entitled to overtime pay for all hours worked beyond 40 in a workweek (as well as any state overtime provisions). Nonexempt employees may be paid on a salary, hourly or other basis.

Employees Not Entitled to Overtime PayThose not covered by FLSA are known as exempt employees. These exemptions also apply in Texas. So if you're paid an annual salary and earning more than a certain amount set by law, you are considered "exempt" and not covered by the FLSA.

An exempt employee is not entitled overtime pay by the Fair Labor Standards Act (FLSA). These salaried employees receive the same amount of pay per pay period, even if they put in overtime hours. A nonexempt employee is eligible to be paid overtime for work in excess of 40 hours per week, per federal guidelines.

Federal overtime laws and Texas overtime laws stipulate that salaried workers must be paid overtime pay for any hours worked beyond 40 in a work week. Salaried employees are exempt from overtime pay requirements only if two specific conditions are met: The employee's salary exceeds $455 per workweek.

Exempt or Nonexempt.Employees whose jobs are governed by the FLSA are either "exempt" or "nonexempt." Nonexempt employees are entitled to overtime pay. Exempt employees are not.

Whether employees are exempt or non-exempt depends on the type of work they do, how they are paid, and how much they are paid. It is not determined by job titles or formal labels. Non-exempt employees in Houston, TX, must be paid overtime pay, whereas exempt employees are not eligible for overtime pay.

Exempt employees must be paid on a salary basis, as discussed above. Nonexempt employees may be paid on a salary basis for a fixed number of hours or under the fluctuating workweek method. Salaried nonexempt employees must still receive overtime in accordance with federal and state laws.

What does non-exempt mean? If employees are non-exempt, it means they are entitled to minimum wage and overtime pay when they work more than 40 hours per week.