Texas Notification of Review of Consumer Report

Description

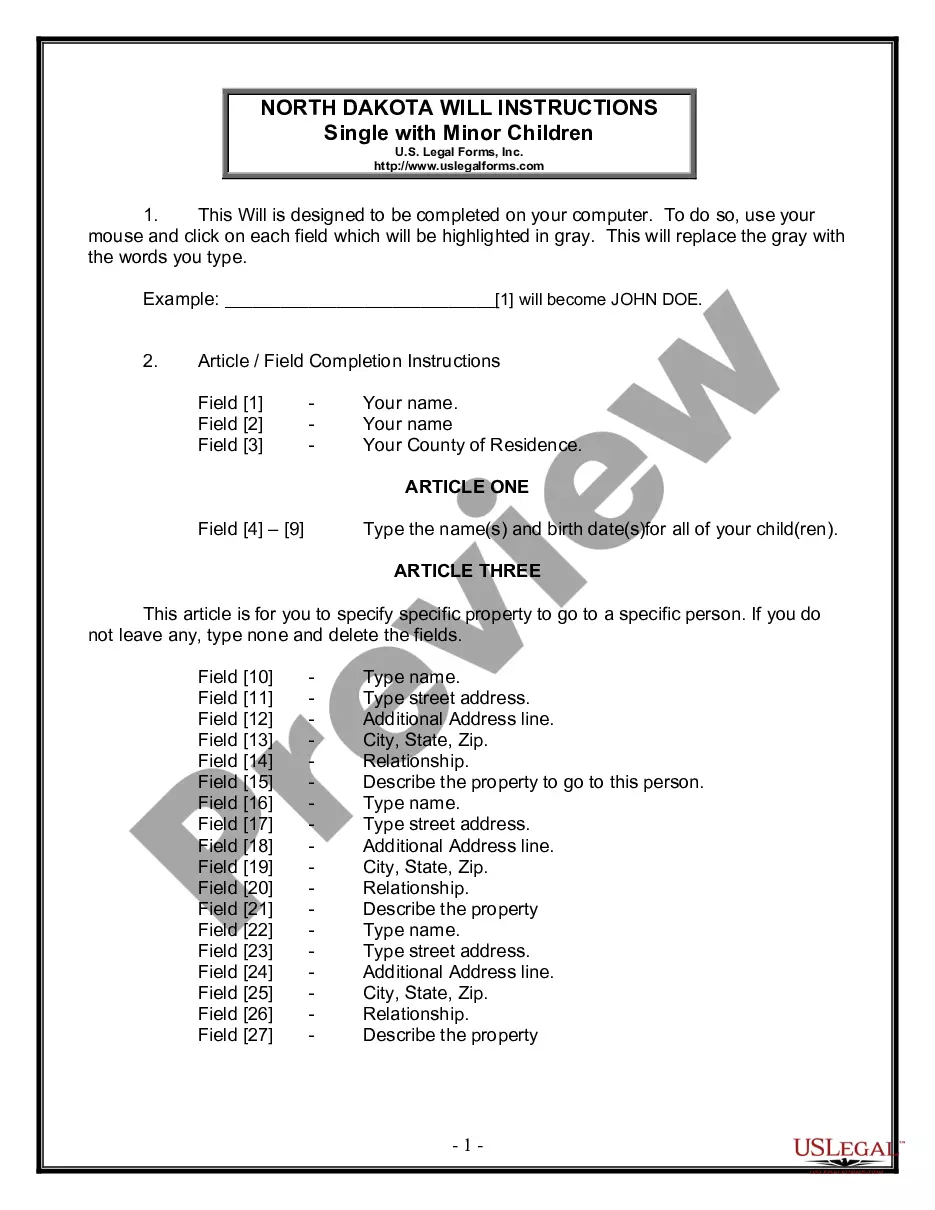

How to fill out Notification Of Review Of Consumer Report?

Have you encountered the circumstance where you require documents for either business or personal reasons almost daily.

There are numerous valid document templates available online, but locating ones you can trust is not straightforward.

US Legal Forms provides thousands of template options, such as the Texas Notification of Review of Consumer Report, which are designed to comply with state and federal requirements.

Once you find the correct template, click Buy now.

Select the pricing plan you prefer, fill in the necessary details to create your account, and complete your order using PayPal or a credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Next, you can download the Texas Notification of Review of Consumer Report template.

- If you do not have an account and wish to begin using US Legal Forms, follow these instructions.

- Locate the template you need and ensure it is for the correct city/state.

- Use the Review button to evaluate the form.

- Read the description to confirm you have selected the right template.

- If the template is not what you are looking for, utilize the Search field to find the template that suits your needs.

Form popularity

FAQ

Two federal laws the Equal Credit Opportunity Act (ECOA), as implemented by Regulation B, and the Fair Credit Reporting Act (FCRA) reflect Congress's determination that consumers and businesses applying for credit should receive notice of the reasons a creditor took adverse action on the application or on an

You can order reports including your annual free reports from Experian, Equifax, and TransUnion at annualcreditreport.com and we recommend that you check your report with each company at least once per year . But you will have to order the specialty consumer reports individually from each reporting company.

Consumer reporting agencies are required by law to remove most negative information about your account after seven years, which generally means that if you find an item in their report that is older than seven years you should dispute that information.

The primary tool the Office of the Attorney General uses to protect Texas consumers is the Deceptive Trade Practices Act (DTPA). This law lists many practices that are false, deceptive, or misleading. When you fall victim to illegal practices covered by the DTPA, you may have the right to sue for damages under the act.

The Deceptive Trade Practices Act (DTPA) is Texas's primary consumer protection statute. The statute prohibits a list of deceptive trade practices deemed to be false, misleading or deceptive. The DTPA gives consumers the right to sue for damages.

The FCRA applies to any company that collects and sells data about you to third parties. Such companies, known as consumer reporting agencies, must follow the stipulations of the FCRA. The three most well-known consumer reporting agencies in the U.S. are Equifax, TransUnion and Experian.

Common violations of the FCRA include:Creditors give reporting agencies inaccurate financial information about you. Reporting agencies mixing up one person's information with another's because of similar (or same) name or social security number. Agencies fail to follow guidelines for handling disputes.

The primary law is the Fair Credit Reporting Act (FCRA). Among other things, the FCRA limits who can access your credit reports and for what purposes. Here are some of the rights provided to consumers under the FCRA: 1. Credit bureaus must provide your credit report to you when you ask for it.

The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and privacy of information in the files of consumer reporting agencies.

Consumer Protection - Texas Attorney General's Office If you spot price gouging or experience unfair or unlawful business practices, please a complaint online or call their Consumer Protection Hotline at 800-621-0508.