Texas Fixed Asset Removal Form

Description

How to fill out Fixed Asset Removal Form?

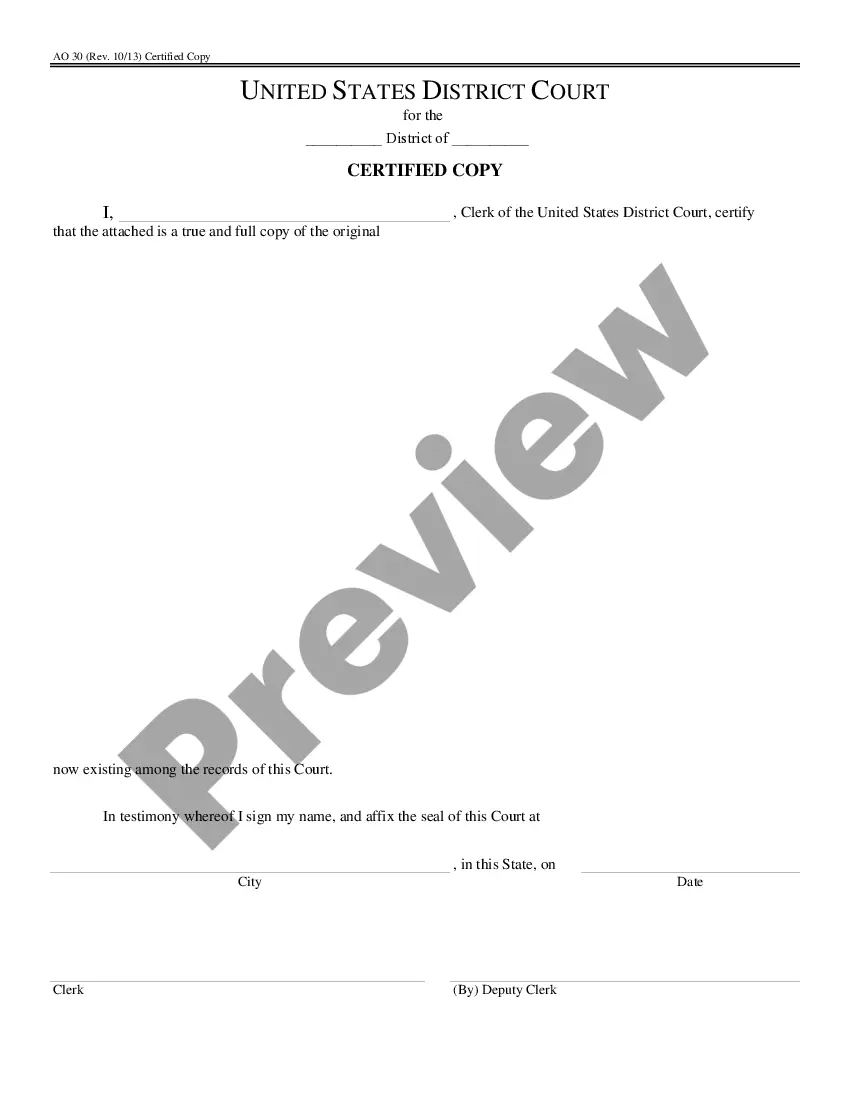

It is feasible to devote hours online attempting to discover the authentic document template that meets the state and federal requirements you need.

US Legal Forms offers countless legitimate forms that have been assessed by professionals.

You can conveniently download or print the Texas Fixed Asset Removal Form from our platform.

To locate another variation of the form, use the Search field to find the template that meets your needs and specifications.

- If you possess a US Legal Forms account, you can Log In and click on the Obtain button.

- Subsequently, you can complete, modify, print, or sign the Texas Fixed Asset Removal Form.

- Each legal document template you acquire becomes yours indefinitely.

- To obtain another copy of a purchased form, visit the My documents tab and click on the corresponding button.

- If you are visiting the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your region/area of interest.

- Review the form outline to confirm that you have chosen the appropriate form.

Form popularity

FAQ

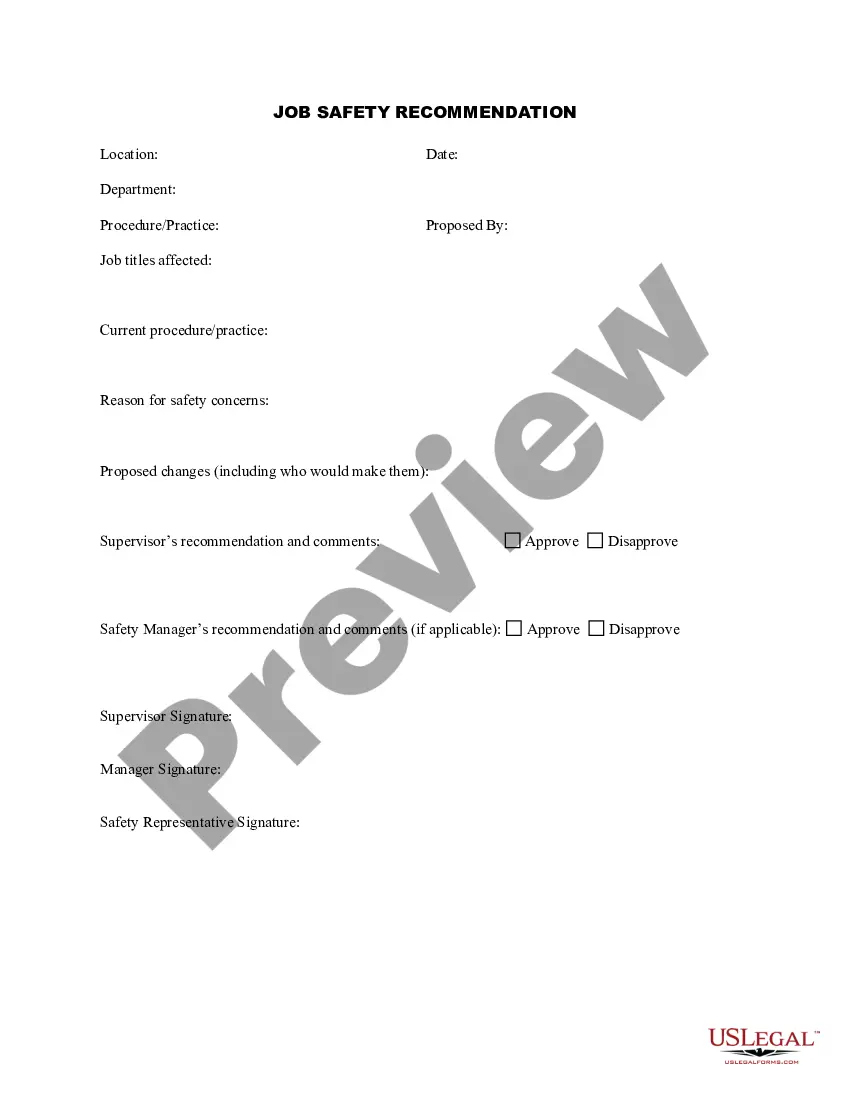

When an asset is fully depreciated, it means its book value is zero. To write it off, you should complete the Texas Fixed Asset Removal Form and remove the asset from your records. This action reflects the asset's current status and maintains the accuracy of your financial reports.

Typical information captured on a fixed asset register includes a unique identifier code, asset name, description, purchase and capitalisation dates, purchase cost, department, cost centre, residual value and asset life and depreciation rule.

How to maintain Fixed Assets Register NGO Financial Management PolicyIdentification or serial number.Acquisition date.Description of asset.Location.Class of asset.Cost of acquisition.Accumulated depreciation.Net book value.

The gain or loss is calculated as the net disposal proceeds, minus the asset's carrying value.

Contents hide1 1. Essential asset information.2 2. Asset value and depreciation tracking.3 3. Warranty and insurance management.4 4. Tag your fixed assets.5 5. Record and monitor asset location.6 6. Assign assets to teams, sites or projects.7 7.8 Using Your Fixed Asset Register for Auditing and Reporting.More items...?

Audit of fixed assetsStep 1: understand the client procedure of Fixed Assets acquisition and disposal.Step 2: Obtain Fixed Assets Register as maintained by the Client.Step 3: Vouching of Additions to Fixed Assets.Step 4: Vouching of Deletion from Fixed Assets.Step 5: Depreciation and Amortization.Step 6: Revaluation.More items...?

A fixed asset register is a detailed list of all fixed assets which are owned by a business. Its main purpose is to enable an organisation to accurately record and maintain both financial and non-financial information pertaining to each asset and to easily identify and verify an asset when required.

Verification of fixed assets consists of examination of related records and physical verification. The auditor should normally verify the records with reference to the documentary evidence and by evaluation of internal controls. Physical verification of fixed assets is primarily the responsibility of the management.

Objectives of Verification of Assets. Ownership: Ownership of the assets should be verified by examining the title deeds. In case the title deeds are held by other persons such as solicitors or bankers, confirmation should be obtained directly by the auditor through a request signed by the client.

Asset management is the process of planning and controlling the acquisition, operation, maintenance, renewal, and disposal of organizational assets. This process improves the delivery potential of assets and minimizes the costs and risks involved.