Tennessee Purchase Agreement by a Corporation of Assets of a Partnership

Description

How to fill out Purchase Agreement By A Corporation Of Assets Of A Partnership?

It is feasible to spend hours online seeking the legal document template that complies with the federal and state requirements you require.

US Legal Forms presents a plethora of legal forms that have been evaluated by experts.

You can easily download or create the Tennessee Purchase Agreement by a Corporation of Assets of a Partnership through our service.

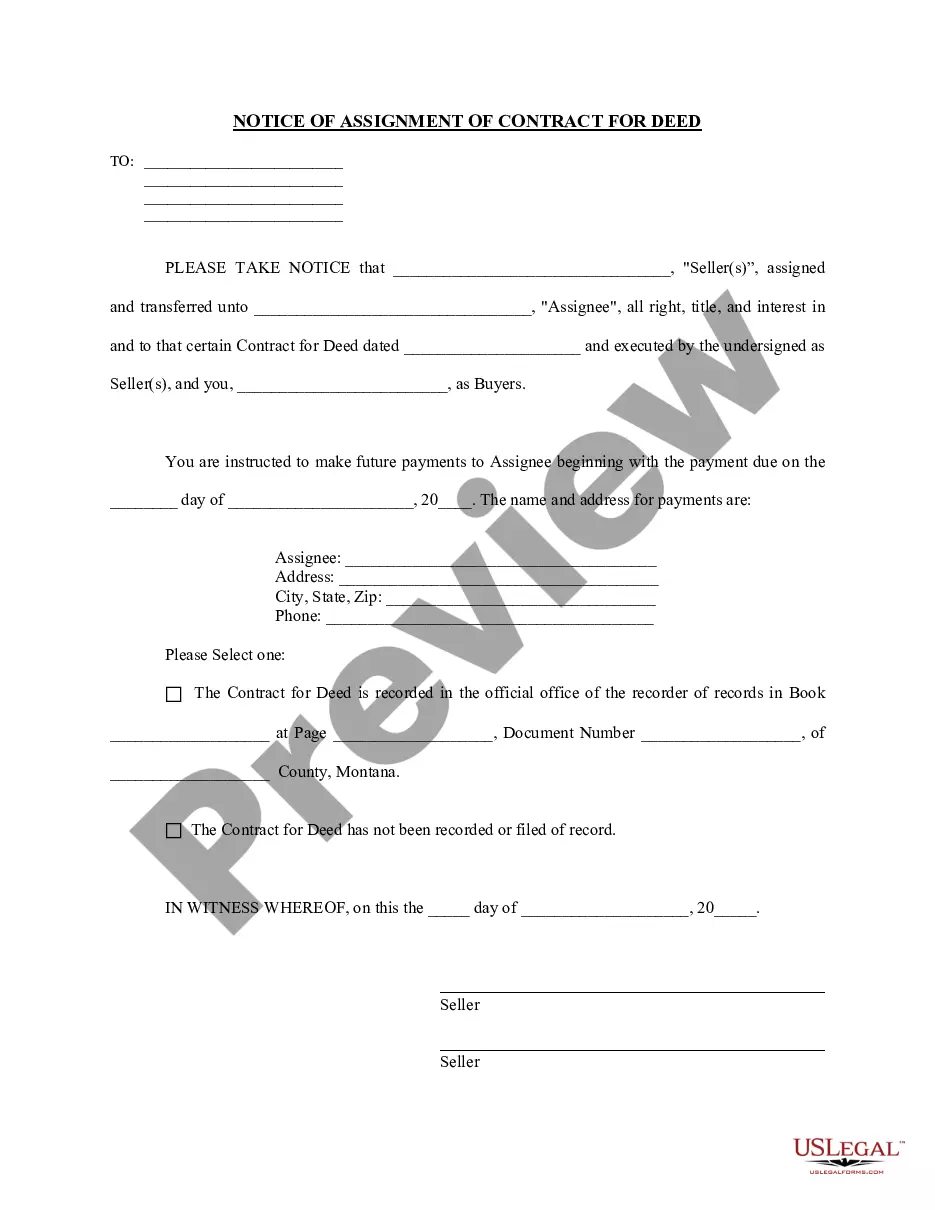

If available, utilize the Review button to examine the document format as well.

- If you possess a US Legal Forms account, you may Log In and hit the Acquire button.

- After that, you can complete, modify, print, or sign the Tennessee Purchase Agreement by a Corporation of Assets of a Partnership.

- Every legal document template you buy is yours indefinitely.

- To retrieve an additional copy of a purchased form, navigate to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple directions below.

- First, confirm that you have selected the right document format for the state/town of your choice.

- Review the form description to make sure you have picked the correct one.

Form popularity

FAQ

An asset purchase agreement is exactly what it sounds like: an agreement between a buyer and a seller to transfer ownership of an asset for a price. The difference between this type of contract and a merger-acquisition transaction is that the seller can decide which specific assets to sell and exclude.

An asset purchase involves just the assets of a company. In either format, determining what is being acquired is critical. This article focuses on some of the important categories of assets to consider in a business purchase: real estate, personal property, and intellectual property.

An asset purchase agreement, also known as an asset sale agreement, business purchase agreement, or APA, is a written legal instrument that formalizes the purchase of a business or significant business asset. It details the structure of the deal, price, limitations, and warranties.

What is an asset purchase? This is an agreement between a buyer and seller to acquire a company's assets. The buyer can cherry pick which assets it wants and leave the rest behind. Assets can be both tangible, such as offices and equipment, and intangible, such as intellectual property and corporate name.

An asset acquisition strategy is when one company buys another company through the process of buying its assets, as opposed to a traditional acquisition strategy, which involves the purchase of stock.

In an asset purchase, the buyer agrees to purchase specific assets and liabilities. This means that they only take on the risks of those specific assets. This could include equipment, fixtures, furniture, licenses, trade secrets, trade names, accounts payable and receivable, and more.

Recording the purchase and its effects on your balance sheet can be done by:Creating an assets account and debiting it in your records according to the value of your assets.Creating another cash account and crediting it by how much cash you put towards the purchase of the assets.More items...

The asset purchase agreement is often drafted up towards the end of the negotiation stage, so that the parties can have a final record of their agreement. The document essentially operates as a contract, creating legally binding duties on each of the parties involved.

An asset purchase involves the purchase of the selling company's assets -- including facilities, vehicles, equipment, and stock or inventory. A stock purchase involves the purchase of the selling company's stock only.

What is a Definitive Agreement? A definitive agreement may be known by other names such as a purchase and sale agreement, a stock purchase agreement or an asset purchase agreement. Regardless of its name, it is the final agreement that spells out details agreed upon by buyer and seller.