Texas LLC Operating Agreement for Husband and Wife

Description

How to fill out LLC Operating Agreement For Husband And Wife?

Finding the appropriate legal document template can be quite challenging. Clearly, there are numerous formats available online, but how can you obtain the legal form you require.

Utilize the US Legal Forms website. The service provides thousands of formats, including the Texas LLC Operating Agreement for Spouses, which you can apply for business and personal purposes. All of the forms are reviewed by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Acquire button to locate the Texas LLC Operating Agreement for Spouses. Use your account to review the legal forms you have purchased previously. Navigate to the My documents tab in your account and obtain another copy of the document you require.

Choose the file format and download the legal document template to your device. Finally, complete, edit, print, and sign the acquired Texas LLC Operating Agreement for Spouses. US Legal Forms is the largest collection of legal forms where you can find various document templates. Take advantage of the service to download professionally crafted documents that comply with state requirements.

- First, ensure you have chosen the correct form for your location/area.

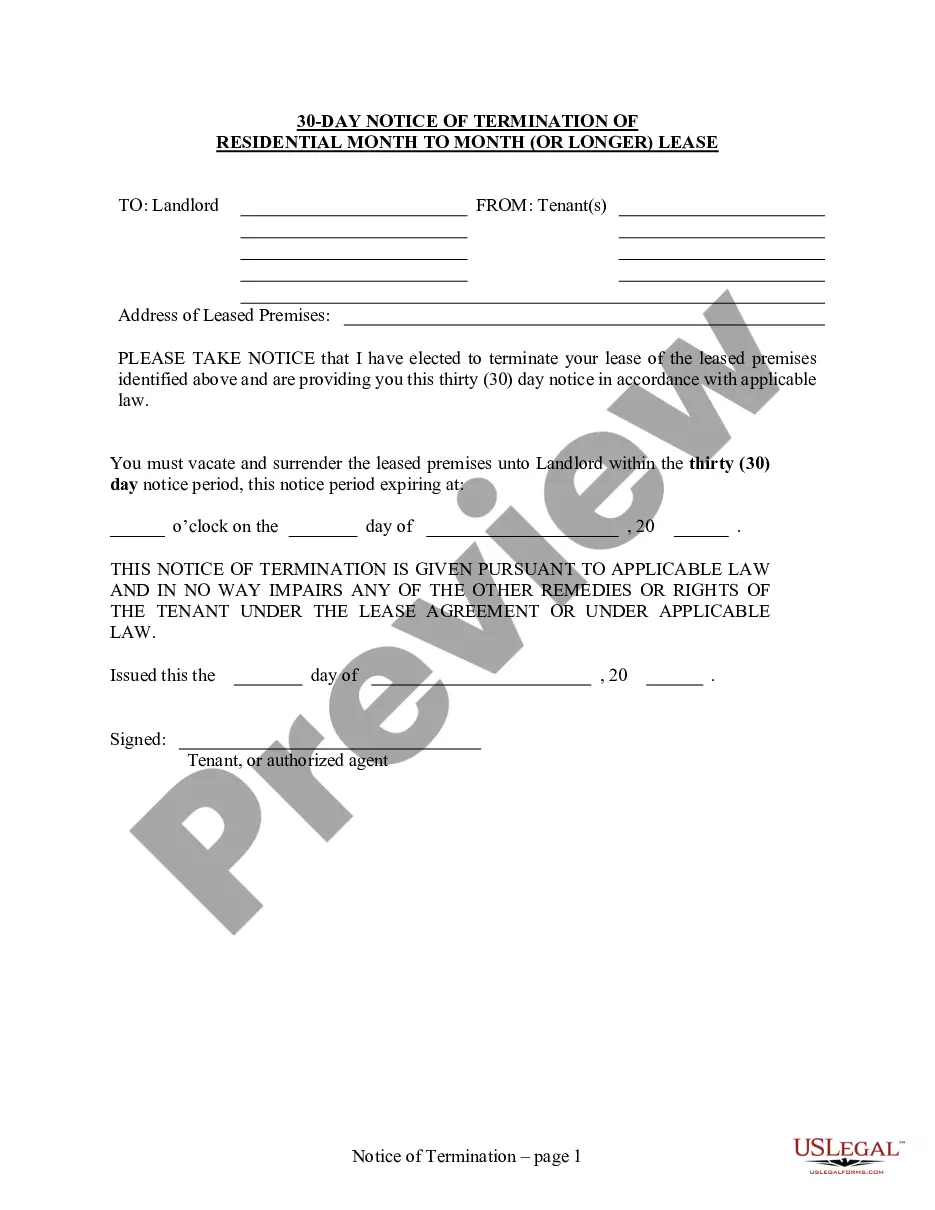

- You can view the form using the Preview button and read the form description to ensure it is the right one for you.

- If the form does not meet your requirements, use the Search field to find the appropriate form.

- Once you are confident that the form is correct, click the Acquire now button to retrieve the form.

- Select the pricing plan you wish and enter the necessary information.

- Create your account and complete your order using your PayPal account or Visa or Mastercard.

Form popularity

FAQ

To convert a single-member LLC to a multi-member LLC in Texas, you first need to draft an updated Texas LLC Operating Agreement for Husband and Wife, reflecting the new member's role. Then, you will file an amendment with the Texas Secretary of State. Remember, accurate record-keeping and proper documentation are crucial during this process. Consulting with a professional may help in ensuring everything is in order.

To add a partner to your Texas LLC, you need to update your operating agreement to reflect the new member's involvement. This includes detailing their contributions, rights, and responsibilities. A well-structured Texas LLC Operating Agreement for Husband and Wife will streamline this process. Consider using USLegalForms for a straightforward guide on making these updates.

A business jointly owned and operated by a married couple is a partnership (and should file Form 1065, U.S. Return of Partnership Income) unless the spouses qualify and elect to have the business be treated as a qualified joint venture, or they operate their business in one of the nine community property states.

Note: If an LLC is owned by husband and wife in a non-community property state, the LLC should file as a partnership. LLCs owned by a husband and wife are not eligible to be "qualified joint ventures" (which can elect not be treated as partnerships) because they are state law entities.

member LLC is a limited liability company with a single owner, and LLCs refer to owners as members. Singlemember LLCs are disregarded entities. A disregarded entity is ignored by the IRS for tax purposes, and the IRS collects the business's taxes through the owner's personal tax return.

If your LLC has one owner, you're a single member limited liability company (SMLLC). If you are married, you and your spouse are considered one owner and can elect to be treated as an SMLLC.

An LLC operating agreement is not required in Texas, but is highly recommended. This is an internal document that establishes how you will run your LLC. It sets out the rights and responsibilities of the members and managers, including how the LLC will be managed.

The straightforward answer is no: You are not required to name your spouse anywhere in the LLC documents, especially if they aren't directly involved in the business. However, there are some occasions where it may be helpful or necessary to include your spouse.

The straightforward answer is no: You are not required to name your spouse anywhere in the LLC documents, especially if they aren't directly involved in the business.

Overview. If your LLC has one owner, you're a single member limited liability company (SMLLC). If you are married, you and your spouse are considered one owner and can elect to be treated as an SMLLC.