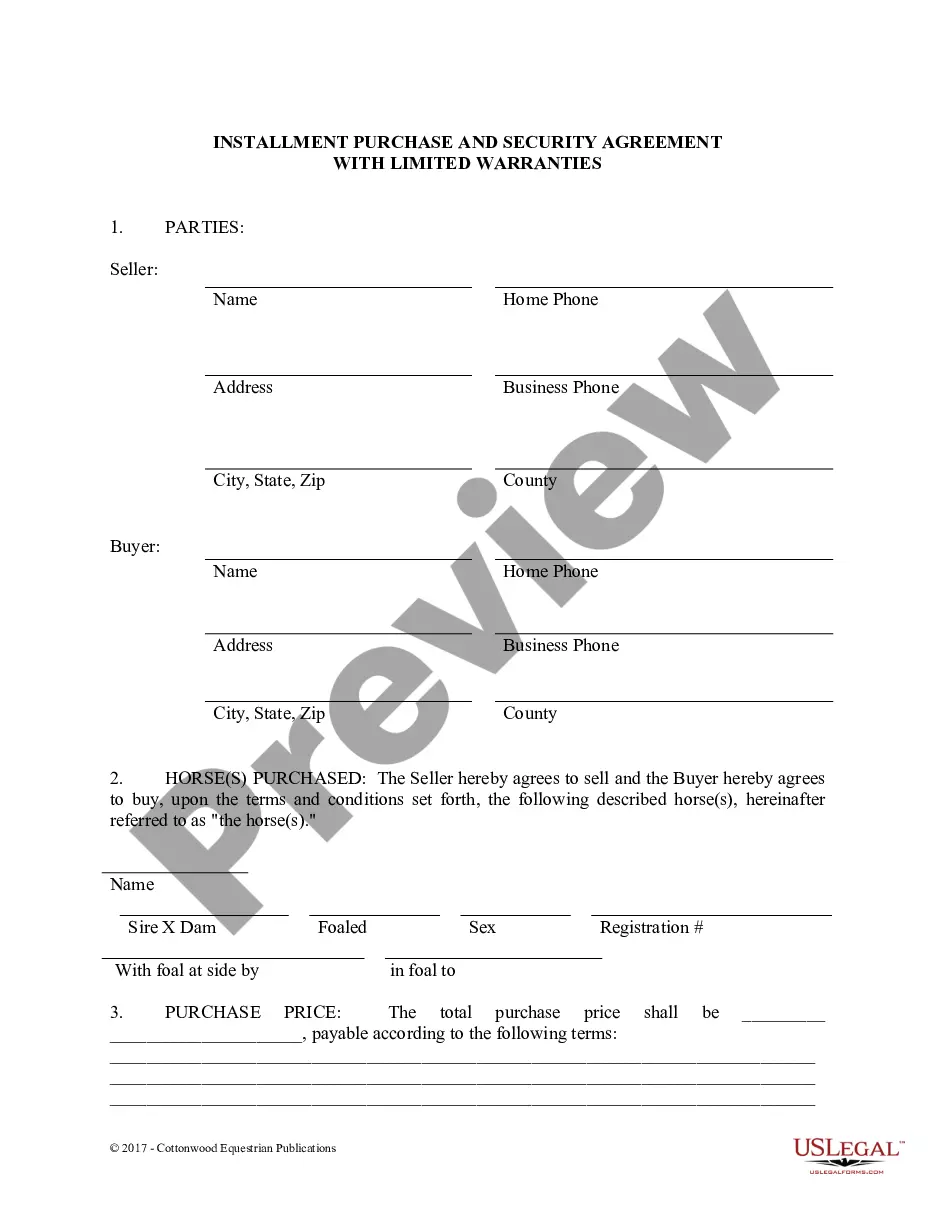

Partnership agreements are written documents that explicitly detail the relationship between the business partners and their individual obligations and contributions to the partnership. Since partnership agreements should cover all possible business situations that could arise during the partnership's life, the documents are often complex; legal counsel in drafting and reviewing the finished contract is generally recommended. If a partnership does not have a partnership agreement in place when it dissolves, the guidelines of the Uniform Partnership Act and various state laws will determine how the assets and debts of the partnership are distributed.

Texas Partnership Agreement Between Accountants

Description

How to fill out Partnership Agreement Between Accountants?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a vast selection of legal record templates that you can download or print.

By using the website, you can access thousands of forms for business and personal uses, categorized by types, states, or keywords. You can quickly obtain the latest versions of forms such as the Texas Partnership Agreement Between Accountants.

If you already have an account, Log In to download the Texas Partnership Agreement Between Accountants from the US Legal Forms library. The Download button will appear on every form you view. You can find all previously purchased forms in the My documents section of your account.

Complete the purchase. Use a credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Make edits. Fill in, modify, and print and sign the downloaded Texas Partnership Agreement Between Accountants. All formats you add to your account have no expiration date and are yours permanently. Hence, if you want to download or print another version, simply go to the My documents section and click on the form you need. Access the Texas Partnership Agreement Between Accountants through US Legal Forms, the largest library of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal requirements.

- Make sure you have selected the correct form for your city/state.

- Select the Review option to check the content of the form.

- Read the description to ensure you have picked the right form.

- If the form does not meet your needs, use the Search field at the top of the page to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Choose your preferred payment plan and fill in your details to register for an account.

Form popularity

FAQ

To fill out a partnership agreement, gather all necessary information from each partner, including their full name and contact details. Carefully input the agreed-upon terms regarding ownership shares, responsibilities, and how profits and losses will be distributed. Also, don't forget to include the signatures of all partners at the end to make the agreement legally binding. For guidance, consider using a Texas Partnership Agreement Between Accountants template available through our platform.

Completing a partnership agreement involves filling in specific details about the partners and their contributions. You should clearly list each partner's name, investment, and the percentage of profit sharing. Ensure you address key elements like decision-making processes and dispute resolution methods. Using a Texas Partnership Agreement Between Accountants will guide you through the essential details required to complete the document accurately.

A partnership agreement typically includes the introduction, definitions, and the main terms of the partnership. It outlines the roles of each partner, how profits are shared, and how disputes will be handled. Additionally, it addresses the duration of the partnership and conditions for termination. For accountants, a well-structured Texas Partnership Agreement Between Accountants ensures clarity and helps prevent future conflicts.

To write a simple partnership agreement, start by defining the partnership's purpose and goals. Include each partner's contributions, responsibilities, and share of profits or losses. You should also outline the process for resolving disputes and what happens if a partner wants to leave. Utilizing a Texas Partnership Agreement Between Accountants template can simplify this process and ensure you cover all essential aspects.

Notarization is not a strict requirement for a partnership agreement in Texas, but it can add an extra layer of authenticity and protection. By notarizing your Texas Partnership Agreement Between Accountants, you can establish a formal record that may be useful in disputes or legal situations. It’s important to consider your specific needs and the potential benefits this process might offer. Overall, having a well-documented agreement is essential for a successful partnership.

While an LLC does not legally require a partnership agreement, having one can provide clarity and structure. A Texas Partnership Agreement Between Accountants for an LLC helps delineate roles, define profit sharing, and set procedures for decision-making. This can protect both the business and its members by minimizing misunderstandings and conflicts that could arise in the absence of clear terms. Therefore, crafting a partnership agreement is a wise choice for LLC members.

A 51% to 49% partnership indicates that one partner holds a majority stake with controlling interest, while the other holds a minority stake. This arrangement can influence decision-making, profit allocation, and overall management of the partnership. In a Texas Partnership Agreement Between Accountants, it is vital to specify how these ratios affect the partners' rights and responsibilities to avoid future conflicts. Clear guidelines help maintain a healthy partnership dynamic.

Without a partnership agreement, your partnership will be governed by default state laws, which may not reflect your intentions. This can lead to disputes and misunderstandings among partners regarding responsibilities and profit sharing. A Texas Partnership Agreement Between Accountants clearly outlines roles, obligations, and profit distribution, ensuring all partners are on the same page. Thus, investing in a formal agreement is crucial for a smooth business operation.

Writing a business agreement between two partners involves clearly outlining the terms of your partnership. Start by specifying each partner's contributions, roles, and responsibilities within the partnership. Include essential elements like profit distribution, conflict resolution methods, and an exit strategy. A well-crafted Texas Partnership Agreement Between Accountants can prevent misunderstandings and establish a solid foundation for your business, and US Legal Forms can assist in creating this document efficiently.

To form a partnership in accounting, you must first identify your partners and define the structure of your partnership. Next, develop a Texas Partnership Agreement Between Accountants that outlines the responsibilities, profit sharing, and decision-making processes for all partners. It's important to register your partnership with the appropriate state authorities to ensure legal recognition. Utilizing resources like US Legal Forms can simplify this process and provide guidance on necessary requirements.