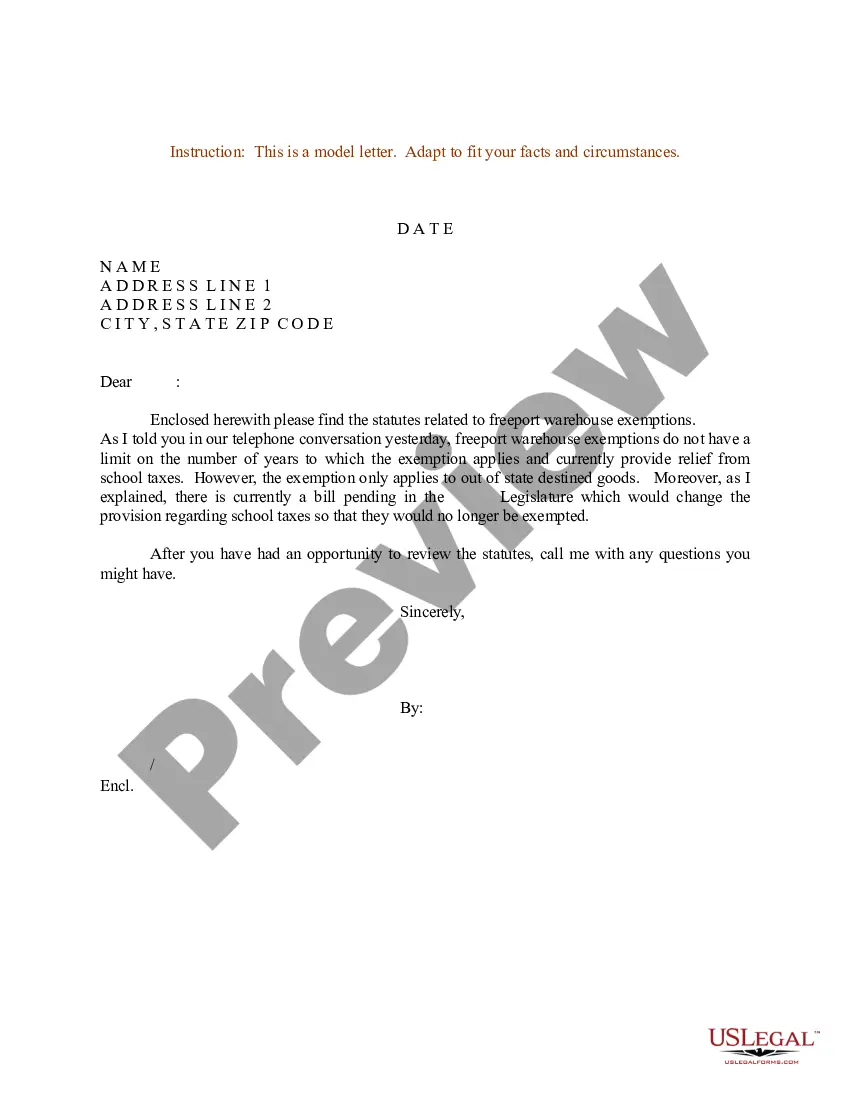

Texas Sample Letter for Freeport Warehouse Exemptions

Description

How to fill out Sample Letter For Freeport Warehouse Exemptions?

Choosing the right lawful document template could be a battle. Of course, there are a variety of themes available on the net, but how will you find the lawful type you want? Utilize the US Legal Forms web site. The services provides a huge number of themes, such as the Texas Sample Letter for Freeport Warehouse Exemptions, which you can use for business and private requirements. All of the types are checked by specialists and meet state and federal specifications.

In case you are presently registered, log in to your account and click the Down load key to obtain the Texas Sample Letter for Freeport Warehouse Exemptions. Utilize your account to look throughout the lawful types you might have bought formerly. Go to the My Forms tab of your account and get an additional copy in the document you want.

In case you are a brand new end user of US Legal Forms, here are easy directions that you can adhere to:

- Very first, make sure you have selected the correct type for your town/county. You may look over the form while using Review key and look at the form information to make certain it is the best for you.

- If the type will not meet your requirements, take advantage of the Seach discipline to obtain the right type.

- Once you are certain the form would work, click the Buy now key to obtain the type.

- Select the pricing prepare you need and enter the needed details. Make your account and purchase an order using your PayPal account or credit card.

- Choose the submit format and down load the lawful document template to your gadget.

- Full, change and printing and signal the received Texas Sample Letter for Freeport Warehouse Exemptions.

US Legal Forms is the greatest local library of lawful types in which you will find different document themes. Utilize the service to down load skillfully-created papers that adhere to express specifications.

Form popularity

FAQ

How many acres do you need for a special ag valuation? Ag exemption requirements vary by county, but generally you need at least 10 acres of qualified agricultural land to be eligible. Check with your county to verify.

To qualify for the general residence homestead exemption an individual must have an ownership interest in the property and use the property as the individual's principal residence. An applicant is required to state that he or she does not claim an exemption on another residence homestead in or outside of Texas.

You are eligible for a homestead exemption if you (1) own your home (partial ownership counts), (2) the home is your principal residence, and (3) you have a Texas driver's license or Texas-issued personal identification certificate (your I.D. card address must match your principal residence address).

If a taxpayer qualifies as a manufacturer, they can give a properly completed Form 01-339 (back), Texas Sales and Use Tax Exemption Certificate (PDF) to their vendor instead of paying tax on qualifying manufacturing equipment, material and supplies. Manufacturing Exemptions - Texas Comptroller texas.gov ? taxes ? publications texas.gov ? taxes ? publications

The Freeport Exemption is a personal property tax exemption for goods that are detained in the State for 175 days or less. Locally, the County offers the exemption to companies that deal with goods-in-transit or inventories used in the manufacturing process. Freeport Tax Exemption | Denton County, TX dentoncounty.gov ? Freeport-Tax-Exemption dentoncounty.gov ? Freeport-Tax-Exemption

Applications for property tax exemptions are filed with the appraisal district in which the property is located. The general deadline for filing an exemption application is before May 1. Appraisal district chief appraisers are solely responsible for determining whether or not property qualifies for an exemption. Property Tax Exemptions - Texas Comptroller texas.gov ? taxes ? exemptions texas.gov ? taxes ? exemptions

Triple Freeport Tax Exemption. Summary. Texas communities tax business inventory at the same rate as land, buildings and equipment. However, some cities, like Lockhart, grant the Triple Freeport Exemption from all three taxing entities, the City of Lockhart, Caldwell County and the Lockhart Independent School District.

An individual can give Form 01-339, Texas Sales and Use Tax Exemption Certification (PDF), to the seller instead of paying sales tax when buying items to be directly donated to the following exempt organizations: religious, charitable, educational, nonprofits exempt under IRC Sections 501(c)(3), (4), (8), (10) or (19), ... Nonprofit and Exempt Organizations ? Purchases and Sales texas.gov ? taxes ? publications texas.gov ? taxes ? publications