Texas Assignment of Assets

Description

How to fill out Assignment Of Assets?

If you want to aggregate, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal documents available online.

Employ the site's straightforward and user-friendly search to find the documents you require.

Numerous templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your credentials to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to access the Texas Assignment of Assets in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Acquire button to obtain the Texas Assignment of Assets.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

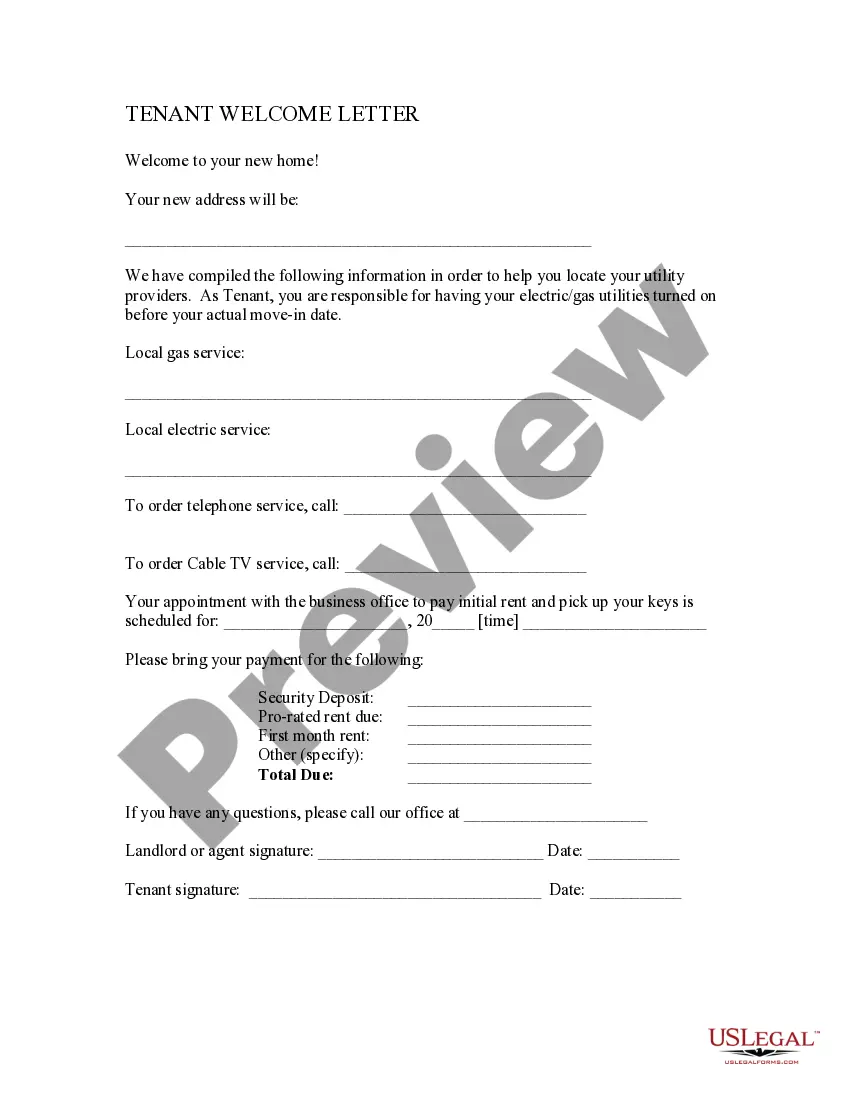

- Step 2. Use the Preview option to examine the content of the form. Do not forget to read the details.

- Step 3. If you are dissatisfied with the form, utilize the Search area at the top of the screen to locate other versions in the legal form format.

Form popularity

FAQ

When facing a lawsuit, protecting your assets involves strategic planning, such as placing assets in a trust or transferring them to a spouse. Additionally, ensuring your insurance coverage is adequate can offer further protection. Understanding the legal landscape of Texas Assignment of Assets is crucial, and uslegalforms provides valuable resources to guide you through this protective process.

Yes, in Texas, you can transfer property without going through probate under specific conditions, such as using a transfer-on-death deed. This option allows property owners to designate beneficiaries directly, bypassing the lengthy probate process. Utilizing resources like uslegalforms can help streamline the Texas Assignment of Assets process, ensuring your intentions are executed smoothly.

To protect your assets from a lawsuit in Texas, consider strategies such as setting up a trust, forming a limited liability company, or utilizing homestead exemptions. Each of these measures can shield your belongings from potential claims. For a more comprehensive approach, consulting with uslegalforms can provide you with tailored legal solutions for Texas Assignment of Assets.

Texas law provides specific protections for various types of assets in the context of lawsuits. Generally, your homestead, certain annuities, and insurance policies are safe from creditors. Knowing your rights under the Texas Assignment of Assets can help you safeguard these assets effectively.

In Texas, several assets remain protected from seizure in a judgment. These include your primary home, retirement accounts, and certain personal items like clothing and household goods. Understanding the nuances of these protections is crucial in the context of Texas Assignment of Assets, as it helps in protecting what matters most to you.

To transfer ownership of a property in Texas, you typically need to execute a deed that details the transfer. This document needs to be signed by the current owner and then filed with the county clerk's office. Consulting with a legal expert or using an online service like uslegalforms can simplify the Texas Assignment of Assets process, ensuring that all requirements are met correctly.

Yes, assignment contracts are legal in Texas, provided they adhere to state laws and the terms of the original agreement. These contracts can effectively facilitate the assignment of assets when properly executed. If you are considering an assignment, exploring options through platforms like US Legal Forms can simplify the process and ensure legal compliance.

To assign assets means to designate certain rights related to the assets to another party. This transfer allows the assignee to utilize the assets in a manner defined by the agreement. For individuals and businesses, understanding Texas Assignment of Assets is vital for effective asset management and legal compliance.

An example of an assignment of property is when a landlord assigns their rental agreement to a new tenant. The new tenant assumes the rights and responsibilities under that agreement, while the landlord retains ownership of the property. This process can streamline property management and is relevant when discussing Texas Assignment of Assets.

The assignment agreement serves to formalize the transfer of rights from one party to another regarding specific assets. It lays out the terms, conditions, and expectations for both parties, thereby reducing potential disputes. This document is especially important in Texas Assignment of Assets to ensure clarity and enforceability.