Texas Equity Share Agreement

Description

How to fill out Equity Share Agreement?

Are you situated in an area where you frequently require documents for business or particular objectives? There is an abundance of legitimate template options accessible online, but obtaining forms you can rely on can be challenging.

US Legal Forms offers thousands of template options, including the Texas Equity Share Agreement, which are designed to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can obtain the Texas Equity Share Agreement template.

Find all the document templates you have purchased in the My documents section. You can download an additional copy of the Texas Equity Share Agreement whenever needed. Just click on the desired form to obtain or print the document template.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service provides professionally crafted legal document templates that can be used for various reasons. Create your account on US Legal Forms and start making your life a bit simpler.

- Locate the form you need and confirm it is relevant to your specific area.

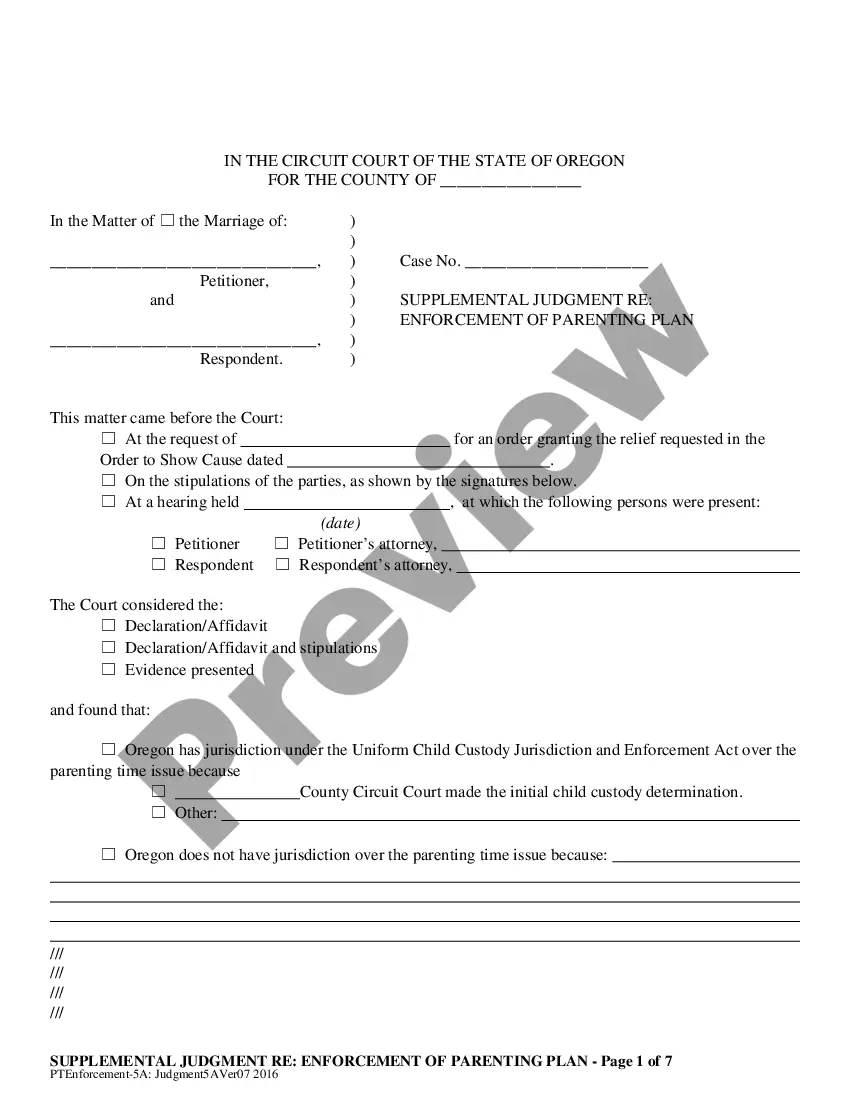

- Utilize the Preview button to examine the form.

- Review the description to ensure you have selected the correct form.

- If the form does not meet your requirements, use the Search feature to find the form that fits your needs.

- Once you find the appropriate form, click Get now.

- Choose the pricing plan you prefer, provide the necessary information to create your account, and complete the transaction using PayPal or credit card.

- Select a suitable file format and download your copy.

Form popularity

FAQ

One potential downside of a home equity agreement is the risk of losing a portion of your property's future appreciation. If the market increases significantly, you might end up sharing more value than anticipated. When entering a Texas Equity Share Agreement, it's wise to fully understand the terms to avoid unexpected outcomes.

In Texas, it's essential to record an affidavit of completion to avoid future complications regarding property ownership and rights. This document signifies that all contractual obligations have been fulfilled, which can protect both parties involved. If you're working on a Texas Equity Share Agreement, ensure all necessary filings are completed to secure your investment.

A contract for deed in Texas should be recorded to protect the interests of both the buyer and the seller. Recording this document helps establish ownership rights and can prevent future disputes over the property. If you are considering a Texas Equity Share Agreement, having your contract professionally documented is advisable.

Yes, home equity agreements are available in Texas, making options accessible for homeowners in need of financial resources. Providers offer various plans tailored to the Texas real estate market, so you can find something that suits your needs. Exploring a Texas Equity Share Agreement can be an effective way to unlock potential equity without the complications of traditional loans.

The main downside of a home equity agreement is the potential loss of some future home value. When you agree to share the appreciation, you limit your profit margin if the property value rises significantly. Furthermore, there may also be fees involved, which can reduce your overall earnings from the agreement. Thus, it is vital to evaluate a Texas Equity Share Agreement carefully before committing.

One primary downside of a home equity agreement (HEA) is that you may relinquish a portion of your home’s future value. This means if your home appreciates significantly, the return on your investment may be lower than expected. Additionally, while you enjoy financial flexibility, sharing equity can increase your obligations and limit your control over the property's equity. Thus, understanding a Texas Equity Share Agreement is crucial before entering any agreement.

While a home equity agreement offers significant benefits, it does have potential downsides. One concern is the sharing of future appreciation of your property, which may affect your long-term financial plans. Additionally, defaulting on the agreement could lead to serious financial repercussions. Thus, carefully considering these factors before entering a Texas Equity Share Agreement is wise.

Yes, the Texas home equity Affidavit and agreement must be recorded. This step is essential to ensure the legal standing of your Texas Equity Share Agreement. Recording protects your interests and informs other parties about the agreement. Therefore, it is crucial to follow through with this to maintain transparency and security over your property.

Finding the best lender for a home equity agreement in Texas requires some research. Consider local banks and credit unions that understand the specifics of the Texas Equity Share Agreement. Customer service, competitive rates, and clear terms are vital factors to evaluate. Ultimately, choosing a lender with experience in equity sharing can lead you to a favorable financial solution.

Yes, you can secure a home equity agreement in Texas. The Texas Equity Share Agreement allows homeowners to leverage their property's equity while maintaining ownership. This type of agreement provides a flexible option to access funds without selling your home. By utilizing this arrangement, you can emphasize your financial goals while enjoying the benefits your equity offers.