Texas Comprehensive Equipment Lease with Provision Regarding Investment Tax

Description

How to fill out Comprehensive Equipment Lease With Provision Regarding Investment Tax?

You can spend hours online searching for the legal document template that meets the state and federal requirements you have. US Legal Forms offers numerous legal templates that are reviewed by professionals.

You can conveniently obtain or print the Texas Comprehensive Equipment Lease with Provision Regarding Investment Tax through our service.

If you already possess a US Legal Forms account, you can sign in and click on the Obtain button. After that, you can fill out, modify, print, or sign the Texas Comprehensive Equipment Lease with Provision Regarding Investment Tax. Every legal document template you purchase is yours indefinitely. To retrieve another copy of any purchased form, go to the My documents section and click on the corresponding button.

Select the format of your document and download it to your device. Make amendments to your document as necessary. You can fill out, edit, sign, and print the Texas Comprehensive Equipment Lease with Provision Regarding Investment Tax. Download and print thousands of document templates using the US Legal Forms website, which provides the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If this is your first time using the US Legal Forms website, follow these simple instructions.

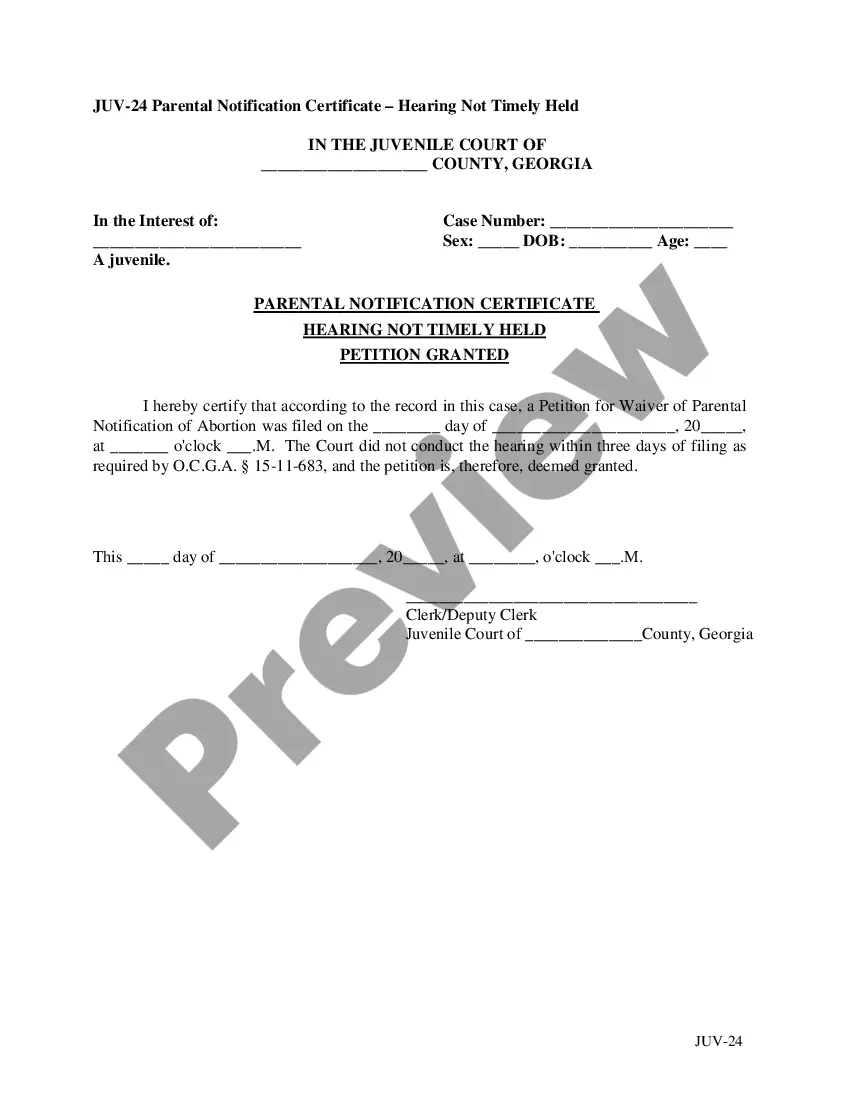

- First, verify that you have selected the correct document template for the state/city you choose. Review the form description to ensure you have selected the appropriate form.

- If available, utilize the Preview button to view the document template as well.

- If you wish to find another variant of your form, use the Search bar to locate the template that fulfills your requirements.

- Once you have identified the template you want, click Obtain now to proceed.

- Select the pricing plan you prefer, enter your details, and create a merchant account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to purchase the legal form.

Form popularity

FAQ

In Texas, various entities qualify for sales tax exemptions, including certain non-profit organizations and government agencies. Understanding who qualifies is essential when engaging in a Texas Comprehensive Equipment Lease with Provision Regarding Investment Tax. By leveraging these exemptions, businesses can effectively manage costs associated with equipment acquisition, ultimately supporting their growth and operational needs.

In Texas, seniors can apply for property tax exemptions once they reach the age of 65. This exempt status can significantly reduce the financial burden on seniors, allowing them to maintain their homes with greater ease. If you are considering a Texas Comprehensive Equipment Lease with Provision Regarding Investment Tax and are a senior, it's important to explore all available tax benefits, including exemptions related to property.

Section 151.331 of the Texas tax code outlines the specifics about what constitutes taxable and non-taxable items within Texas. When forming a Texas Comprehensive Equipment Lease with Provision Regarding Investment Tax, this section plays a crucial role in identifying eligible equipment for tax exemptions. By understanding this section, businesses can make informed decisions that align with state regulations while minimizing their tax burden.

Section 151.338 of the Texas tax code addresses the sales tax exemption for certain types of equipment leases. This section is particularly relevant when considering a Texas Comprehensive Equipment Lease with Provision Regarding Investment Tax, as it provides clarity on tax implications. Understanding this section can help taxpayers leverage exemptions effectively, ensuring compliance while optimizing expenses associated with equipment leasing.

Protesting property taxes in Texas can be worthwhile, especially if you believe your assessed value is higher than fair market value. If you have a lease agreement like the Texas Comprehensive Equipment Lease with Provision Regarding Investment Tax, it can impact your overall tax liabilities. Evaluating your property assessment and potential savings can inform your decision.

Rule 3.294 in Texas addresses certain procedures and guidelines for the taxation process. It is particularly relevant for businesses utilizing a Texas Comprehensive Equipment Lease with Provision Regarding Investment Tax, as it affects how leases are assessed for tax purposes. Understanding this rule can empower you to navigate your tax responsibilities more effectively.

Tax code 23.1242 in Texas relates to the appraisal and application of exemptions for certain types of properties. When dealing with a Texas Comprehensive Equipment Lease with Provision Regarding Investment Tax, this section can significantly influence your financial strategy. Knowing the implications of this tax code can help you optimize your operations.

In Texas, property tax responsibility for leased equipment generally falls on the lessee, not the lessor. This means that if you are operating under a Texas Comprehensive Equipment Lease with Provision Regarding Investment Tax, you should anticipate these tax obligations. Understanding this responsibility can assist you in better financial planning.

In Texas, certain disabled individuals may qualify for property tax exemptions. Eligibility often depends on disability status, income, and property use, which can impact equipment leased under a Texas Comprehensive Equipment Lease with Provision Regarding Investment Tax. If you think you qualify, explore the application process to secure your benefits.

Section 23.12 of the Texas Tax Code provides guidelines on the appraisal of property, especially concerning business personal property. This section directly applies to equipment leased under a Texas Comprehensive Equipment Lease with Provision Regarding Investment Tax, ensuring accurate valuation for taxation purposes. Knowing these details can help you better understand your tax liabilities.