Texas Sample Letter for Compromise on a Debt

Description

How to fill out Sample Letter For Compromise On A Debt?

If you wish to obtain, attain, or create valid document templates, utilize US Legal Forms, the most extensive compilation of legal forms available online.

Employ the site’s straightforward and convenient search feature to find the documents you need.

Various templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Step 4. After locating the form you need, click the Buy now button. Choose your preferred pricing plan and enter your information to create an account.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to download the Texas Sample Letter for Compromise on a Debt with just a few clicks.

- If you are already a US Legal Forms subscriber, Log In to your account and click the Download button to obtain the Texas Sample Letter for Compromise on a Debt.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have chosen the form for the correct city/state.

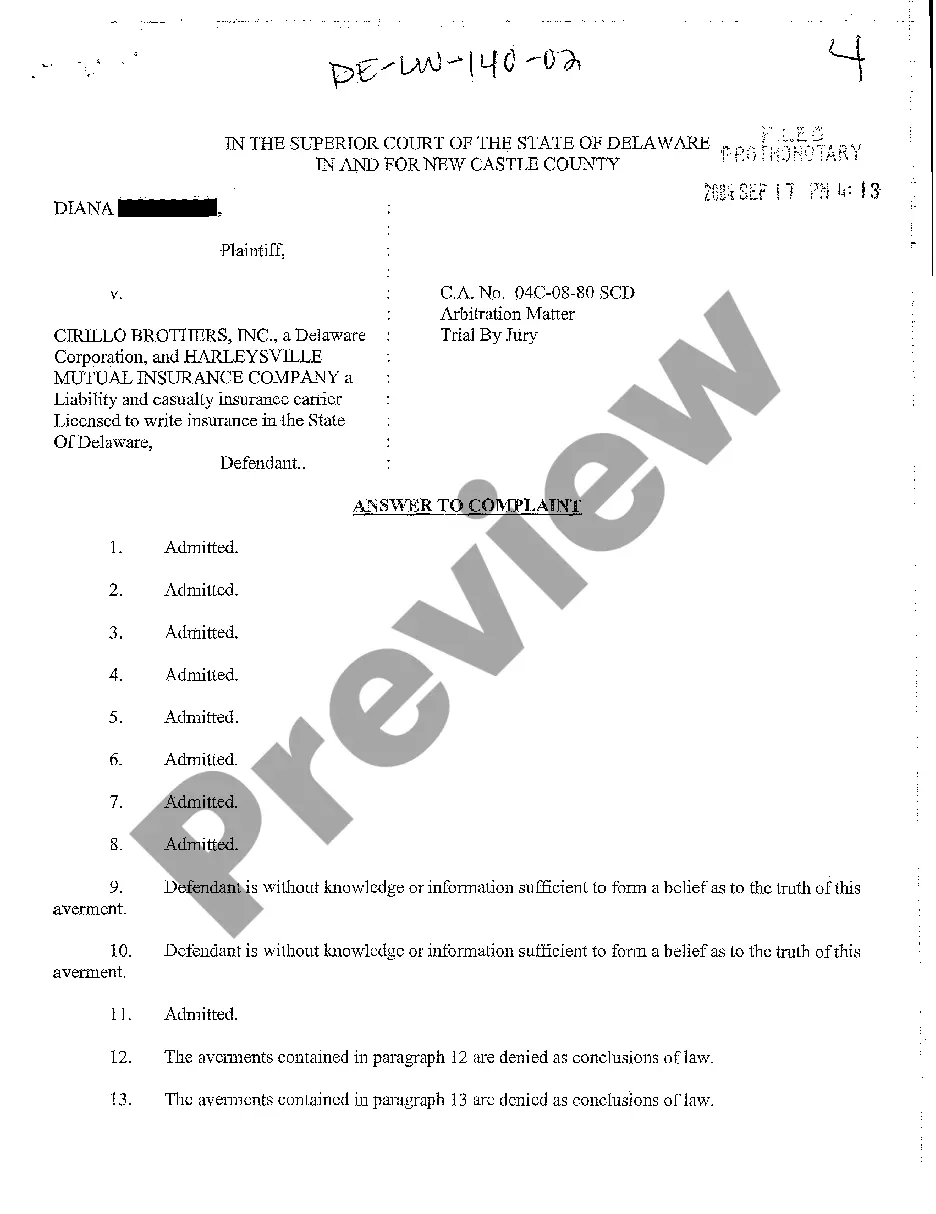

- Step 2. Use the Preview option to review the content of the form. Don’t forget to check the summary.

- Step 3. If you are dissatisfied with the form, utilize the Search feature at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Defending against a debt collection lawsuit involves understanding your rights and reviewing the claims made against you. Common defenses include disputing the validity of the debt or asserting improper service of the lawsuit. Utilizing a Texas Sample Letter for Compromise on a Debt may also be strategic, as it shows your willingness to negotiate and address the issue without prolonged litigation.

Writing an answer to a debt collection lawsuit means clearly addressing each point raised in the lawsuit. Start by formatting the document properly and including a heading with the court information. Specificity is key; denying or admitting accusations should be straightforward. Moreover, consider using a Texas Sample Letter for Compromise on a Debt to propose a settlement, which can lead to a resolution without further dispute.

Answering a lawsuit for debt collection in Texas involves drafting a written response to the claims made against you. Be sure to admit or deny each allegation and assert any defenses you have. Additionally, you can propose a compromise using a Texas Sample Letter for Compromise on a Debt, which may help you settle the matter outside of court and preserve your financial well-being.

Filling out a debt validation letter requires you to include specific information, such as your identity details and the account in question. Clearly request that the debt collector provide proof of the debt, including the original creditor's name. Using a Texas Sample Letter for Compromise on a Debt can simplify this process, as it offers a template to ensure you cover all necessary elements while communicating effectively with your creditor.

To get a debt lawsuit dismissed in Texas, you can file a motion to dismiss based on several grounds, such as lack of jurisdiction or failure to state a claim. Providing evidence that supports your position is crucial. You might also consider negotiating a settlement, as a Texas Sample Letter for Compromise on a Debt can facilitate these discussions and potentially lead to a favorable outcome without going to court.

Responding to a debt collection lawsuit in Texas involves preparing a formal answer to the complaint filed against you. You have a limited time frame, usually 20 days, to file this response. It's essential to address each claim made by the debt collector and present any defenses you may have. Utilizing a Texas Sample Letter for Compromise on a Debt can also help you propose a resolution directly with the creditor.

A reasonable offer to settle a debt often ranges from 30% to 50% of the total amount owed, depending on your financial situation and the creditor's willingness to negotiate. When making this offer, consider using the Texas Sample Letter for Compromise on a Debt to present your case clearly. Be prepared to explain your offer by demonstrating your financial difficulties. Having a fair proposal can aid in reaching a settlement.

To dispute a debt collection in Texas, begin by writing a formal letter to the collection agency. Use the Texas Sample Letter for Compromise on a Debt as a guide for your correspondence, ensuring you outline your reasons for disputing the debt. Provide any supporting evidence and request validation of the debt. This process helps protect your rights and clarifies any inaccuracies about the debt.

A debt settlement letter should include your personal information, details about the debt, and the proposed settlement amount. Utilize the Texas Sample Letter for Compromise on a Debt to ensure you cover all necessary points, like your proposal for monthly payments if applicable. Also, clearly state that your intention is to resolve the debt to avoid further collection actions. Providing a clear and concise letter can improve communication with creditors.

To write a letter requesting proof of debt, begin by addressing the debt collector with your name and address at the top. Clearly state that you are requesting validation of the debt according to the Fair Debt Collection Practices Act. Include a mention of the Texas Sample Letter for Compromise on a Debt as it can provide a useful template for your request. Finally, keep a copy of your letter for your records and send it via certified mail to ensure you have proof of delivery.