Texas Exchange Agreement for Real Estate

Description

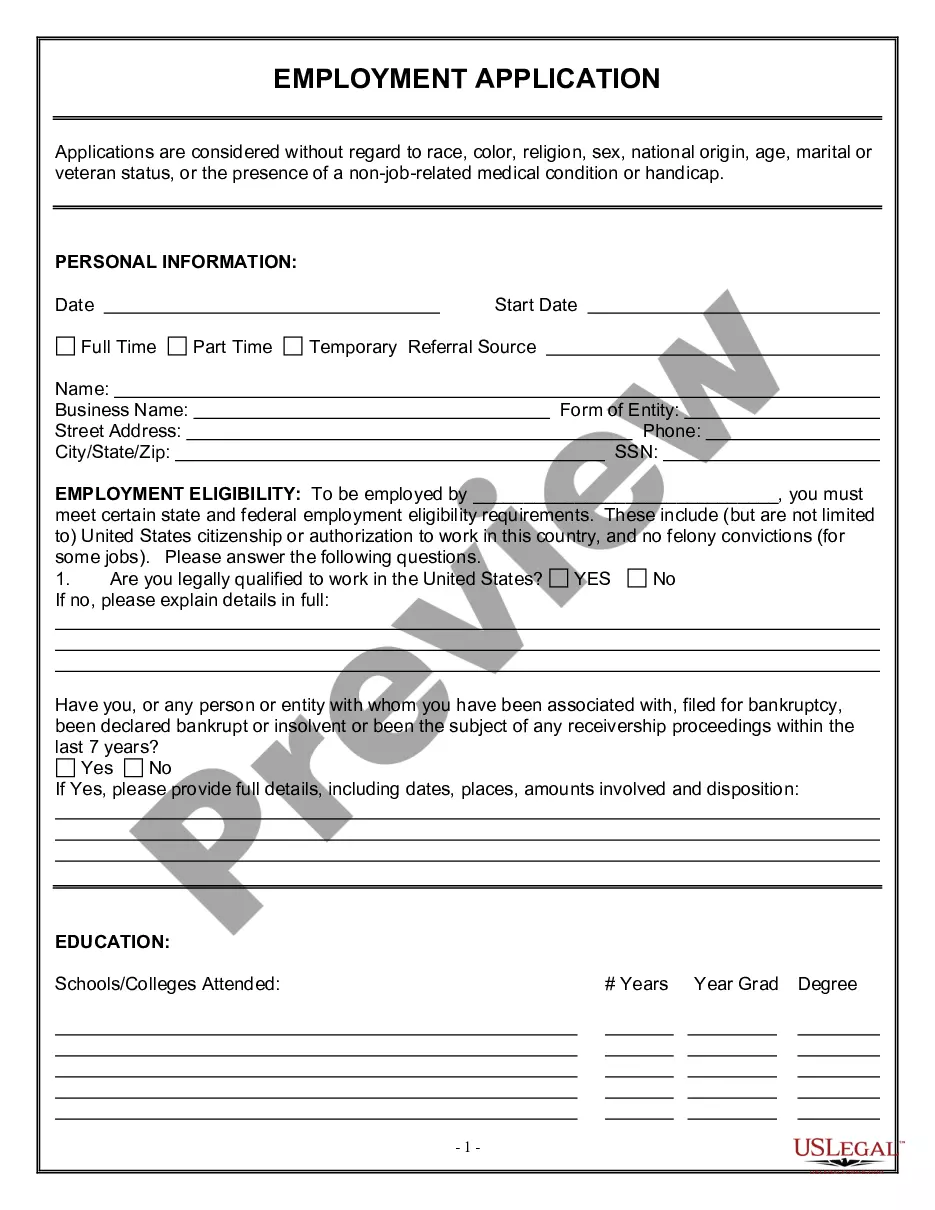

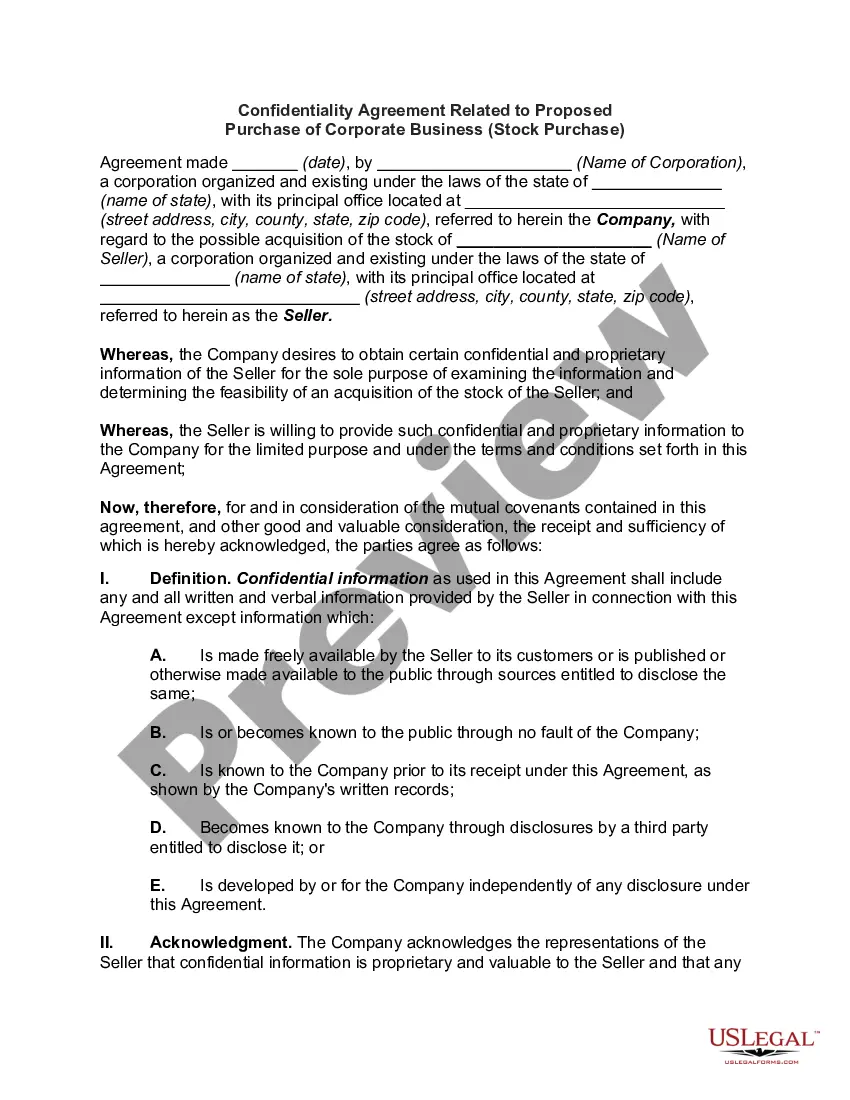

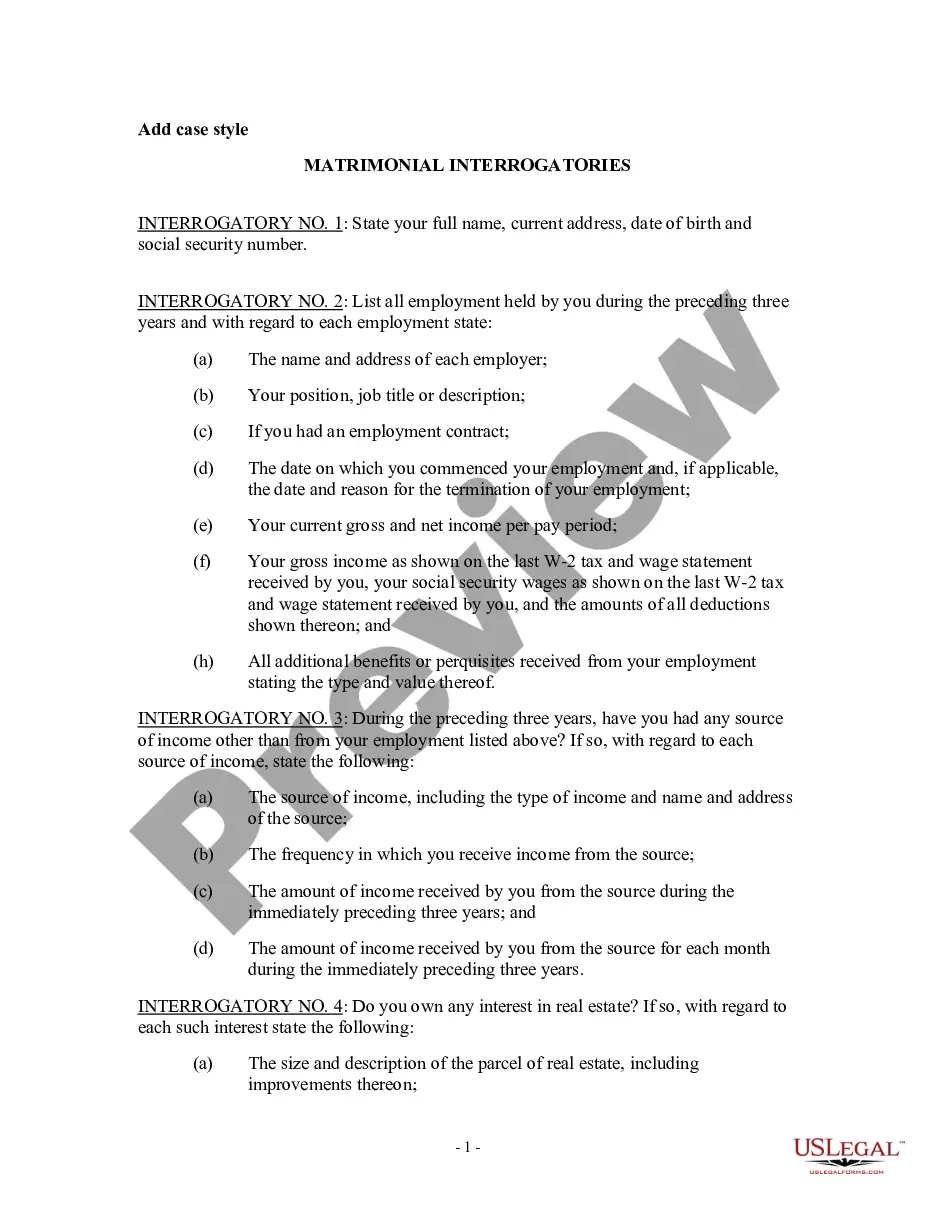

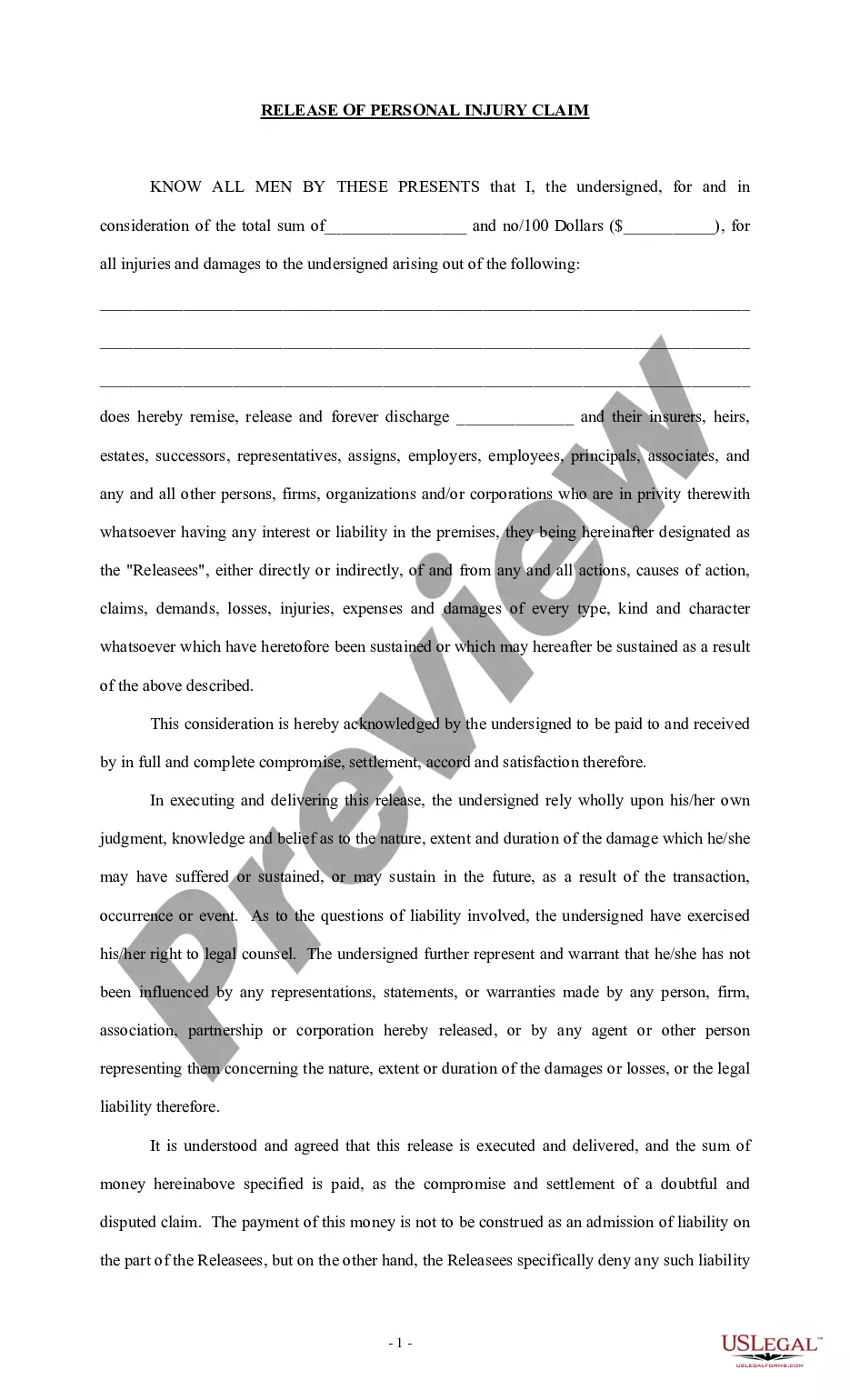

How to fill out Exchange Agreement For Real Estate?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a diverse selection of legal form templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest forms such as the Texas Exchange Agreement for Real Estate in just a few minutes.

If you have a subscription, Log In to retrieve the Texas Exchange Agreement for Real Estate from your US Legal Forms library. The Download option will appear on every form you view. You have access to all previously downloaded forms in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make adjustments. Fill out, modify, and print and sign the downloaded Texas Exchange Agreement for Real Estate. Every template you added to your account has no expiration date and is yours permanently. Therefore, if you want to download or print another copy, simply go to the My documents section and click on the form you need. Access the Texas Exchange Agreement for Real Estate with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- Ensure you have chosen the correct form for your city/state.

- Click on the Preview option to review the form's details.

- Read the form's description to confirm that you have selected the right form.

- If the form does not meet your requirements, use the Search box at the top of the page to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking on the Get now button.

- Then, choose the pricing plan you prefer and enter your information to sign up for the account.

Form popularity

FAQ

There are also states that have withholding requirements if the seller of a piece of property in these states is a non-resident of any of the following states: California, Colorado, Hawaii, Georgia, Maryland, New Jersey, Mississippi, New York, North Carolina, Oregon, West Virginia, Maine, South Carolina, Rhode Island,

The basic premise of a Texas 1031 exchange is the same as it is throughout the country; if you have real property that is used in your trade or business, or that you are holding for investment purposes and you wish to sell it, you may be able to defer the federal and state income taxes that would normally be incurred

Although many taxpayers include language in their purchase and sale agreements establishing their intent to perform an exchange, it is not required by the Internal Revenue Code in a Section 1031 exchange. It is important, however, that the purchase and sale agreements for both properties be assignable.

Tom: The short answer is yes. Section 1031 is a federal tax code, so it is recognized in all states, so you can exchange from state to state. We regularly are dealing with transactions from our home state of Oregon and into California, Washington, and vice versa.

The term 1031 Exchange originates from section 1031 of the Internal Revenue Code. This permits an investor to substitute their investment property with another one that is similar or labeled as like-kind. The investor is given an option to defer the capital gain taxes temporarily.

Yes. The contract forms are available for public use. A TREC contract form, however, is intended for use primarily by licensed real estate brokers or sales agents who are trained in their correct use.

It states an affirmative promise by the seller or buyer to actually do an act or thingsuch as the seller agreeing to deliver good, indefeasible, and undisputed title at closing. There is also a difference in how these two categories of obligation are enforced in the event of default.

Measured from when the relinquished property closes, the Exchangor has 45 days to nominate (identify) potential replacement properties and 180 days to acquire the replacement property. The exchange is completed in 180 days, not 45 days plus 180 days.

Are text messages legally binding? Only some verbal agreements are considered legally binding under Texas law. A verbal contract can be legally binding if it meets certain legal requirements like specificity and adequate consideration.