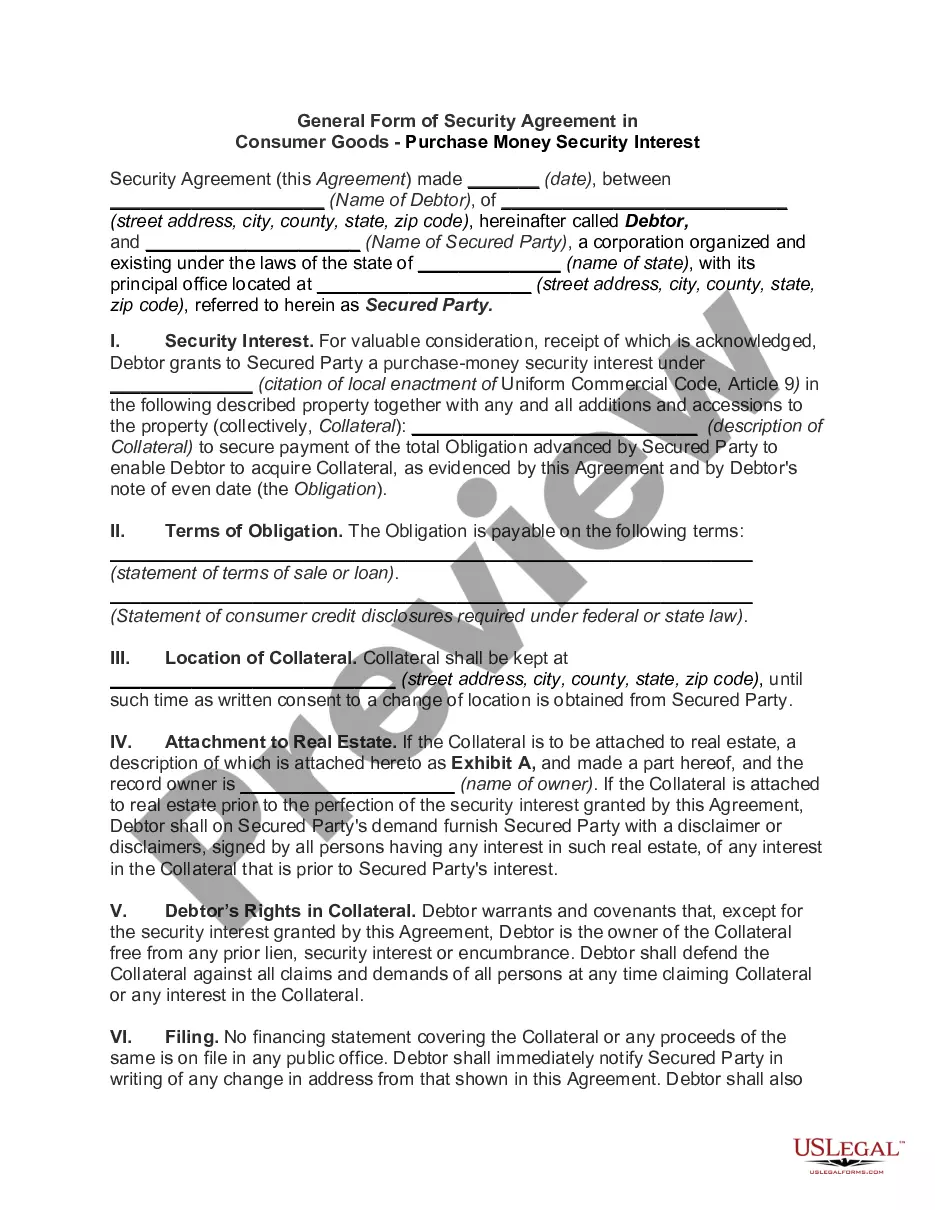

Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Texas Sample Letter for Change of Venue and Request for Homestead Exemption

Description

How to fill out Sample Letter For Change Of Venue And Request For Homestead Exemption?

You can commit hours on-line searching for the authorized papers format that suits the state and federal specifications you will need. US Legal Forms provides thousands of authorized varieties which are examined by experts. You can actually acquire or produce the Texas Sample Letter for Change of Venue and Request for Homestead Exemption from our service.

If you have a US Legal Forms accounts, you are able to log in and then click the Obtain key. Afterward, you are able to full, revise, produce, or indication the Texas Sample Letter for Change of Venue and Request for Homestead Exemption. Every single authorized papers format you buy is your own for a long time. To have an additional backup of any purchased develop, visit the My Forms tab and then click the corresponding key.

If you are using the US Legal Forms website the first time, keep to the straightforward instructions under:

- Initially, be sure that you have chosen the correct papers format for the area/town of your choosing. Look at the develop explanation to make sure you have picked the appropriate develop. If available, use the Review key to check throughout the papers format as well.

- If you wish to discover an additional model of your develop, use the Look for field to obtain the format that suits you and specifications.

- When you have found the format you need, click Purchase now to continue.

- Choose the pricing strategy you need, type your qualifications, and register for a free account on US Legal Forms.

- Full the transaction. You can use your credit card or PayPal accounts to pay for the authorized develop.

- Choose the structure of your papers and acquire it to the gadget.

- Make changes to the papers if necessary. You can full, revise and indication and produce Texas Sample Letter for Change of Venue and Request for Homestead Exemption.

Obtain and produce thousands of papers web templates using the US Legal Forms Internet site, which offers the most important selection of authorized varieties. Use specialist and condition-certain web templates to handle your small business or person requires.

Form popularity

FAQ

HECHO! How to Fill out Texas Homestead Exemption 2022 YouTube Start of suggested clip End of suggested clip In. You do not need to worry about the legal description. If you do not know it. It can be found onMoreIn. You do not need to worry about the legal description. If you do not know it. It can be found on bcad.org. If you look up your property's. Information.

Taxing units may offer a local option exemption based on a percentage of a home's appraised value. Any taxing unit can exempt up to 20 percent of the value of each qualified homestead. No matter what percentage of value the taxing unit adopts, the dollar value of the exemption must be at least $5,000.

REQUIRED DOCUMENTATION Attach a copy of property owner's driver's license or state-issued personal identification certificate. The address listed on the driver's license or state-issued personal identification certificate must correspond to the property address for which the exemption is requested.

If you receive this exemption and purchase or move into a different home in Texas, you may also transfer the same percentage of tax paid to a new qualified homestead. This is known as a ceiling transfer (Request to Cancel/Port Exemptions).

HECHO! How to Fill out Texas Homestead Exemption 2022 YouTube Start of suggested clip End of suggested clip Put the address you are applying for the homestead exemption for which you own and live. In. You doMorePut the address you are applying for the homestead exemption for which you own and live. In. You do not need to worry about the legal description. If you do not know it. It can be found on bcad.org.

Put simply, a homestead exemption lowers the taxable value of your property. This means you will pay less property tax on your home. As of August 2023, you're entitled to up to $40,000 in value reductions. This is only a general guideline figure, though.