Texas Affidavit of Facts Concerning the Identity of Heirs

Form popularity

FAQ

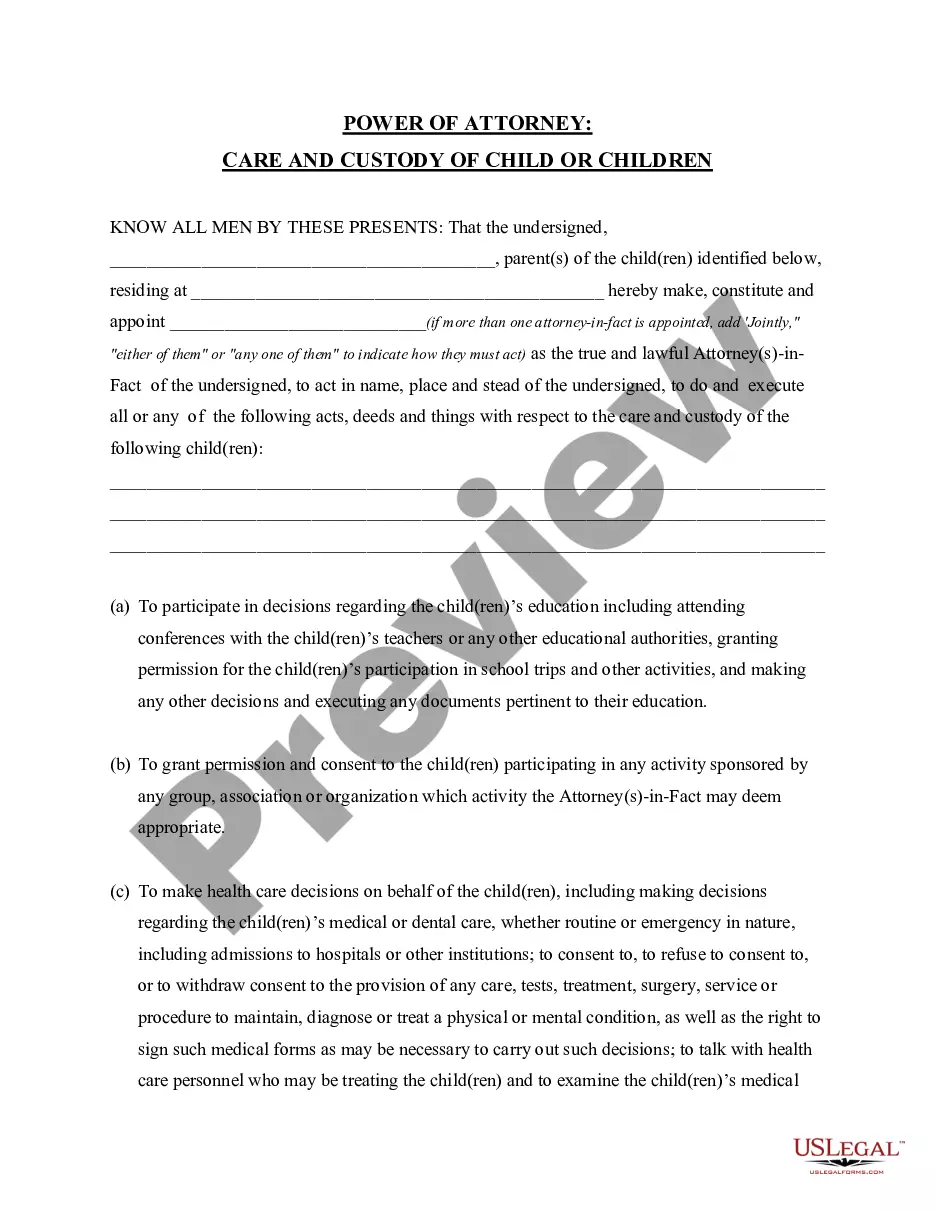

Ing to the Code, heirs at law generally starts with my spouse, then my children, then my parents, then my siblings, then my nieces and nephews, and then my cousins.

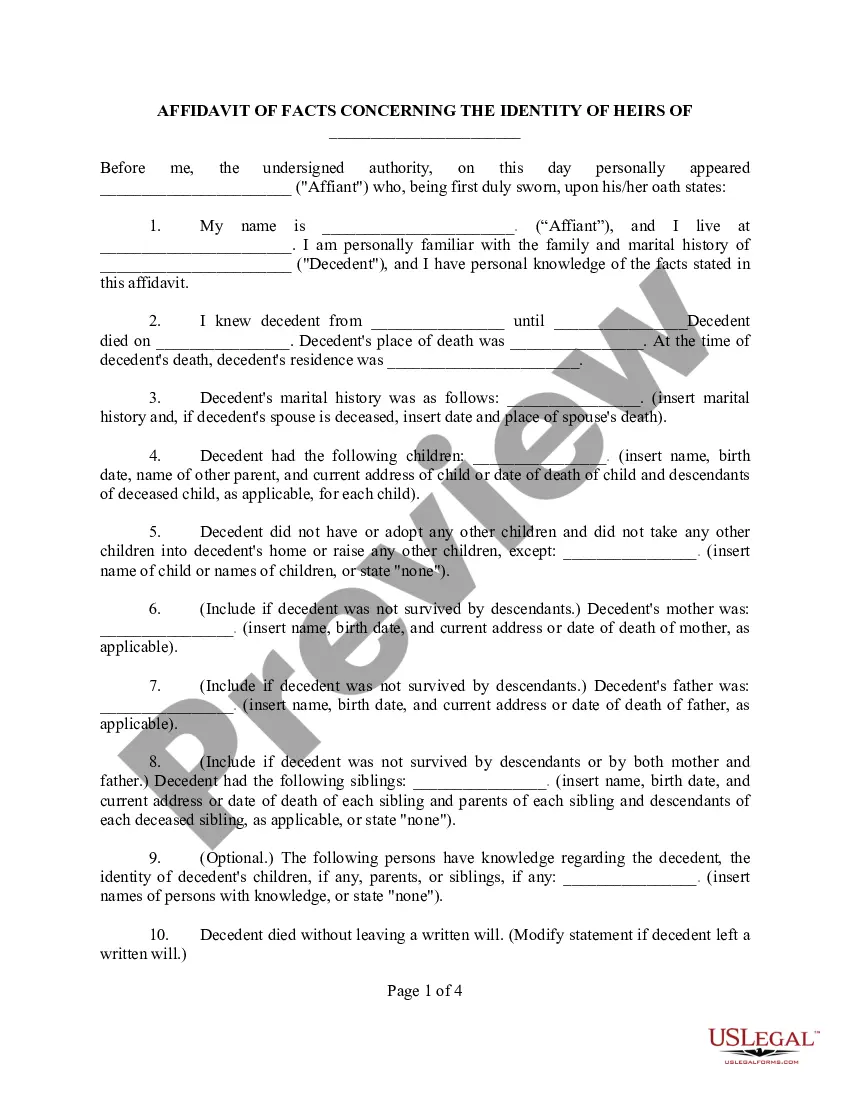

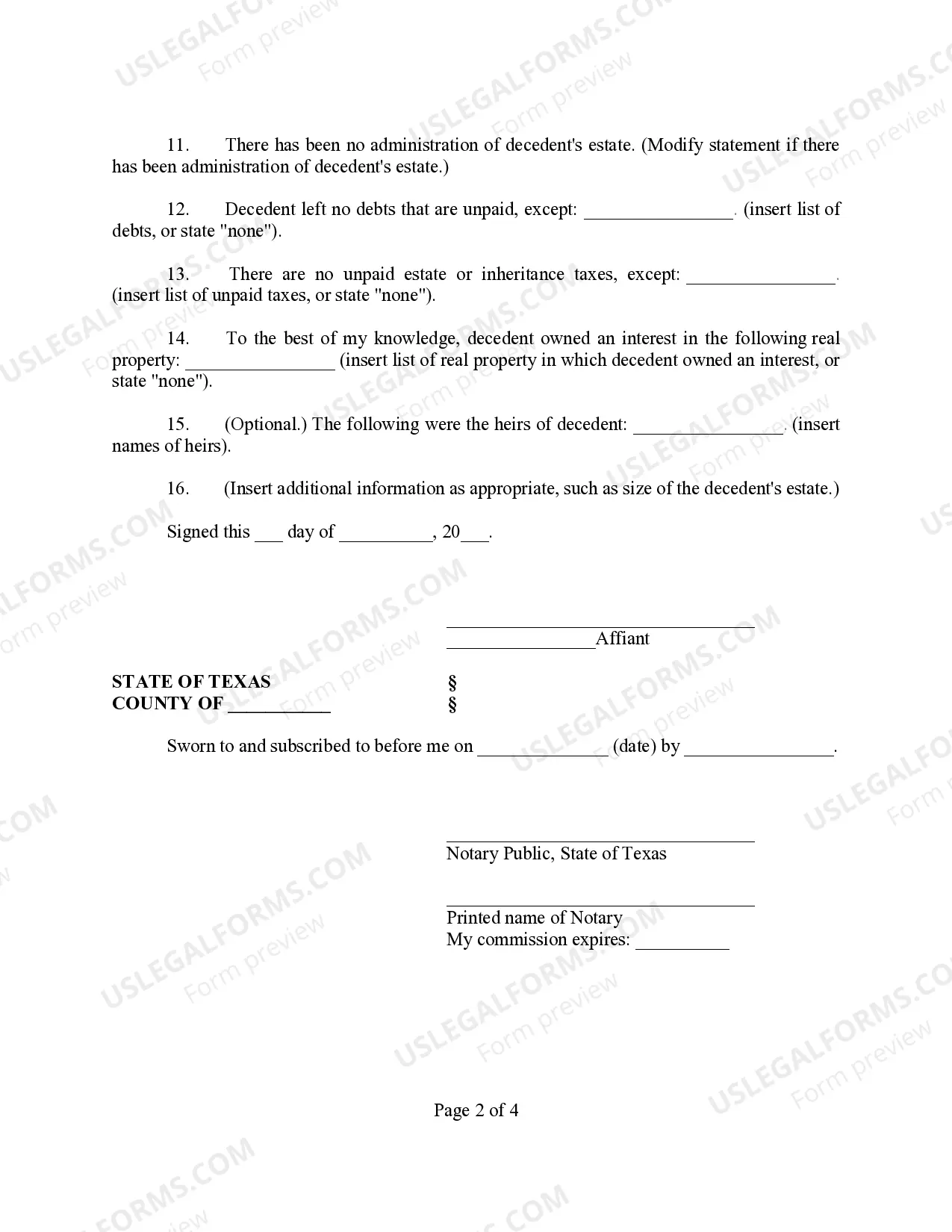

A properly prepared Texas Affidavit of Heirship must provide the following information: The deceased owner's full name, last address, date of birth and date and place of death. It should list all real estate owned by the deceased owner.

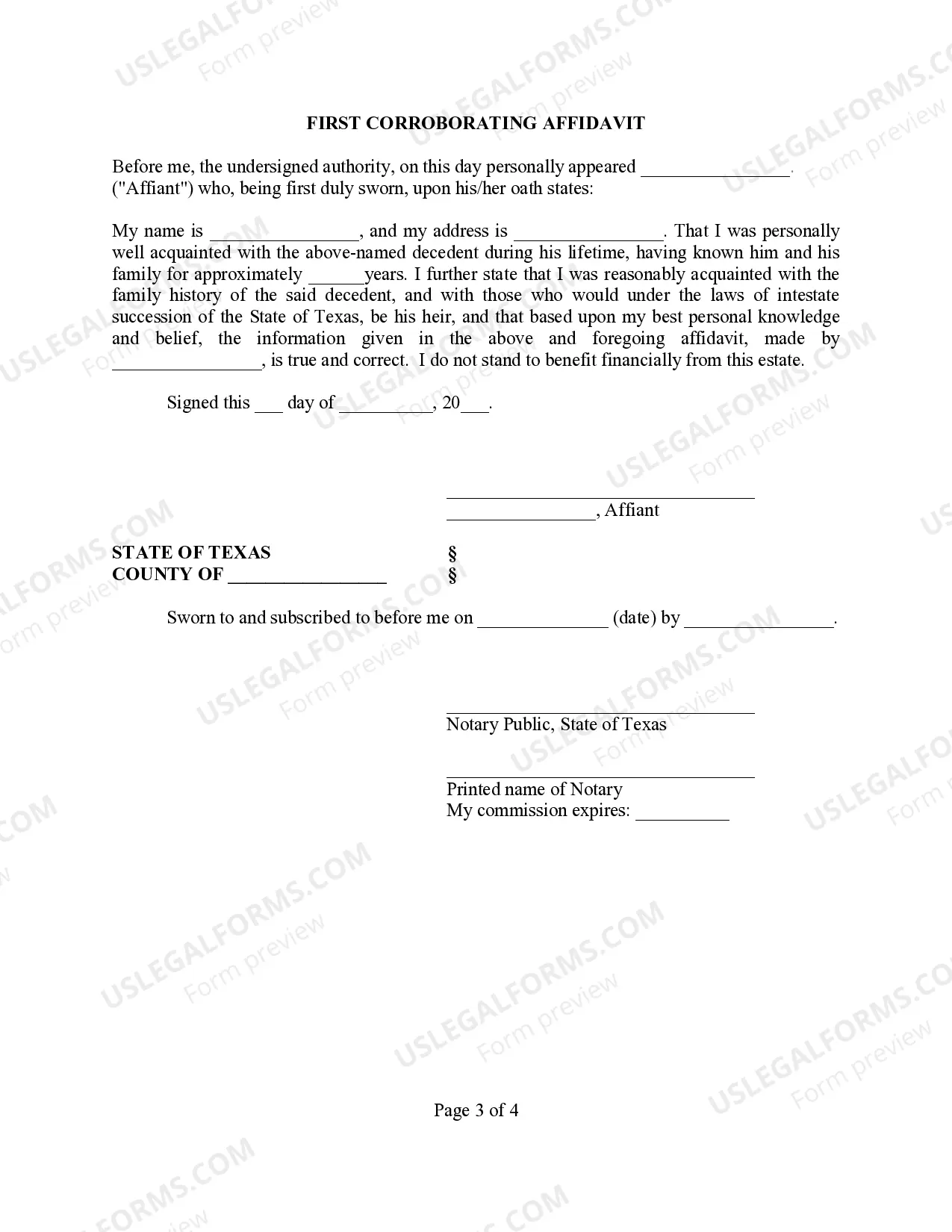

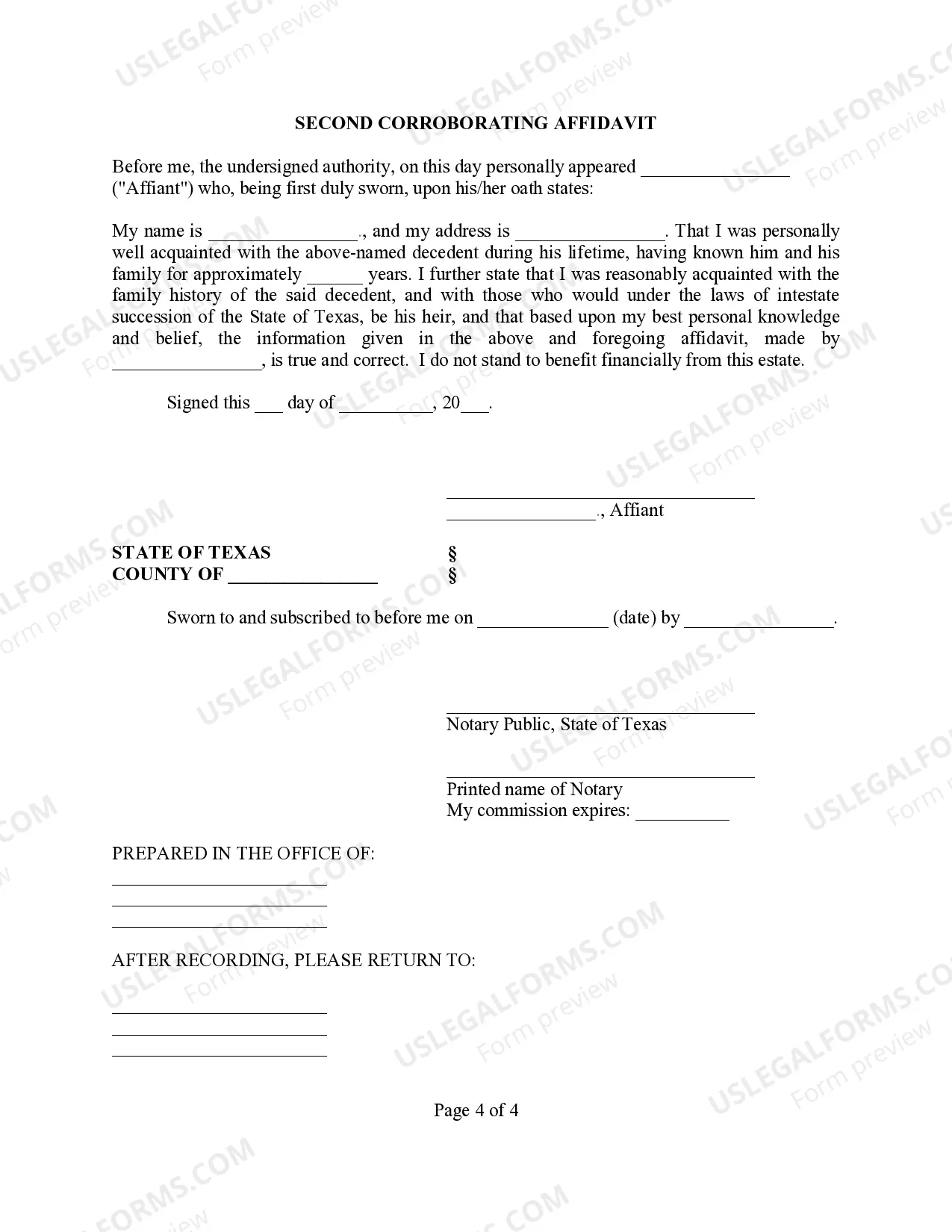

Requirements for Affidavit of Heirships in Texas The affiant must be a person with personal knowledge of the family and marital history of the decedent. The affidavit must include the name and address of the affiant.

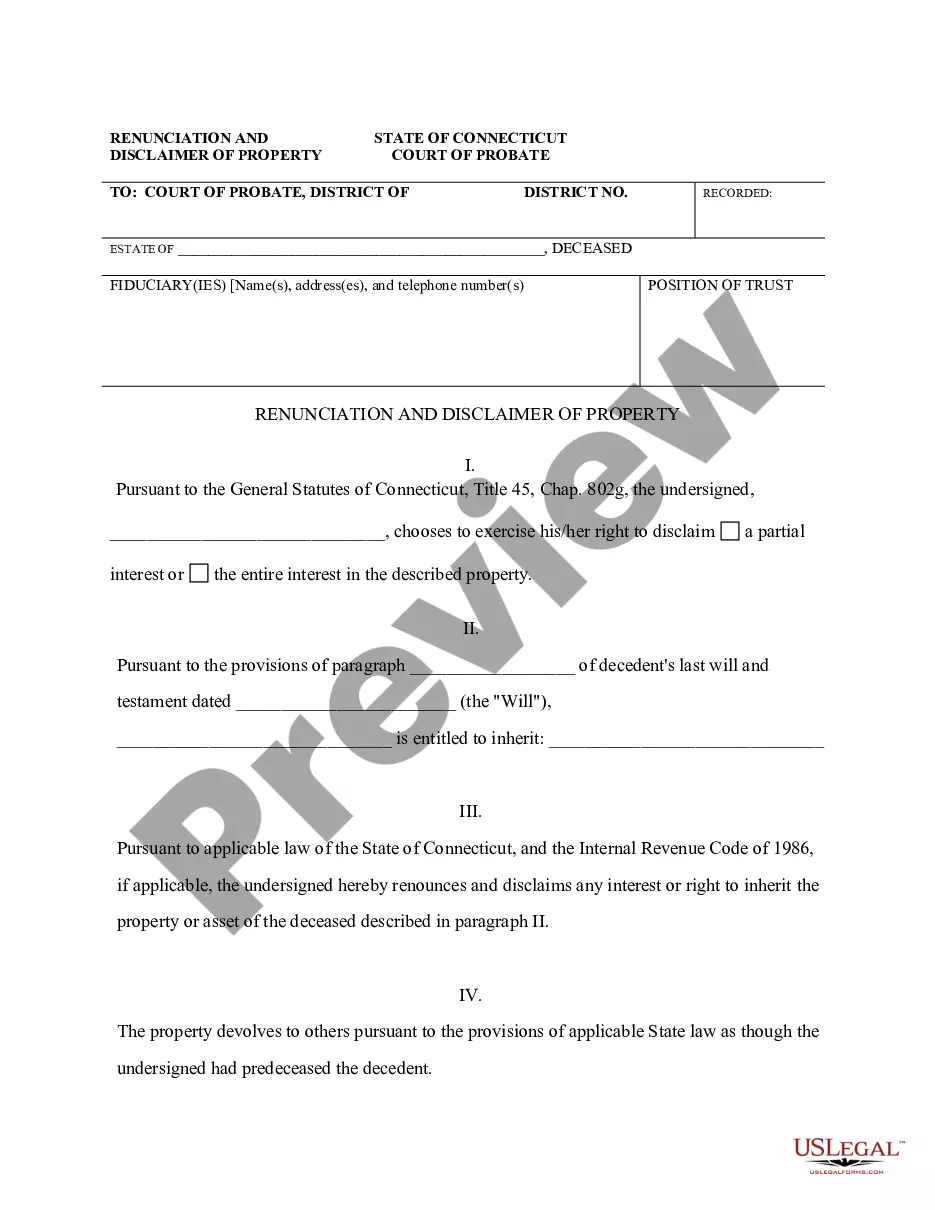

An affidavit of heirship is a document that can be used in some states to transfer ownership of property left by a deceased person to their family. This allows for property to be inherited without a will or a court proceeding.

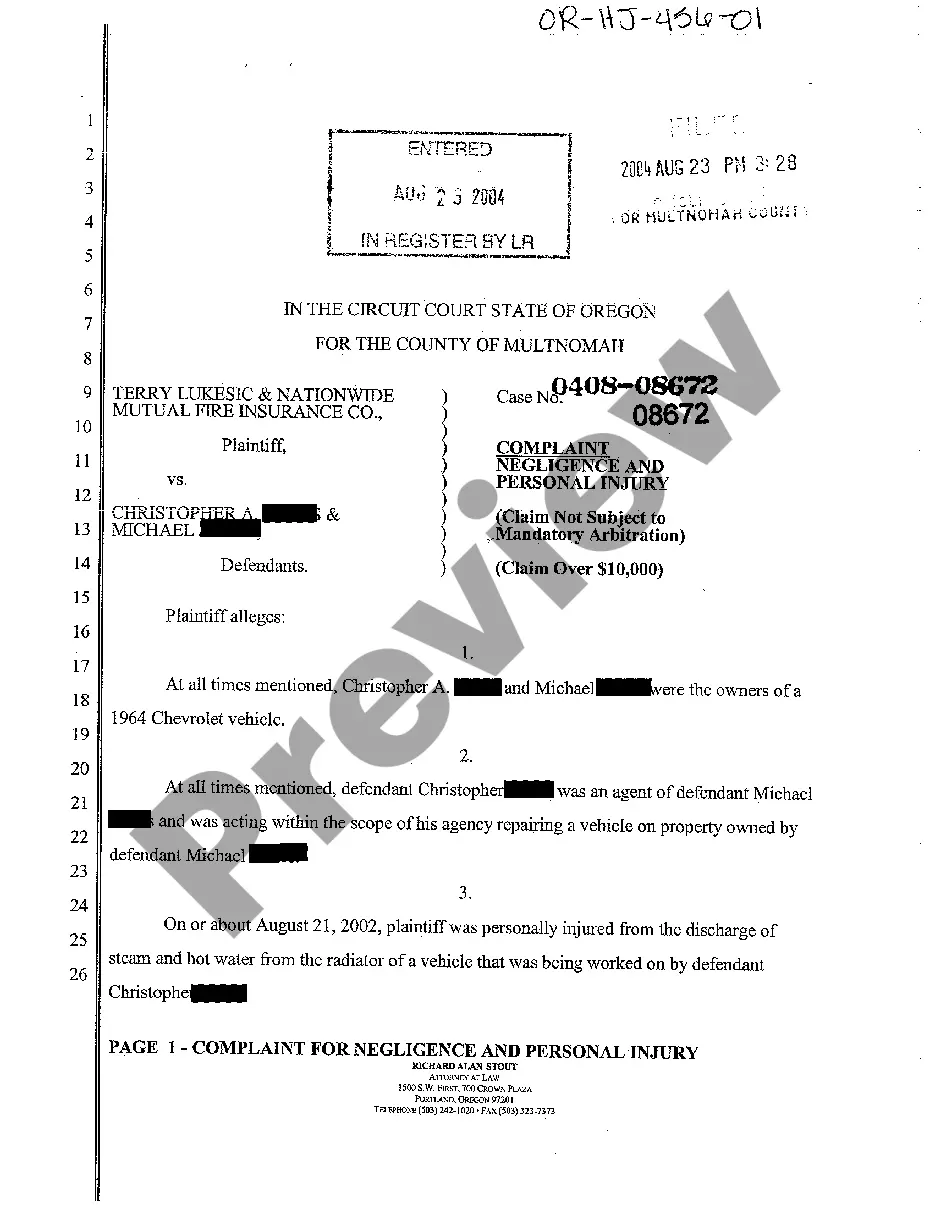

An affidavit of heirship can be contested. This may be done by other heirs who disagree that you should receive the property or believe they should have been listed as an heir on the affidavit.

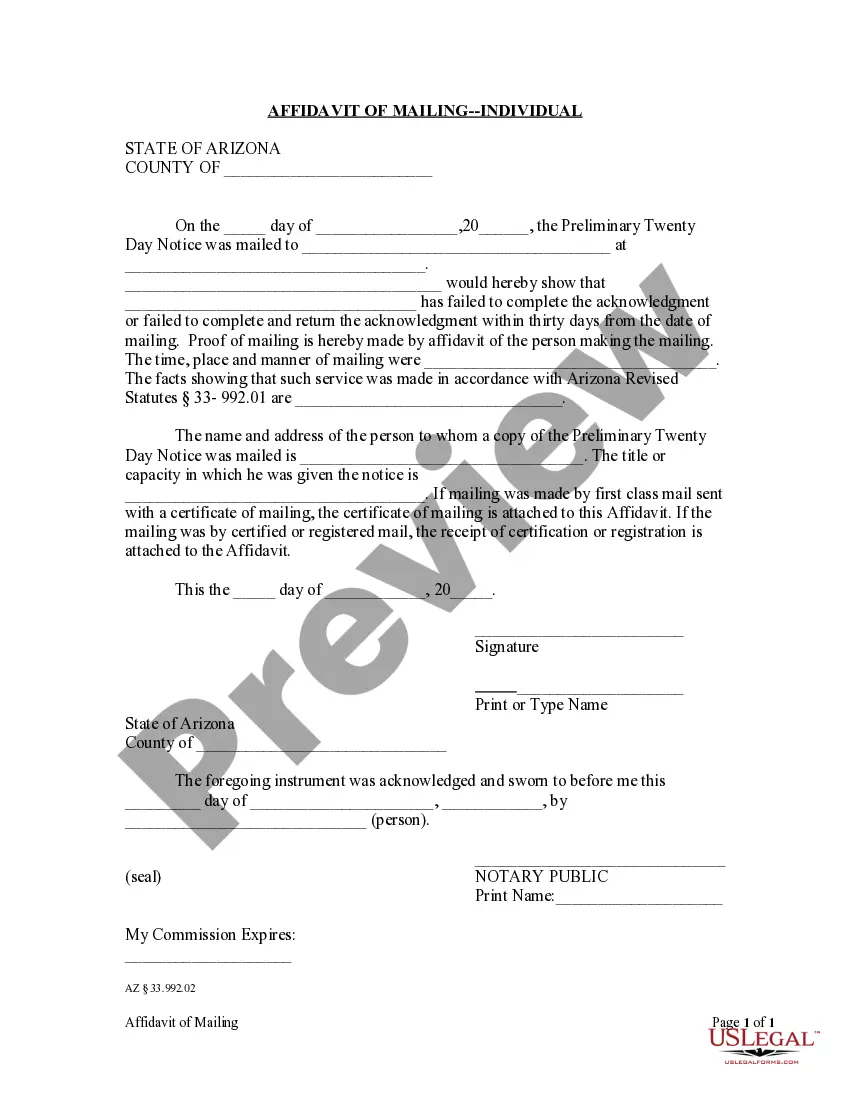

Create the affidavit of heirship. The affidavit must include specific information such as the name and address of the affiant, the decedent's name and date of death, marital history, and the names and addresses of the decedent's children and siblings. Sign the affidavit of heirship in front of a notary public.

If the deceased property owner had a Will stating who the property should be transferred to, the Will should be filed for Probate within 4 years of the date of death. The property may subsequently be transferred or sold by the Executor named in the Will ing to the wishes of the deceased owner.

A ballpark fee for preparation of the affidavit is between $750 for a very simple estate with few heirs to several thousand dollars for a more complicated estate with many heirs. The filing fees to record the affidavit in each county where the real property is located usually run about $50 to $75 in Texas.