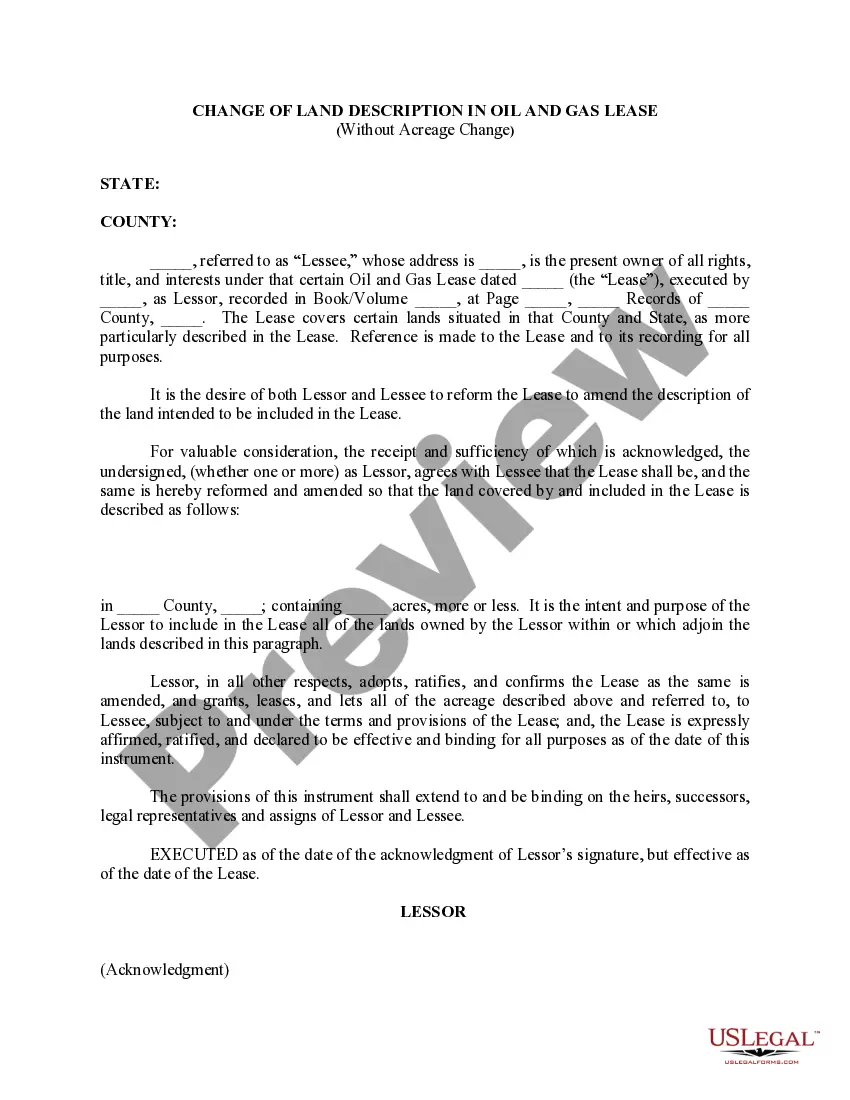

Texas Change of Land Description in Oil and Gas Lease - Without Acreage Change

Description

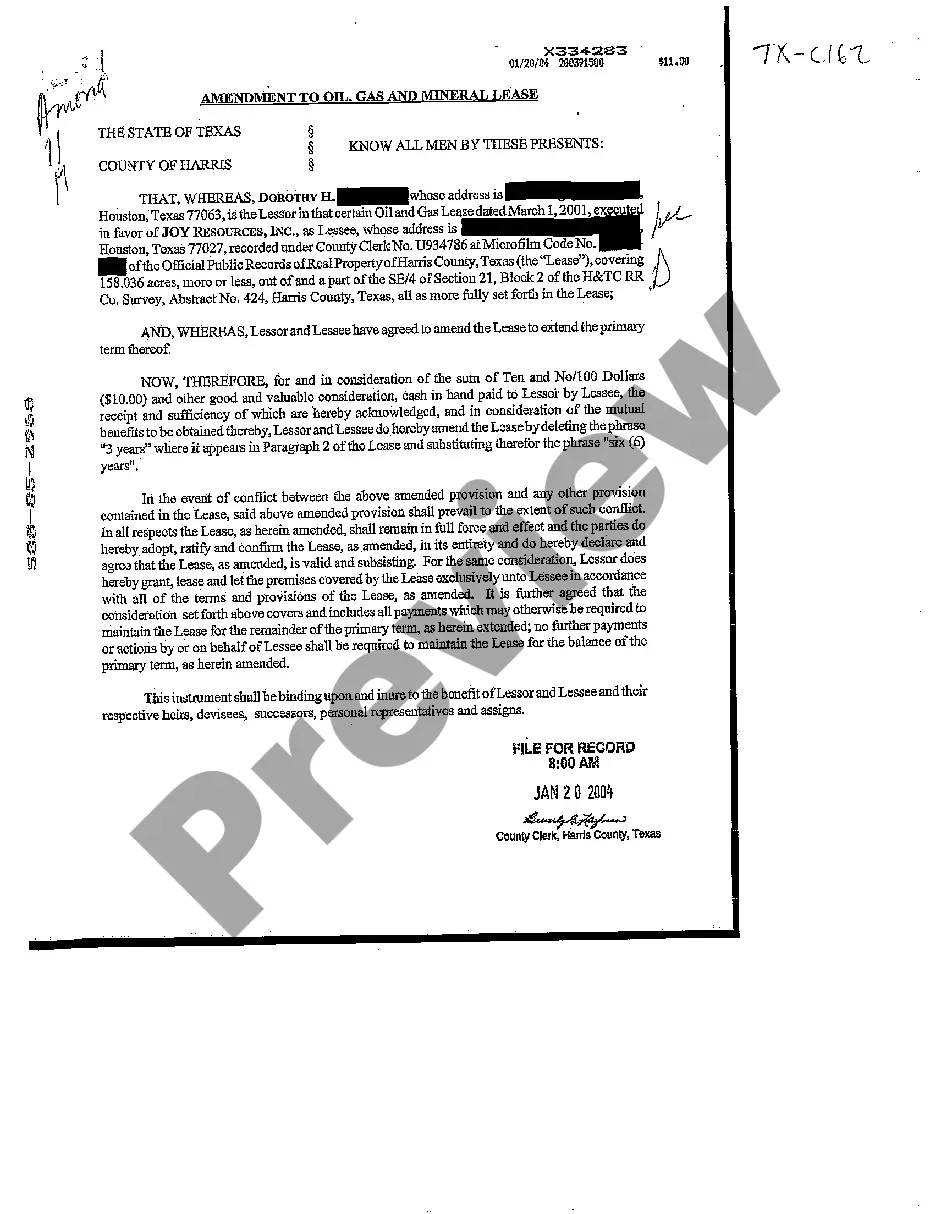

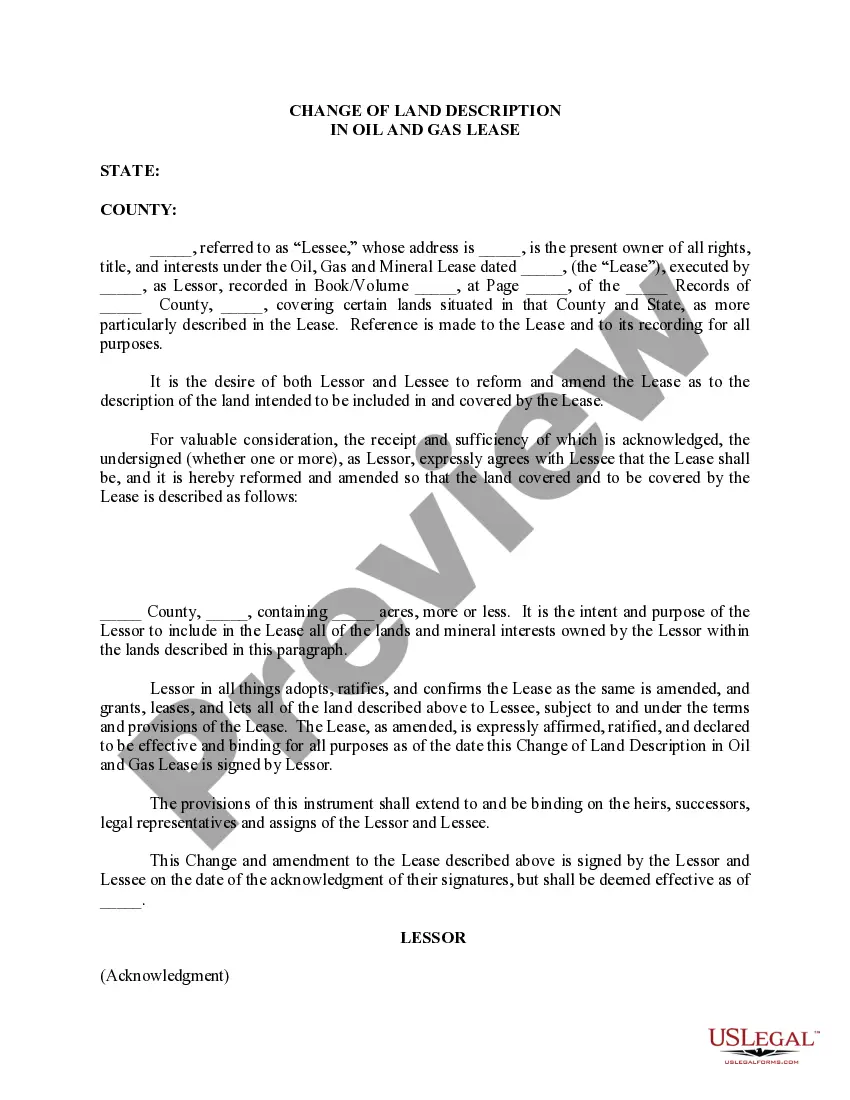

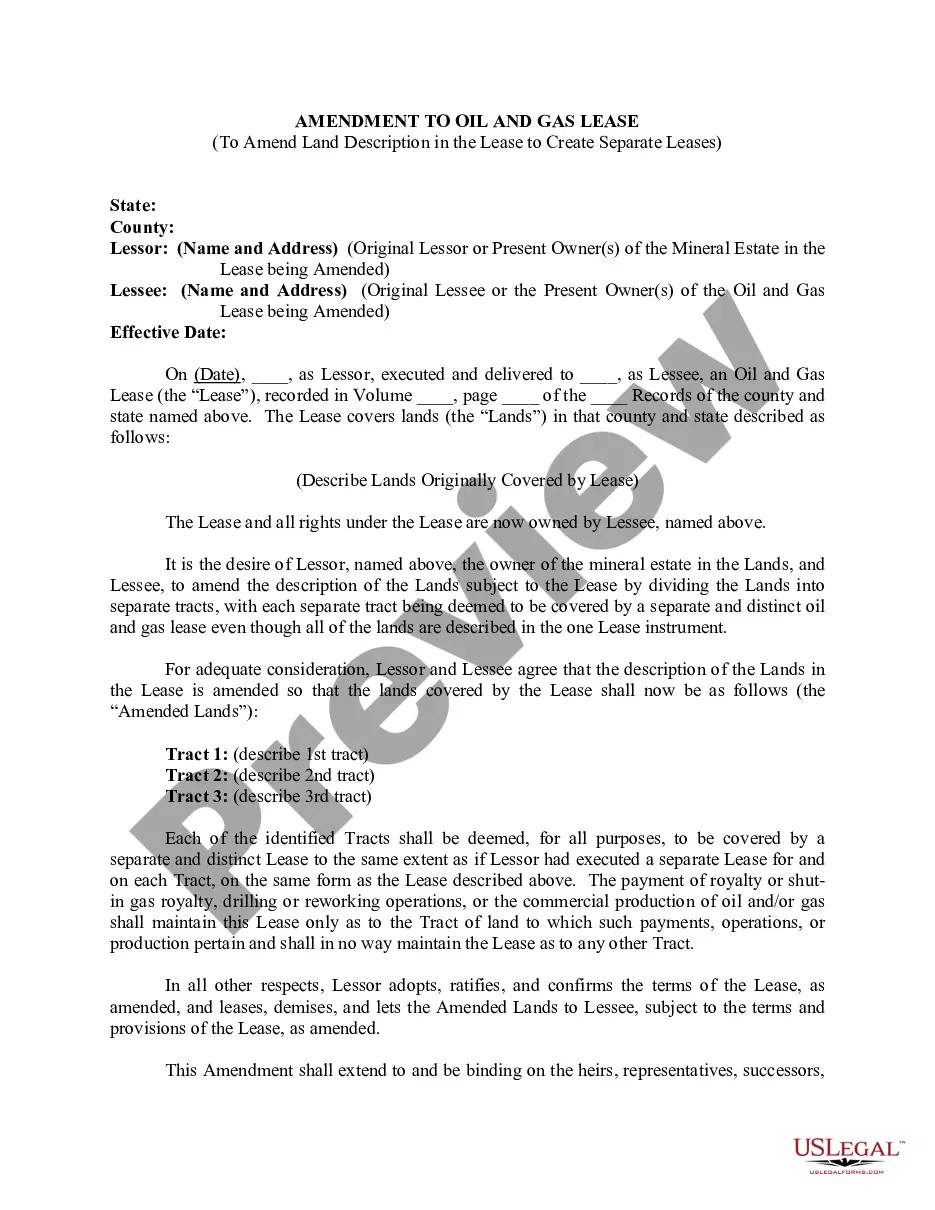

How to fill out Texas Change Of Land Description In Oil And Gas Lease - Without Acreage Change?

Access to top quality Texas Change of Land Description in Oil and Gas Lease - Without Acreage Change samples online with US Legal Forms. Prevent hours of lost time seeking the internet and dropped money on forms that aren’t updated. US Legal Forms provides you with a solution to exactly that. Find above 85,000 state-specific legal and tax templates you can save and submit in clicks in the Forms library.

To get the sample, log in to your account and click Download. The document is going to be saved in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, take a look at our how-guide below to make getting started simpler:

- See if the Texas Change of Land Description in Oil and Gas Lease - Without Acreage Change you’re considering is suitable for your state.

- See the sample using the Preview option and browse its description.

- Visit the subscription page by clicking on Buy Now button.

- Choose the subscription plan to go on to register.

- Pay by credit card or PayPal to finish making an account.

- Choose a favored file format to save the document (.pdf or .docx).

You can now open up the Texas Change of Land Description in Oil and Gas Lease - Without Acreage Change sample and fill it out online or print it out and do it yourself. Consider sending the document to your legal counsel to be certain everything is filled out appropriately. If you make a mistake, print out and complete sample once again (once you’ve made an account all documents you save is reusable). Make your US Legal Forms account now and get a lot more templates.

Form popularity

FAQ

In the event oil and gas were found and the wells produce, then the royalties kick in. So if the oil well produce 100 barrels a day, and the price of oil is $80 per barrel that month, then the cash flow is 100x$80 = $8,000/day The royalty owner, who agreed to 15% royalty, would receive $8,000 x 0.15 = $1,200/day.

You can retain your mineral rights simply by putting an exception in your sales contract, provided that the buyer agrees to it, of course. If you sell your house with no such legal clarification, then those mineral rights automatically transfer to the buyer.

For many years, almost all oil and gas leases reserved a 1/8th royalty. Today, the royalty fraction is negotiable, and is usually between 1/8th and 1/4th. Bonus. The bonus is the amount paid to the Lessor as consideration for his/her execution of the lease.

Further, annual rental fees for onshore oil and gas leases $1.50 per acre during the first five years and $2 per acre each year thereafter allow drilling companies to hold and explore mineral leases for the price of a cup of coffee.

A royalty is the portion of production the landowner receives. A royalty clause in the oil or gas title process will typically give a percentage of the lease that the company pays to the owner of the mineral rights, minus production costs. Royalties are free from costs and charges, other than taxes.

To calculate your oil and gas royalties, you would first divide 50 by 1,000, and then multiply this number by . 20, then by $5,004,000 for a gross royalty of $50,040. Once you calculate your gross royalty amount, compare it to the number you see on your royalty check stubs.

Nationally, mineral rights owners can expect anywhere from $100 to $5,000 per acre for their mineral rights lease. The most valuable mineral rights leases are on producing parcels of land that are still expected to hold many more precious minerals.

Unless you also own the minerals under your land, that someone might have every right to start drilling. In the United States, mineral rights can be sold or conveyed separately from property rights. As a result, owning a piece of land does not necessarily mean you also own the rights to the minerals beneath it.

The specific provisions of the laws vary from state to state, but drillers are generally allowed to extract minerals from a large area or "pool"--in most states a minimum of 640 acres--if leases have been negotiated for a certain percentage of that land. The company can then harvest gas from the entire area.