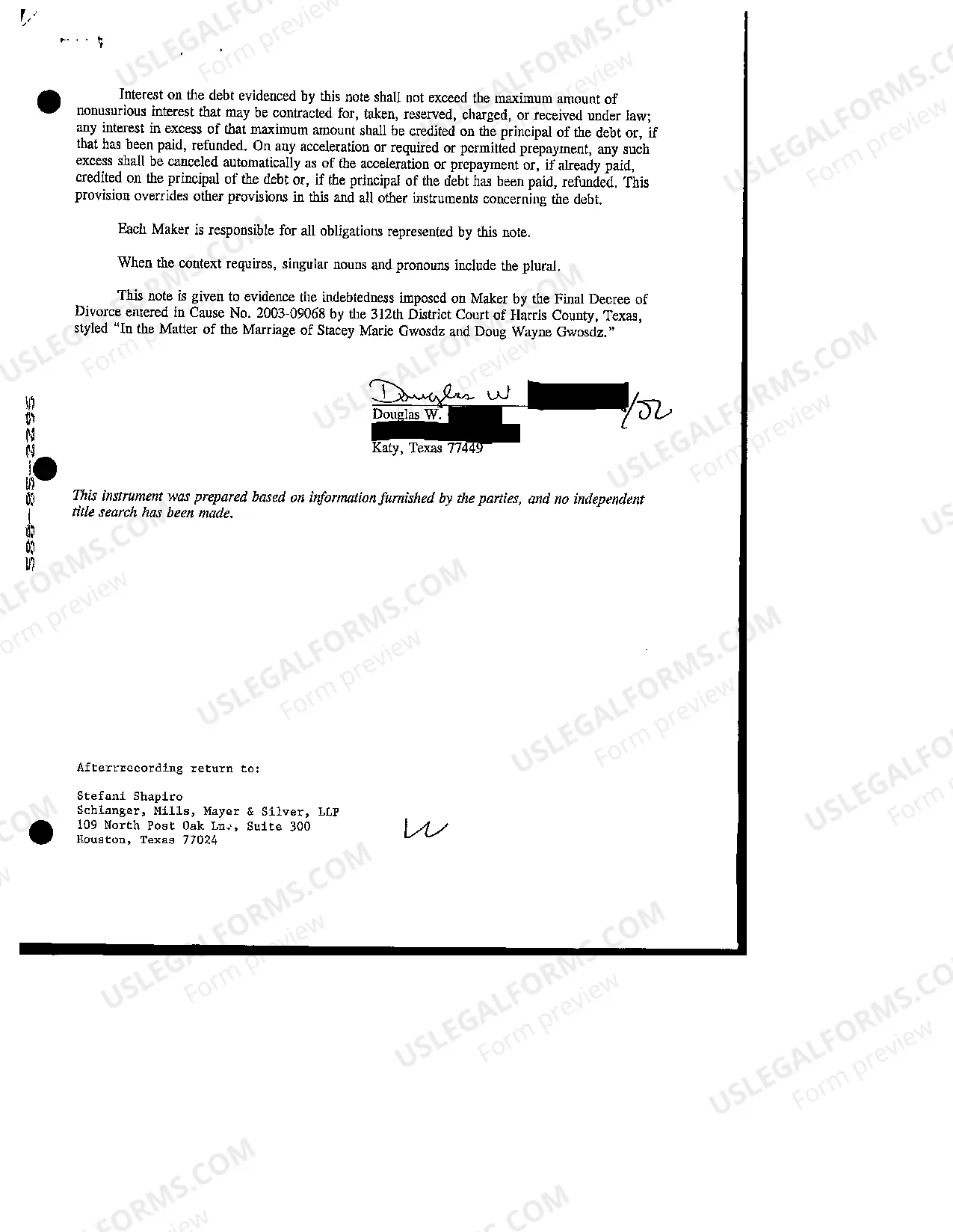

Texas Real Estate Lien Note

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

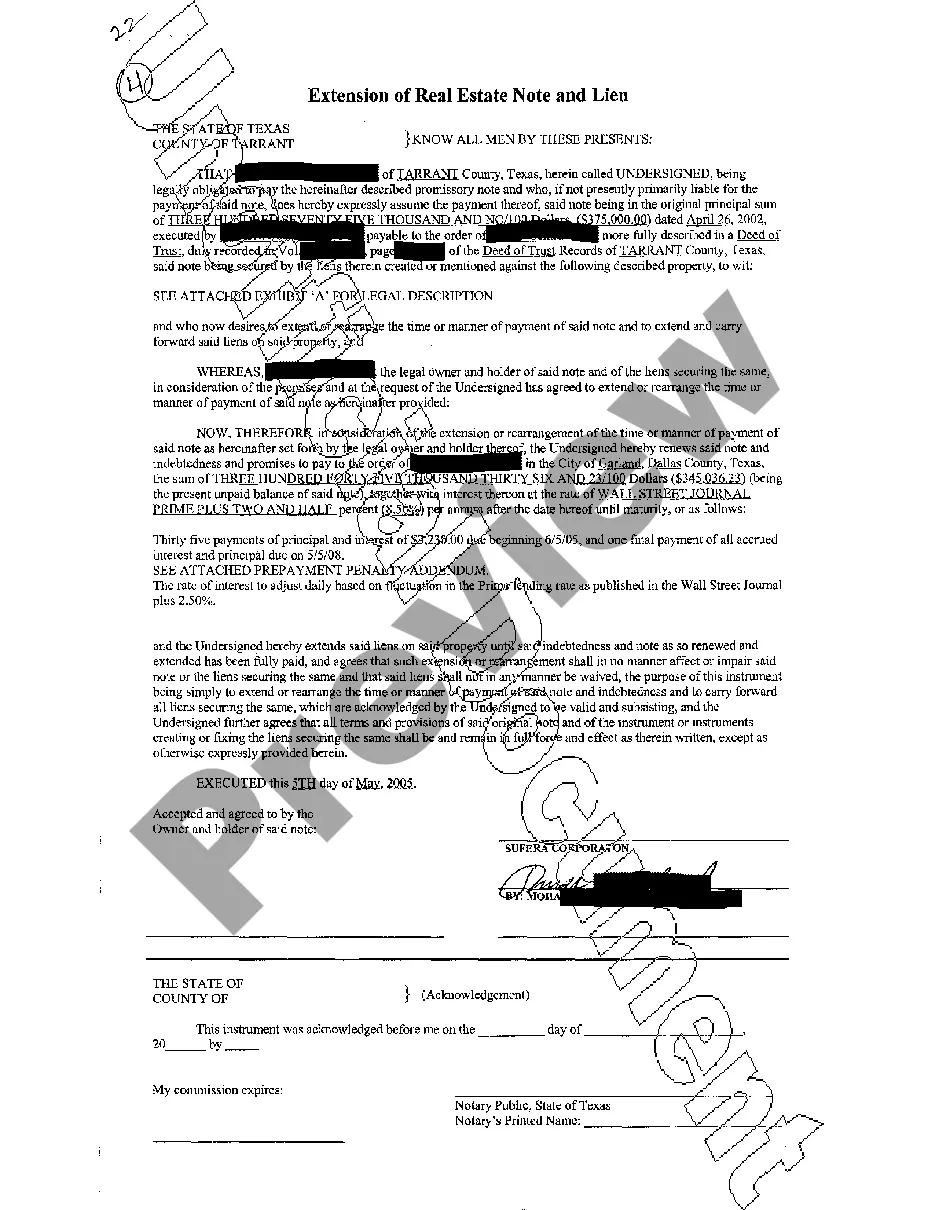

Real Estate Lien Note: A legal document that signifies a debt obligation backed by the collateral of specified real estate property. If the borrower fails to meet the conditions of the note, a lien can be placed on the property as a security measure.

Step-by-Step Guide

- Understanding the Agreement: Review the terms of the real estate lien note to ensure clarity on interest rates, repayment schedule, and the legal implications of failure to pay.

- Secure Legal Consultation: Consult with a real estate attorney to discuss any potential legal implications and to ensure all state-specific regulations are followed.

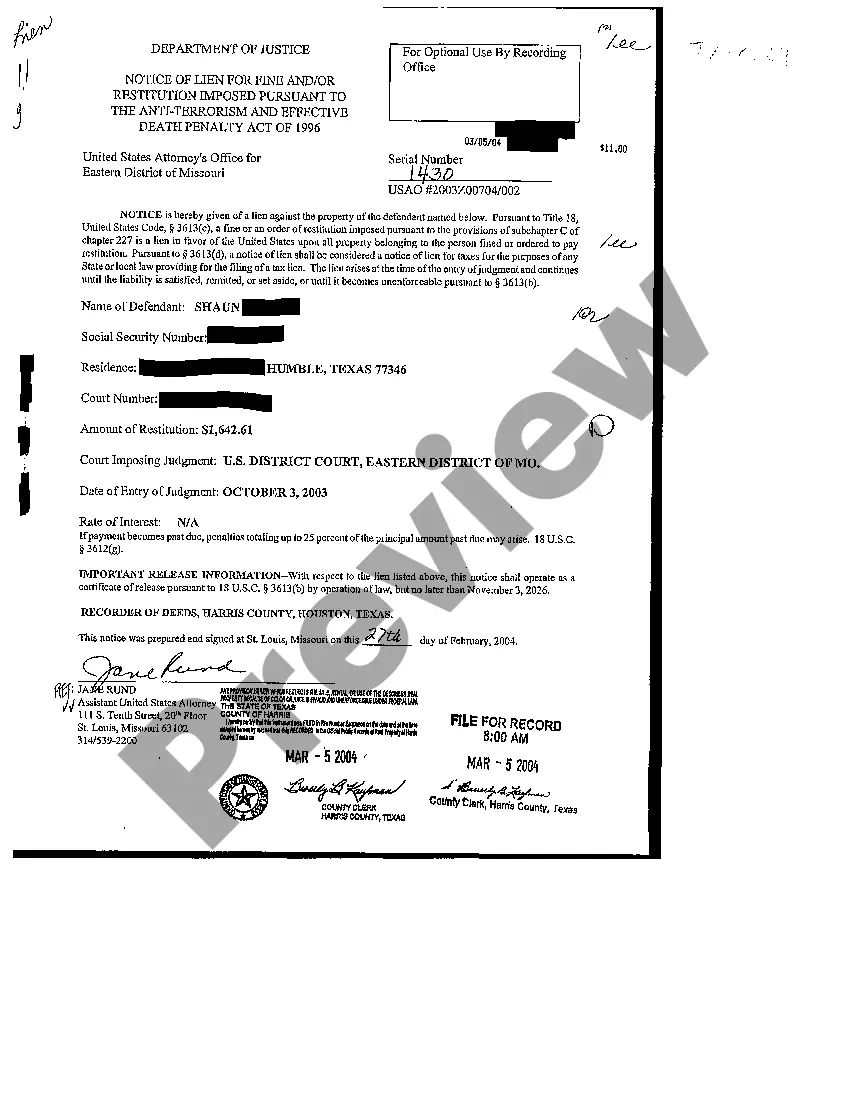

- Filing the Lien: If a default occurs, follow the appropriate legal steps to file a lien on the property as specified in the note.

- Enforcement: Understand the legal process for enforcing a real estate lien, including potential foreclosure proceedings if the borrower continues to default.

Risk Analysis

- Legal Risks: Non-compliance with state laws can render a lien invalid.

- Financial Risks: Liquidating the property may not cover the full amount of the debt, particularly in a declining market.

- Administrative Burdens: Managing and enforcing a lien requires time and resources, which can be considerable depending on the situation.

Key Takeaways

Understanding and managing a real estate lien note is complex and requires careful legal consideration. It offers a mechanism for lenders to secure debts but comes with inherent risks and responsibilities.

Common Mistakes & How to Avoid Them

- Insufficient Documentation: Always ensure full and accurate paperwork is kept to avoid disputes.

- Ignoring State Laws: Each state has specific laws governing liens that must be adhered to.

- Delaying Action: Timely action is crucial in the enforcement of a lien to minimize financial losses.

Pros & Cons

- Pros: Provides security for lenders; can lead to early debt resolution.

- Cons: Can be costly and time-consuming; may damage relationships with borrowers.

How to fill out Texas Real Estate Lien Note?

Access to top quality Texas Real Estate Lien Note templates online with US Legal Forms. Prevent days of lost time browsing the internet and dropped money on forms that aren’t up-to-date. US Legal Forms offers you a solution to just that. Get around 85,000 state-specific authorized and tax samples that you could save and complete in clicks in the Forms library.

To find the example, log in to your account and then click Download. The document will be saved in two places: on your device and in the My Forms folder.

For individuals who don’t have a subscription yet, look at our how-guide below to make getting started simpler:

- Check if the Texas Real Estate Lien Note you’re looking at is suitable for your state.

- See the sample making use of the Preview option and read its description.

- Visit the subscription page by simply clicking Buy Now.

- Select the subscription plan to continue on to sign up.

- Pay out by credit card or PayPal to complete creating an account.

- Pick a preferred format to download the document (.pdf or .docx).

You can now open up the Texas Real Estate Lien Note template and fill it out online or print it and get it done by hand. Consider sending the document to your legal counsel to make sure things are filled out appropriately. If you make a mistake, print and complete application once again (once you’ve registered an account all documents you save is reusable). Create your US Legal Forms account now and access far more templates.

Form popularity

FAQ

Texas has a homestead exemption, which means creditors can still place liens on a debtor's primary real estate, but they cannot seize the property. However, having a lien on your homestead still clouds the title.

Fill out the appropriate mechanics lien form. (Lien form for Original Contractors Lien form for Subcontractors & Suppliers) Deliver your lien form to the county recorder office. Serve your lien on the property owner.

A lien is a legal right or claim against a property by a creditor. Liens are commonly placed against property, such as homes and cars, so creditors, such as banks and credit unions, can collect what is owed to them. Liens can also be removed, giving the owner full and clear title to the property.

In the United States, a mortgage note (also known as a real estate lien note, borrower's note) is a promissory note secured by a specified mortgage loan. Mortgage notes are a written promise to repay a specified sum of money plus interest at a specified rate and length of time to fulfill the promise.

A judgment lien lasts for ten years. According to Section 52.001 of the Texas Property Code, a judgment lien cannot attach to any real property that is exempt from seizure or forced sale under Chapter 41 of the Texas Property Code.