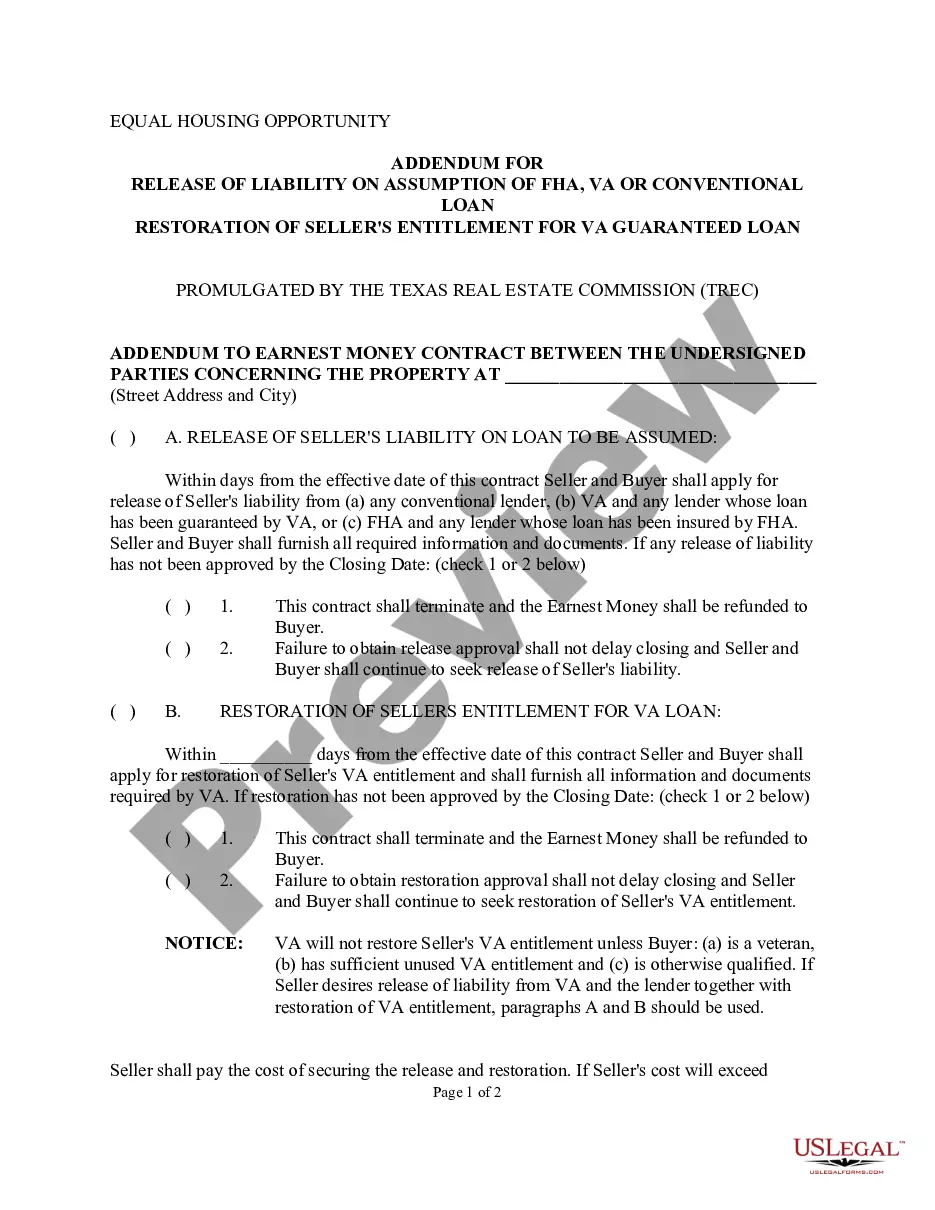

This detailed sample Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

Texas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan

Description

How to fill out Texas Addendum For Release Of Liability On Assumption Of FHA, VA Or Conventional Loan, Restoration Of Seller's Entitlement For VA Guaranteed Loan?

Access to high quality Texas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan samples online with US Legal Forms. Prevent hours of wasted time searching the internet and dropped money on files that aren’t up-to-date. US Legal Forms offers you a solution to just that. Get more than 85,000 state-specific authorized and tax forms that you can save and submit in clicks in the Forms library.

To find the example, log in to your account and then click Download. The document is going to be stored in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, look at our how-guide listed below to make getting started simpler:

- Find out if the Texas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan you’re considering is appropriate for your state.

- View the form using the Preview option and read its description.

- Go to the subscription page by simply clicking Buy Now.

- Choose the subscription plan to keep on to sign up.

- Pay by credit card or PayPal to complete creating an account.

- Choose a preferred file format to download the file (.pdf or .docx).

You can now open the Texas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan sample and fill it out online or print it out and get it done yourself. Take into account giving the document to your legal counsel to make certain all things are filled in appropriately. If you make a error, print out and complete application once again (once you’ve made an account every document you save is reusable). Create your US Legal Forms account now and access more templates.

Form popularity

FAQ

An addendum is an additional document that gets added to the purchase and sale agreement. The document will include any additional information or requests that the buyer did not put into the original purchase and sale agreement.Another example of an addendum is one that includes contingencies.

The average down payment for residential properties on seller-financed loans in 2018 was 19%. While there are ways to buy or sell a property with zero or very little money down, this is rare. In most circumstances, sellers require 10% to 20% down, although there's no minimum requirement.

The seller financing addendum outlines the terms at which the seller of the property agrees to loan the money to the buyer in order to purchase their property.Once complete, this addendum should be signed and attached to the purchase agreement made between the parties.

Step 1 Get the Original Purchase Agreement. The buyer and seller should get a copy of the original purchase agreement. Step 2 Write the Addendum. Complete a blank addendum (Adobe PDF, Microsoft Word (. Step 3 Parties Agree and Sign. Step 4 Add to the Purchase Agreement.

Texas no longer allows owner-financing under last year's Texas House Bill 10 the SAFE Act unless the seller has a license. SAFE (which stands for Secure and Fair Enforcement for Mortgage Licensing Act) was passed in order to comply with a federal law of the same name.

What's a Seller Addendum? It's an addition to the normal sale and purchase agreement that severely limits Seller's liability during and after the sale process. For example, the Seller Addendum might limit damages to which Buyer is entitled in the event Seller fails to disclose some problem with the property.

In seller financing, the seller takes on the role of the lender. Instead of giving cash to the buyer, the seller extends enough credit to the buyer for the purchase price of the home, minus any down payment. The buyer and seller sign a promissory note (which contains the terms of the loan).

Complete the addendum, including your name, the purchaser's name and a description of the property. Include the type of financing that you are providing, such as first mortgage, second mortgage or deed of trust. List the terms of the loan.