Texas General Warranty Deed from Individual to Five (5) Individuals

Definition and meaning

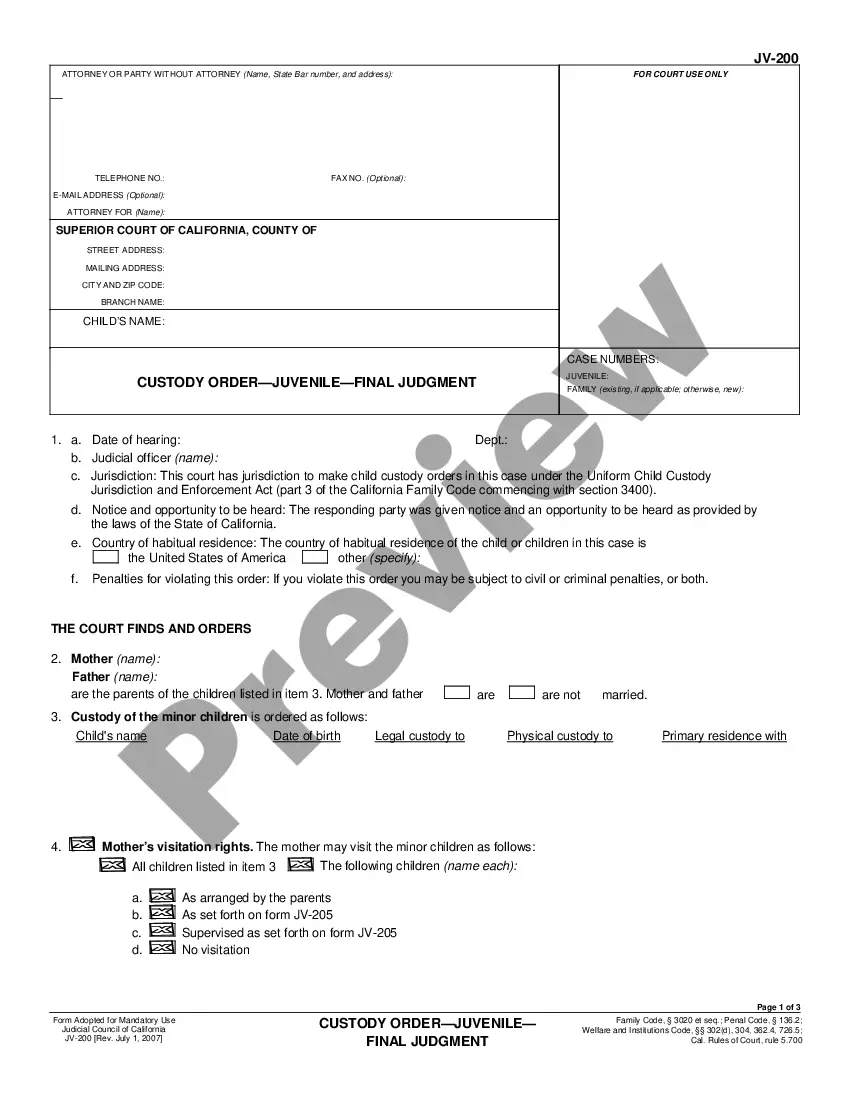

A Texas General Warranty Deed is a legal document used to transfer ownership of real property from one individual to multiple grantees, in this case, five individuals. This type of deed provides the highest level of protection to the grantees as it guarantees that the grantor holds clear title to the property and has the right to transfer it. Additionally, it assures that the property is free from any encumbrances or claims against it, except those explicitly stated in the deed.

How to complete a form

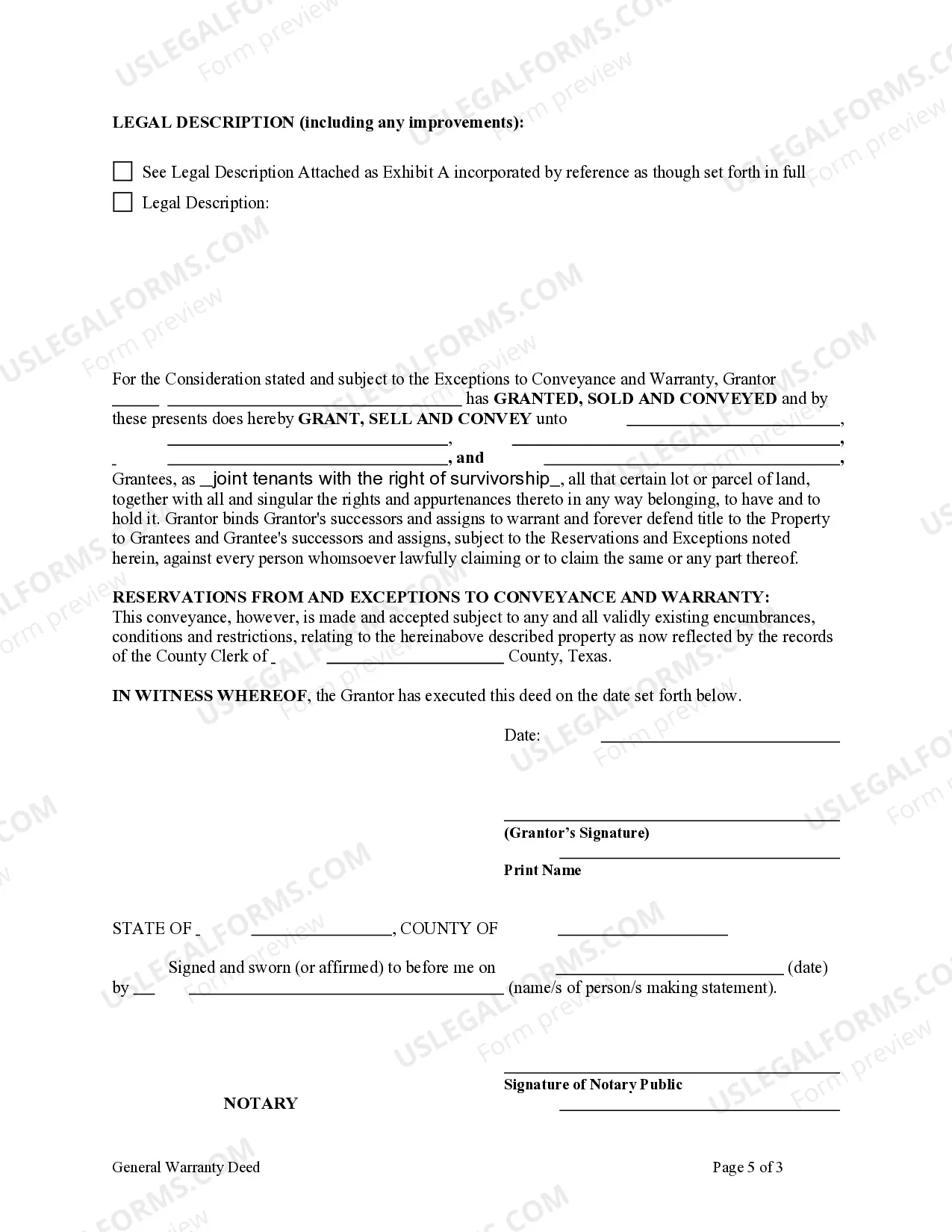

Completing the Texas General Warranty Deed involves several key steps:

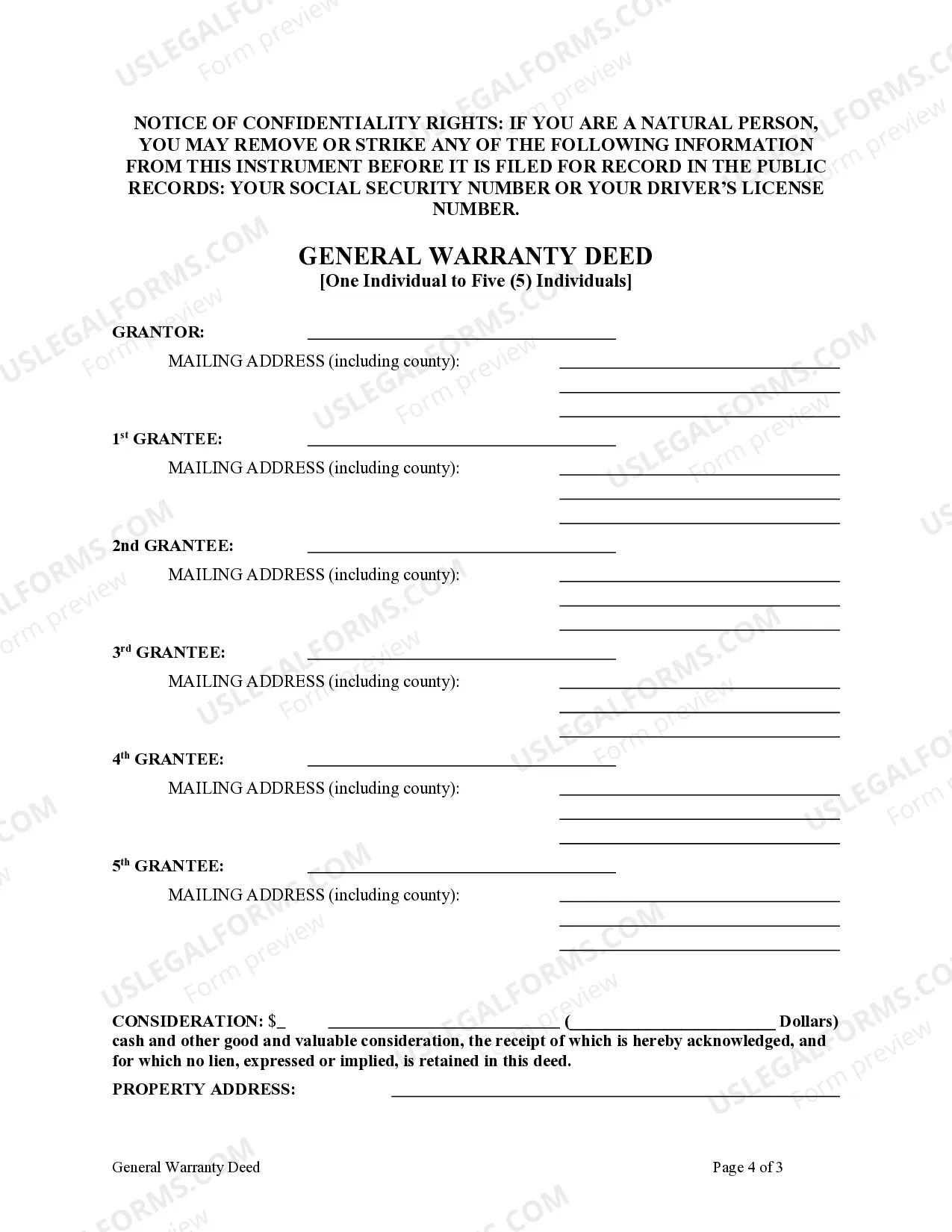

- Begin by entering the mailing address of the grantor.

- List the full names and mailing addresses of all five individuals receiving the property.

- Specify the consideration amount, which is the value exchanged for the property.

- Provide the property address along with a detailed legal description.

- Indicate how the grantees will hold the property, choosing from the available options such as Tenants in Common or Joint Tenants with Right of Survivorship.

Once filled out, the form must be signed in the presence of a notary public for it to be legally binding.

Key components of the form

The Texas General Warranty Deed includes several essential components:

- Grantor Information: The name and address of the person transferring the property.

- Grantee Information: Names and addresses of the five individuals receiving the property.

- Consideration: The value exchanged for the property.

- Property Description: A complete and accurate description of the property being transferred.

- Signatures: Signatures of the grantor and the notary public.

Who should use this form

This form should be utilized by individuals wishing to transfer ownership of real estate to five other individuals. It is particularly useful for individuals who are selling, gifting, or transferring property to family members, friends, or business partners. It is essential for users to understand the implications of transferring property and ensure that all legal obligations are met.

Common mistakes to avoid when using this form

When completing the Texas General Warranty Deed, be mindful of the following common mistakes:

- Failing to provide accurate and complete grantee information.

- Omitting the legal description of the property.

- Not specifying how the grantees will hold the property.

- Forgetting to notarize the document after signing.

Double-check all information provided to ensure the deed is enforceable.

Form popularity

FAQ

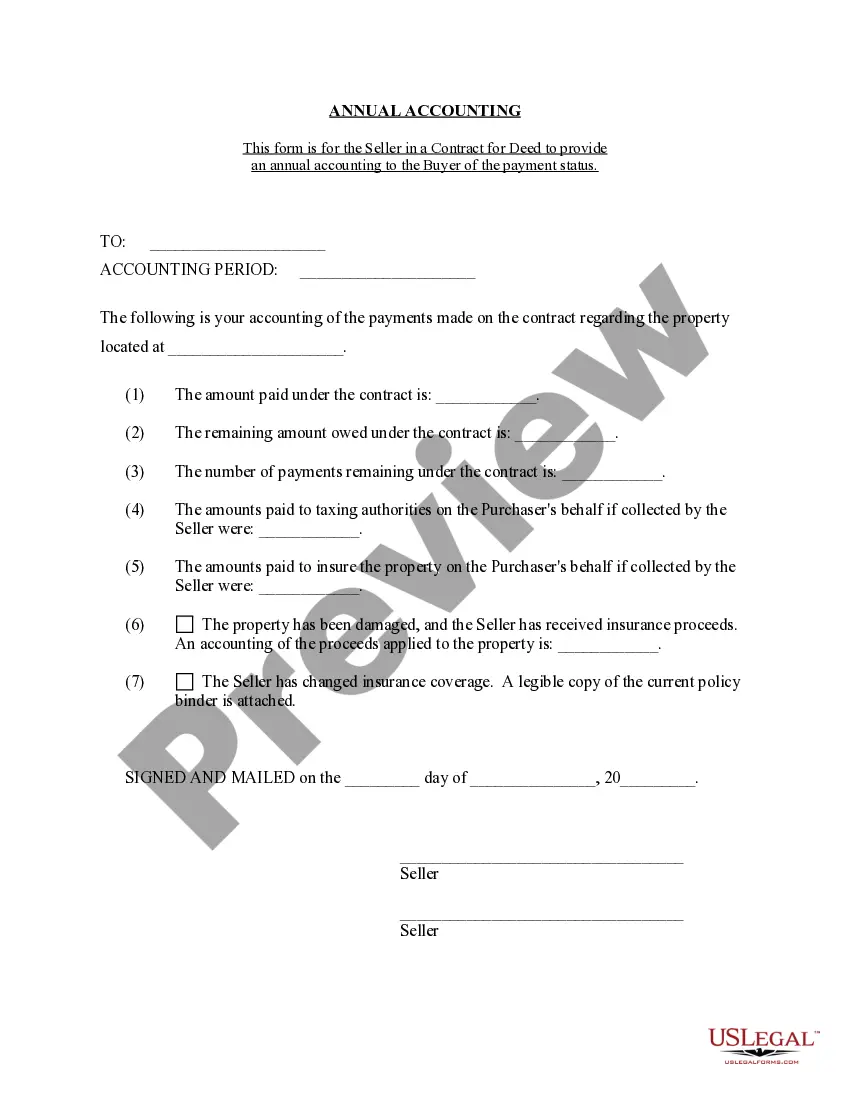

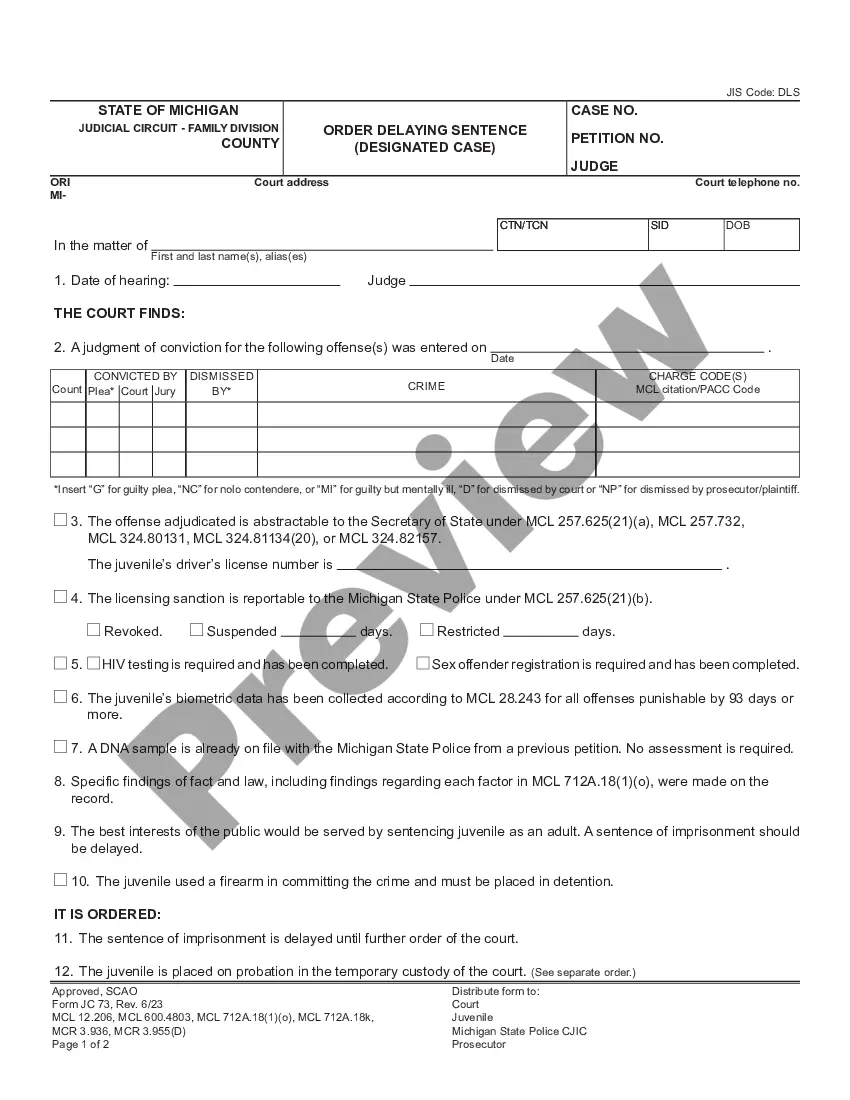

Find the most recent deed to the property. It is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor). Create a new deed. Sign and notarize the deed. File the documents in the county land records.

The deed must be presented to and accepted by the grantee, and it should be filed of record in the county clerk's office to put the public on notice of the transfer. Failure to file the deed can subject the property to future claims by other parties. Most commonly, a grantor provides a general warranty deed.

Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.

A warranty deed, also known as a general warranty deed, is a legal real estate document between the seller (grantor) and the buyer (grantee). The deed protects the buyer by pledging that the seller holds clear title to the property and there are no encumbrances, outstanding liens, or mortgages against it.

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.

The deed must be presented to and accepted by the grantee, and it should be filed of record in the county clerk's office to put the public on notice of the transfer. Failure to file the deed can subject the property to future claims by other parties. Most commonly, a grantor provides a general warranty deed.

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

As a property owner and grantor, you can obtain a warranty deed for the transfer of real estate through a local realtor's office, or with an online search for a template. To make the form legally binding, you must sign it in front of a notary public.

It's important to note that a warranty deed does not actually prove the grantor has ownership (a title search is the best way to prove that), but it is a promise by the grantor that they are transferring ownership and if it turns out they don't actually own the property, the grantor will be responsible for compensating