Tennessee Distributor Agreement for Software

Description

How to fill out Distributor Agreement For Software?

If you wish to finish, acquire, or print approved documents templates, utilize US Legal Forms, the top selection of legal forms available online.

Take advantage of the website's easy and user-friendly search to locate the documents you require.

Various templates for business and personal purposes are organized by categories, states, or keywords.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the payment.

Step 6. Choose the file format of the legal form and download it to your device.

- Utilize US Legal Forms to locate the Tennessee Distributor Agreement for Software with just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Download button to receive the Tennessee Distributor Agreement for Software.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are a first-time user of US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

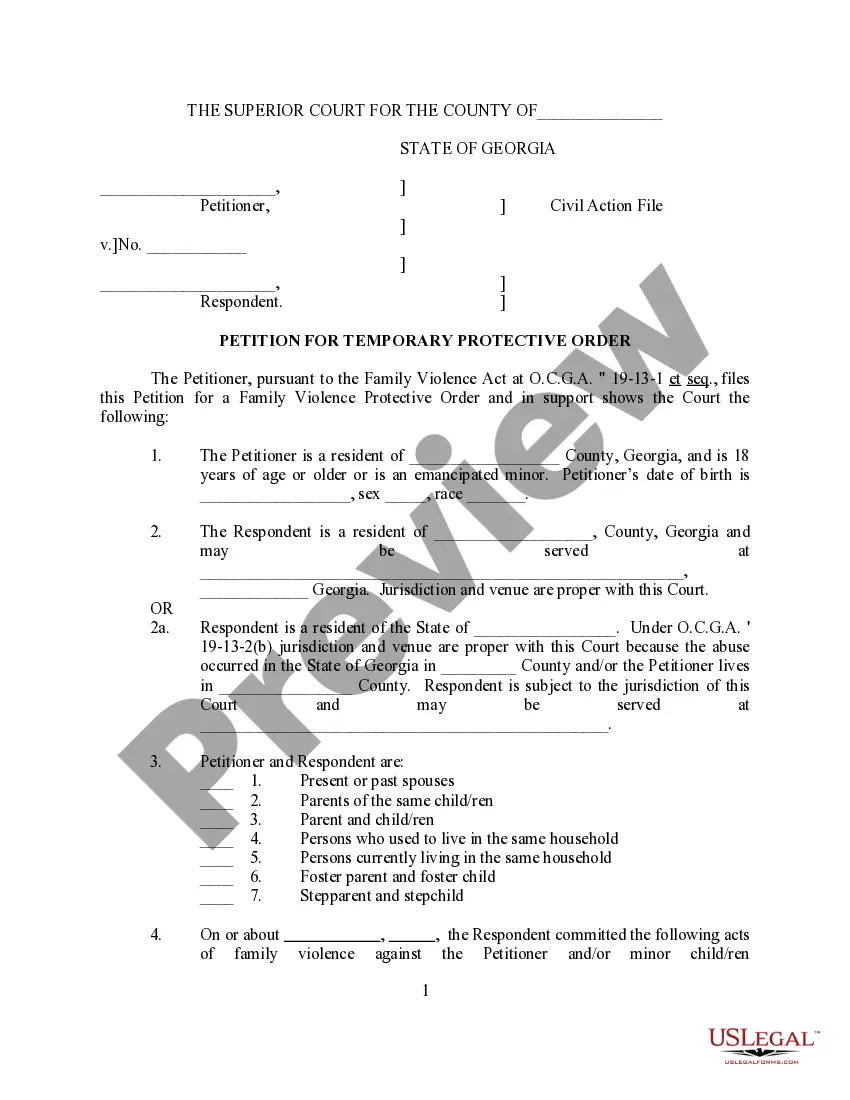

- Step 2. Use the Preview option to review the form’s details. Don’t forget to read the information.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other forms in the legal form design.

- Step 4. Once you have located the form you need, click the Purchase now button. Select the payment plan you prefer and enter your details to register for an account.

Form popularity

FAQ

An example of a distributorship is a company that partners with a software developer to sell its software in a specific geographic area. The distributor benefits by gaining access to a unique product, while the developer expands its market reach. This relationship is governed by agreements like the Tennessee Distributor Agreement for Software, which set the expectations and rights for both parties involved.

To create a simple agreement, start by defining the parties involved and the purpose of the agreement. Clearly outline the obligations of each party, including terms of compensation and responsibilities. Make sure to include relevant details specific to the Tennessee Distributor Agreement for Software, such as duration and termination clauses. Using templates available on platforms like uslegalforms can simplify this process.

The three main types of software contracts typically include licensing agreements, service agreements, and distribution agreements. Licensing agreements dictate how users can utilize the software, while service agreements detail the support and maintenance provided. Distribution agreements, like the Tennessee Distributor Agreement for Software, focus on the terms and conditions under which products are sold and distributed. Understanding these types can help you select the right contract for your business needs.

While Tennessee law does not require an operating agreement for LLCs, it is highly recommended to have one. An operating agreement outlines the management structure and operating procedures of your LLC. This document helps prevent misunderstandings among members and strengthens the credibility of your business. Additionally, having a clear agreement can be beneficial when drafting a Tennessee Distributor Agreement for Software.

Yes, Tennessee does provide guidelines for taxing software as a service. The state's tax structure can be complex, so it's important to understand how it applies to your specific business model. For those involved with software distribution, consulting with a tax professional or using platforms like US Legal Forms can clarify your obligations.

The purpose of a distributor agreement is to formalize the relationship between manufacturers and distributors. It establishes the framework for sales, marketing strategies, and revenue sharing. When utilized properly in a Tennessee Distributor Agreement for Software, it helps streamline operations and reduce misunderstandings.

Generally, a license agreement provides specific rights to use or distribute software, but it may not always grant full distribution rights. It is essential to review the licensing terms to understand your rights. If you're looking to distribute software in Tennessee, ensure that your license agreement aligns with your goals.

Software distribution involves making software products available to end-users through various channels. This process includes marketing, sales, and technical support. By entering into a Tennessee Distributor Agreement for Software, businesses can expand their reach and enhance customer access to software solutions.

A distribution agreement functions by clearly defining the relationship between a supplier and a distributor. It provides guidelines on how the products will be marketed, sold, and supported. In the context of a Tennessee Distributor Agreement for Software, this ensures that the distributor is fully equipped to represent the software effectively and legally.

A software distribution agreement is a legal contract that outlines the terms under which a distributor can sell and market a software product. This document typically covers licensing rights, territorial restrictions, and the obligations of both the distributor and the software owner. Understanding this agreement is crucial for anyone involved in software distribution.