Tennessee Software License Subscription Agreement

Description

How to fill out Software License Subscription Agreement?

You might invest time online trying to locate the legal document template that meets the federal and state requirements you desire. US Legal Forms provides thousands of legal forms that have been reviewed by experts.

You can easily download or print the Tennessee Software License Subscription Agreement from the platform. If you already possess a US Legal Forms account, you can Log In and click the Download button. Then, you can fill out, modify, print, or sign the Tennessee Software License Subscription Agreement.

Every legal document template you acquire belongs to you permanently. To obtain another copy of the purchased form, go to the My documents section and click the appropriate button.

Complete the transaction. You can use your credit card or PayPal account to pay for the legal form. Choose the format of the document and download it to your device. Make adjustments to the document if necessary. You may fill out, modify, and sign and print the Tennessee Software License Subscription Agreement. Download and print thousands of document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/city of your preference.

- Review the form description to confirm you have chosen the right form.

- If available, utilize the Review button to look through the document template as well.

- If you wish to find another version of the form, use the Search box to locate the template that fits your needs.

- Once you have found the template you want, click Acquire now to proceed.

- Select the payment plan you prefer, enter your details, and register for an account on US Legal Forms.

Form popularity

FAQ

A contract becomes legally binding in Tennessee when it includes an offer, acceptance, and consideration. Both parties must agree on the terms and intend to create a legally enforceable agreement. Ensure that your Tennessee Software License Subscription Agreement meets these requirements to protect your interests.

In Tennessee, certain services such as professional services (like legal or medical) are not taxable. Additionally, some educational services and services provided by nonprofits may also be exempt. When signing a Tennessee Software License Subscription Agreement, it's wise to verify which services apply to your situation.

Yes, software as a service (SaaS) is generally considered taxable in Tennessee. The state views SaaS as a subscription service, which falls under taxable services. When entering into a Tennessee Software License Subscription Agreement, it’s important to factor in these tax implications.

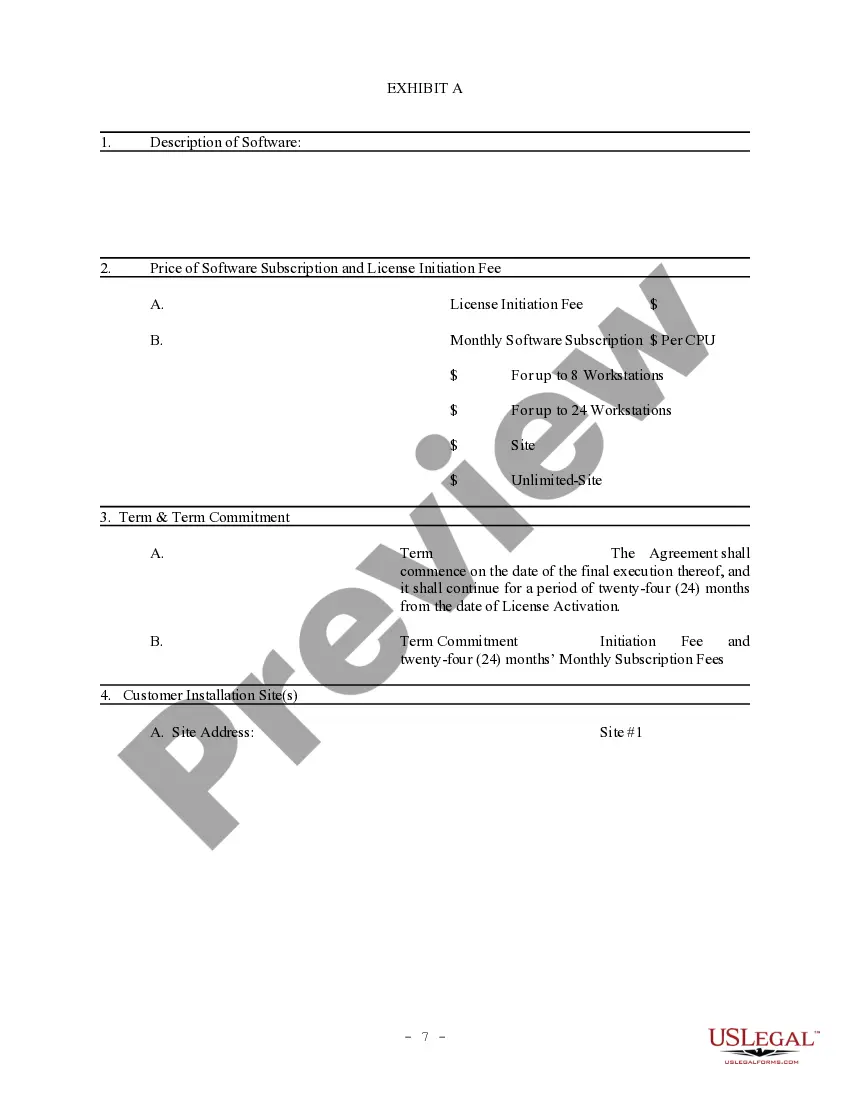

The three main types of software contracts include software licenses, service agreements, and maintenance contracts. Software licenses outline usage rights, service agreements define the scope of support, and maintenance contracts detail updates and repairs. Knowing these distinctions is essential when navigating your Tennessee Software License Subscription Agreement.

A software license grants you the right to use a particular software program under specified conditions. In contrast, a service contract often covers ongoing support, maintenance, or updates for that software. Understanding the differences can help you determine the best Tennessee Software License Subscription Agreement that suits your needs.

Yes, software maintenance is generally taxable in Tennessee if it involves tangible personal property. If the maintenance service includes updates or enhancements that are delivered in a physical form, it will likely incur sales tax. Always refer to your Tennessee Software License Subscription Agreement to verify the specific terms regarding tax.

Software maintenance can be taxable, but this largely depends on the state regulations. In some states, if the maintenance includes updates or technical support, it may incur sales tax. For Tennessee, it is crucial to consult your Tennessee Software License Subscription Agreement to clarify any tax implications.

In Tennessee, maintenance contracts may be subject to sales tax depending on the nature of the services provided. If the maintenance service includes tangible personal property, it is likely taxable. However, if it involves only services without the transfer of goods, it may not be taxable. It’s important to review your Tennessee Software License Subscription Agreement to understand your specific obligations.

A software licensing agreement is a legal document that outlines how software can be used. It specifies the rights granted to the user, including limitations and responsibilities. A Tennessee Software License Subscription Agreement will detail terms related to access, payment, and usage, ensuring both parties understand their obligations.

In Tennessee, you may be taxed on subscriptions, particularly for digital services. The tax treatment can vary based on the type of subscription and the services provided. When entering into a Tennessee Software License Subscription Agreement, always check the tax obligations to avoid any surprises.