Tennessee Drafting Agreement - Self-Employed Independent Contractor

Description

How to fill out Drafting Agreement - Self-Employed Independent Contractor?

Locating the appropriate valid document template may pose a challenge. Obviously, there are numerous designs available online, but how can you find the valid form you need? Use the US Legal Forms website. The service offers thousands of templates, including the Tennessee Drafting Agreement - Self-Employed Independent Contractor, which can be utilized for both business and personal purposes. All forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Acquire button to locate the Tennessee Drafting Agreement - Self-Employed Independent Contractor. Utilize your account to search for the valid forms you have previously obtained. Navigate to the My documents section of your account and download another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your city/county. You can review the document using the Preview button and read the document details to confirm it is the right one for you. If the form does not meet your requirements, utilize the Search field to find the appropriate form. Once you are certain the document is suitable, click the Purchase now button to acquire the form. Choose the pricing plan you prefer and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the valid document template to your device. Complete, edit, print, and sign the received Tennessee Drafting Agreement - Self-Employed Independent Contractor. US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Use the service to obtain professionally crafted paperwork that adheres to state requirements.

Use the service to obtain professionally crafted paperwork that adheres to state requirements.

- Locating the appropriate valid document template may pose a challenge.

- If you are already registered, Log In to your account.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- Ensure you have selected the correct form for your city/county.

- Select the file format and download the valid document template to your device.

- US Legal Forms is the largest repository of legal forms.

Form popularity

FAQ

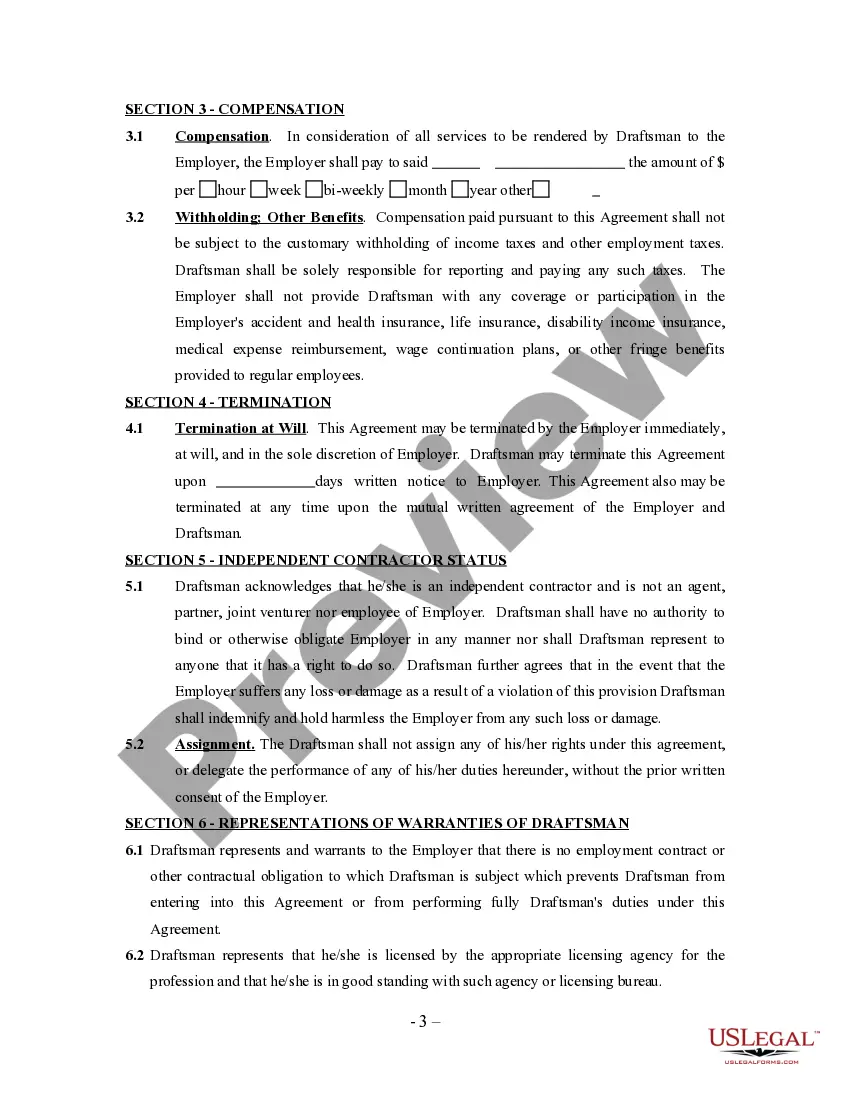

To fill out an independent contractor agreement, start by entering the name and contact details of both parties. Specify the services to be provided, payment arrangements, and any deadlines. With the Tennessee Drafting Agreement - Self-Employed Independent Contractor, you can access user-friendly templates that guide you through each section, making it easier to create a comprehensive contract.

An independent contractor generally needs to fill out tax forms, such as the IRS W-9, and any specific agreements related to their projects. Additionally, contracts outlining the terms of engagement are essential. The Tennessee Drafting Agreement - Self-Employed Independent Contractor streamlines this process by offering essential documents that ensure compliance and clarity in your contractor relationships.

Filling out an independent contractor form requires you to input your basic information and describe the services you provide. Be specific about the project details, including deliverables and timelines. For assistance, consider using the Tennessee Drafting Agreement - Self-Employed Independent Contractor, which offers valuable insights for accurately completing such forms.

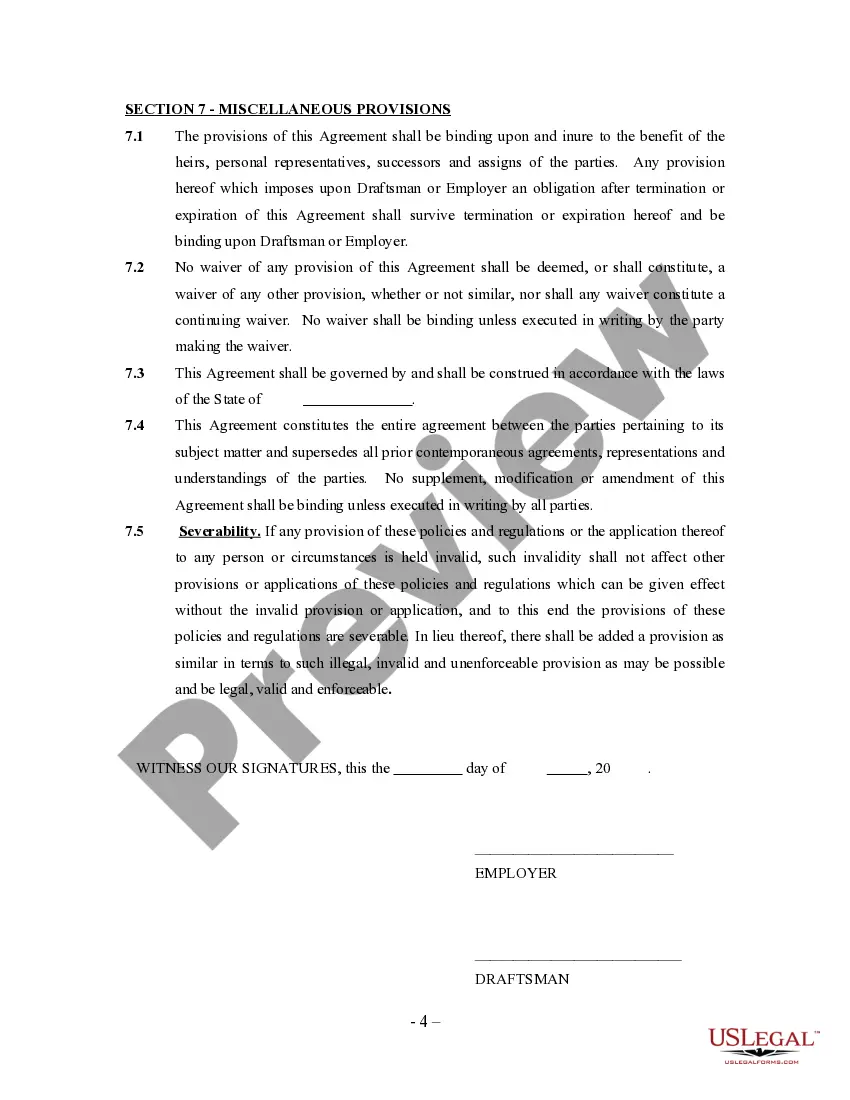

To write an independent contractor agreement, start by defining the scope of work, payment terms, and deadlines. Clearly state the relationship dynamics, emphasizing that the contractor operates independently. Utilizing the Tennessee Drafting Agreement - Self-Employed Independent Contractor can simplify this process, as it offers templates to guide you in creating a thorough and legally sound agreement.

Filling out a declaration of independent contractor status form involves providing your personal information, such as name and address, and detailing the nature of your work. Include specific terms that clarify your relationship with the client, stating you are self-employed and independent. The Tennessee Drafting Agreement - Self-Employed Independent Contractor provides a comprehensive structure for such forms, ensuring you meet state requirements.

Creating an independent contractor agreement involves outlining the terms of your engagement clearly and comprehensively. Start by detailing the scope of work, payment structure, and duration of the contract. You can efficiently draft a Tennessee Drafting Agreement - Self-Employed Independent Contractor using templates available on USLegalForms, ensuring you cover all necessary legal aspects and protect both parties.

In Tennessee, the amount of work an independent contractor can perform without a contractor’s license often depends on the nature of the work involved. For many types of contracting work, such as general maintenance and repairs, no license is required for small jobs. However, it’s important to understand the scope of the Tennessee Drafting Agreement - Self-Employed Independent Contractor to ensure compliance with local laws.

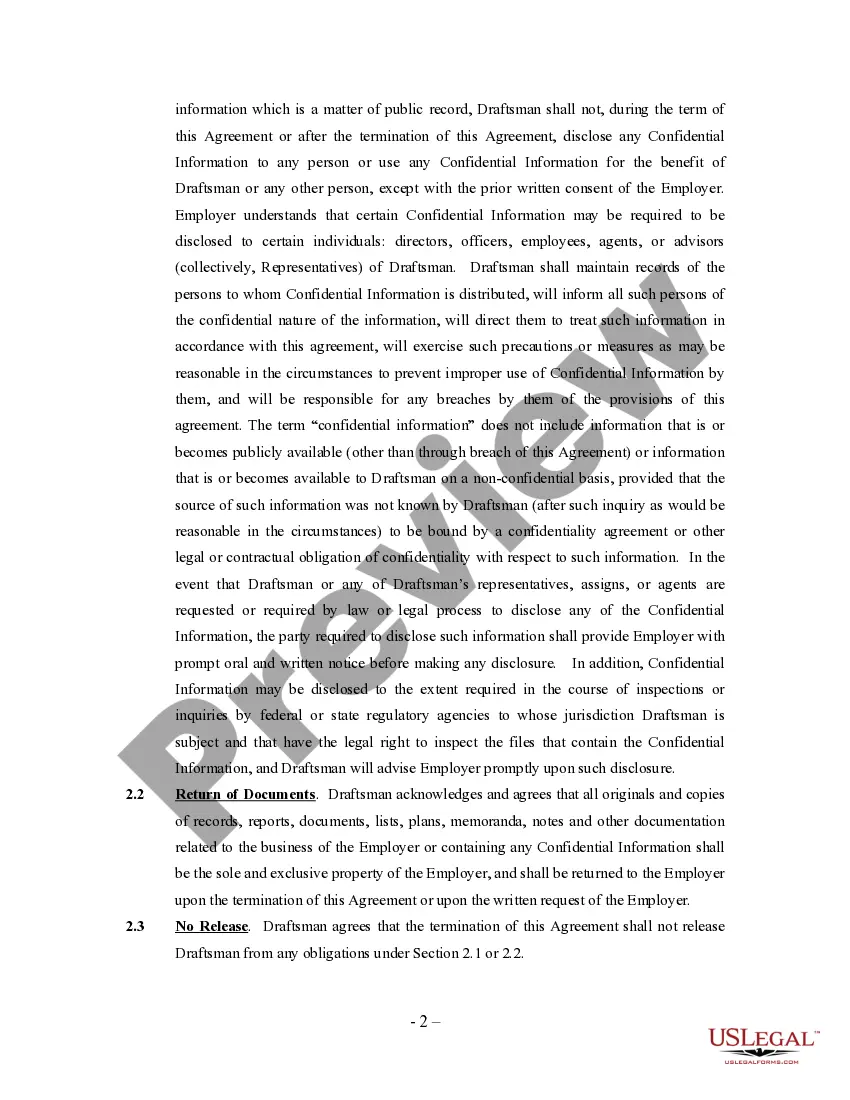

The independent contractor agreement in Tennessee serves as a formal document that stipulates the terms of engagement between a contractor and a business. It includes details such as job scope, payment, duration of the contract, and confidentiality issues. By utilizing a Tennessee Drafting Agreement - Self-Employed Independent Contractor, you can protect yourself and clarify expectations for both parties involved.

Legal requirements for independent contractors in Tennessee include having a clear contract that outlines work parameters and payment terms. Additionally, correctly classifying yourself as an independent contractor rather than an employee is crucial to avoid legal complications. A comprehensive Tennessee Drafting Agreement - Self-Employed Independent Contractor will ensure you comply with these requirements and support a secure working relationship.

Yes, you can write your own legally binding contract as long as it meets the legal requirements of your state. In Tennessee, a well-drafted independent contractor agreement outlines the essential terms of your work arrangement. Using a platform like USLegalForms can help you create a Tennessee Drafting Agreement - Self-Employed Independent Contractor that adheres to local laws and protects your interests.