Tennessee Framework Contractor Agreement - Self-Employed

Description

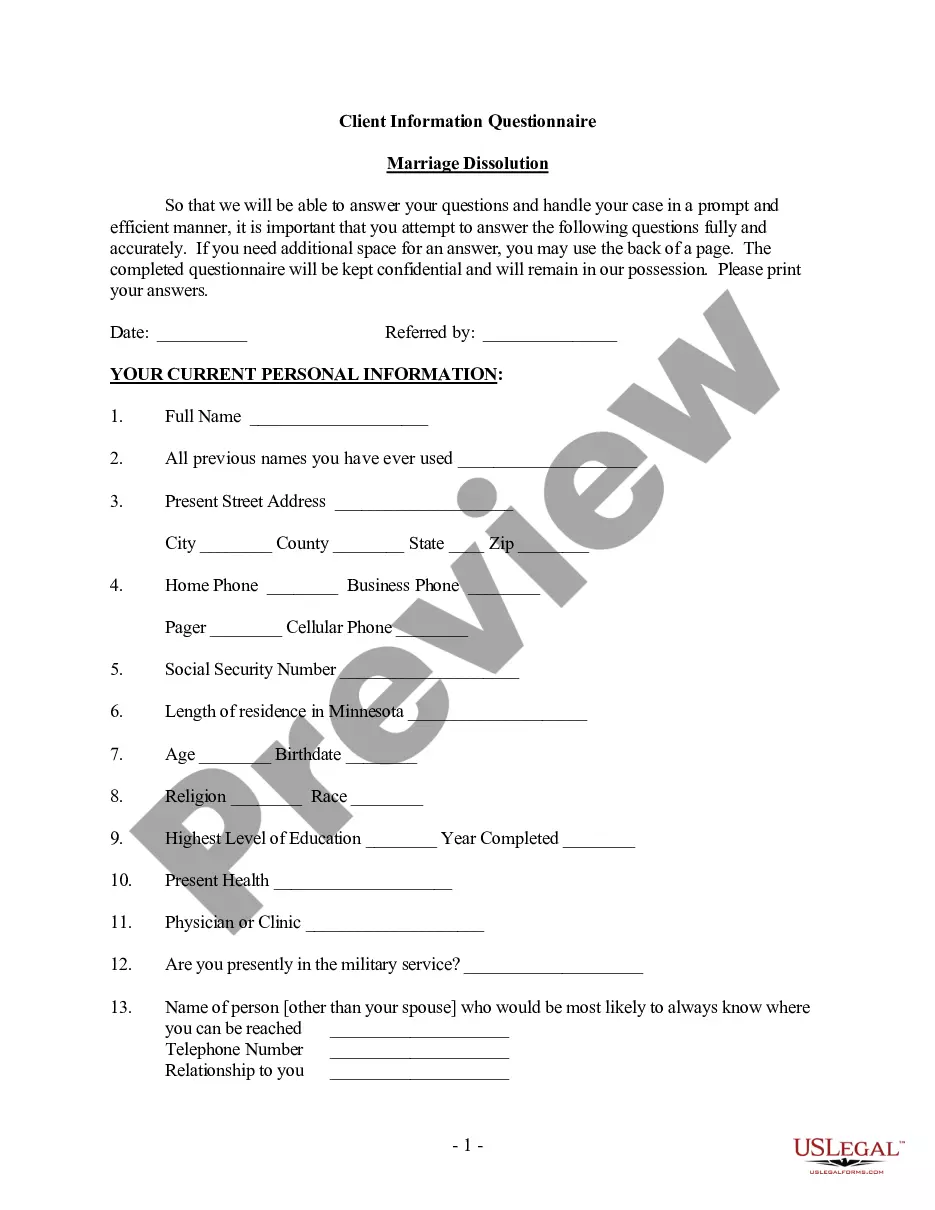

How to fill out Framework Contractor Agreement - Self-Employed?

It is feasible to dedicate time on the internet searching for the valid document template that fulfills the federal and state requirements you need.

US Legal Forms offers thousands of valid templates that are reviewed by experts.

You can easily acquire or print the Tennessee Framework Contractor Agreement - Self-Employed from the services.

If available, utilize the Preview button to review the document template as well. If you wish to find another version of your form, make use of the Lookup field to find the template that meets your needs and specifications. Once you have identified the template you want, click Get now to proceed. Select the pricing plan you desire, enter your details, and register for an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to purchase the legal document. Choose the format of your document and download it to your system. Make modifications to the document if necessary. You can complete, edit, sign, and print the Tennessee Framework Contractor Agreement - Self-Employed. Download and print thousands of document templates using the US Legal Forms site, which provides the largest selection of legal templates. Utilize professional and state-specific templates to manage your business or personal needs.

- If you already have a US Legal Forms account, you may Log In and click the Obtain button.

- After that, you may complete, modify, print, or sign the Tennessee Framework Contractor Agreement - Self-Employed.

- Every legal document template you obtain is yours forever.

- To get another copy of the purchased form, go to the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your county/area of preference.

- Review the form details to confirm you have chosen the right form.

Form popularity

FAQ

Creating an independent contractor agreement involves outlining the scope of work, compensation, and terms of the project. You can craft your agreement using templates, but ensure it aligns with the Tennessee Framework Contractor Agreement - Self-Employed to meet state requirements. Consider using US Legal Forms as a reliable resource for customizable templates that fit your needs. Clear agreements promote healthy working relationships and protect both parties.

An operating agreement is not legally required for an LLC in Tennessee. However, it is highly recommended as it defines the structure and management of your business. It can also complement your Tennessee Framework Contractor Agreement - Self-Employed by clarifying roles and responsibilities. Having this document in place can help prevent disputes among members.

To become an independent contractor in Tennessee, start by registering your business with the state. You will need to obtain any necessary licenses or permits based on your industry. It's helpful to familiarize yourself with the Tennessee Framework Contractor Agreement - Self-Employed to outline your terms clearly. Additionally, consider consulting a legal professional to ensure compliance.

To write an independent contractor agreement, begin with a title that clearly states the document's purpose. Next, include sections for the parties' information, detailed work descriptions, compensation, and terms of termination. Tailor these sections to reflect your needs while aligning with the Tennessee Framework Contractor Agreement - Self-Employed requirements. Utilize platforms like uslegalforms for guidance and templates to facilitate the process.

Writing a self-employed contract starts with outlining the scope of work and expectations clearly. Include essential elements such as payment rates, project timelines, and confidentiality clauses, if needed. Make sure the contract adheres to the Tennessee Framework Contractor Agreement - Self-Employed standards to protect both parties. Finally, both parties should sign and date the contract to confirm their agreement.

To fill out an independent contractor form, first gather all necessary information about both parties involved, including names, addresses, and contact details. Then, specify the services provided, payment terms, and deadlines. It’s important to ensure all details align with the Tennessee Framework Contractor Agreement - Self-Employed to avoid any misunderstandings. Lastly, carefully review the form for accuracy before signing.

A basic independent contractor agreement typically includes important elements such as the scope of work, payment terms, and confidentiality clauses. It serves as a guideline for the relationship between clients and contractors, ensuring mutual understanding. The Tennessee Framework Contractor Agreement - Self-Employed offers a robust template to cover all essentials, facilitating smoother business operations.

In Tennessee, an independent contractor agreement outlines the terms between a client and a contractor for services rendered. This legally binding document clarifies job expectations, payment details, and both parties' duties. Using the Tennessee Framework Contractor Agreement - Self-Employed ensures that you have a comprehensive agreement that protects your interests.

Legal requirements for independent contractors in Tennessee include having a valid business license and adhering to tax regulations. Contractors must understand their role as self-employed individuals, which involves managing their own withholdings. Utilizing the Tennessee Framework Contractor Agreement - Self-Employed can help clarify these obligations, making sure you stay compliant.

Filling out an independent contractor agreement starts with clearly stating the scope of work and payment terms. It's crucial to specify both parties' responsibilities and obligations. The Tennessee Framework Contractor Agreement - Self-Employed template provides a structured format, ensuring all necessary details are included for clarity and legal protection.