Tennessee Disability Services Contract - Self-Employed

Description

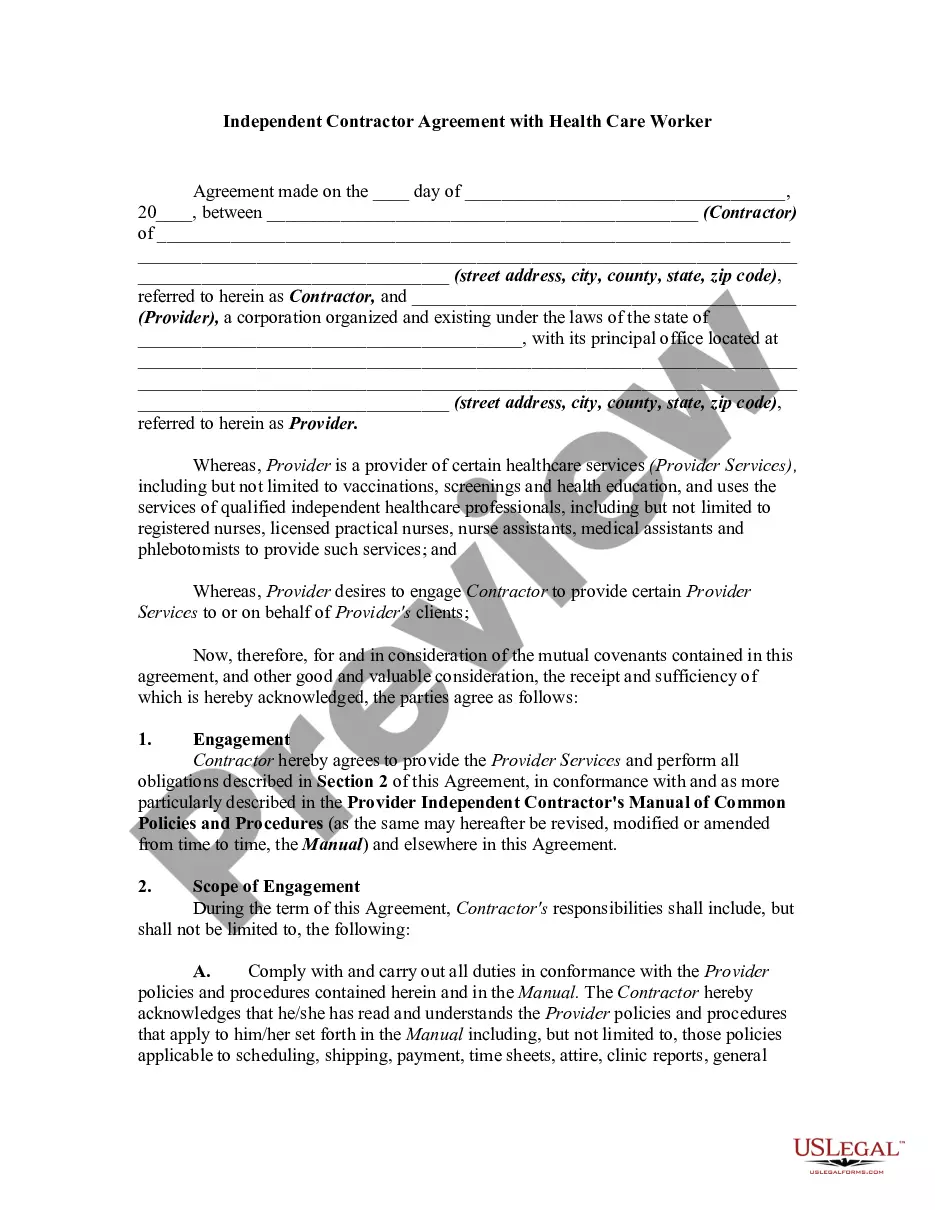

How to fill out Disability Services Contract - Self-Employed?

It is feasible to spend time online trying to locate the legal document template that meets the federal and state requirements you need.

US Legal Forms offers a wide array of legal forms that can be examined by experts.

You can easily download or print the Tennessee Disability Services Contract - Self-Employed from the platform.

If available, use the Preview button to look through the document template as well. To find another version of the form, utilize the Search field to locate the template that fulfills your needs and specifications.

- If you already possess a US Legal Forms account, you can sign in and click the Get button.

- Then, you can complete, modify, print, or sign the Tennessee Disability Services Contract - Self-Employed.

- Every legal document template you obtain is yours permanently.

- To access another version of any purchased form, navigate to the My documents section and select the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document template for the county/region you select.

- Review the form description to confirm you have selected the right one.

Form popularity

FAQ

Employment contract law in Tennessee governs the agreements between employers and independent contractors. It covers aspects such as payment terms, job responsibilities, and termination conditions. Understanding these laws is vital for anyone entering into a Tennessee Disability Services Contract - Self-Employed to ensure compliance and protect your rights.

The time it takes to become an independent contractor in Tennessee can vary based on the complexity of your business setup and local regulations. Generally, you can expect to spend a few weeks gathering necessary documents and obtaining licenses. However, once established, you will be able to effectively engage in contracts like the Tennessee Disability Services Contract - Self-Employed.

Becoming an independent contractor in Tennessee involves several steps, including registering your business, obtaining any required licenses, and setting up a system for managing your finances. You should also create a solid service agreement that outlines your responsibilities and compensation, particularly if you plan to engage with the Tennessee Disability Services Contract - Self-Employed.

In Tennessee, certain conditions may automatically qualify you for disability benefits, including severe mental impairments, specific physical ailments, and terminal illnesses. However, each case is evaluated individually, and it's crucial to provide thorough documentation. Familiarizing yourself with the details of the Tennessee Disability Services Contract - Self-Employed can guide you through the qualification process.

As an independent contractor, you may face different tax obligations compared to traditional employees. You are responsible for self-employment taxes, which can increase your overall tax rate. It is advisable to consult a tax professional to navigate your responsibilities while working under the Tennessee Disability Services Contract - Self-Employed.

Getting approved for disability in Tennessee can be a challenging process. It often requires substantial documentation of your medical condition and how it impacts your ability to work. By understanding the criteria set forth in the Tennessee Disability Services Contract - Self-Employed, you can better prepare your application and improve your chances of success.

Yes, in many cases, you need a business license to operate as an independent contractor in Tennessee. The requirements can vary depending on your location and the nature of your business. It is essential to check with your local government offices to ensure you meet the necessary criteria, especially when working under the Tennessee Disability Services Contract - Self-Employed.

To qualify as an independent contractor in Tennessee, you must demonstrate that you operate your own business and provide services under your own terms. You should have a written agreement outlining your services and compensation, which aligns with the Tennessee Disability Services Contract - Self-Employed. Additionally, you must manage your own taxes and business expenses, ensuring compliance with local regulations.

The easiest disabilities to get approved for typically include conditions that are well-documented and have clear medical evidence, such as certain mental health disorders or physical impairments. It’s crucial to present comprehensive medical records during the application process. A Tennessee Disability Services Contract - Self-Employed can assist you in preparing your case effectively for a smoother approval experience.

Yes, you can own a business and collect Social Security Disability Insurance (SSDI), but there are specific guidelines to follow. Your business income must not exceed a certain threshold to maintain eligibility. Engaging with a Tennessee Disability Services Contract - Self-Employed can provide clarity on how to balance business ownership with SSDI benefits.