Tennessee Data Entry Employment Contract - Self-Employed Independent Contractor

Description

How to fill out Data Entry Employment Contract - Self-Employed Independent Contractor?

Are you in a situation where you require documents for possibly business or personal purposes almost every day.

There are numerous legal document templates accessible online, but locating ones you can trust is not straightforward.

US Legal Forms offers a vast array of form templates, such as the Tennessee Data Entry Employment Contract - Self-Employed Independent Contractor, which are designed to comply with federal and state requirements.

If you find the correct form, simply click Buy now.

Select the payment plan you prefer, fill in the necessary information to create your account, and pay for your order using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Tennessee Data Entry Employment Contract - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it pertains to the correct city/state.

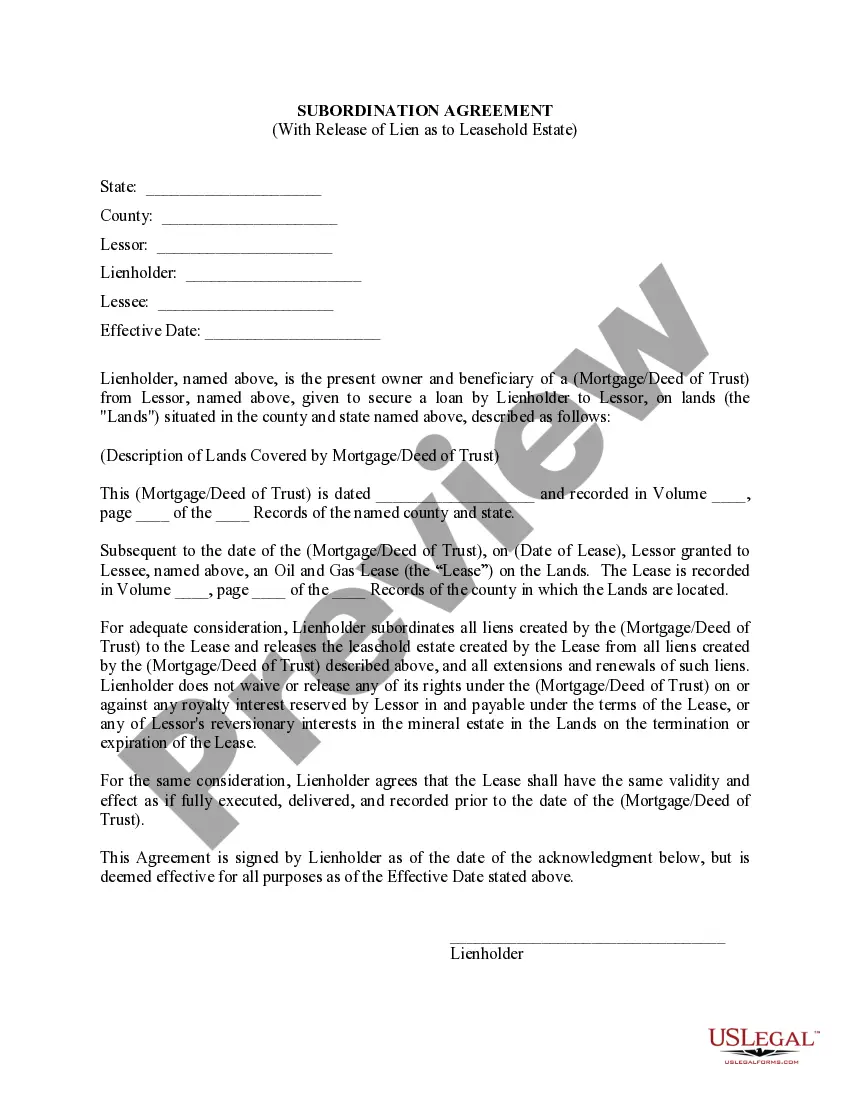

- Utilize the Preview button to review the form.

- Examine the details to confirm that you have selected the correct document.

- If the form isn't what you want, use the Search field to locate the form that meets your needs and requirements.

Form popularity

FAQ

Yes, having a contract is highly advisable if you are self-employed. Contracts help clarify obligations and protect your interests. When utilizing a Tennessee Data Entry Employment Contract - Self-Employed Independent Contractor, you ensure that both parties understand the scope of work and payment terms. This is an essential step in creating a professional relationship with your clients.

Absolutely, you can be both self-employed and have a contract. Contracts provide a formal agreement that outlines your terms of service with clients. A Tennessee Data Entry Employment Contract - Self-Employed Independent Contractor serves as a solid example, ensuring clarity and mutual agreement between you and your client. This arrangement protects your rights and establishes expectations clearly.

Yes, being a contractor does count as self-employed. As a contractor, you operate your own business and provide services based on contracts. For example, if you are involved in a Tennessee Data Entry Employment Contract - Self-Employed Independent Contractor, you can enjoy the flexibility and independence that comes with this classification. This means you can choose your clients and set your rates.

In Tennessee, whether you need a business license depends on your specific work and location. Many independent contractors benefit from obtaining a business license, as it legitimizes their services. If you're entering agreements such as a Tennessee Data Entry Employment Contract - Self-Employed Independent Contractor, the license can enhance your professional credibility. Always check your local regulations to ensure compliance.

Recently, there have been changes affecting self-employed individuals. These new rules often pertain to tax deductions and reporting requirements. For those operating under a Tennessee Data Entry Employment Contract - Self-Employed Independent Contractor, staying updated on these regulations is crucial for compliance and financial planning. It can also help you maximize your benefits as an independent contractor.

Yes, independent contractors are generally subject to self-employment tax. This tax applies to your net earnings from self-employment, which includes the income you earn from contracts. Specifically, if you are using a Tennessee Data Entry Employment Contract - Self-Employed Independent Contractor, it’s essential to account for these obligations when filing your taxes. Consulting with a tax professional can help you navigate this requirement.

Yes, a 1099 employee can have a contract. This agreement outlines the terms of their work, including compensation and responsibilities. In the context of a Tennessee Data Entry Employment Contract - Self-Employed Independent Contractor, the contract protects both parties involved and clarifies the expectations. Having a well-defined contract adds security to your independent work arrangement.

Writing an independent contractor agreement involves outlining the relationship between you and the contractor. Start by defining the project expectations, payment terms, and length of the agreement. The Tennessee Data Entry Employment Contract - Self-Employed Independent Contractor should be precise and cover all necessary elements to avoid future disputes. Consider checking US Legal Forms for comprehensive templates that can help you draft a professional agreement.

To fill out an independent contractor form, gather the essential details about the services provided and compensation structures. Ensure you include both parties' contact details, along with any specific terms relevant to the Tennessee Data Entry Employment Contract - Self-Employed Independent Contractor. Utilizing templates from US Legal Forms can simplify this process by providing you with a clear framework.

Filling out an independent contractor agreement requires attention to detail. Start by including your personal information and the contractor's information. Clearly state the terms of the Tennessee Data Entry Employment Contract - Self-Employed Independent Contractor, including project scope, payment terms, and deadlines. You can use platforms like US Legal Forms to access templates that guide you through this process.