Tennessee Operating Agreement of Minnesota Corn Processors, LLC

Description

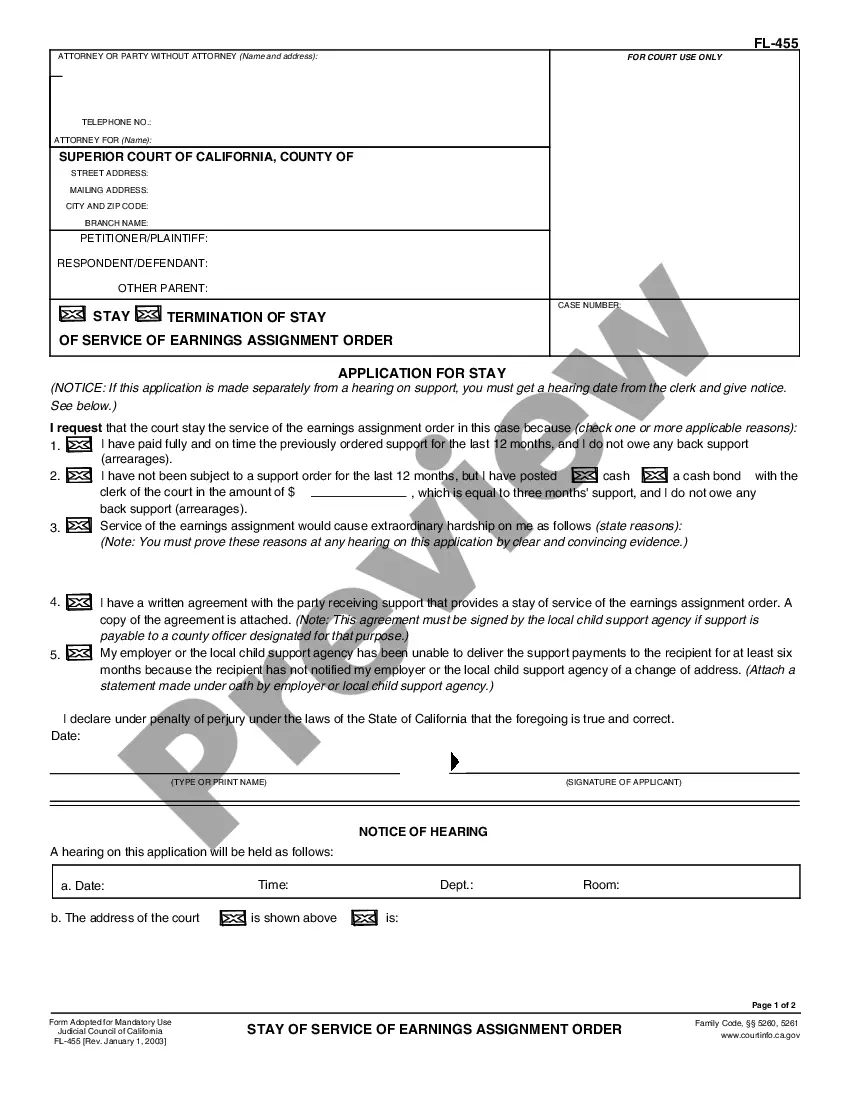

How to fill out Operating Agreement Of Minnesota Corn Processors, LLC?

If you wish to comprehensive, download, or produce legal papers web templates, use US Legal Forms, the largest selection of legal kinds, which can be found on-line. Use the site`s simple and convenient search to discover the paperwork you need. A variety of web templates for business and individual reasons are sorted by groups and suggests, or key phrases. Use US Legal Forms to discover the Tennessee Operating Agreement of Minnesota Corn Processors, LLC in just a handful of clicks.

If you are already a US Legal Forms buyer, log in to your account and click the Obtain button to obtain the Tennessee Operating Agreement of Minnesota Corn Processors, LLC. You can even gain access to kinds you formerly saved inside the My Forms tab of your account.

Should you use US Legal Forms the first time, follow the instructions below:

- Step 1. Be sure you have chosen the shape for your right town/nation.

- Step 2. Use the Preview method to examine the form`s content. Never forget to see the description.

- Step 3. If you are unsatisfied with all the kind, utilize the Research field towards the top of the screen to locate other types in the legal kind template.

- Step 4. After you have discovered the shape you need, go through the Buy now button. Opt for the pricing program you prefer and add your accreditations to register for an account.

- Step 5. Method the deal. You may use your credit card or PayPal account to accomplish the deal.

- Step 6. Choose the structure in the legal kind and download it on your own device.

- Step 7. Complete, edit and produce or indication the Tennessee Operating Agreement of Minnesota Corn Processors, LLC.

Each legal papers template you buy is the one you have for a long time. You possess acces to every kind you saved in your acccount. Select the My Forms area and select a kind to produce or download yet again.

Remain competitive and download, and produce the Tennessee Operating Agreement of Minnesota Corn Processors, LLC with US Legal Forms. There are thousands of specialist and state-specific kinds you can use for your business or individual requires.

Form popularity

FAQ

A Minnesota LLC isn't legally obligated to have an operating agreement. Minnesota Statute § 322C. 0110 outlines what an operating agreement may cover but doesn't state that LLCs must have one.

In order to operate, LLCs require real humans (and other entities) to carry out company operations. Iowa state law doesn't require you to have a written operating agreement. Iowa statute § 489.110 lists common provisions an operating agreement can include, but the law doesn't state that you must have one.

Minnesota LLC Approval Times Mail filings: In total, mail filing approvals for Minnesota LLCs take 3-4 weeks. This accounts for the 11-12 business day processing time (a bit more than 2 weeks), plus the time your documents are in the mail. Online filings: Online filings for Minnesota LLCs are approved immediately.

Although not required by Minnesota law, an operating agreement further protects those with an interest in an LLC by pre-determining how the LLC will conduct business. A Bloomington LLC operating agreements lawyer could help you form an operations structure optimized for your business.

Under Connecticut law, an LLC is not required to have an operating agreement. In 2017, Connecticut enacted the Connecticut Uniform Limited Liability Company Act (?CULLCA?), which applies to all limited liability companies in Connecticut.

A written operating agreement is not legally required for most Tennessee LLCs (the exception being director-managed LLCs). Even so, having a written operating agreement is essential for opening a business bank account, heading off disagreements between members, and bolstering your limited liability status.

Operating agreements function as a legal contract between or among members of a multimember LLC, though even single-member LLCs can benefit from one, too. Most LLCs won't need to file or provide proof of an operating agreement?in fact, a business can keep these documents confidential among members if preferred.

For tax purposes, LLCs must apply for a federal Employer ID Number from the Internal Revenue Service (IRS), and a Minnesota Tax ID Number from the Minnesota Department of Revenue.