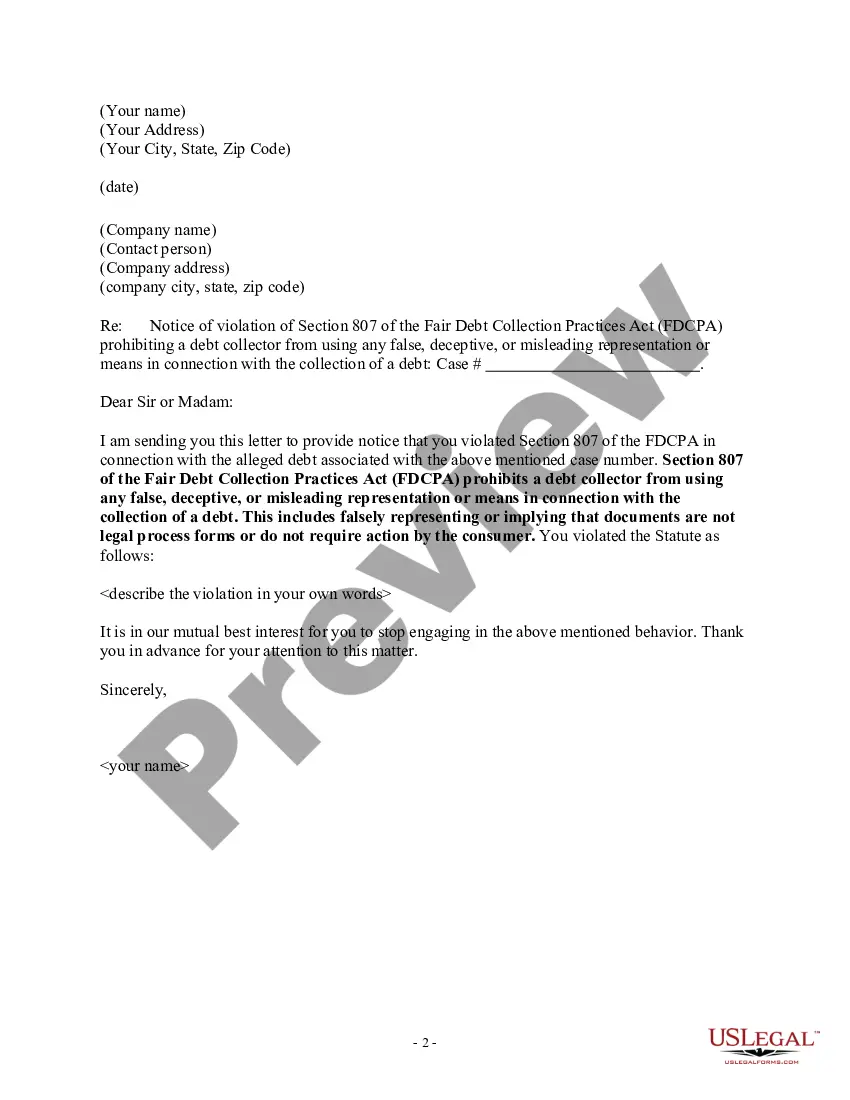

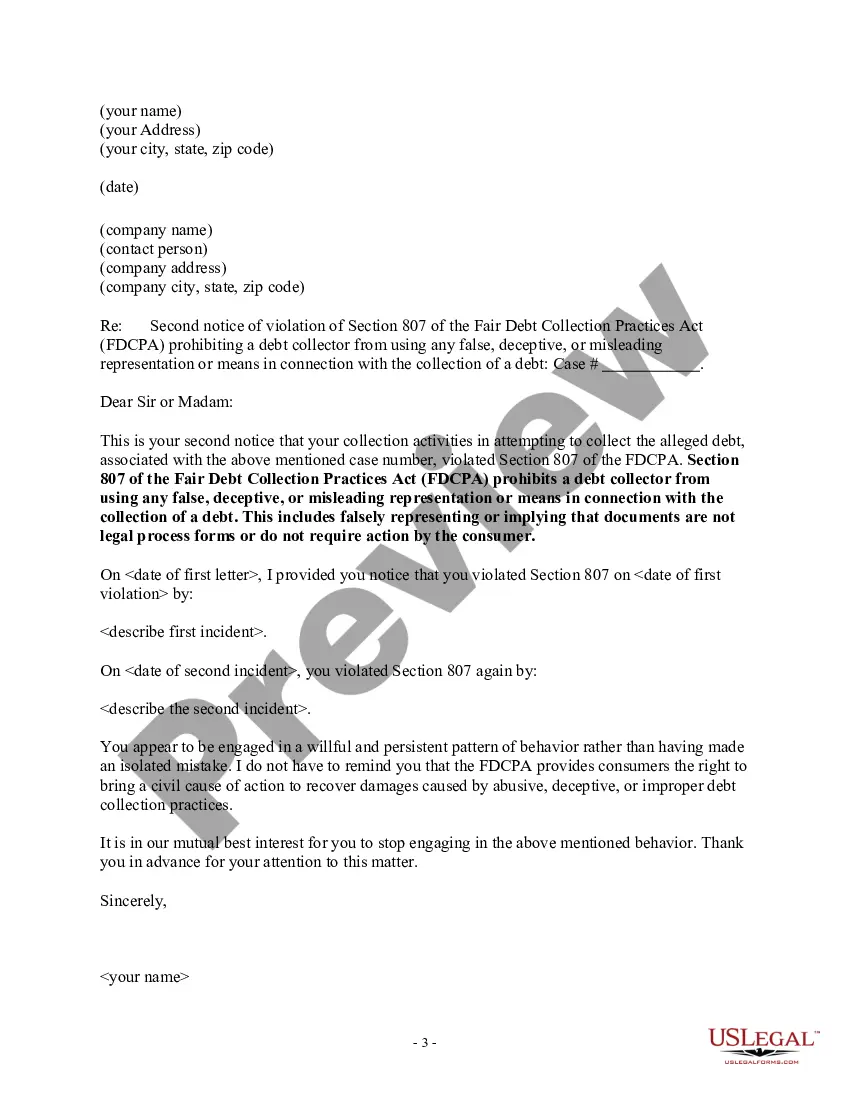

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing or implying that documents are not legal process forms or do not require action by the consumer.

Tennessee Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action

Description

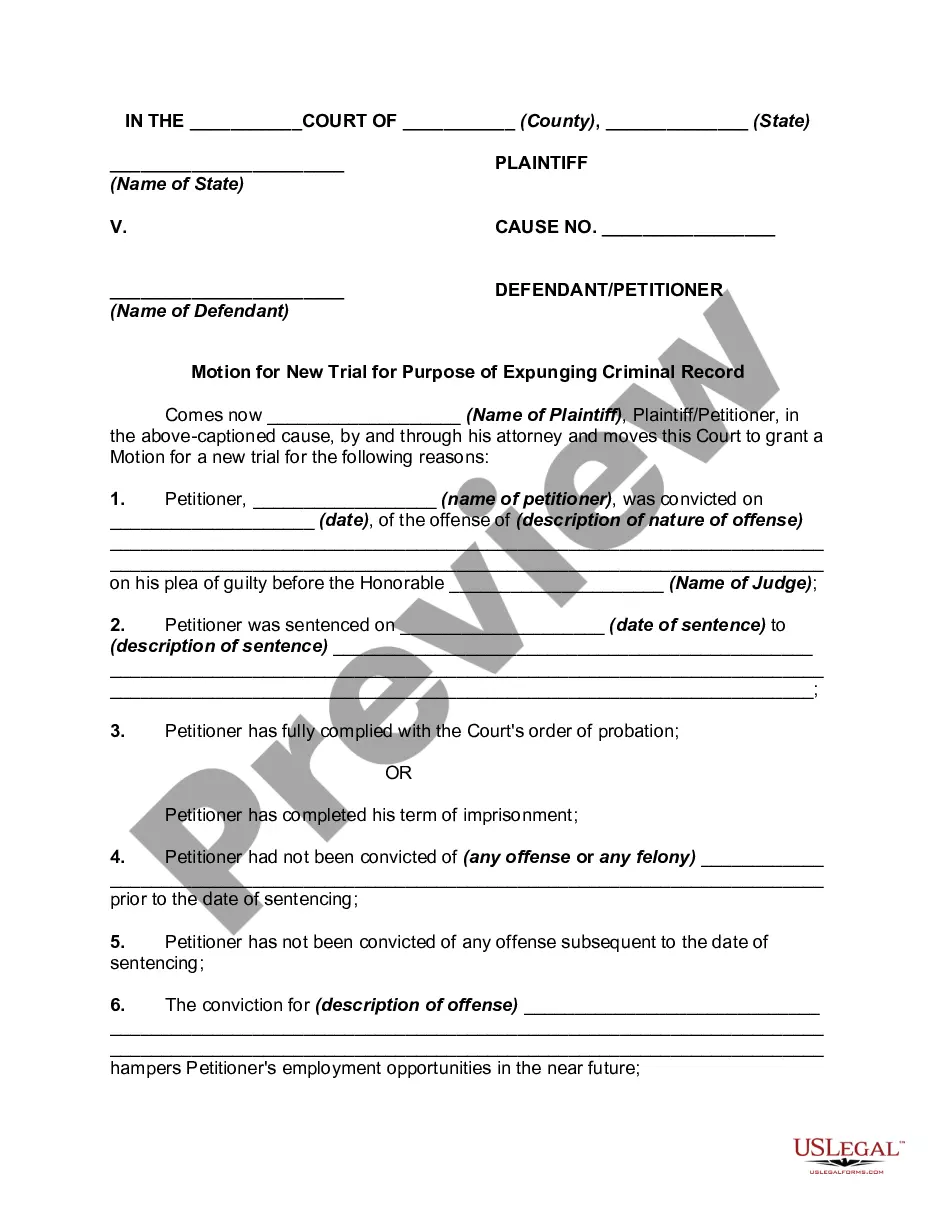

How to fill out Notice To Debt Collector - Falsely Representing Documents Are Not Legal Process Or Do Not Require Action?

Selecting the appropriate legitimate document template can be rather challenging.

Of course, there are numerous templates available online, but how do you find the correct one you need.

Utilize the US Legal Forms website. This platform offers a wide array of templates, including the Tennessee Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action, which you can use for both business and personal purposes.

First, ensure you have selected the correct form for your city/county. You can review the form using the Review button and examine the form details to confirm it's right for you.

- All of the forms are verified by professionals and comply with federal and state regulations.

- If you are currently registered, Log Into your account and click on the Obtain button to locate the Tennessee Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action.

- You can use your account to access the legitimate forms you have purchased before.

- Navigate to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

Form popularity

FAQ

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

Repeated calls. Threats of violence. Publishing information about you. Abusive or obscene language.

You are not obliged let a debt collector into your home and they don't have the right to take goods away. It's very important to understand that a debt collector is not the same as an enforcement agent or bailiff. Debt collectors have no special legal powers.

The FDCPA does not cover business debts. It also does not generally cover collection by the original creditor to whom you first became indebted. Under the FDCPA, debt collectors include collection agencies, debt buyers, and lawyers who regularly collect debts as part of their business.

There are 3 ways to remove collections without paying: 1) Write and mail a Goodwill letter asking for forgiveness, 2) study the FCRA and FDCPA and craft dispute letters to challenge the collection, and 3) Have a collections removal expert delete it for you.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

Unfair practices are prohibitedDeposit or threaten to deposit a postdated check before your intended payment date. Take or threaten to take property if it's not allowed. Collect more than you owe on a debt, which may include fees and interest.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.16 Sept 2020

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.