Tennessee Letter to Debt Collector - Only call me on the following days and times

Description

How to fill out Letter To Debt Collector - Only Call Me On The Following Days And Times?

US Legal Forms - one of the largest repositories of legal documents in the United States - provides a variety of legal document templates that you can download or print.

While using the website, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent editions of forms such as the Tennessee Letter to Debt Collector - Only contact me on the following days and times within minutes.

If you already have a monthly subscription, Log In and download the Tennessee Letter to Debt Collector - Only contact me on the following days and times from the US Legal Forms library. The Download button will appear on every form you view. You also have access to all previously acquired forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the purchase.

Select the format and download the form onto your device. Make adjustments. Fill out, edit, print, and sign the obtained Tennessee Letter to Debt Collector - Only contact me on the following days and times.

Each template you added to your account has no expiration date and is your property indefinitely. Therefore, if you wish to download or print an additional copy, simply go to the My documents section and click on the form you need.

Access the Tennessee Letter to Debt Collector - Only contact me on the following days and times with US Legal Forms, the most comprehensive library of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements and specifications.

- If you are using US Legal Forms for the first time, here are simple steps to get you going.

- Ensure you have selected the appropriate form for your city/county.

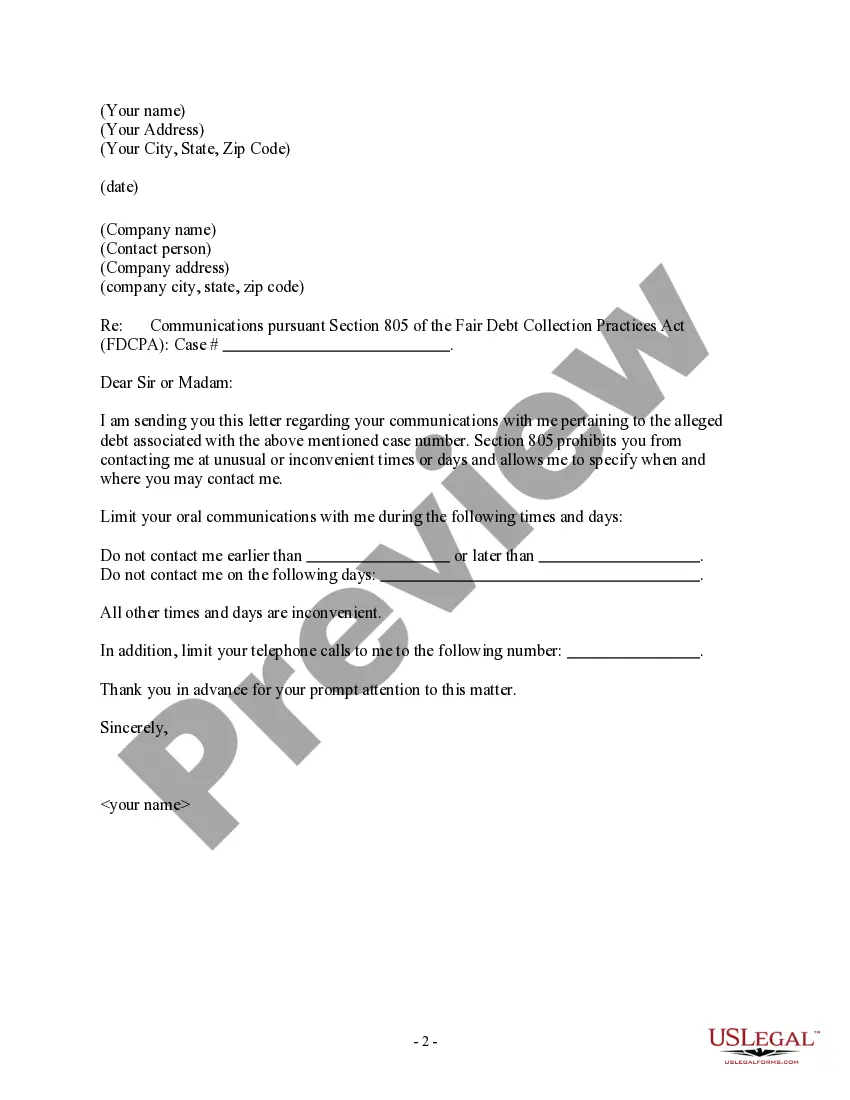

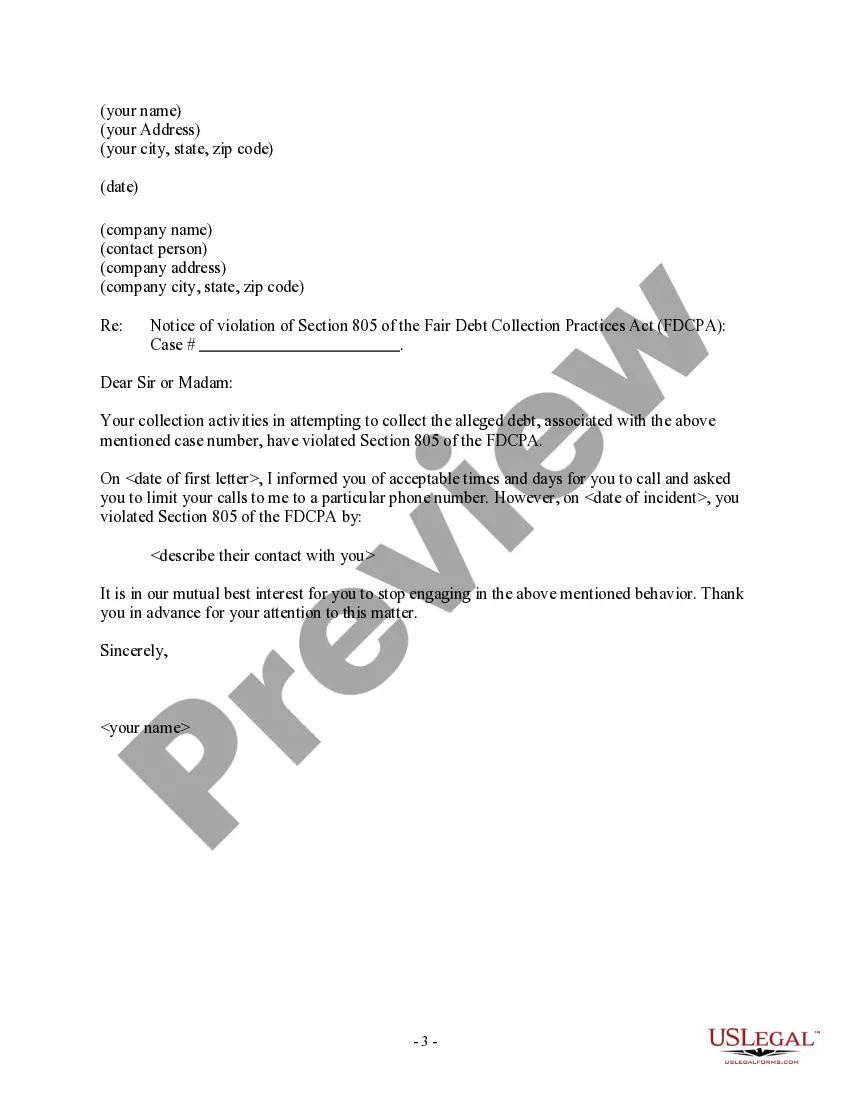

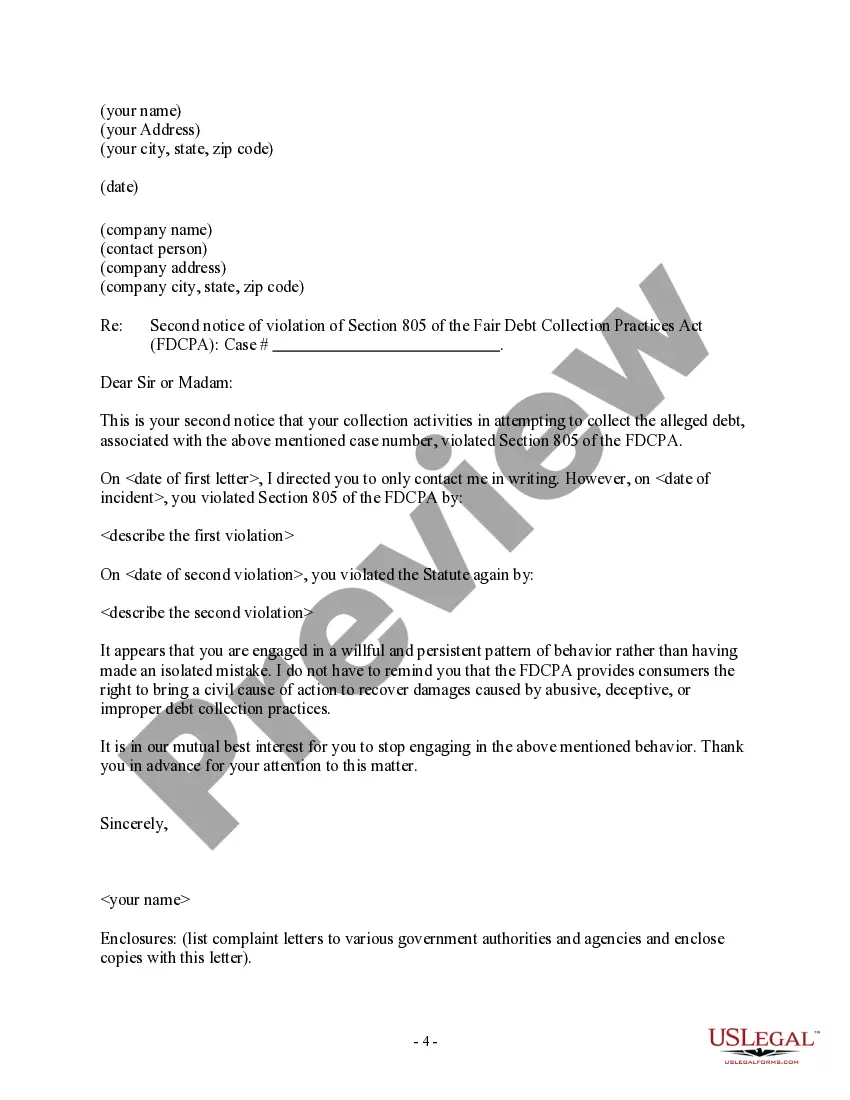

- Click the Preview button to examine the form's content.

- Review the form description to confirm you have chosen the correct form.

- If the form doesn't meet your needs, utilize the Search field at the top of the screen to locate one that does.

- Once you are satisfied with the form, finalize your choice by clicking the Buy now button.

- Then, select the payment plan you desire and provide your credentials to create an account.

Form popularity

FAQ

How to Write a Debt Verification LetterDetermine the exact amounts you owe.Gather documents that verify your debt.Get information on who you owe.Determine how old the debt is.Place a pause on the collection proceedings.

If you make a payment (even as small as $5), the debt collector will be given the right to sue you again, leading to possible wage garnishment. In Tennessee the statute of limitations on debt is as follows: Mortgage debt: 6 years. Medical debt: 6 years.

Dear debt collector: I am responding to your contact about collecting a debt. You contacted me by phone/mail, on date and identified the debt as any information they gave you about the debt. You can contact me about this debt, but only in the way I say below.

Tennessee Debt Collection Laws Related to Time There is a statute of limitations on debt in Tennessee which is 6 years. This means that if the debt does not get closed out in six years, a lender is not eligible to sue the person to collect the debt.

The time limit is sometimes called the limitation period. For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts.

In California, the statute of limitations on most debts is four years. With some limited exceptions, creditors and debt buyers can't sue to collect debt that is more than four years old.

The statute of limitations on debt in the state of Tennessee is six years. This means that if a debt has not been repaid in six years, the lender cannot sue to collect the debt.

There is a statute of limitations on debt in Tennessee which is 6 years. This means that if the debt does not get closed out in six years, a lender is not eligible to sue the person to collect the debt.

You cannot be arrested or go to jail simply for being past-due on credit card debt or student loan debt, for instance. If you've failed to pay taxes or child support, however, you may have reason to be concerned.