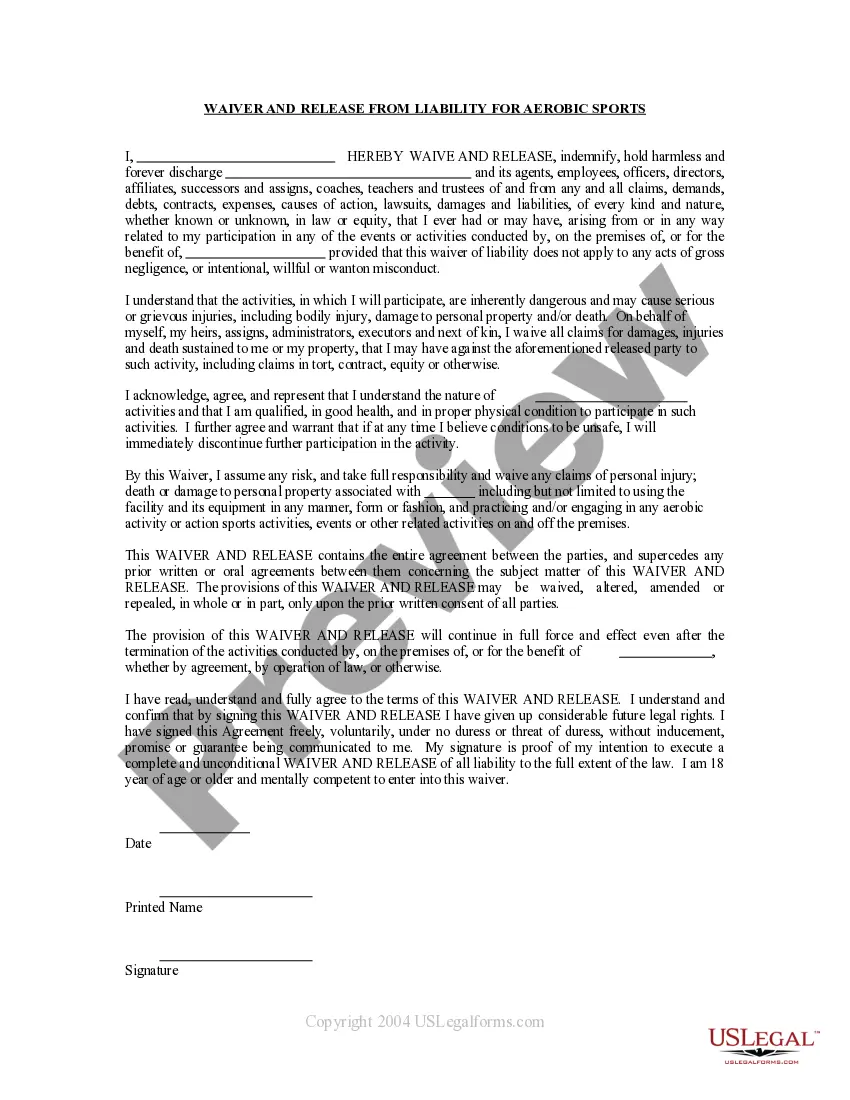

Section 806 of the Fair Debt Collection Practices Act states in part that a debt collector may not harass, oppress, or abuse any person in connection with the collection of a debt. One example of such activity involves using threats (including implied threats), violence, or other criminal means to harm anyone's reputation, property, or physical person.

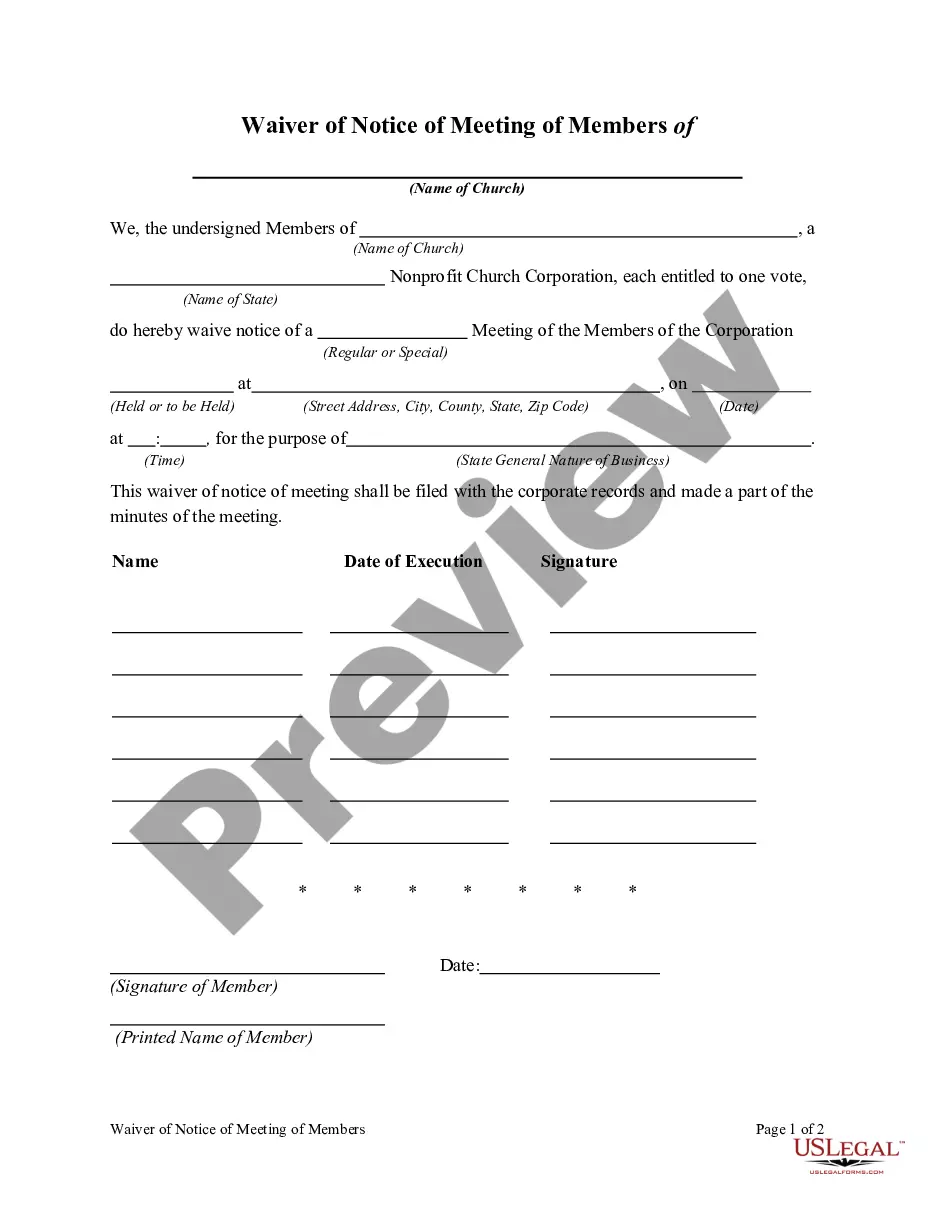

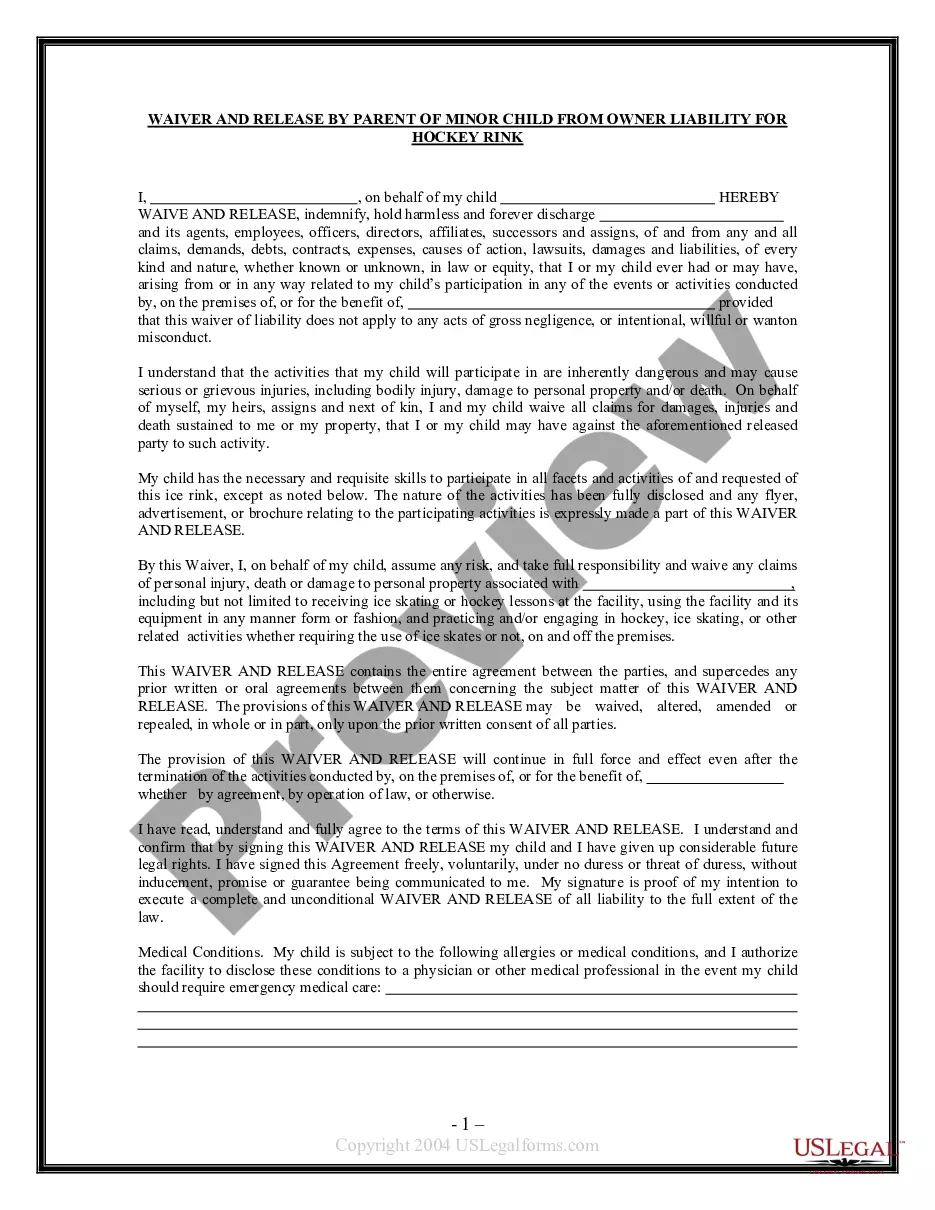

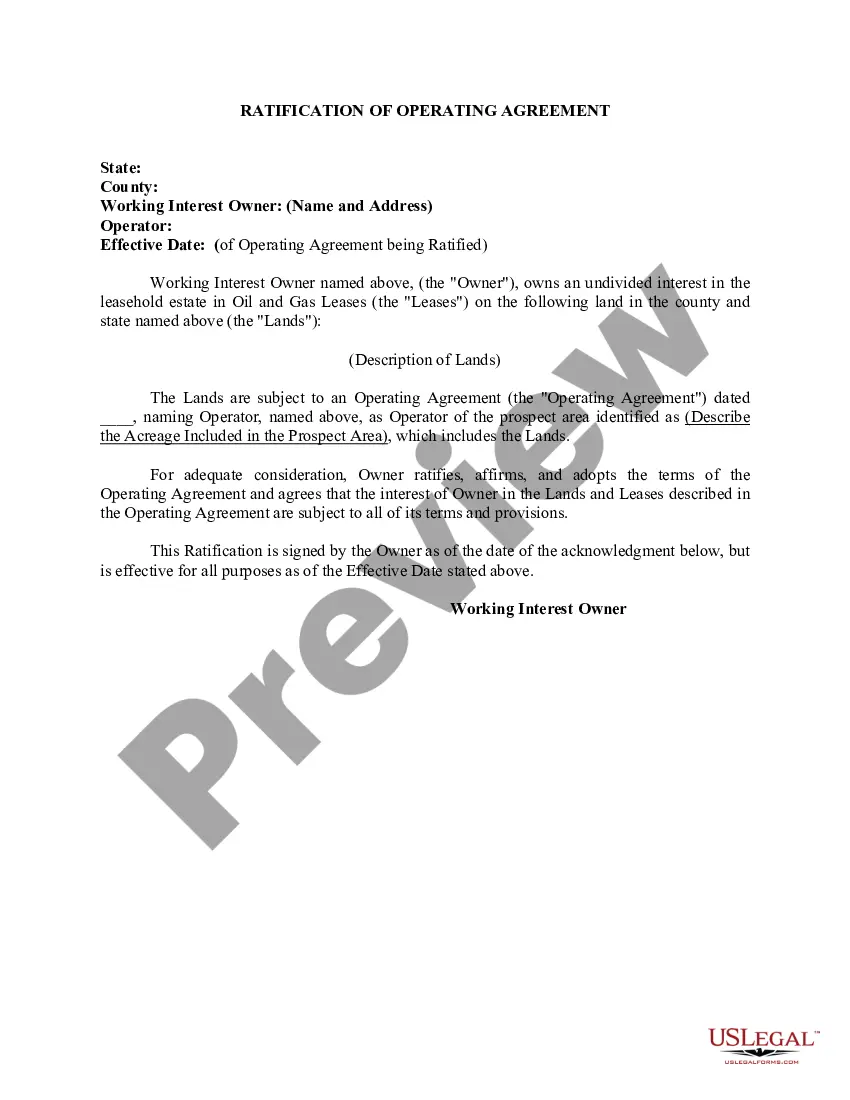

Tennessee Letter Informing Debt Collector of Harassment or Abuse in Collection Activities Involving Threats to Use Violence or other Criminal Means to Harm the Physical Person, Reputation, and/or Property of the Debtor

Description

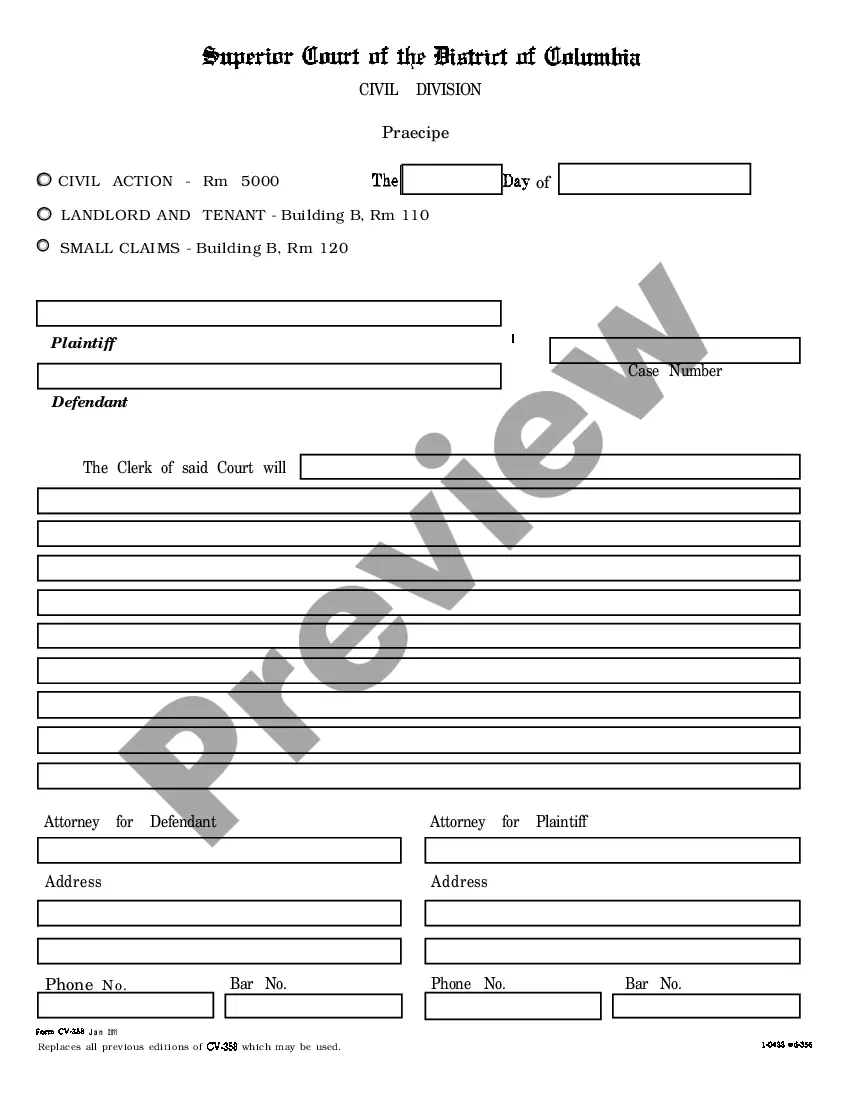

How to fill out Letter Informing Debt Collector Of Harassment Or Abuse In Collection Activities Involving Threats To Use Violence Or Other Criminal Means To Harm The Physical Person, Reputation, And/or Property Of The Debtor?

You may invest hours on the internet attempting to locate the legal document template that satisfies the state and federal criteria you desire.

US Legal Forms offers an extensive selection of legal forms that are examined by professionals.

It is easy to access or print the Tennessee Letter Notifying Debt Collector of Harassment or Abuse in Collection Practices Involving Threats to Use Violence or other Illegal Means to Inflict Harm on the Physical Person, Reputation, and/or Property of the Debtor with my help.

First, ensure you have selected the correct document template for your county/town of choice. Review the form description to confirm you have chosen the suitable template. If available, utilize the Preview button to browse through the document template as well.

- If you possess a US Legal Forms account, you can Log In and click the Obtain button.

- Subsequently, you can complete, modify, print, or sign the Tennessee Letter Notifying Debt Collector of Harassment or Abuse in Collection Practices Involving Threats to Use Violence or other Illegal Means to Inflict Harm on the Physical Person, Reputation, and/or Property of the Debtor.

- Every legal document template you acquire is your property indefinitely.

- To obtain an additional copy of any purchased form, navigate to the My documents tab and click the respective button.

- If you are visiting the US Legal Forms site for the first time, follow the straightforward instructions below.

Form popularity

FAQ

You're protected from harassing or abusive practicesThe Fair Debt Collection Practices Act prohibits debt collectors from using any harassing or abusive practices in an attempt to collect the debt. Harassment is more than just repeatedly asking you to pay money, says bankruptcy attorney Jay Fleischman.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.16-Sept-2020

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

Federal law doesn't give a specific limit on the number of calls a debt collector can place to you. A debt collector may not call you repeatedly or continuously intending to annoy, abuse, or harass you or others who share the number.

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.

Fortunately, there are legal actions you can take to stop this harassment:Write a Letter Requesting To Cease Communications.Document All Contact and Harassment.File a Complaint With the FTC.File a Complaint With Your State's Agency.Consider Suing the Debt Collection Agency for Harassment.

The Fair Debt Collection Practices Act (FDCPA) (15 USC 1692 et seq.), which became effective in March 1978, was designed to eliminate abusive, deceptive, and unfair debt collection practices.

What can the loan defaulter do when he or she is threatened by recovery agents? File a complaint at a police station. Injunction suit against the bank and recovery agents. File a complaint with the Reserve Bank of India (RBI) Defamation suit. Trespass complaint. Extortion complaint.01-Sept-2018

Problems Faced by Debt Collection Agents and How to Solve Them!Oral Contracts:Faulty Written Agreements:Money Recovery Issues:Collection Methods Are Not Real-Time:Mobile Borrowers:Too Many Calls:Contacting Wrong People:Customer Bankruptcy:More items...?30-Nov-2019