Tennessee Plan of Liquidation

Description

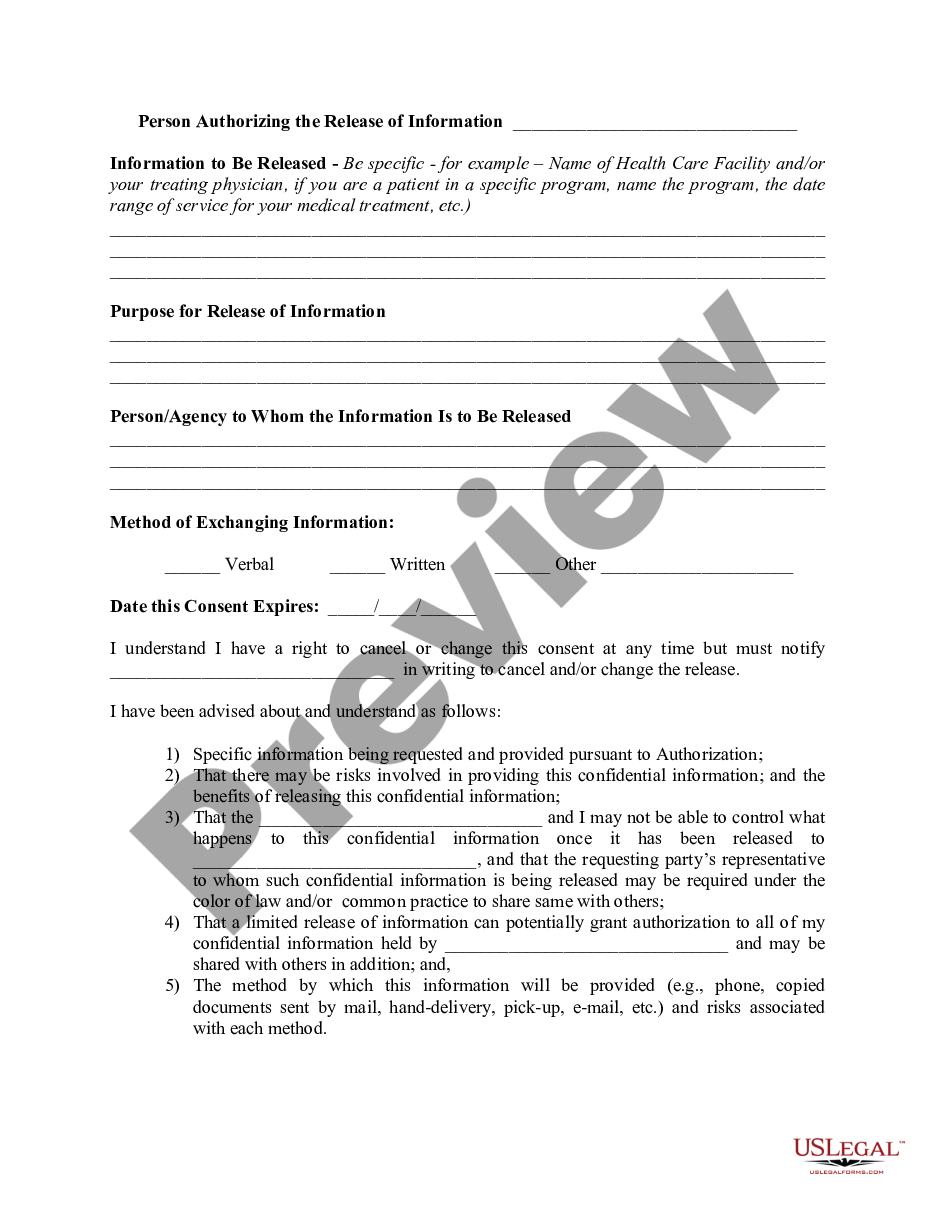

How to fill out Plan Of Liquidation?

Are you currently within a placement that you need to have papers for either company or person reasons just about every time? There are a variety of lawful document layouts available online, but getting ones you can rely on is not effortless. US Legal Forms gives thousands of form layouts, such as the Tennessee Plan of Liquidation, that happen to be written to fulfill state and federal demands.

In case you are already familiar with US Legal Forms internet site and possess your account, just log in. Next, you may down load the Tennessee Plan of Liquidation web template.

Unless you come with an account and wish to begin to use US Legal Forms, follow these steps:

- Discover the form you will need and make sure it is to the appropriate area/county.

- Use the Preview button to review the shape.

- Browse the outline to actually have selected the appropriate form.

- If the form is not what you are seeking, make use of the Look for area to get the form that meets your requirements and demands.

- Whenever you find the appropriate form, click on Purchase now.

- Pick the prices program you want, fill in the desired info to create your account, and buy your order utilizing your PayPal or Visa or Mastercard.

- Choose a handy data file structure and down load your copy.

Get each of the document layouts you have purchased in the My Forms menu. You may get a additional copy of Tennessee Plan of Liquidation whenever, if possible. Just click on the required form to down load or printing the document web template.

Use US Legal Forms, the most considerable selection of lawful forms, in order to save time and steer clear of faults. The service gives professionally made lawful document layouts that can be used for a variety of reasons. Create your account on US Legal Forms and begin producing your lifestyle a little easier.

Form popularity

FAQ

Overview. If you are a corporation, limited partnership, limited liability company, or business trust chartered, qualified, or registered in Tennessee or doing business in this state, then you must register for and pay franchise and excise taxes.

What You Can Do Here File an Application for Reinstatement for a business and pay the fee online. The filing fee is $70. ... Print and Mail the Application for Reinstement. Information will be collected through the online tool, and then printed on the correct form to be mailed to the Secretary of State with payment.

In order to get back into business again, you can apply for reinstatement. To revive or reinstate your Tennessee LLC, you'll need to submit the following to the Tennessee Secretary of State: a completed Application for Reinstatement Following Administrative Dissolution/Revocation. the $70 reinstatement fee.

A business entity that has failed to file its annual report on a timely basis may be administratively dissolved and placed in inactive status. The filing history of every business is shown in the Business Information Search.

The Department of Revenue issues this letter upon taxpayer request. A Certificate of Tax Clearance declares that all tax returns administered by the Department of Revenue have been filed and all liabilities have been paid. Certificates of Tax Clearance are issued to both terminating and ongoing businesses.

The Department of State, Division of Business Services, is responsible for approving Tennessee dissolutions. You can file the notice online, by mail, or in person. Include the filing fee of $20. You will need a tax clearance letter from the Department of Revenue before you can dissolve the LLC.

Final return status means that a taxpayer is in the process of winding down business operations which will result in or is intended to result in the taxpayer ceasing to exist or no longer being subject to the franchise and excise taxes (Tenn.

Here's how to dissolve an LLC in Tennessee: Review Your LLC's Operating Agreement. ... Vote to Dissolve an LLC. ... File Articles of Dissolution. ... Notify Tax Agencies and Pay Remaining Taxes. ... Inform Creditors and Settle Existing Debt. ... Wind Up Other Business Affairs. ... Distribute Remaining Assets.