Tennessee Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus

Description

How to fill out Approval Of Amendment To Articles Of Incorporation To Permit Certain Uses Of Distributions From Capital Surplus?

You may commit time on the Internet trying to find the lawful document template that meets the state and federal requirements you require. US Legal Forms supplies thousands of lawful forms that happen to be evaluated by professionals. It is possible to down load or print the Tennessee Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus from the service.

If you already have a US Legal Forms bank account, you may log in and click on the Acquire button. Afterward, you may comprehensive, change, print, or indication the Tennessee Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus. Each and every lawful document template you acquire is your own forever. To have one more version for any purchased develop, check out the My Forms tab and click on the related button.

Should you use the US Legal Forms web site the very first time, follow the basic directions listed below:

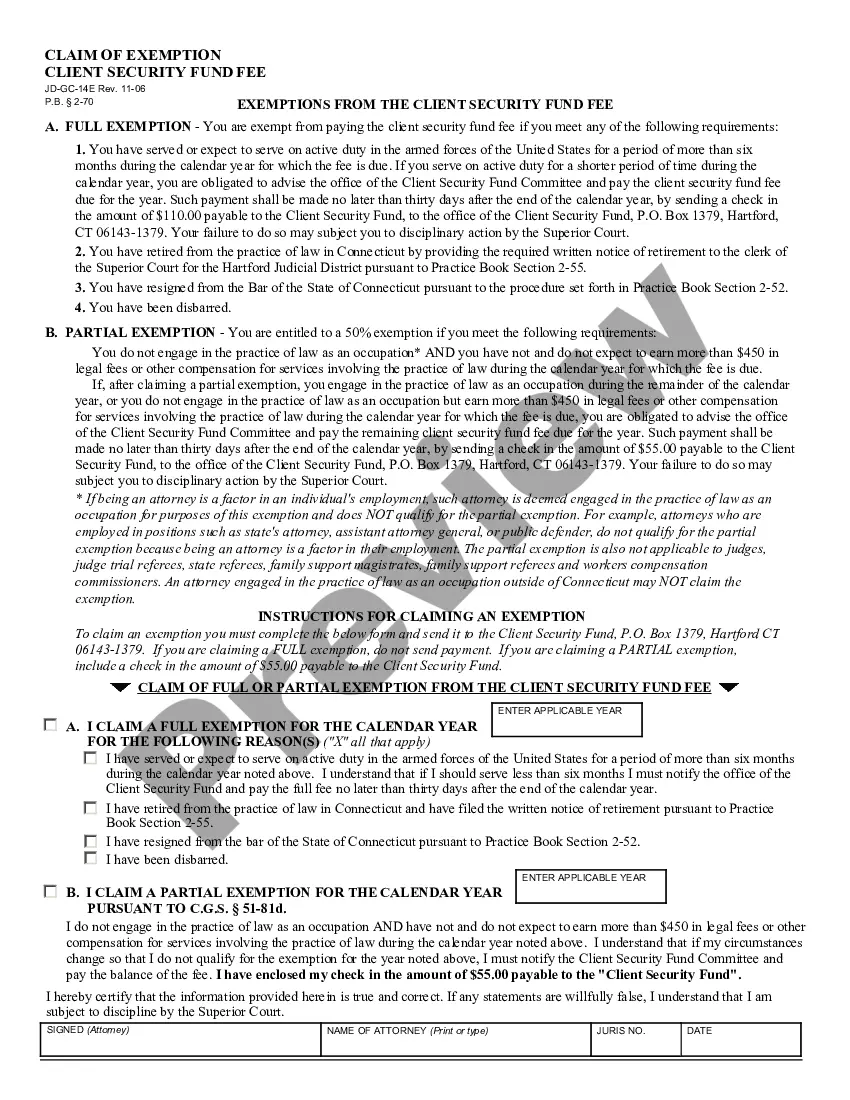

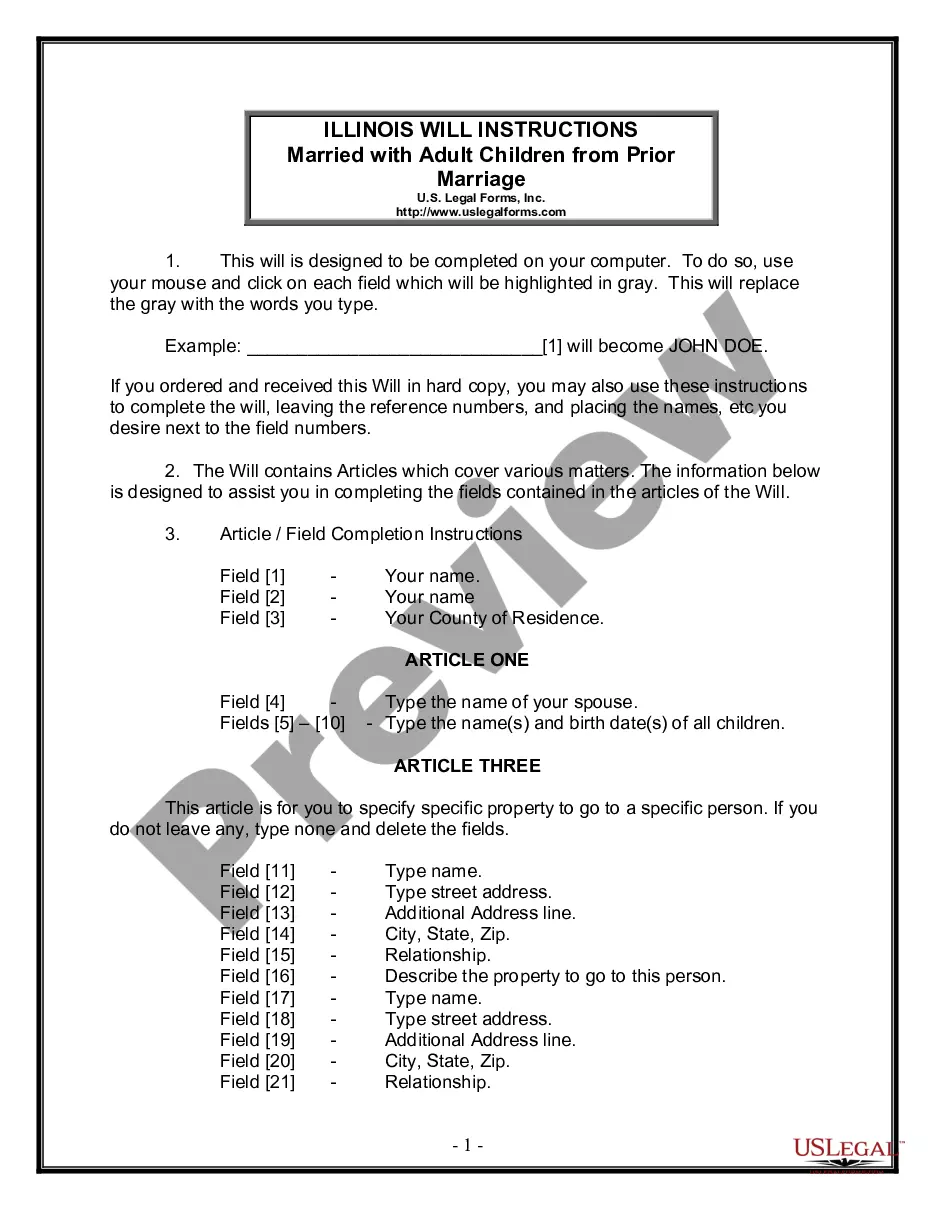

- First, make certain you have chosen the best document template for your region/metropolis of your choice. Read the develop information to make sure you have picked out the appropriate develop. If offered, use the Review button to check through the document template also.

- If you want to locate one more model from the develop, use the Lookup industry to obtain the template that suits you and requirements.

- After you have found the template you need, click on Purchase now to continue.

- Pick the costs strategy you need, key in your accreditations, and sign up for an account on US Legal Forms.

- Comprehensive the deal. You can utilize your Visa or Mastercard or PayPal bank account to purchase the lawful develop.

- Pick the file format from the document and down load it for your gadget.

- Make alterations for your document if possible. You may comprehensive, change and indication and print Tennessee Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus.

Acquire and print thousands of document layouts using the US Legal Forms site, that provides the most important collection of lawful forms. Use skilled and status-certain layouts to tackle your company or personal requirements.