Tennessee Approval of deferred compensation investment account plan

Description

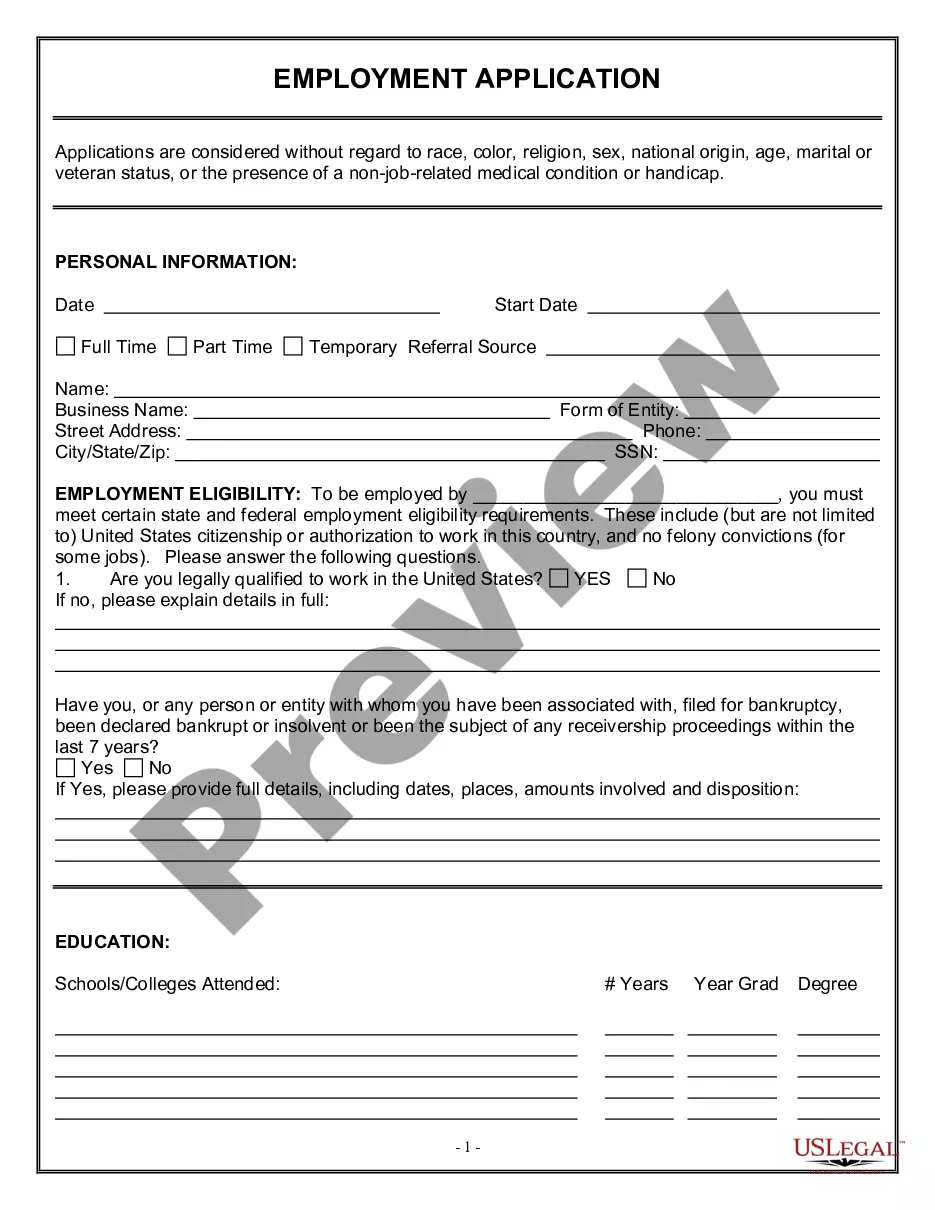

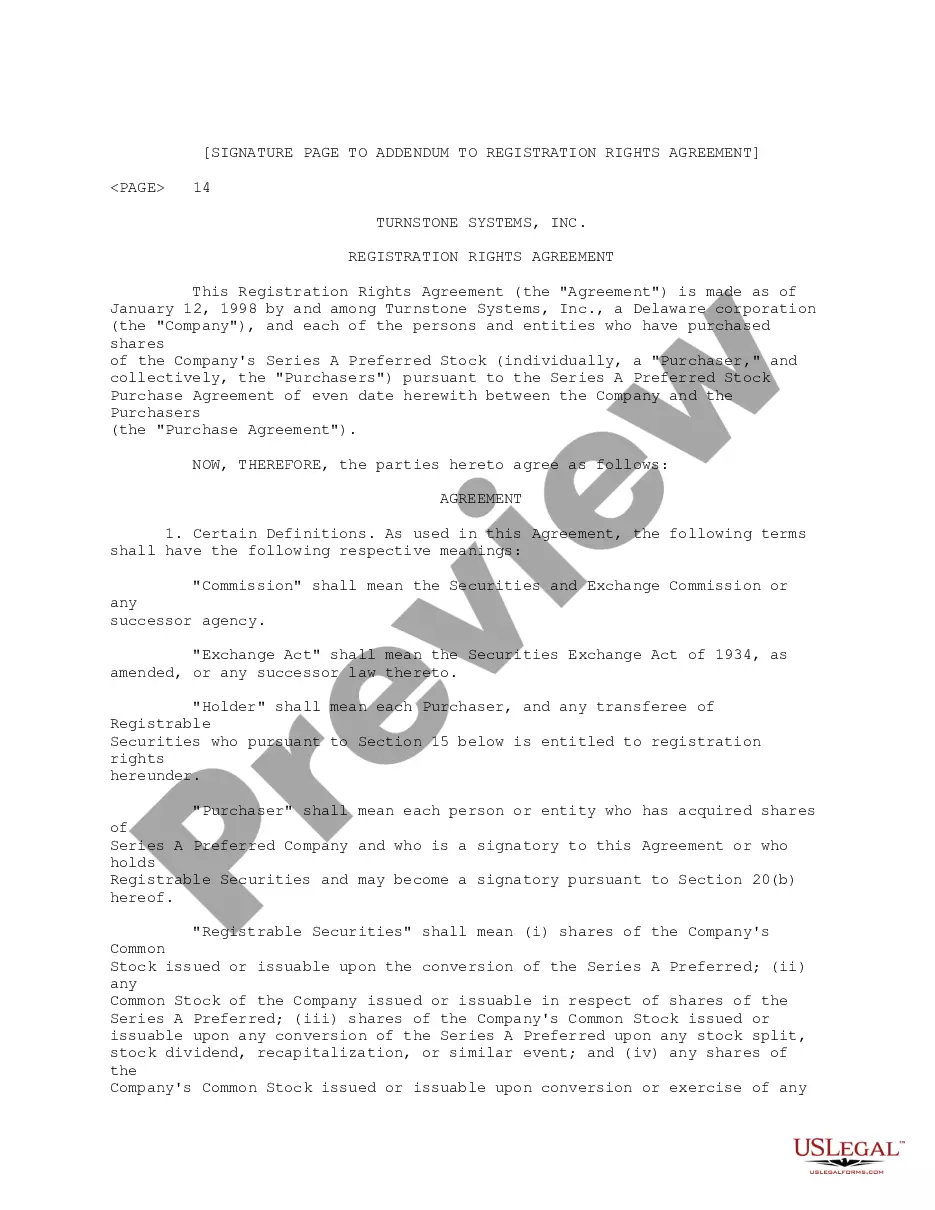

How to fill out Approval Of Deferred Compensation Investment Account Plan?

US Legal Forms - one of many largest libraries of legal kinds in America - offers a variety of legal papers layouts you may obtain or print out. While using web site, you may get 1000s of kinds for organization and personal functions, sorted by classes, states, or keywords and phrases.You can get the latest variations of kinds like the Tennessee Approval of deferred compensation investment account plan in seconds.

If you currently have a membership, log in and obtain Tennessee Approval of deferred compensation investment account plan from the US Legal Forms collection. The Obtain switch will appear on every form you look at. You get access to all previously saved kinds in the My Forms tab of the profile.

If you want to use US Legal Forms initially, allow me to share basic recommendations to help you started:

- Make sure you have chosen the right form for your personal town/area. Click on the Preview switch to check the form`s content. Browse the form outline to actually have selected the correct form.

- When the form does not match your specifications, make use of the Research area on top of the monitor to get the the one that does.

- Should you be content with the form, validate your option by simply clicking the Get now switch. Then, pick the prices plan you favor and supply your references to register to have an profile.

- Process the purchase. Utilize your charge card or PayPal profile to finish the purchase.

- Select the file format and obtain the form in your product.

- Make modifications. Complete, revise and print out and sign the saved Tennessee Approval of deferred compensation investment account plan.

Every single design you included with your money lacks an expiry time and is also your own property forever. So, if you would like obtain or print out another duplicate, just go to the My Forms segment and then click about the form you will need.

Gain access to the Tennessee Approval of deferred compensation investment account plan with US Legal Forms, by far the most comprehensive collection of legal papers layouts. Use 1000s of specialist and express-distinct layouts that fulfill your business or personal demands and specifications.

Form popularity

FAQ

Additional savings opportunity As an added benefit, the State of Tennessee offers the ability to save through a 457 deferred compensation plan. The 457 has the same investment options as the 401(k) and does not share a contribution limit with other retirement plans.

The State of Tennessee 457(b) Deferred Compensation Program is a powerful tool to help you reach your retirement dreams. It complements other retirement benefits or savings that you may have and allows you to save and invest extra money for retirement.

Deferred compensation plans are an incentive that employers use to hold onto key employees. Deferred compensation can be structured as either qualified or non-qualified under federal regulations. Some deferred compensation is made available only to top executives.

You can process a distribution request by logging in to your account and navigating to Loans & Withdrawals > Taking a Withdrawal > Request a Withdrawal. If you have questions about distributions, call the Service Center at 844-523-2457.

Deferred compensation plans are funded informally. There's essentially a promise from the employer to pay the deferred funds, plus any investment earnings, to the employee at the time specified. In contrast, with a 401(k), a formally established account exists.

Key Takeaways. Deferred compensation plans allow employees to withhold a certain amount of their salaries or wages for a specific purpose. Deferred compensation plans can be qualified or non-qualified. Qualified plans fall under the Employee Retirement Income Security Act and include 401(k)s and 403(b)s.

More details on the retirement plan limits are available from the IRS. The normal contribution limit for elective deferrals to a 457 deferred compensation plan is increased to $23,000 in 2024. Employees age 50 or older may contribute up to an additional $7,500 for a total of $30,500.

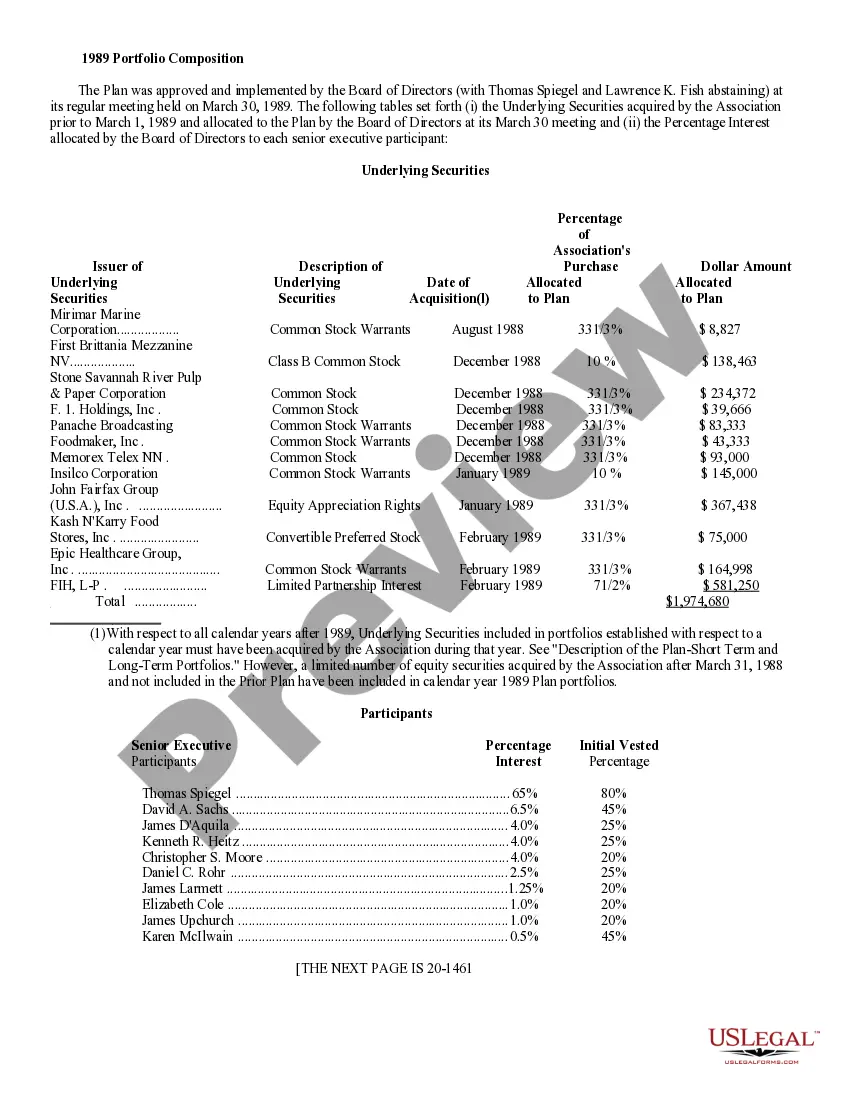

Investing your deferred compensation Your plan might offer you several options for the benchmark?often, major stock and bond indexes, the 10-year US Treasury note, the company's stock price, or the mutual fund choices in the company 401(k) plan.